ECBC Global Concept Note on Third Country Equivalence for Covered Bonds

An Industry concept note on third country equivalence for a global implementation of the Covered Bond Directive

The implementation of the European Union (EU) Covered Bond Directive represents a real legislative lighthouse driving harmonisation and alignment of market best practices with a principle-based approach in the 30 countries of the European Economic Area (EEA). The Directive offers an overarching legislative benchmark which is leading structural convergence of legal fundamentals and market best practices, and delivering a stable long-term funding tool that allows for solid diversification of funding strategies for lenders and provides a safe harbour for investors. Furthermore, the Directive facilitates a systemic consolidation of macroprudential features securing financial stability in times of geopolitical turmoil and reinforcing the objectives of the Capital Markets Union (CMU).

More importantly, this legislative blueprint also serves as a point of reference for other developed economies and emerging countries in terms of how to ensure long-term access to capital markets and optimise private capital in the interest of housing markets. The European Covered Bond Council (ECBC) and the International Secondary Mortgage Market Association (ISMMA) are acting as market think-tanks and catalysts in order to secure a level playing field globally, and the Covered Bond Label is the principal global market portal facilitating investors’ and issuers’ due diligence.

The Covered Bond Label provides clear and transparent information on structural legislative characteristics jurisdiction by jurisdiction; detailed and harmonised data on cover assets; and unique liability data points on a bond-by-bond basis. This up-to-date and transparent knowledge platform, together with the European Mortgage Federation (EMF) Hypostat, which reports housing market data and trends, and the ECBC Covered Bond Fact Book, is boosting harmonisation and dissemination of best practices. Together, they help to facilitate open access to reliable data for investors and to increase market liquidity by enabling market participants to make rapid and informed decisions as they navigate the evolving regulatory landscape.

Facing the turmoil created by the collapse of Silicon Valley Bank (SVB) and Credit Suisse early in 2023, covered bonds once again demonstrated their solidity and their safe harbour characteristics. Equally importantly, they also showed their capability to function as the market opener after intense disruptions. Throughout their more than 250 years of existence, covered bonds have played a pivotal role in banks’ wholesale funding, providing lenders with a cost-effective and reliable long-term funding instrument for mortgage and public-sector loans. The Industry continues to build on the lessons learnt from financial crises while maintaining a focus on the essential features and qualities that have made the covered bond asset class such a success story.

ECBC Global Concept Note 02-2024.pdf

To develop synergies between traditional, new and emerging covered bond markets, provide advisory on best practice harmonisation and join forces for the establishment of a more level playing field for all at a global level, in 2015 the ECBC established its Global Issues Working Group (GIWG). To date, the work undertaken by the GIWG has been instrumental in ensuring a proper recognition of the macro-prudential value of the covered bond asset class while securing an appropriate, homogenous and cross-border regulatory treatment by different jurisdictions at a global level. In September 2022, the ECBC Steering Committee mandated the GIWG to elaborate a Concept Note on third country equivalence, to act as a roadmap helping global authorities and stakeholders in aligning policy and market best practices around the Covered Bond Directive. In doing so, ECBC members have acknowledged the important role played by the Working Group as a global discussion forum for the exchange of market best practices and as an educational platform for issuers and the global investor community. The overarching aim of the Working Group is to enhance transparency and convergence, and to ensure that there is a progressive common understanding of the covered bond concept, with similar market solutions and infrastructures, and more importantly, comparable regulatory treatment. In this context, the Working Group has been looking into the following topics via dedicated topical Work Streams:

Looking back over recent years, the covered bond space has been fundamentally impacted by major waves of monetary policy, supervisory review and regulatory change, which have all had significant consequences for the long-term financing and housing finance sectors.

At EU level, for example, the Capital Markets Union (CMU) initiative, which seeks to ensure the capability of the financial services sector to support the growth agenda and provide long-term financing to the real economy, has given rise to the following areas of reflection:

- Striking the right balance, in terms of a level playing field, between international banks operating in the European Union and European actors operating both internationally and domestically.

- Carefully examining the market impact of several key regulatory developments and trying to secure the European banking pillars in the BCBS debates (i.e. Net Stable Funding Ratio (NSFR), risk weighting, capital floors framework, leverage ratio).

- The role of European lenders in the framework of housing and of small and medium sized enterprise (SME) financing, and how lending to the real economy is becoming increasingly multi-faceted.

- The role of covered bonds and the Industry’s firm commitment to achieve a higher degree of harmonisation, in line with EU objectives and market preferences.

- Developing the concepts of Energy Efficient Mortgages and Green Covered Bonds for the benefit of EU citizens and the environment.

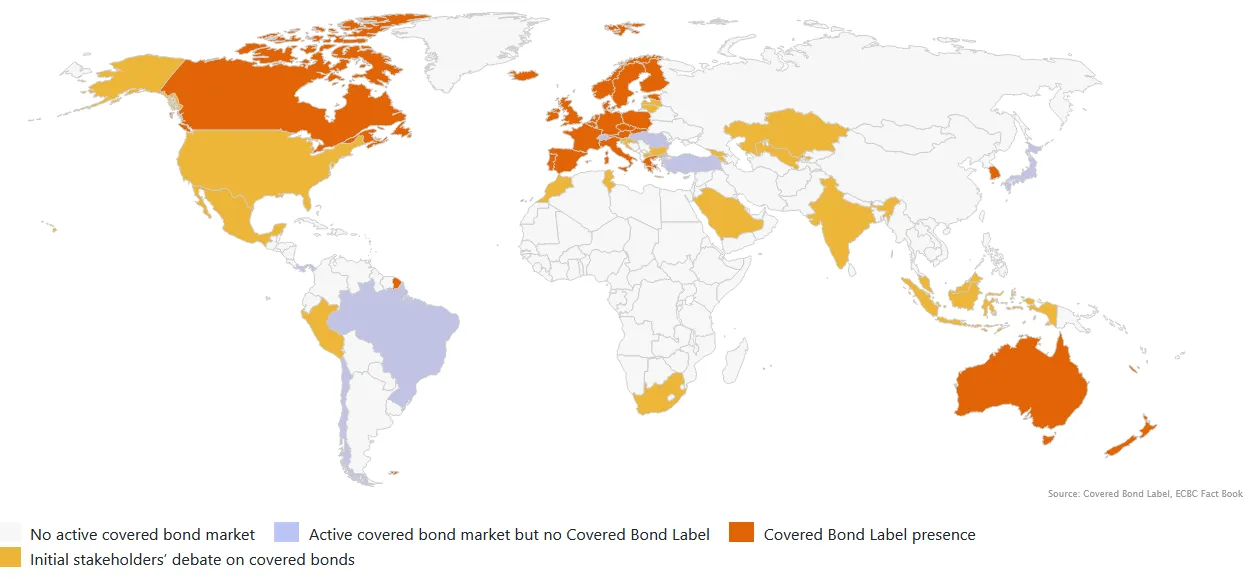

Covered bonds sit at the heart of the European financial tradition, having played a central role in funding strategies for the last two centuries. The strategic importance of covered bonds as a long-term funding tool is now recognised at a global level. In this context, Armenia, Australia, Brazil, Canada, Chile, Georgia, Morocco, New Zealand, Singapore, South Korea, and Turkey have implemented covered bond legislation in recent years. Major jurisdictions including India, Indonesia, Japan, Kazakhstan, Malaysia, Mexico, North Macedonia, Panama, Peru, Saudi Arabia, South Africa, Tunisia, the United States, and Uzbekistan are either in the process of adopting covered bond legislation or are investigating the introduction of covered bonds.

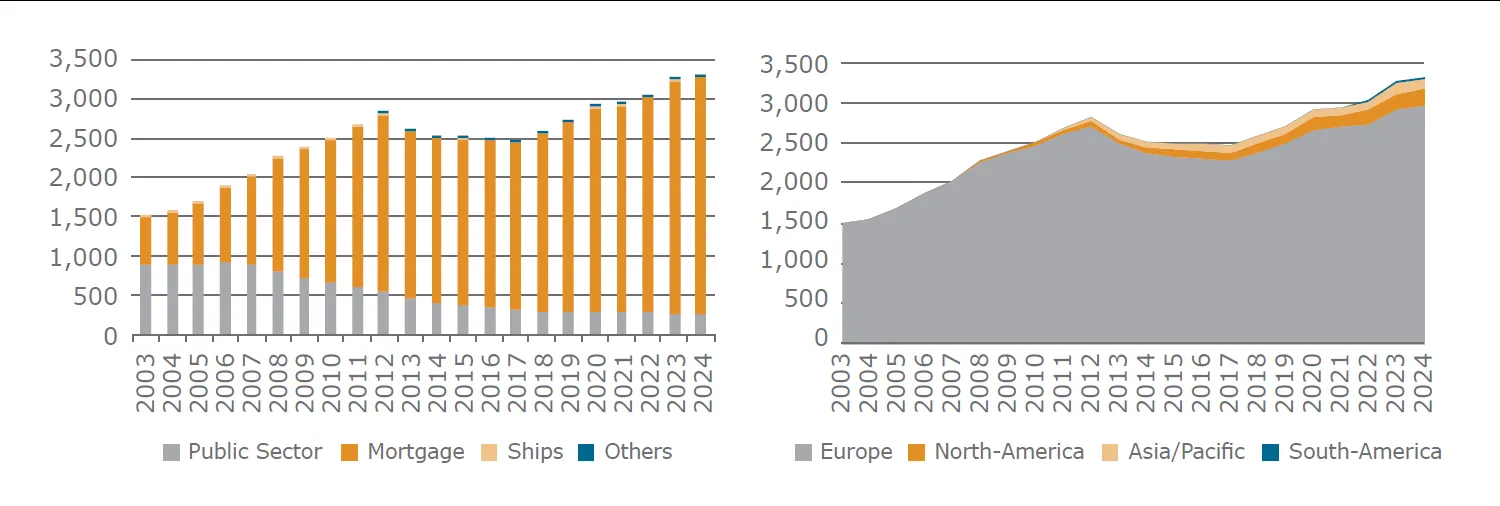

The outstanding amount of covered bonds reached another record in 2024, reflecting the large volume of new supply more than compensating for covered bonds that matured in 2024. The volume of outstanding covered bonds increased by EUR 53bn, reaching EUR 3.31trn by the end of 2024 (compared to EUR 3.26trn at the end of 2023). This marked the seventh consecutive year of growth, although the growth rate slowed to 1.6%, down from 7.6% in 2023, which had been the fastest growth rate since 2008. Moreover, it was the third year in a row that the outstanding amount of covered bonds rose further above the EUR 3trn mark. A breakdown by covered bond type showed that the increase in 2024 was largely due to a rise in outstanding amounts of mortgage covered bonds, as outstanding volumes of public sector and ship covered bonds declined slightly in 2024.

Indeed, the nominal amount of mortgage covered bonds rose by EUR 56bn to EUR 3trn (+1.9%), which was the first time since the start of the series that the amount breached the EUR 3trn mark. Overall, the figures once more underline the significant importance of covered bonds as a bank funding tool, not only in Europe but also around the globe.

The top five countries ranked by size of outstanding covered bonds (see Figure 1) in 2022 remained unchanged from 2021 with only Sweden and Spain changing their ranking: Denmark (EUR 463 bn) retaining the top spot, followed by Germany (EUR 394 bn), France (EUR 368 bn), Sweden (EUR 225 bn) and Spain (EUR 209 bn).

Source: ECBC, ABN AMRO

At the end of 2024, 333 covered bond issuers were active around the globe, of which 82 also issue sustainable covered bonds. The number of issuers dropped slightly last year, which is the balance between issuers leaving the market (mainly due to mergers and take-overs) and new issuers joining the market. Last year, four new issuers entered the covered bond market, while the number of sustainable covered bond issuers increased by eight. Meanwhile, the total number of countries with outstanding covered bonds stood at 31 at the end of 2024, slightly lower than in previous years, but more than double the number of 20 years ago. The regional breakdown shows that the majority (87.7%) of all issuers are located in Europe, but that this share is gradually declining. Indeed, the share of issuers from Asia/Pacific rose to 8.4% last year, while that of North America remained at around 3% in 2023, with those from South America remaining at 1.2%. Finally, there were 436 covered bond programmes at the end of the year, as some issuers have public sector as well as mortgage covered bond programmes while some are using multiple mortgage-backed ones.

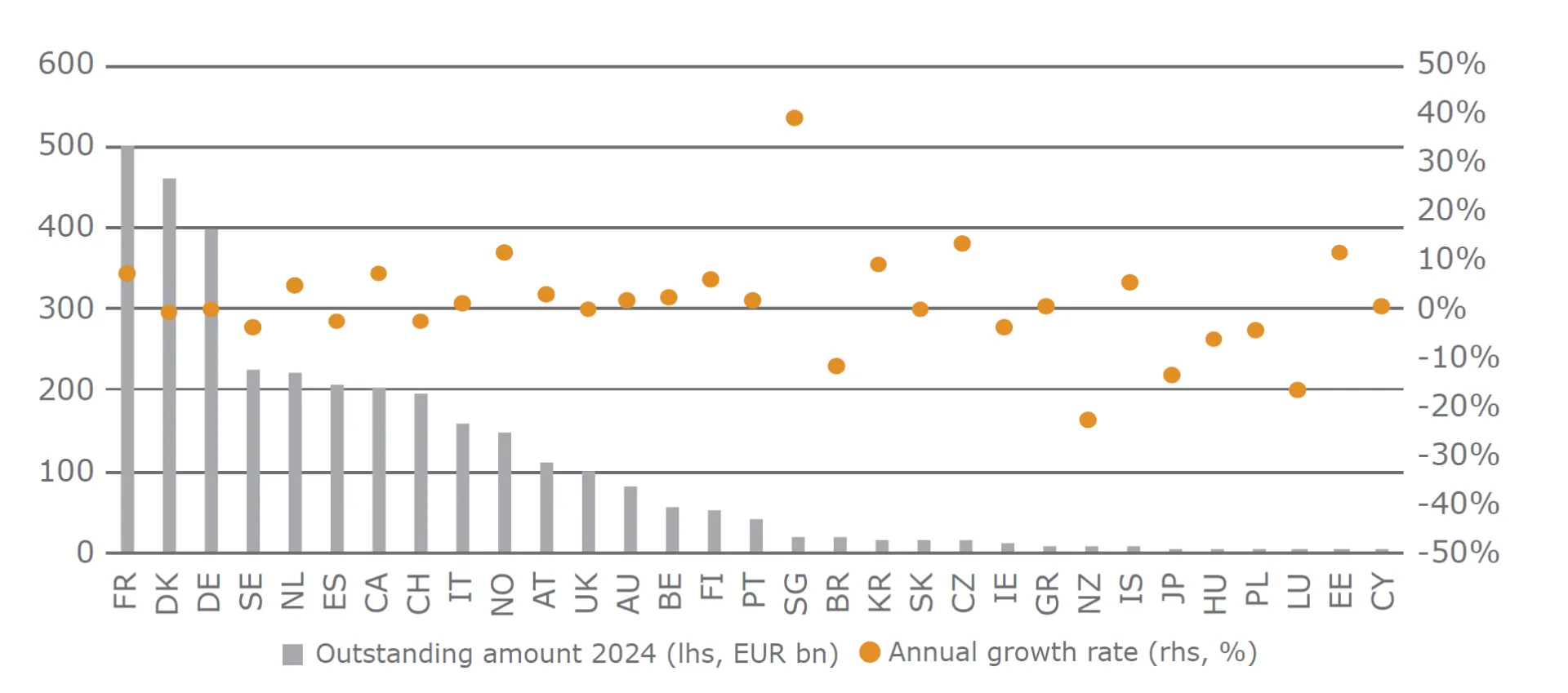

France took over the league tables from Denmark and at the end of 2024, it continued to lead as country with the largest volume of outstanding covered bonds. The EUR 502bn of outstanding covered bonds, a solid 7% increase compared to 2023, was also the highest volume outstanding it ever had. It is followed by Denmark at the second place (EUR 460bn) and Germany completes the top three (EUR 399bn). After the three largest covered bond jurisdictions, Sweden comes at fourth place with EUR 225bn outstanding at the end of 2024. The high rankings for Denmark and Sweden reflect their large domestic covered bond markets.

Within the top ten, the Netherlands moved up one spot to rank 5 in 2024, swapping places with Spain. Once one of the largest covered bond markets, Spain has experienced a decline of over 50% since 2012. Meanwhile, Canada (nr. 7) swapped places with Switzerland. Interesting to note is that the rankings from positions 9 to 16 remained unchanged last year. Singapore, however, made a significant leap, securing 17th place and marking the largest upward movement in the rankings.

Source: ECBC, ABN AMRO

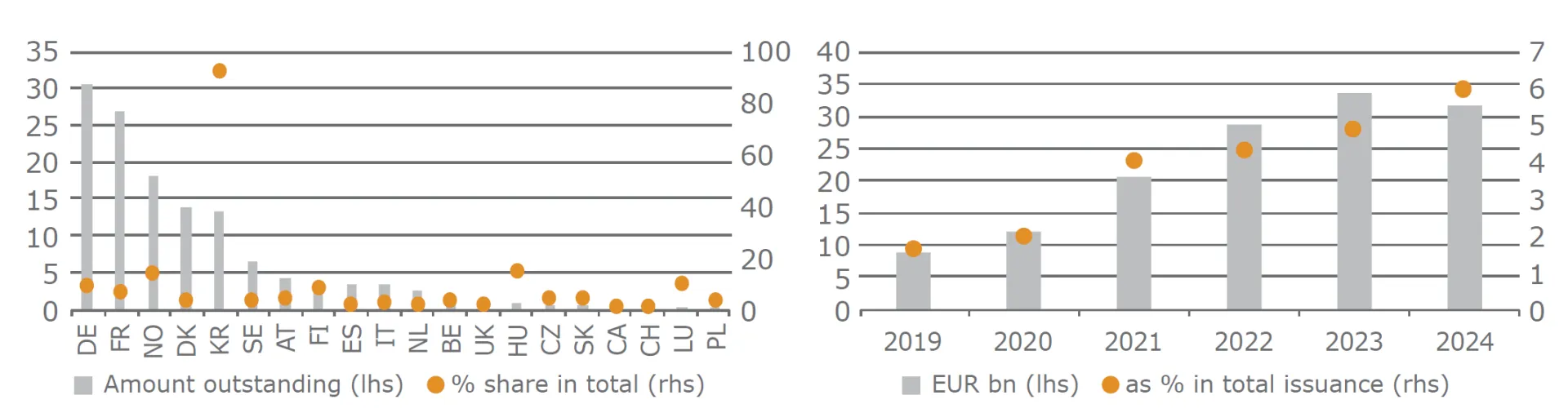

The market for sustainable covered bonds, i.e. covered bonds that have a green or social angle, has been steadily growing since the first sustainable covered bond was issued in 2014. As a result of their increasing relevance and the role that they can play in financing part of the energy transition, we decided to start collecting data about sustainable covered bonds in 2019. The volume of outstanding sustainable covered bonds was at the end of 2024 almost seven times larger than in 2019. Indeed, the total amount of sustainable covered bonds increased by EUR 23bn to EUR 131bn in 2024. This translates into an annual growth rate of 22%, which is below the growth rates in previous years, which to a large part is due to an ongoing rise in the denominator. Still, the share of sustainable covered bond in the total volume of outstanding covered bonds is now almost 4%, double that in 2021. Although still relatively small, the market is growing solidly.

Source : ECBC, ABN AMRO

The firm commitment to contribute to European efforts to enhance financial stability and transparency led the covered bond industry to launch a quality label in 2012. The Covered Bond Label was developed by the European issuer community, led by the ECBC, working in close cooperation with investors and regulators, and in consultation with all major stakeholders such as the European Commission and the European Central Bank. The Covered Bond Label and its transparency platform went live in January 2013, providing detailed covered bond market data, comparable cover pool information and legislative details on the various national legal frameworks designed to protect bondholders. As of September 2025, 196 labels have been granted to 159 issuers from 25 countries, covering over EUR 2.48 trillion of covered bonds outstanding, where over 5,600 covered bonds include information on the LCR, maturity structures, regulatory treatment, etc.

Over the last decade, by supporting better data monitoring, harmonised rating criteria and deeper screening of factors influencing investment value, the Covered Bond Label has become a beacon for investment professionals, enabling market participants to make informed decisions and navigate the evolving regulatory landscape with confidence. With a focus on regulatory compliance with the Covered Bond Directive, the LCR and alignment with sustainability goals, the Label represents a transparency and quality benchmark for the covered bond sector around the world.

In this context, covered bond issuers from these 25 different jurisdictions have come together to develop a Harmonised Transparency Template (HTT). Since 2016, the HTT has been providing cover pool information in a harmonised format, which allows for both the recognition of national specificities, with the National Transparency Tabs, and the comparability of information required to facilitate investors’ due diligence. In particular, to align with the requirements of the Covered Bond Legislative Package, in June 2022, the Covered Bond Label published an updated provisional HTT, fully aligned with Art. 14 of the Covered Bond Directive, before the deadline for the implementation of national transposition laws, which was formally approved in September 2022. Additional country-specific information on the covered bond programmes can be found in the National Transparency Templates included in the HTT.

The critical mass achieved by this initiative (over 74% of covered bonds outstanding globally now hold the Label) demonstrates the Industry’s recognition of the need to respond to the requirements of new classes of investors by providing higher levels of transparency to aid investment decisions. In this context, it is important to highlight that as of September 2025, six non-EEA countries (Australia, Canada, New Zealand, Singapore, South Korea and the UK) on aggregate hold 48 labelled cover pools, linked to 603 covered bonds, which account for over EUR 407 bn, equivalent to over 78% of the non-EEA covered bond market share.

The Industry has demonstrated its capacity to drive innovation and implement global transparency benchmarks through market initiatives such as the Covered Bond Label and the European Secured Note (ESN) instrument. More importantly, the community, by acting as a market catalyst, has facilitated investors’ compliance with their due diligence obligations and provided a key contribution to the building of the Capital Markets Union in Europe. This market principle-based approach, in parallel with the introduction of the Covered Bond Directive, has shown that it is possible to build, from the bottom up, proposals and outcomes based on market consensus to initiate global solutions that enhance transparency, comparability, convergence of markets and best practices. Taking stock of where we have come from, where we are and where we are heading, it is clear that the market and the environment in which it operates are constantly evolving and, as such, the work of the ECBC and its Global Issues Working Group is always in progress. This provides us with an ongoing challenge, and we believe that the ECBC initiatives currently underway will help further strengthen the asset class and facilitate the convergence of market and supervisory best practices.

In line with the ever-growing importance of sustainable finance, the covered bond Industry has embraced the urgency and challenges of this issue, and, as of September 2025, the Covered Bond Label is held by 186 sustainable covered bonds, collectively worth over EUR 116 bn issued by 50 issuers in 15 jurisdictions. Moreover, to provide more asset-related information for labelled covered bonds which are flagged as sustainable, starting from Q1 2023, labelled issuers were requested to complete the F1 Tab of the Label’s Harmonised Transparency Template (HTT), which is specifically dedicated to sustainable mortgages in the cover pool. From Q1 2024, the ESG disclosure in the HTT is further developed by providing issuers the possibility to indicate whether their sustainable covered bonds are sustainable-collateral-asset-based or are linked to (re)financing of sustainable projects without sustainable assets in the cover pool. The challenges that lie ahead in this area are characterised by agreeing on a shared set of definitions to define “sustainable” and the specific ESG criteria for the underlying assets in the cover pool.

The ongoing harmonisation of the covered bond asset class at both the EU and global level represents a new era for the Industry. Alongside this, market conditions, political and environmental developments and new trends are all impacting and shaping the product here and now, and will continue to do so going forward.