27 March 2024

The current geopolitical context, the resulting energy crisis and climate change are making it increasingly necessary to radically rethink the regulatory framework and market best practices of the European housing finance sector. The need for a real acceleration in pace in the coordination of national and European policies opens new scenarios that have perhaps never been seen before.

This turning point is already having a profound influence on current political and legislative debates on crucial market dossiers such as the EU Taxonomy, the Energy Performance of Buildings Directive, the implementation of the final Basel III reforms and, more generally, all issues related to digitalisation and sustainability.

The key to interpreting these new dynamics must be found in the political perimeter outlined by the NextGenerationEU package, which is intended to provide the keys to a future full of opportunities for upcoming generations.

The housing sector is key to the development of a clear market roadmap that will enable the European Union to achieve its goal of reducing greenhouse gas emissions. Indeed, housing is a strategic sector not only because homes are the main place where people spend their lives and, increasingly, work, but also because buildings account for 40% of CO2 emissions in continental Europe.

The scale of the investment needed to improve the energy performance of more than 220 million homes to meet the EU’s energy saving targets is immense and cannot be achieved by the public sector alone. The private finance sector in the EU has a central role to play in the transition to a more sustainable economy, reducing energy poverty for households, especially those that struggle to meet the transition challenges, safeguarding consumers’ wealth in terms of disposable income and asset value, and supporting economic growth and job creation. In this context, it is of strategic importance to align the interests of lenders, investors, SMEs, utilities and, above all, consumers in multi-service platforms at European level. If we are to reach our 2030 targets, almost 500,000 homes in Europe must be renovated each week.

The real breakthrough of a net-zero Europe will come from the large-scale use of green mortgages. Today, the mortgage market is equivalent to around 46% of the EU’s GDP. Stimulating the development and offering of green mortgages is crucial to achieving a climate neutral economy, as highlighted by the Energy Efficient Mortgages Initiative (EEMI), which seeks to introduce an integrated greener, sustainability-focused approach to purchasing, renovating and living in homes.

At the heart of the EEMI are efforts to boost and support consumer demand for building energy renovation by way of an energy efficient mortgage ‘ecosystem’. Bringing together a wide range of relevant market players, including lenders, investors, SMEs and utilities, the EEMI is aligning strategies and actions through a new, innovative market mechanism focused on a green “fulcrum” of products, services and data.

Based on consumer research, market research and value chain analysis conducted over a number of years, the EEMI has boiled the findings down into core elements which are being brought together in an EEMI ‘ecosystem’. The EEMI Ecosystem is intended to guide consumers towards financial and technical solutions which support them in the energy renovation of their homes. In essence, by combining market innovation, digitalisation and green financing instruments across the whole value chain and seamlessly integrating all market participants into a new value chain, the EEMI Ecosystem will optimise the end-to-end customer journey and experience, deploy market interventions and partnerships that support delivery and maximise benefits for consumers.

Concretely, the EEMI Ecosystem ‘platform’ is focused on the delivery of a seamless customer renovation journey by way of a three-pillar structure, comprising:

With a view to delivering this ‘ecosystem’, the EEMI is currently building a constellation of national platforms focused on local characteristics and implementation needs but with a European footprint. The EEMI governance structure, combining the European-level EEM Label and Advisory Council with the EEMI national hubs, is providing the European coordination of national actions, including institutional interventions.

Overall, it is the ambition of the EEMI that the “ecosystem” will:

As indicated above, at the heart of this new ecosystem lies the Energy Efficient Mortgage Label, launched in 2021 as a quality benchmark for consumers, lenders and investors to support recognition of and confidence in energy efficient mortgages. This is achieved through access to relevant, quality, and transparent information for potential borrowers, regulators, and other market participants. In addition, the Label aims to facilitate a process of standardisation to secure and enhance overall regulatory recognition of the asset class.

The Label is built around the EEML Convention and a process of self-certification, both of which are overseen by the label governance structure consisting of: the Label Committee, the Label Secretariat and the Label Advisory Council.

The EEML has been developed using the Covered Bond Label as a blue-print, which is managed by the EMF-ECBC and can look back on a 10-year success story, a period during which it has established itself as the global reference point and data collection benchmark for the over EUR 3 tn. outstanding covered bond asset class. It is the intention that the EEML emulates this goal in relation to energy efficient mortgages and in the wider field of financing of energy efficient renovation, scaling-up volumes and best practices in respect of both ESG-related retail activities and funding policies.

The initiative comes at a pivotal point in time, where efforts are underway at EU level to redesign the regulatory and monetary policy framework to address climate change and transition risks. As of August 2023, 34 pioneering lending institutions from 12 countries have adopted the EEML, covering the four corners of the Old Continent, large and small lending institutions, traditional banks and FinTech platforms.

To be part of the EEML interested parties need to self-certify that they are a lending institution with products aligned with the EEML Convention, for which they need to disclose relevant information using the Harmonised Disclosure Template, at least on a quarterly basis. A dedicated Harmonised Reporting Template has been developed for Retrofitting Loans with which to provide the relevant disclosure on leases, targeted and non-targeted loans.

The EEM definition was launched in December 2018 and consists of high-level, principles-based guidelines for the technical assessment and valuation of eligible properties. The definition provides clear eligibility criteria for assets and projects that can be financed by energy efficient loans and for the tagging of existing assets in banks’ portfolios. The EEM definition provides the protocols to ensure appropriate lending secured against properties that are likely to have both lower credit risk and support climate change mitigation and adaptation.

Importantly, the EEM Label Committee is working on the revision of the Definition/Convention to ensure alignment, as appropriate, with the EU Taxonomy.

Finally, it is worth noting here that in recognition of the availability of different types of energy efficient/green financing products, the EEM Label website also provides the possibility to label unsecured consumer loans for energy efficient renovation purposes.

The Harmonised Disclosure Template

With a growing focus on sustainable finance – from regulators, market participants and investors alike – transparency and disclosure are becoming crucial drivers in harmonising best practices and in mitigating the “green-washing” risk in the financial sector, securing investors’ confidence and financial stability. Considering this, the Harmonised Disclosure Template (HDT) allows for improved comparability of energy efficiency mortgages. The key is to establish centralised and up-to-date qualitative and quantitative information, which will be available for investors, regulators and other market participants.

The objective is to stimulate the creation of a positive incentive sequence across the mortgage value chain for more consistent and standardised data collection and management, as well as to better link loan information, property and energy efficiency characteristics in a single common template. Standardisation will support investor due diligence, facilitate regulatory reporting requirements in this area and enhance overall transparency in the EEM and (covered) bond markets. To strike the balance between the standardised structure valid for all labelled EEM products and the national peculiarities in reporting specific data points such as the breakdown of loan size, the HDT provides for the introduction of nation-specific breakdowns managed by national coordinators.

The HDT is based on the Master Template delivered under the Energy efficient Data Protocol & Portal (EeDaPP) Project, which organises EEM “input” data and is also inspired by the successful Harmonised Transparency Template (HTT) of the Covered Bond Label. Indeed, efforts have also been undertaken to align the HTT and the HDT as much as possible to facilitate completion and due diligence by banks which have both an EEM Label and the Covered Bond Label. The HDT is furthermore fully compliant with existing regulatory and market disclosure requirements.

The HDT must be completed for each labelled EEM product at least every quarter and has the following structure:

In order to be aligned with market best practices and with regulatory requirements, the HDT undergoes an annual revision process which culminates with the approval of the updated HDT in September/October. This effort is supported by both the lending institution community and by the Disclosure Working Group comprising national coordinators, EEML Committee members and interested representatives of the lending institutions to support the Secretariat in gathering potential amendments to the HDT based on suggestions related to overarching and national-specific reporting and disclosure issues.

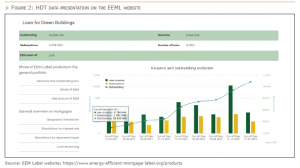

Currently, 34 lending institutions have disclosed HDTs on 34 products that are available on the EEM Label website. As with the Covered Bond Label, for the EEML the HDTs are exclusively publicly available via the lending institutions’ own websites. A reporting tool using direct links to the HDTs creates a graphical representation of the data contained therein on the EEML website, as shown in Figure 2.

The Harmonised Reporting Template

In the same fashion as the HDT reports data on EEM Labelled mortgage products, the Harmonised Reporting Template (HRT) focuses on retrofitting loans intended to support consumers in improving the energy performance and/or reducing environmental risk vulnerability of their dwelling. The HRT is inspired by the work already done in the HTT and HDT, as well as by reporting templates from the ECB and reporting templates used for private finance loans by various market participants.

The HRT must be completed by all lending institutions which present a labelled retrofitting loan starting from cut-off date Q2 2023. It is structured as follows:

Self-certification

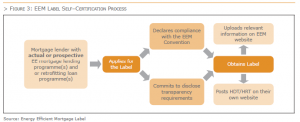

As indicated above and once again drawing on the experience of the Covered Bond Label, the EEML is based on a process of self- certification, according to which lending institutions signal their compliance with the Convention. The process of self-certification is detailed in Figure 3.

The self-certification process highlights and is testament to a real ESG engagement and strategy for EEM labelled lenders. This process of self-certification has proven to work very efficiently in relation to covered bonds, as a result of subsequent scrutiny by other market participants, including investors and rating agencies, of the publicly disclosed HTT, representing a form of “third-party verification”. This has given rise to a market-led mechanism which effectively polices itself with the result that the cost of not accurately disclosing data or falsely declaring compliance with the Convention is high in terms of reputation and potential impact on the underlying product or ratings. This will help to mitigate any risk of “green-washing”.

Authors : EMF-ECBC Secretariat