International Secondary Mortgage Market Association (ISMMA) is the first global association to bring together secondary mortgage markets institutions to focus on advocacy on regulatory issues, share information, and provide support to newly-established institutions in this space. ISMMA was established in 2018 under the sponsorship of the World Bank.

The association provides a platform for member countries to exchange ideas on how to improve access to housing finance for their citizens and ultimately reach the goal of adequate, safe and affordable housing for all. The UN estimates that the global population will reach 8.5 billion by 2030, with almost 60% of the population living in urban centers.

An estimated 3 billion people will need new housing and basic urban infrastructure by 2030. Against the backdrop of rapid urbanization putting pressure on housing delivery systems, many urban poor will not be able to afford formal housing without proper housing finance solutions. This puts the issue of housing finance at the forefront of global development agenda, and the ISMMA will serve as an important platform to envision and design solutions to enhance access to housing finance.

ISMMA focuses on advocacy on regulatory issues, information sharing, and providing support to newly-established institutions in this field. This is the first global association to bring together secondary mortgage market institutions.

The association provides a platform for its now 31 member countries to exchange ideas on how to improve access to housing finance for their citizens and ultimately reach the goal of adequate, safe and affordable housing for all, which is one of the Sustainable Development Goals. Membership to ISMMA is open to all secondary mortgage market associations around the world.

The ISMMA secretariat moved from the World Bank to the European Mortgage Federation – European Covered Bond Council as of 1 July 2022.

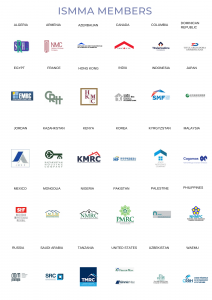

ISMMA currently has 31 member organisations from Algeria, Armenia, Azerbaijan, Canada, Columbia, Dominican Republic, Egypt, France, Hong Kong, India, Indonesia, Japan, Jordan, Kazakhstan, Kenya, Korea, Kyrgyzstan, Malaysia, Mexico, Mongolia, Nigeria, Pakistan, Palestine, Philippines, Russia, Saudi Arabia, Tanzania, United States, Uzbekistan and WAEMU.

Download the full list of ISMMA members here .

OUR HISTORY

OUR HISTORYThe concept of a ‘community of practice’ for secondary mortgage market institutions had been discussed for several years prior to ISMMA’s inception in 2018. There had been a round-table discussion in 2014 during the Global Housing Finance Conference in Washington D.C., where the idea was floated for a knowledge sharing platform for secondary mortgage market institutions.

The idea gained strength with the support and drive of Cagamas Berhad ahead of the 2018 conference. At this stage, there was a positive alignment of institutions and a desire to both share more national experiences and to learn from others. The World Bank had supported the creation of several Mortgage Refinance Companies (MRCs) in Egypt, Jordan, Tanzania and Nigeria with a pipeline of new companies under creation in Kenya and Pakistan.

So there was a natural objective of reaching synergies and shared lessons across these different but very similar institutions. This was the aim of ISMMA, to be a place where like-minded institutions can come together and by sharing knowledge strengthen the outlook for afford- able housing in each of their countries.

The expected knowledge sharing among members was along the lines of credit policies, capital market strategies or IT platforms, yet within less than a year of ISMMA’s establishmenty the agenda changed radically. ISMMA became an important source of information on how each secondary mortgage market was adapting to the reality of COVID-19 in their countries. What measures were governments and central banks taking? What would be impact of mortgage payment moratoriums? What would happen to house prices?

ISMMA members were able to share this information and become important contributors towards global information gathering on policy responses. Quarterly virtual meetings became the norm, which were always extremely well attended and with a rich and diverse content from all parts of the world.

During its first four years, ISMMA saw the establishment of several new entities including KMRC in Kenya, PMRC in Pakistan, UMRC in Uzbekistan, TIDOM in Dominican Republic and SRC in Saudi Arabia. A pipeline of new companies is still strong with several countries expected to create secondary mortgage market institutions over the coming years.

The new Secretariat for ISMMA at the European Mortgage Federation – European Covered Bond Council (EMF-ECBC) gives ISMMA an opportunity to grow further and help to shape the future direction of the sector. Discussions have already taken place on important agendas that will likely dominate housing finance policy over the next decade. In particular, the current inflationary environment and less benign economic conditions will provide a test for many housing markets that have not experienced credit cycles yet.

Alongside this will be an ever-growing focus on climate mitigation and adaptation in the housing sector. The way housing is financed will be central to this conversation and provides a powerful policy tool for creating green financial incentives for market mechanisms to adequately respond to environmental needs.

Just like COVID-19 was unexpected, the future will hold more unanticipated challenges; one certainty though is that information sharing among a group of institutions with a common mission to finance affordable housing in their countries, will make all of us better able to face down these challenges.

EEMI International Sustainable Housing Finance Symposium, 3-4 October 2022 | Venice, Italy