26 April 2018

By Agustin Martin, Aaron Baker, BBVA, Jacek Kubas, EBRD and Colin YS Chen, DBS Bank & Chairman of the ECBC Global Issues Working Group

This article is taken from the 2017 edition of the ECBC European Covered Bond Fact Book, which can be accessed here.

Covered bonds, since their inception in 1769 in Prussia, have grown to become a significant bank wholesale funding instrument across Europe, praised for their stability and limited credit risk (to date, there has been no actual default of a covered bond programme); in fact, banks in certain jurisdictions such as Denmark fund their entire mortgage lending activities via covered bond issuances.

Covered bonds are becoming increasingly popular in the emerging markets; recently covered bond laws, or changes to existing covered bond laws, were adopted in Singapore, Poland, Romania; while the work is on-going in such countries like Croatia, Slovakia, Estonia, Latvia and Lithuania. In the CEE region, the European Bank for Reconstruction and Development has been an active supporter of such efforts.

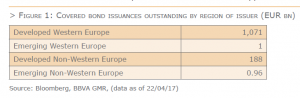

There are 17 European countries that have market-quoted covered bonds outstanding, with the largest markets being Germany, France, Spain and the Nordics. That said, there are a multitude of other European countries that have seen no meaningful issuance despite the existence of covered bond legislation (28 countries in the EEA have covered bond legislation) permitting their issuance, including Bulgaria, Romania and Lithuania.

Since 2013, covered bonds have become an increasingly global debt product, with a steadily declining proportion of Europe-based issuers and Canadian and Australian issuers notably ramping up their issuances. Furthermore, we have seen recent additions to the covered bond family, with South Korea, Singapore and Turkey-based issuers all engaging in the covered bond market, whereas revamps of covered bond frameworks to make them more internationally desirable have made rapid advances in emerging Europe, for example in Romania and Poland. The accommodative monetary policies in Europe and the Americas, and the European Central Bank’s covered bond purchase programme (CBPP3) have furthermore created favourable conditions to establish covered bond programmes in non-traditional jurisdictions.

Covered bonds can potentially provide several key benefits to a transition economy. By allowing banks to fund longer-term assets in a way which is cost effective, more accurately matched to the term of those assets (thus removing balance sheet gap risks), and relatively delinked from their own credit rating (which allows market access at times of systemic stress), covered bonds contribute to the stability of the banking system.

This is particularly the case in the EBRD region (including, in particular, Central and Eastern Europe), where banks so often rely on funding from a parent, either an Italian or German or Scandinavian bank. The Vienna II Initiative advocates for such reliance to be decreased, and local funding sources explored.

Due to the fact that covered bonds can be secured on a portfolio of high-quality mortgage assets, usually with an 80 per cent loan-to-value (LTV) ratio, and subject to strict quality controls, they can contribute to an improvement in loan origination processes. They do not allow the originator to pass on any credit risk to a third party and therefore encourage sustainable, responsible lending practices.

In many countries, particularly those that are not part of the euro-zone, the development of local currency denominated covered bonds with both high credit and liquidity characteristics brings an important source of diversification for domestic investors such as fledgling pension funds. As such they can fulfil an important role in the development of local capital markets.

We expected there to be a much greater proliferation of covered bonds originating from emerging market jurisdictions in 2017. In 2016 and early 2017 we did see the increase issuances out of Poland, including two international euro-denominated benchmark issues. Particular reason for this was the adoption of the new law that entered into force on the 1st January 2016. Similarly, there was an increase covered bond activity in Hungary, due to the introduction of the mandatory refinancing ratio. While in other countries, like for example Romania, the issuances, so far, did not materialise due to either overliquidity of the banking system and/or certain legal, economic or political uncertainties.

Further, with the US gradually withdrawing monetary support and likely to be followed in the medium term by the ECB (although this is not happening currently), arguably the ‘horse could have bolted’ for the prospects for emerging market covered bonds, particularly in respect of reliance on non-domestic covered bond investors who expressed an interest in emerging covered bonds as part of a general ‘search for yield’ strategy (for example Poland). Despite this, we remain positive on the prospects for the development of new covered bond jurisdictions, particularly if the global economy continues to grow at its current pace with the concurrent sustained increase in global demand for mortgage lending.

Given the positive legislative and regulatory backdrop of the asset class, we see growth in the medium term across Central and Eastern Europe, Asia and LatAm, although we qualify this view to some extent depending on regional specificities. Legislative hurdles and political discussions aside, which tend to focus disproportionately on encumbrance limits, depositor preference and derivative treatment, we consider that issuance levels in Central and Eastern Europe are dependent on market, legal and political conditions. Furthermore, the European Commision’s work on covered bonds within the Capital Market Union (as announced in the “CMU mid-term review”) will have a significant impact on the CEE jurisdictions. One can only assume, at this stage, that the outcome of the planned Covered Bond Directive be close to what the European Banking Authority proposed in December 2016.

In other parts of the world, following on from the breakthrough issuances from Asian-based issuers, we see continued issuance, although the headwinds in this jurisdiction will be restrictive asset encumbrance levels set by regulators and limited funding needs given excess liquidity in the banking systems of the viable jurisdictions. The new legislation in Brazil could open up the LatAm covered bond markets more meaningfully but it depends on the political and economic situation stabilising.

In the remainder of this article, we attempt to answer the question of what the necessary conditions are for the incorporation of a meaningful covered bond bank funding channel for issuers. We focus on Brazil and Poland, given our expectation that these jurisdictions could see the development of substantial covered bond markets

in the medium term.

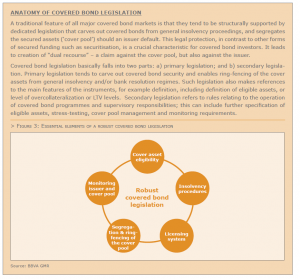

In our view, covered bond legislation is a necessary but not a sufficient condition for the successful introduction of the covered bond product, albeit with the notable exception of the UK covered bond market before legislation was enacted in 2008. There have even been examples within developed covered bond markets where legislation has opened a door that no bank has actually needed to open, such as the Spanish export-guarantee loan covered bonds (Cédulas Internacionalización) whose legislation received royal assent in 2013, which has never reached a publicly issued format, which supports our argument or the current situaiton in Romania, although this hopefully will change soon.

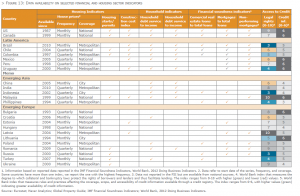

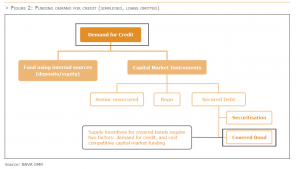

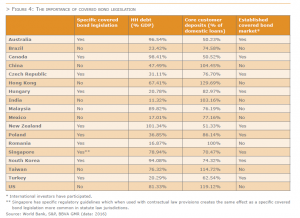

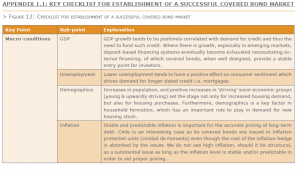

Looking at the table below, it is clear that there is no meaningful covered bond jurisdiction without specific covered bond legislation in place. In our view, legislation is an enabling factor but the driving force is demand for the eligible collateral (typically mortgages) and the need to diversify funding away from short-tenor but economical deposits. Proxies for both of these factors can be seen in a jurisdiction’s household debt (HH) and customer deposits as a percentage of domestic loans, respectively. Jurisdictions such as the US have substitute products that are more economical than covered bonds, namely Agency MBS, whereas others such as Hong Kong have an abundance of deposit funding that creates headwinds for the need for a covered bond product and its resulting supply.

Turkey has already seen the first issuance by Vakifbank, sold into Europe with much fanfare (over 4x subscribed), making it the largest book order in EUR covered bonds of 2016. Such robust demand indicates that the monetary conditions and yield compression in the European fixed-income markets can have beneficial spill-over effects for developing covered bond markets, although this avenue would appear impaired presently due to wider socio-political developments.

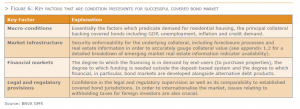

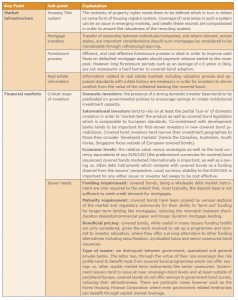

Shifting our gaze to Latin America, there are a multitude of covered bond legislations with various levels of robustness when compared to European equivalents, including those of Colombia, Uruguay, Peru, Paraguay, Panama and Chile, with only arguably the latter having limited, locally distributed covered bond issuance with certain features that make the product less compelling for international investors. We would posit that there are four key factors that explain the success of a jurisdiction in issuing covered bonds, with each factor explained in more detail in Appendix 1.1.

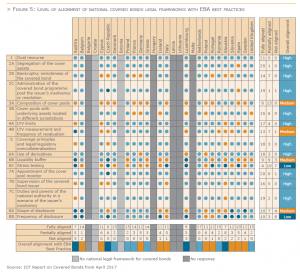

In addition, in relation to the covered legislation within the EU – the very useful tool is the EBA table of the “covered bond traffic lights” with three colours green, yellow and red showing the relevant compliance with the EBA principles.

Moving to the specific case of Brazil, the enabling primary legislation was passed in 2015 but the market still awaits secondary legislation that will provide eligibility and related regulatory requirements for the product. On 30 January 2017, Brazil’s central bank published a request for comment on proposed regulations to govern covered bonds that would remove the last legislative hurdle prior to banks issuing such instruments. The comment period ends in April 2017 and is expected to lead to final rules within three months.

In our view, the proposed regulation’s text is generally aligned with covered bond standards that we see in developed jurisdictions, such as minimum over-collateralisation levels, loan-to-value limits, a 180-day liquidity test and a proposed asset encumbrance limit of 10% of the issuer’s total assets; furthermore, the covered bond ‘model’ is on balance sheet ring-fencing in line with the German model. The consultation leaves open the treatment of derivatives and potential set-offs against the cover pool, which are important points for international covered bond investors. Mindful that legislation is necessary but not sufficient, we take a look at some of the key factors that we list in Appendix 1.1, which help set the scene for determining the potential success of Brazilian covered bond programmes.

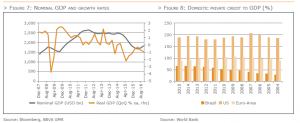

Brazilian covered bonds, by definition backed by residential mortgage assets, require not only demand for residential credit within the banking system, but also the exhaustion of more typical emerging market bank funding sources like deposits. Demand for residential mortgages is highly correlated with GDP growth, which in turn drives demand for credit within the economy for investment, residential or otherwise.

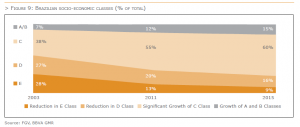

The ability of Brazilian banks to advance longer-term credit, crucial for products like residential mortgages, is helped by the relative stability of inflation, with the figure being in a range of 3-7% between 2006 and 2015, although more recently it has surged to 9.4% as a result of wider macroeconomic instability. Demand for housing is underpinned not just by population growth (+11% between 2006 and 2013), but also, more importantly, by the emergence of a larger middle class, aka the ‘aspiring class’, which tends to seek residential ownership, thereby providing a structural underpinning to the housing market in Brazil.

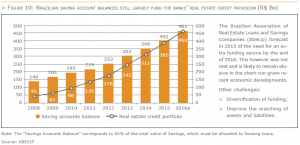

The main sources of financing for residential housing demand are the Savings and Loans Banking System (SBPE) and the Employee Retirement Fund (FGTS), which together account for over 90% of the financing of the Brazilian real estate market. According to the Central Bank of Brazil, 65% of savings accounts are funnelled through to real estate credit as a matter of regulatory preference, whereas the FGTS is used for low-income housing. The Brazilian banking system’s capacity to sustain the growth in demand for housing credit is showing increasing signs of strain, with earlier estimations by the Brazilian Association of Real Estate Loans and Savings Companies (ABECIP) indicating that the savings account funding method could be exhausted in the next few years.

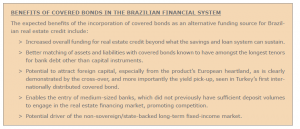

Naturally, the reliance on such short-term liabilities to fund longer-term assets raises the question of financial stability, with Brazilian regulators looking to alternative funding products that can be used to ‘term-out’ the funding for residential mortgages; covered bonds are an obvious bank funding product for such purpose. The request for comment on the consultation for introducing covered bonds sets a minimum liability tenor of two years, which would no doubt help reduce the asset liability matching for the Brazilian financing system given that the average tenor of underlying mortgages is 10 years.

Before looking at a place where a covered bond market could fit into the banking system, it is important to note that, by and large, covered bonds are funding instruments of private banks. This is because while they offer defined pricing advantages over senior unsecured issuances, their price advantage over sovereign and/ or sovereign-related enterprises has only really been seen in peripheral Europe, in a market where there is arguably the overarching authority of the EU to protect the systemic importance of the covered bond product. In Brazil, c.45% of the banking assets are in the hands of state banks, which while not necessarily unusual for emerging economies, does limit the potential size of any embryonic covered bond market.

Finally, it is important to note that wholesale real estate debt financing products are not non-existent in Brazil, and there are several competing alternative wholesale financing products to covered bonds. In Brazil there are:

> Real Estate Investment Funds (FII): these are a type of mortgage REIT that enable investment into real estate leases, property development and other real estate-related financing activities.

> Certificate of Real Estate Credit Receivables (CRI): these are effectively securitisations backed by real estate loans and purchased by institutional investors.

> Real Estate Letters of Credit (LCI): these are fixed-income securities, backed by real estate loans, which are tax-exempt for domestic investors and whose returns are typically backed by some percentage of a house price and/or interest-rate index.

The global covered bond community’s expectation for many years has been that Brazil will join the covered bond fraternity, although there have been headwinds since 2H15, notably from macroeconomic instability partly caused by the fall in commodity prices, which has led to a contraction in GDP and rising inflation.

In our view, Brazilian covered bonds would make an important contribution to the private Brazilian banks’ funding toolkit, especially in respect of reducing their asset-liability duration mismatch. The success of the product is predicated on there being sufficient domestic and international investor demand, in addition to continued increases in demand for real estate credit, which has recently tapered substantially owing to wider macroeconomic uncertainties. Although credit demand overall remains weak in the Brazilian economy given three years of economic recession, declining mortgage interest rates will help stimulate demand for home loans. It is this decline in interest rates accompanied by a return to a positive growth trajectory for the Brazilian economy that would be the real catalyst for the utilisation of Brazilian covered bonds, regulatory issues aside.

Due to various factors, the Polish covered bonds market had never significantly developed, despite the existence of favorable market conditions. This was mostly due to two factors: (i) an outdated legal framework (the Act on Mortgage Bonds and Mortgage Banks from 1997) and; (ii) the structure of the covered bonds’ model whereby only mortgage banks were/are allowed issuing covered bonds, while over 95 per cent of mortgages were granted by universal and not mortgage banks.

It became apparent that the Act on Mortgage Bonds and Mortgage Banks from 1997 required updating and alignment with international standards. This was confirmed by the levels of outstanding covered bonds in Poland at that time (2014/15), which were lower than in Hungary, or the neighboring Slovak Republic or the Czech Republic. In order to create the market, participants, the Ministry of Finance and the EBRD worked together to create a new legal and regulatory framework for covered bonds in Poland.

Such work resulted in a new covered bond legislation. On 24 July 2015 the Polish parliament approved an amendment to the existing covered bond framework, the Act on Mortgage Bonds and Mortgage Banks. Amendments were also introduced to the Polish bankruptcy law. The changes came into effect on 1 January 2016 and one can already observe the increased activity in the market.

The amendments are also the first in Europe providing for a pass-through structure in the legislation (CPT) directly. As already indicated, Polish covered bonds can only be issued by specialised mortgage banks, currently only three have such a license, whilst a number of banks have applied to obtain the necessary license and establish the mortgage bank.

The revised Polish covered bonds law remains fairly traditional. Inspired by German legislation, Polish covered bonds can be secured by mortgage loans or by public sector debt. Residential mortgage loans can be used as collateral for covered bonds up to a maximum 80 per cent of the value of the underlying property (LTV ratio). For non-residential mortgage loans the LTV ratio is 60 per cent. Mortgage banks are not allowed to originate or acquire mortgage loans with a LTV ratio higher than 100 per cent. The collateral for public sector covered bonds can consist of debt issued or guaranteed by central governments or central within the European Union or the Organisation for Economic Co-operation and Development (OECD), except for states that are currently in the process of restructuring or have restructured their foreign debt within the last five years. Substitution assets, which can consist of cash, central bank deposits or public sector debt eligible as ordinary collateral, are limited to a maximum of 15 per cent of the volume of collateral required to cover the outstanding covered bonds. Derivatives used for hedging purposes can also be included in the cover pool.

An independent cover pool monitor needs to be appointed for each covered bond issuer by the Polish Financial Supervisory Authority (KNF). The main task of the cover pool monitor is to ensure that the issuer complies with the coverage requirements set out by the covered bond framework. The framework now also requires a nominal minimum OC of 10 per cent. This limit is a minimum, and banks, hoping for a higher rating uplift, have to comply with the expectation of rating agencies that may ask for a 20 to 30 per cent level of OC. The total nominal amount of outstanding covered bonds may not exceed 40 times the issuer’s own capital.

In case of bankruptcy, the cover pools and covered bonds are split from the issuer’s balance sheet and an administrator, who represents the rights of the covered bondholders, will be appointed by the bankruptcy court. The maturity dates of all outstanding covered bonds will automatically be extended by 12 months. Interest payments on outstanding covered bonds will continue to be made as specified in the terms and conditions of

the bond in question. The law regulates these points in details.

This reform can successfully be defined as creating conditions precedent underpinning the Polish covered bond market. The law has been actively used by the issuers, and there seems to be a bright light for the future of the Polish covered bond market with strong investors’ (including international investors’) interest. We hope that this is an example that will be followed by other jurisdictions working on the new law, in the region. So far, we have observed two international benchmark issues (each EUR 500 million) and a number of domestic issuances.