29 April 2020

By Franz Rudolf and Julian Kreipl, UniCredit

In recent years, more and more banks, both newcomers and established covered bond issuers, have opted for “semi-benchmark” covered bonds. We provide an overview of this emerging market segment and look at which issuers from which countries are using this format, what the drivers behind this development are and what regulatory differences exist. Last but not least, we provide an outlook on the future development of this format.

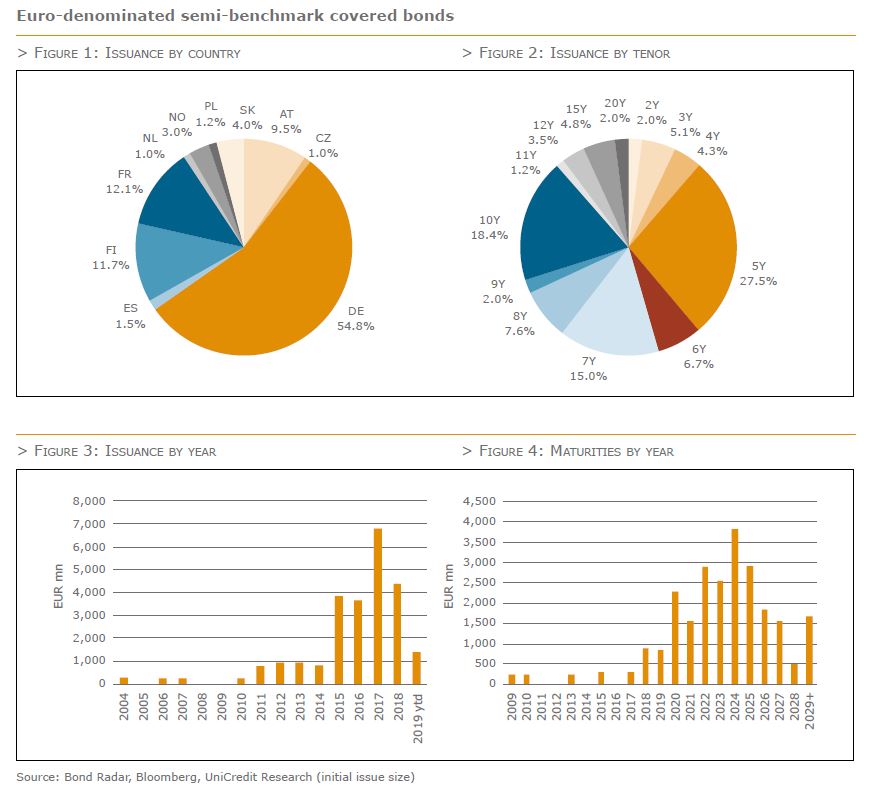

We analysed the issuance of semi-benchmark covered bonds back to 2004 using Bond Radar and Bloomberg data. From 2004 to 2009, there were hardly any semi-benchmark covered bonds issued at all.

But starting in 2010, semi-benchmark issuance picked up. In our view, this was driven by two main factors:

1. Triggered by the financial crisis, average issuance size generally declined in order to reduce execution risk and rating agencies applied stricter requirements to reduce refinancing risk and

2. banks in new and smaller markets made use of covered bonds as a funding tool and, in mature markets, more and more banks with smaller cover pools started to issue covered bonds.

What do we mean by “semi-benchmark”? As the term indicates, we are talking about a bond size that has “almost” benchmark size in a market-defined meaning and “most” characteristics of a common benchmark format. The size of a euro-denominated benchmark covered bond is defined as at least EUR 500mn with characteristics defined along regulatory guidelines. We used the term “semi” instead of “sub” as sub-benchmark have no lower limit, while semi-benchmark covered bonds have a clearly defined volume range. Regarding the size of the semi-benchmark segment, we define semi-benchmark covered bonds as ranging from EUR 250mn to EUR 499mn. This leaves us with the following benchmark segments with respect to the volume of bonds:

> Semi-Benchmark: ≥ EUR 250mn and ≤ EUR 499mn

> Small-Benchmark: ≥ EUR 500mn and ≤ EUR 999mn

> Jumbo-Benchmark: ≥ EUR 1bn

According to our definition, next to size, the covered bond must be publically placed, while we do not distinguish between pot or retention deals, auctions or club deals. However, we do not include retained deals. These are bonds that are issued to be used, for example, as ECB collateral. Thus, we generally do not include sole-lead issues which we consider not to be placed publically or which are not actively traded. Hence, we are applying rules similar to those of index providers but less restrictive (e.g. regarding the number of bookrunners). Deals with an initial volume below EUR 250mn that have been tapped to reach the semi-benchmark size have been excluded; hence, only “Day-1” semi-benchmark deals are viewed as semi-benchmark bonds. Our last, but rather standard criterion is the coupon type: we counted only fixed coupon bonds (however, we are aware that there are a number of bonds with floating interest rates, especially in local currencies other than the euro). We analyzed foreign currency bonds separately, applying the same criteria as for euro-denominated semi-benchmark covered bonds.

In the following, we always refer to the initial issue size, unless otherwise stated. We thus only take into account the initial volume issued and ignore taps of semi-benchmark deals. In the past 15 years, German issuers have made the most use of semi-benchmark transactions. In total, there have been 53 semi-benchmark covered bonds from Germany, with total market volume of EUR 13.5bn or 55% of the semi-benchmark segment. The country with the second-highest amount and number of deals is France (eight deals amounting to EUR 3bn), followed by Finland (eleven deals adding up to EUR 2.9bn) and Austria (eight deals totaling EUR 2.35bn). In total, we considered 91 bonds.

The semi-benchmark segment exists in ten countries with a total of 41 issuers. Here, too, Germany is in the lead: in Germany there are 18 issuers, followed by Austria and France with six issuers each and Finland with four issuers.*

There are several reasons for the increasing number of semi-benchmark covered bonds issued in recent years. We highlight the most important drivers when comparing them to:

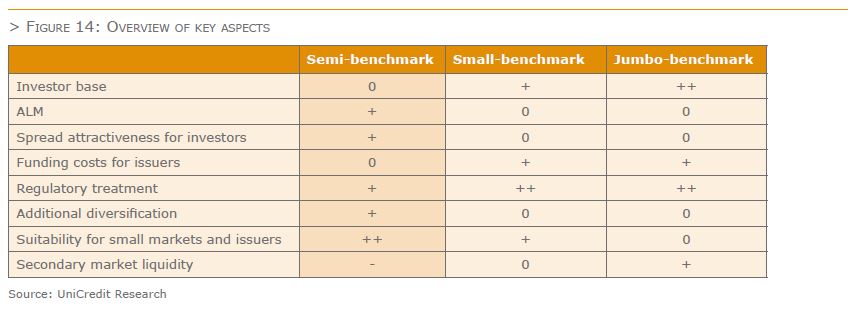

> Small/Jumbo benchmark bonds. From an issuer perspective, semi-benchmark covered bonds have the advantage of optimised issuer asset/liability management and a more suitable size for smaller new issuers. In addition, foreign currency issues are a good supplement to the funding mix. From an investor point of view, semi-benchmark covered bonds offer a spread pickup and enable investors to achieve higher diversification in terms of issuer and country selection;

> Private placements. Semi-benchmark covered bonds benefit from better regulatory treatment, higher liquidity and a broader investor base than private placements.

In the past decade, the focus on asset/liability management has increased. Mismatches between assets and liabilities increase refinancing risks and thus e.g. overcollateralisation requirements of rating agencies. A granular liability structure enables the issuer to optimise asset/liability management. This structure is of course issuer-specific and depends on, among other things, the size of the cover pool, the type of collateral (e.g. granular residential mortgages versus large-scale commercial mortgages), the number of outstanding covered bonds, the type of covered bonds (benchmark, private placements, registered covered bonds), and the maturity structure. One way to optimise asset/liability management is the use of semi-benchmark covered bonds. This enables issuers to efficiently place smaller-sized bonds (compared to Jumbo benchmark bonds) to a broader investor base (compared to private placements), a relatively balanced approach. Thus, the maturity structure can be modelled more evenly. Our thoughts on this subject assume that there is a certain limitation to an issuer’s volume of covered bond collateral and therefore there is a need to make efficient use of that collateral.

Two simplified ALM models:

In the following two charts we illustrate two different, highly simplified funding models

1. Funding by Jumbo-benchmark covered bonds with a volume of EUR 1bn and

2. Funding by using small-benchmark covered bonds (EUR 500mn) and semi-benchmark covered bonds (EUR 250mn).

In both cases, the amounts add up to EUR 7.2bn in assets and EUR 6bn in covered bonds.

Semi-benchmark covered bonds usually offer a (slight) pickup to bonds with larger volume. This can be driven, for example, by differences in liquidity and/or a smaller/broader investor base. We illustrate the spread pickup for two examples: the left chart shows covered bonds issued in Finland in semi-benchmark size, small-benchmark size and Jumbo-benchmark size. The chart on the right shows covered bonds in these three segments across European issuers (figure 8; excluding the periphery). The spread difference is around 1bp between Jumbo and small-benchmark covered bonds and around 3bp between small-benchmark and semi-benchmark bonds. The results match our expectations: overall, the spread difference between small benchmark and Jumbo-benchmark covered bonds is negligible (especially when considering additional aspects such as differences in rating, country, issuer, coupon, etc., which we ignored for modeling purposes). It also confirms our assumption that the spread pickup of semi-benchmark is more pronounced, making them generally

attractive for investors.

Semi-benchmark covered bonds offer investors the opportunity to increase diversification. Investors are able to choose from a greater number of bonds, issuers and countries. For example, take covered bonds from Slovakia. Currently, there are three EUR benchmark covered bonds from two issuers outstanding. If bonds in semi-benchmark size are added, the number of bonds increases to nine and the number of issuers increases to three. Another example is Finland, where 33 EUR small- and Jumbo-benchmark covered bonds are outstanding along with an additional nine semi-benchmark covered bonds. Including semi-benchmark covered bonds results not only in an increase in the overall number of bonds, but also the number of issuers almost doubles from four to seven. Thus, investors are able to buy covered bonds from a significantly higher number of issuers.

Semi-benchmark covered bonds enjoy some of the benign regulatory treatment of larger benchmark bonds but not all of them (see figure 9). The key difference to the other volume ranges is the treatment under the Liquidity Coverage Requirement (LCR). The maximum achievable level for semi-benchmark covered bonds is Level 2a. This is a clear advantage over covered bonds of smaller volume, e.g. EUR 100mn. However, small- and Jumbo-benchmark covered bonds are able to achieve Level 1 (depending on a number of prerequisites such as a certain rating and OC thresholds, etc.).

The Delegated Regulation 2015/61 on the Liquidity Coverage Requirement (LCR) is probably the most important regulatory topic when thinking about semi-benchmark covered bonds and it is also a key point determining the definition of the lower limit of EUR 250mn for the segment. With a size of at least EUR 250mn, covered bonds from EEA issuers are potentially eligible for LCR Level 2. With a rating of at least A-/A3 (credit quality step 2), semi-benchmark covered bonds can be Level 2a, and with a rating below A- or unrated, semi-benchmark covered bonds can be Level 2b (provided the cover assets fulfil the eligibility criteria). Covered bonds issued by non-EEA credit institutions are eligible for Level 2a, regardless of the issue size, but they need to be rated at least AA-/Aa3 (credit quality step 1). Depending on the issue size, the cover pool needs to meet an asset coverage requirement of at least 2% (for issues ≥ EUR 500mn) or 7% (for issues < EUR 500mn).

With respect to other regulatory treatments, e.g. risk-weight and repo treatment, semi-benchmark covered bonds are treated similarly:

> UCITS 52(4): Eligible. The UCITS Directive 2009/65/EC on the coordination of laws, regulations and administrative provisions relating to undertakings for collective investment in transferable securities (UCITS) and especially Article 52(4) does not set any limits on the minimum issue size of a single bond.

> CRR 129: Eligible. The CRR Regulation 575/2013 on prudential requirements for credit institutions and investment firms and especially Article 129 relating to exposures in the form of covered bonds also does not set any issue-size limits.

> Solvency II: Eligible. For a covered bond to be eligible for preferential Solvency II treatment and benefit from a lower risk factor (which broadly depends on the credit quality step and the duration of the bond), it needs to be rated by an ECAI and compliant with UCITS 52(4). There are no limitations in respect to size. Semi-benchmark covered bonds thus benefit from the same spread risk factors as bonds of larger volume.

> ECB repo: Eligible. The Eurosystem collateral framework (ESCF) is a comprehensive framework that includes a broad range of assets eligible as collateral for credit operations (monetary policy and intraday credit). The eligibility criteria do not distinguish assets by size. Semi-benchmark covered bonds therefore have to fulfill the same criteria as small-benchmark covered bonds and are generally eligible as collateral in repo transactions. The ESCF also does not apply higher haircuts to semi-benchmark than to small benchmark covered bonds (Jumbo-benchmark covered bonds receive better treatment).

> CBPP3: Eligible. In order to qualify for purchase under the CBPP3 (currently reinvestment phase), covered bonds must meet several criteria, but the outstanding volume of a bond is not relevant in this context. Accordingly, semi-benchmark covered bonds are generally eligible for CBPP3 purchases.

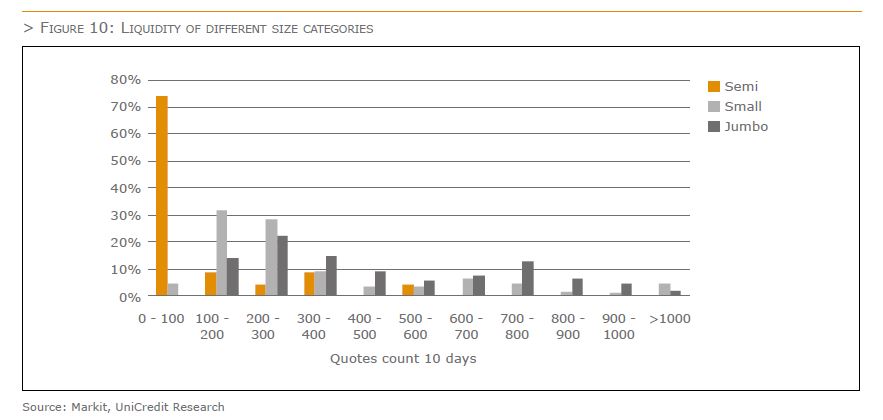

The liquidity of covered bonds is a topic that has been discussed for a long time, even before the ECB purchase programs were launched. The Eurosystem’s CBPP3, with a volume of EUR 262.2bn as of year end 2018, thus representing a significant portion of the market, has weighed on liquidity in recent years. It is therefore not easy to determine differences in liquidity for the three covered bond volume classes. However, the number of quotes recorded by Markit might give an indication. In figure 10, we illustrate the number of quotes within ten days for bonds that were issued in 2018 and 2019, clustered by volume type. The chart shows that there seems to be a correlation between the size of the bond and the number of quotes. Almost three-quarters of semi-benchmark covered bonds have quotes in the range up to 100/10 days, and none in the bracket above 500 quotes/10 days. The typical bracket for small-benchmark covered bonds is significantly higher, in the range of 100-200 and 200-300 quotes/10 days. The number of quotes for Jumbo covered bonds is even higher and more evenly distributed. While the drivers of the distribution of covered bonds across quote brackets are manifold, e.g. differences between issuers, ratings, countries, etc., it can be generally observed that Jumbo covered bonds from outside Europe have a relatively high number of quotes. Overall, the results of our analysis of the number of quotes is in line with our expectation that semi-benchmark covered bonds have lower liquidity in secondary markets than their larger peers. This is not surprising: the Jumbo concept was created in the mid-1990s in order to increase liquidity and to make Pfandbriefe more attractive to international investors.

In the covered bond universe, Markit iBoxx indices are the most commonly used and broadest spread index family with country-specific sub-indices as well as sub-indices for different tenors. iBoxx indices are therefore often used as benchmarks for ETFs. As many investors and their portfolios are – in one way or the other – linked to benchmarks, benchmark eligibility is an important criterion. However, the issue size required (among other criteria) to be included in one of the iBoxx Covered Bond indices is at least EUR 500mn, which means semi-benchmark covered bonds are not eligible for iBoxx indices. This is currently a clear disadvantage for semi-benchmark covered bonds.

Looking at the development of the benchmark definition in recent years, the size required for a bond to be deemed benchmark was significantly lowered in 2012. Up until the end of 2011, the required benchmark size was EUR 1bn. During the financial crisis, the placement of large-sized bonds became more difficult and the execution risk of placing these bonds increased significantly. In addition, rating agencies put a stronger focus on a balanced asset/liability profile. As a consequence, more and more smaller covered bonds were issued. Finally, the benchmark requirement was lowered to EUR 500mn. While there is currently no further reduction of the threshold planned, one should not rule this out in the long run.

The investor base for semi-benchmark covered bonds is somewhat smaller than for larger bonds. Given that some investors prefer large-size covered bonds, i.e. at least EUR 500mn, the lower the bond size, the lower the number of investors. These investors include, for example, central banks (especially outside Europe) and large fund managers. In addition, the credit work of investors needed to invest in bonds from smaller issuers with smaller bond volumes might be an obstacle. This is partially mitigated in markets where there is a deep and granular domestic investor base, for example in Germany.

Semi-benchmark covered bonds are sometimes used to complement funding structures. For example,funding needs in non-domestic currencies can arise if an issuer has commercial real estate assets in a country outside the euro area and funds these assets in the same currency (e.g. a German bank issuing in Swedish krona or sterling). Another example is when issuers want to broaden their investor base and specifically issue bonds in the local currency of the investor, e.g. in Norwegian krona or Swiss franc. For figures 12 and 13, we applied the following assumptions: covered bonds issued in currencies other than the euro and the respective domestic currency, semi-benchmark size in euro-equivalent at the time of issuance and bonds with a fixed coupon. The data shows that German and French banks have made use of semi-benchmark covered bonds in non-euro currencies relatively often. It also shows that the peak of 2005 and 2006, just before the financial crisis, has not been reached again. Since 2010 issuers have regularly issued semi-benchmark covered bonds in various currencies but relatively infrequently. The currencies used most often are Swiss francs (mostly used by French and German banks), followed by USD (most often used by German banks) and sterling (also most often used by German banks).

Semi-benchmark covered bonds have been increasingly used in the past decade for various reasons. They can be used to optimise an issuer’s asset/liability management – either to smoothen the maturity profile or to get funding in foreign currencies, and they provide an adequate format for issuers with smaller cover pools in order to place their bonds to an international investor base. This applies for banks in both, new as well as established covered bond jurisdictions. With covered bonds in the CEE region gaining momentum, the number of semi-benchmark bonds is likely to increase going forward. This will offer further opportunities for investors to diversify their investments and will eventually improve the liquidity of the asset class.

* Including inactive issuers