Covered Bonds: Between Innovation and Tradition

BACKGROUND/TRADITION/RECENT HISTORY

The discussion about innovation in covered bonds has always been relatively simple, “If it’s not broken, don’t fix it”. In this context, taking some perspective, we are talking about a financial product that has stood the test of time for more than 200 years. In 1769 an edict of Frederick the Great, established the Pfandbrief, an instrument that would become the cornerstone of the European housing finance industry. In the following centuries, all other European nations steadily enacted covered bond legislation with one key objective: to provide banking systems with a cost-efficient financing instrument that could improve prosperity by facilitating the acquisition of a home for families and businesses. Since then, covered bonds have become the traditional pillars of European mortgage financing.

No product or service, however, can prevail without adapting to the times. Technologically, the de-materialization of securities into book-entry system and the implementation of “delivery versus payment” settlement were milestones that in the late 1900’s bullet-proofed an already great product. From a transparency perspective, the adoption of the Covered Bond Label in 2012, a truly new common standard on disclosure, came to align transparency practices, simplifying comparisons for investors. The impeccable track record of the product, plus these developments, made European covered bonds the instrument of choice for everyone during the crises plaguing capital markets since 2007. Used as highly secure investments, either posted as collateral for central bank facilities, or simply launched as market-openers after periods of high volatility, covered bonds simply became the Swiss-army knife of funding products in the European capital markets of the early 21st century.

INTRODUCTION TO INNOVATION/TECHNOLOGY

During recent years the world has experienced an unprecedented wave of technological advancements covered bond markets couldn’t simply ignore. Particularly, the exponential evolution of computational capabilities, fast data transfer, and the creation of advanced tools like Distributed Ledger Technology (DLT) and Artificial Intelligence (AI) foretell a new wave of transformation in all economic sectors. Thus, this chapter dives into these two latest trends and how they’ve been affecting the covered bonds space. Furthermore, it explores any future use-cases and how the covered bond product could benefit from further adoption of these technologies.

1. Distributed Ledger Technology:

As already described by our colleague Karsten Rühlmann in his article on digitalization published in the 2021 ECBC Fact Book, DLT is one technology that, if implemented correctly, could be transformative in the covered bond value chain. Operational cost savings, lower settlement risks, and enhanced transparency are only a few of its potential benefits. However, some unaddressed issues remain that hinder implementation, from security concerns in the creation and exchange of tokens to market fragmentation, which is a natural enemy of cost efficiencies. Regulatory uncertainties regarding the dematerialization of financial instruments are still preventing market wide adoption. This is why the evolving “proof of concept” transactions that took place during 2024, under the umbrella of the Eurosystem and the imminent of our own CBDC (Central Bank Digital Currency), the so-called Digital Euro, are so important. They will help us all to determine which aspects of the technology are readiest for implementation. All of this is taking place in an increasingly competitive global environment in which not moving forward simply means falling behind.

What is DLT?

DLT refers to a decentralized system for recording transactions across a network of computers, where each participant holds a synchronized copy of the ledger. Unlike traditional systems that rely on a Central Securities Depository (CSD), centralized, trusted, third-parties, to maintain official ownership records, with settlement occurring typically on T+2 basis, DLT enables real-time, shared recordkeeping without a central authority, while also allowing the automatic processing of associated rights and obligations, such as coupon and principal payments, through so called “smart contracts”. DLT is an umbrella term including those more commonly used decentralized digital databases (registers) that record transactions and other data in a continuous chain of blocks. Hence the term “blockchain”, sometimes incorrectly used as synonym of DLT, which is characterized by three essential properties:

(i) Security:

The blocks are linked using a cryptographic hash function: so-called “hashes”. This allows data of any size, such as text, to be mapped in a code with a fixed character length. Each change to the input data leads to a completely different hash result and would therefore be detected immediately by the network if anyone tried to change it (e.g. the term “Covered Bond” is expressed by the following hash using the SHA-1 hash function: “099f0e164141187ff2d5696a27d082c03f95cb59”). By the time it is recorded on a blockchain this information is made unchangeable. The blockchain is usually operated by a decentralised network with each network participant (known as a validator) owning a copy of the entire blockchain concerning a particular asset (e.g. a bond). When a new transaction is entered into the network, the validators check the validity of the transaction on the basis of defined consensus mechanisms and ensure that it fulfils all the necessary criteria. If this is the case, the transaction is included in a new block and added to the blockchain with a timestamp. This creates a secure, seamless, and unalterable history of all transactions on that asset that can be viewed and verified by every member of the network.

(ii) Digital:

Digitization is achieved through tokenisation, i.e. the representation of an asset on the blockchain, including the rights and obligations it contains. In the case of securities, these are so-called security tokens. The security token represents ownership of the underlying asset and, unlike conventional securities, is not held in a securities account but in a wallet. This means that the holders of a security no longer have a physical document, nor are the securities held in a centralized platform, but as an electronic record in a decentralized environment such as the blockchain.

(iii) Automation:

Automation can be achieved through smart contracts. Smart contracts are simple programs that run on a blockchain. They are executed only when all relevant contractual conditions are met and can be used to automate the associated process steps (such as payments or transfers of ownership) without the need to involve a third party for processing.

Historical overview

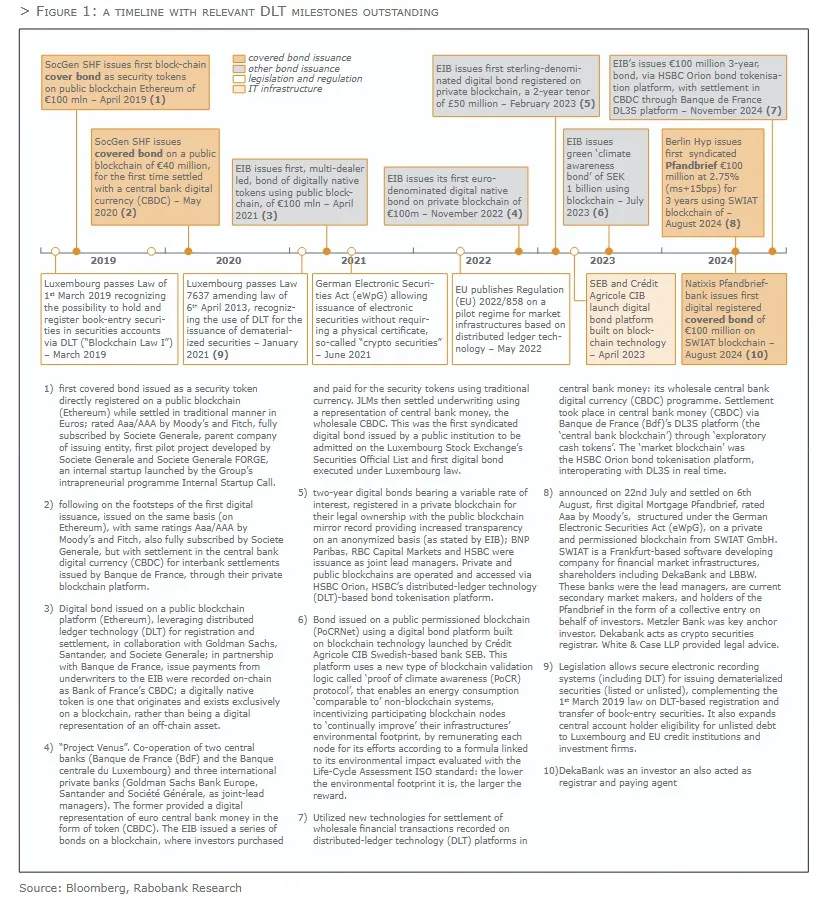

In 2019 Société Générale SFH issued the first digital covered bond (“obligations de financement de l’habitat”) with a size of EUR 100 million as a security token on the Ethereum public blockchain. This pilot transaction was fully subscribed by Société Générale. Subsequently, five years passed before the occurrence of the first syndicated digital covered bond: Berlin Hyp executed a three-year Mortgage Pfandbrief on 2nd August 2024, which was fully placed with external investors. A few weeks later, Natixis Pfandbriefbank issued a EUR 100m digital (registered) covered bond placed with one investor. Figure 1 on the next page provides a timeline including key DLT milestones over the last six years.

The case study of Berlin Hyp’s Blockchain Pfandbrief

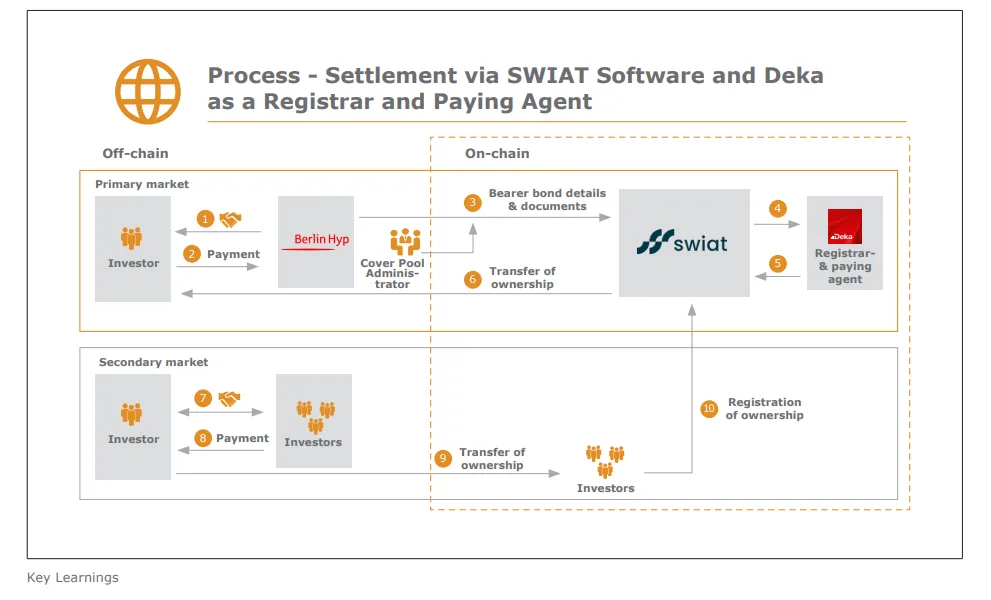

Berlin Hyp executed its Aaa-rated digital transaction on the private, fully permissioned “SWIAT” private block-chain, supported by the German Electronic Securities Act (eWpG), which came into force in 2021. The Berlin Hyp Pfandbrief was only the second crypto bearer security based on the eWpG and followed a EUR 100 million syndicated transaction by KfW, launched a few weeks earlier. When the eWpG came into force, an important change was also made to the Pfandbrief Act (PfandBG). Section 8 (3) of the PfandBG was amended so that for a Pfandbrief issued as an electronic security in accordance with the eWpG it is not necessary to be authorised by the cover pool monitor’s signature on the securities certificate. Instead, the new electronic issue can also be put into circulation by depositing the cover pool monitor’s authorisation with the cryptosecurities registrar. In the absence of electronic central bank money, the securities issue took place entirely on the “SWIAT” block-chain, yet the payment processes had to be handled conventionally, off the blockchain. It would have been technically possible to process payments on the blockchain, yet that requires using electronic commercial bank money. However, this would have created an additional settlement risk, which was avoided . The following diagram shows the individual process steps in the primary and secondary markets and illustrates which take place on-chain and which off-chain.

The case study of Berlin Hyp’s Blockchain Pfandbrief

Berlin Hyp executed its Aaa-rated digital transaction on the private, fully permissioned “SWIAT” private block-chain, supported by the German Electronic Securities Act (eWpG), which came into force in 2021. The Berlin Hyp Pfandbrief was only the second crypto bearer security based on the eWpG and followed a EUR 100 million syndicated transaction by KfW, launched a few weeks earlier. When the eWpG came into force, an important change was also made to the Pfandbrief Act (PfandBG). Section 8 (3) of the PfandBG was amended so that for a Pfandbrief issued as an electronic security in accordance with the eWpG it is not necessary to be authorised by the cover pool monitor’s signature on the securities certificate. Instead, the new electronic issue can also be put into circulation by depositing the cover pool monitor’s authorisation with the cryptosecurities registrar. In the absence of electronic central bank money, the securities issue took place entirely on the “SWIAT” block-chain, yet the payment processes had to be handled conventionally, off the blockchain. It would have been technically possible to process payments on the blockchain, yet that requires using electronic commercial bank money. However, this would have created an additional settlement risk, which was avoided . The following diagram shows the individual process steps in the primary and secondary markets and illustrates which take place on-chain and which off-chain.

The transaction has provided some key learnings from both the issuer and investor perspective:

(i) Investor education:

There is huge interest in digital securities. Berlin Hyp had contact with numerous investors during the two-week marketing phase. A global investor call and a call held specifically for (German) savings banks alone attracted 135 participants. However, it also became clear that many investors still have a need for knowledge and have not yet undergone corresponding New Product Processes. To this end, they need support from intermediaries specialising in crypto securities.

(ii) ECB eligibility:

From an investor’s perspective, the lack of ECB eligibility for digital securities is an obstacle and thus presents a significant impact on investor demand. It will be important for the future success of crypto securities to ensure their eligibility for central bank borrowing.

(iii) LCR eligibility:

The limited demand due to the lack of ECB eligibility also means that most crypto securities do not reach the minimum volume required for LCR eligibility. This is a clear disadvantage, especially for covered bonds that are otherwise categorised as highly liquid in the benchmark format.

(iv) Risk weighting:

The Basel Committee is reviewing the extent to which crypto assets issued on public blockchains should be assigned different – higher – risk weightings from 2026. A comparable review in connection with private blockchains is not currently planned but cannot be ruled out. In order to keep potential damage away from investors, Berlin Hyp has therefore decided to convert the Blockchain Pfandbrief into a traditional certificated security in the terms and conditions should the risk weightings be increased for regulatory reasons.

(v) Documentation:

MTN programmes usually provide for the safekeeping of any drawings with a CSD and clearing via a clearing house. In the case of digital securities, both tasks are performed by the crypto securities registrar. Berlin Hyp’s Blockchain Pfandbrief was therefore documented in separate bond terms and conditions.

(vi) Rating considerations:

Issues outside MTN programmes are not automatically rated by the rating agency mandated with the programme rating. Instead, it must be commissioned separately. The Berlin Hyp Blockchain Pfandbrief was rated by Moody’s. The rating is determined and assigned differently than for conventional Pfandbriefe. In addition to the covered bond analysts, a team of digital assets analysts will also assess the instrument. The focus here is particularly on the security and performance of the decentralised network and the blockchain technology used. It is also important that it is clearly documented what happens to the asset if the technology used or the digital securities registrar is no longer available. Doubts or obvious deficiencies in the robustness of the DLT network do not lead to a different credit rating for the instrument, but to none being issued at all.

(vii) Technology:

The settlement on the “SWIAT” blockchain worked smoothly. T+2 was chosen for security reasons. Same-day settlement would have been perfectly possible too.

(viii) Increased efficiency:

This is the greatest benefit from the issuer’s point of view. The lengthy issuing process with a settlement period of usually five bank working days can be shortened to same-day settlement. In this way, the issuer achieves savings, not least by avoiding interim refinancing via senior unsecured instruments.

There is still some way to go before digital covered bonds replace their traditional counterparts, as the conditions for a level playing field need to be created. Once that is achieved, issuers and investors will increasingly favor crypto securities. The efficiency gains described above are a clear advantage. Added to this is the high level of security resulting from the immutability of the information on the blockchain.

This also suits covered bonds particularly well, as security is their central element.

Regulatory developments and considerations

Current EU legislation and regulation is not yet at the stage where it can advance the development of a liquid secondary market for digital bonds. The Central Securities Depositories Regulation (CSDR), in particular Article 3, requires issuers to ensure that any transferable security admitted to trading on venues (e.g., Euronext, Deutsche Börse) is registered in book-entry form in a CSD. Similarly, Article 23 of the Markets in Financial Instruments Regulation (MiFIR) requires securities traded by investment firms to be traded on a regulated market. While both regulations entered into force in 2018 the EU introduced a temporary exemption to address these barriers, through Regulation (EU) 2022/858, also known as the EU DLT Pilot Regime, which came into force in March 2023. This initiative aims to test the settlement, listing and trading of DLT-based bonds, and assesses whether such an exemption could encourage the development of digital bond infrastructure.

The EU DLT Pilot Regime, a three-year trial renewable in three-year increments, introduced frameworks such as DLT Settlement Systems (DLT SS) and DLT Trading and Settlement Systems (DLT TSS) to be operated by authorised entities therein. These allow digital bonds to be issued and admitted to trading on regulated markets in Europe, potentially increasing secondary market liquidity. The scheme may serve as a testing ground for future legislation that would permanently enable the full lifecycle of digital bonds to operate in a regulated environment through DLT SS and DLT TSS.

At an individual country level, the Netherlands is the only major market whose existing securities legislation appears to be able to accommodate the issuance of DLT bonds. Elsewhere, Luxembourg adapted their regime for dematerialized securities, France adapted its regime for registered securities, and Germany passed its new German Electronic Securities Act to accommodate the issuance of DLT-based bonds. Later Italy and Spain adapted their legislation to be compatible with the EU DLT Pilot Regime and set the stage for bids to operate DLT SS and DLT TSS. Poland was the latest country to amend its securities law framework and adapt its existing regime for dematerialized securities to allow registration in DLT accounts or in DLT registers.

2. Artificial Intelligence

The financial landscape is undergoing a transformative shift with the advent of AI. AI is rapidly changing the way humans interact with technology, the so-called “Large Language Models” (LLMs) that have stormed user interfaces. They are in the initial stages of providing, through natural language prompts tools to analyze large and intricate data sets to better understand and predict behaviors. As AI technologies continue to evolve, their applications are becoming increasingly relevant in various domains, including the covered bond market. In this article, we will explore potential use cases focusing on its impact on issuers, rating agencies and investors. Some of these use-cases are expected to materialize soon, while others are still seen as long-term prospects.

(i) Issuers:

In pool selection, AI algorithms have the potential to assist by optimising the composition of the cover pool. They could help identify the best assets for inclusion in a cover pool and which composition would achieve the lowest level of overcollateralisation. In doing so, AI could potentially deliver dynamic outcomes that automatically consider dynamic events such as house price changes, concentration limits, prepayments, loan-to-value ratios, interest rate adjustments, arrears and any new bond issuances, thereby ensuring a continuous optimization between assets and outstanding bonds. AI could also predict cash flows and potential risks, thereby giving issuers the possibility to create different stress scenarios, especially if they are able to leverage on rating agency assumptions and modelling.

Other applications of AI include the calculation of the carbon footprint of cover pools, as well as streamlining legal processes. Among the use cases we foresee for the latter are assisting in drafting prospectuses via specific interfaces, particularly to those chapters that focus on issuer specific information and where financial figures are included. One other, in combination with blockchain technologies, could be the drafting and reviewing of bond documentation, which is currently still a largely manual process. Increased standardisation and automation could streamline this process, accelerating it and reduce the likelihood

of operational or manual errors. Lastly, to the extent that investor reporting activities are not yet fully automated, AI could be instrumental in optimising the workload of generating these periodic reports.

(ii) Rating agencies:

The major rating agencies are already utilizing AI algorithms in various ways, such as for data collection, data analysis and to streamline or reduce repetitive tasks. AI enhances their capabilities by facilitating improved financial analytics and insights, handling complex tasks like dissecting financial reports, generating nuanced insights, and making informed predictions. AI-driven solutions accelerate daily tasks such as monitoring stock, bond or commodity prices and managing client interactions.

Despite these benefits, AI also introduces an array of challenges and risks for credit rating agencies. One primary concern is the potential for algorithmic bias, where AI systems may inadvertently incorporate historical biases present in data, leading to unfair or inaccurate results. Moreover, as AI models become increasingly complex, the transparency and interpretability of decision-making processes can diminish, making it difficult for stakeholders to understand and trust AI-driven “black box” assessments. There is also the issue of data privacy and security, as AI systems require extensive data sets, which can be vulnerable to breaches or misuse. Furthermore, regulatory and compliance challenges arise, as existing legal frameworks may still not be equipped to handle the rapid advancements in AI technology. These risks necessitate rigorous oversight and continuous improvement of AI systems to ensure they deliver reliable and ethical outcomes in credit rating operations.

(iii) Investors:

The key benefits for investors include amongst others the ability to analyze large and intricate data sets to better understand and predict behaviors. The new models will enhance analysts’ understanding of market trends, simplifying their work and enhancing their insights of the underlying risk drivers. These models will allow market participants to receive tailor-made analysis, to fit their desired risk exposure. This will enable improved methods for analyzing cover pools, a better grasp of risk drivers, and more effective comparisons of cover pools and covered bond programs across various issuers and jurisdictions, all contributing to greater transparency.

CONCLUSION

Covered bonds have evolved as a centuries-old financial instrument to become a resilient cornerstone of European housing and public sector finance. While investor protection has long dictated a cautious approach to innovation, recent advances in DLT and AI are now reshaping the landscape without compromising covered bonds’ unique safety features. Pilot digital covered bond transactions – like Berlin Hyp’s blockchain-based Pfandbrief – have demonstrated clear benefits in transparency, efficiency, and

automation, though regulatory, infrastructural, and market-readiness challenges remain. Meanwhile, AI is beginning to offer powerful tools for issuers, investors, and rating agencies – enhancing risk assessment, optimizing pool composition, streamlining documentation, and improving reporting processes. As regulatory frameworks continue to adapt, particularly through the EU DLT Pilot Regime, the path toward mainstream adoption of digital and AI-enhanced covered bonds becomes clearer. Long-term success will depend on harmonized legislation, investor education, and a level playing field that preserves the product’s historic security and credibility while embracing technological progress. The challenge ahead lies in balancing innovation with the safety and reliability that define the covered bond. The question is no longer whether the market will evolve, but how decisively it will choose to do so.