30 August 2023

The publication of this year’s European Covered Bond Council (ECBC) Covered Bond Fact Book, the 18th edition, comes at a critical geopolitical moment, when financial markets are entering uncharted waters and where high inflation and a new monetary policy landscape are once again highlighting the anti-crises nature of this asset class in providing, in parallel, stable and robust long-term financing and efficient asset liability management. During the recent months of market turmoil and volatility of deposits, lenders have been able to secure access to capital market funding by relying on the 250 years’ old DNA of covered bonds and their macroprudential characteristics including low volatility, exceptionally low transaction execution risk, superb credit ratings, and decreased refinancing costs, and limit banks’ reliance on riskier funding means and interbank markets.

This anti-cyclical, long-term financing instrument has become a pillar of financial stability and is the nexus between harmonised European financial innovation and the traditions that sit within national legal frameworks.

Together, via the harmonisation and convergence of efforts through the entry into force of the Covered Bond Directive and the ongoing pursuit of third-country equivalence for non-EEA countries, our industry continues to push geographical barriers.

In this context, the present publication stands as an Industry transparency and informative toolkit offering a deep dive in the covered bond world, summarising the latest market trends, providing a statistical overview and compiling detailed legal information, jurisdiction by jurisdiction. Moreover, the Fact Book sheds light on potential of this asset class to support the transition to a climate-neutral economy with their pivotal role in forging a path to sustainable growth, stability, shared prosperity and, in the end, a brighter future for all. The covered bond market continues to evolve and expand, transcending borders and bridging gaps between capital markets and the real economy.

The ECBC Covered Bond Fact Book together with the Covered Bond Label comparative database serve as a map and compass, guiding market participants, regulators and policymakers through the intricacies of the covered bond market.

This compendium of market developments encompasses the essence and collaborative spirit of the ECBC members’ work, which amalgamates different cultures, perspectives as well as, more importantly, legal and financial features defined by a common qualitative and quantitative perimeter. Over the years, this collaborative and constructive approach has become the true fil rouge of our Industry’s modus operandi i.e., always ready to adapt to challenges whilst preserving asset quality and ensuring investor protection. The Fact Book represents the collective effort of our community to produce a prime academic and statistical benchmark publication, whilst coordinating a discussion forum involving over 2,000 covered bond experts and aficionados around the globe.

Over time, this community has been able to foster a covered bond philosophy with clear macroprudential characteristics for investors, thereby ensuring capital market accessibility and financial stability for mortgage and housing markets.

More importantly, beyond the purely financial aspects, for most jurisdictions the introduction of covered bonds has also resulted in the provision of more affordable mortgages, more funding choices for lenders and more long-term borrowing options for consumers when they make the biggest investment of their life.

On a daily basis, capital market participants need complete and accurate information to support regulatory compliance with the Covered Bond Directive, LCR eligibility and ESG-related diligence matters, to name but a few priorities, and this need is growing all the time. This is where the ECBC comes into its own. The ECBC-led Covered Bond Label, has become a qualitative benchmark as an informative gateway into the covered bond space.

Most recently, the ECBC has completely refreshed its Comparative Database2 on global covered bond legislative frameworks, which is embedded in the Covered Bond Label website.

During the recent periods of market turmoil, pandemic and technological innovation, the EMF-ECBC has played a prominent role as a market catalyst through its efforts to monitor and align best practices. Furthermore, through its technical committees, working groups and task forces, the EMF-ECBC has developed technical knowledge and centres of competence in relation to both the mortgage and covered bond businesses, with a focus on retail considerations, property valuation, prudential regulation, funding strategies, to name but a few key areas. By adopting a “think-tank” approach and adhering to a clear global market governance structure, the EMF-ECBC has applied this expertise to help minimise market disruption. At the same time, it has sought to deliver active coordination and implementation of initiatives aimed at harmonising procedures, standards, definitions and solutions, for example via the Covered Bond Label and its Harmonised Transparency Template (HTT), the Energy Efficient Mortgages Initiative (EEMI) or the Energy Efficient Mortgage Label (EEM Label) and its Harmonised Disclosure Template (HDT).

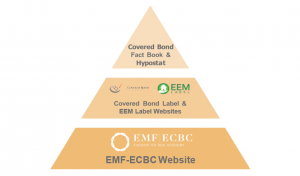

Significantly, all of this know-how and expertise can be accessed by way of a unique information “pyramid” which offers market participants with direct and rapid access to a wide variety of information and data on specific national markets or on European/global market and policy trends. The content and structure of this pyramid is fine-tuned on a regular basis with market participants in the covered bond and mortgage spaces.

The operational entry level of the pyramid is the EMF-ECBC website through which the EMF-ECBC provides access to all position papers, studies and analysis produced by its technical committees and working groups, offering a valuable window into the potential of current and future legislative and market evolutions. The EMF-ECBC website furthermore provides links to its member organisations, giving an insight into the experts behind the knowledge.

Stepping up a level, the next layer of the pyramid consists of the Covered Bond Label website, where around EUR 2 trillion of covered bonds outstanding are officially registered. The Covered Bond Label website

offers a unique level of transparency as the data it holds is managed directly by issuers, ISIN by ISIN, bond by bond, on:

At the top of the pyramid are the EMF-ECBC’s flagship publications offering a deeper dive into market dynamics and legislative developments: the ECBC Fact Book and the EMF Hypostat. The ECBC Fact Book crowns the Covered Bond Label website and Comparative Database with its deeper dive into key themes and trends having impacted the covered bond space in the previous year, national legislation, summaries of the overarching macroprudential value and regulatory treatment of the asset class, as well as synopses of rating agencies’ methodologies. Through the Hypostat, the EMF-ECBC delivers a unique analysis of trends in Europe’s mortgage and housing markets, offering a comprehensive asset side perspective of mortgage market dynamics and national characteristics for investors and other market participants.

Presently, this information pyramid acts as an operational magnifying glass which guides market participants through the labyrinth of compliance with the Covered Bond Directive, providing legal details, hard data and intelligence, all of which is crucial for investor due diligence. The pyramid’s cornerstone lies in the compliance disclosure requirements, with the Covered Bond Label’s HTT being fully aligned to Article 14 of the Directive.

At the global level, the ongoing prospect of a third-party equivalence regime is boosting the interest in adopting covered bond legal frameworks and helping to make compliance with the qualitative standards foreseen in the Directive a clear point of reference for regulators and legislators.

Access to information, market guidance and harmonisation efforts are the secret ingredients which make the covered bond space a unique area of the market rooted in stakeholder confidence that, in turn, represents the real essence of the crisis management capabilities of the covered bond asset class.

The EMF-ECBC has always sought to be part of the solution and, through the recent market turmoil, has activated the Industry’s best resources to monitor, analyse, discuss and guard against potentially negative impacts for mortgage, housing and funding markets worldwide. As a community, the EMF-ECBC remains committed to supporting the transition to a more sustainable economy and society, encouraging countries to move from a pandemic mind-set towards a more sustainable capital markets infrastructure, and supporting consumers and borrowers in turning the current challenges into opportunities.

After so many years, there is no doubt that we are stronger together and we would like to thank all ECBC members for their input, engagement and continued support during what have been challenging times. We would particularly like to express our gratitude to the contributors to this year’s publication for their work in ensuring that this 18th edition of the ECBC European Covered Bond Fact Book remains:

Morten Bækmand Nielsen, ECBC Chairman

Luca Bertalot, EMF-ECBC Secretary General