24 August 2018

HISTORY OF ESN: CMU PLANS TRIGGERING IDEAS CREATED BY ECBC

The Capital Markets Union (CMU) plan, outlined in the 2015 European Commission’s Green Paper on Building a Capital Markets Union, aims to develop better regulation by means of market initiatives that can support growth and lending to the real economy, in its role as market catalyst. The CMU should help channel private funds to all companies, including SMEs, and infrastructure projects in order to facilitate expansion and thereby create jobs. By linking savings with high-growth investment opportunities, the CMU will offer new opportunities for both savers and investors. The ECBC decided to assist and support the development of any market initiative going forward that has the potential to play a crucial role in financing growth and the real economy while preserving the strength of the traditional covered bond market it represents. The ECBC established a Task Force on Long-Term Financing, the purpose of which was to investigate the possibility and viability of the creation of new capital instruments that make use of some key features that have made covered bonds one of the safest and most successful financial tools in use in Europe, and which played a central role in the crisis management toolkit of banks during the financial crisis by providing a safe and reliable source of funding. This ECBC Task Force (since renamed ESN task force) prepared the response to the EC’s Green Paper which aimed to provide clear building blocks for a market initiative on a pan-European dual recourse long-term funding instrument, which would allow for the financing of asset classes beyond the traditional covered bond collateral types of mortgages and public sector assets such as small and medium-sized enterprise (SME) and/ or infrastructure assets. The ECBC’s proposal represented a market initiative creating a new pan-European funding instrument, which was called the European Secured Notes (ESN). This initiative would require a limited legislative intervention at national level and would respond to several of the priorities for early action foreseen in the Green Paper, in particular: (i) widening the investor base for SMEs, and (ii) building sustainable high-quality securitisation. On several occasions, institutions like the European Central Bank, the European Commission, the European Investment Bank, the European Banking Authority and several national regulators have praised the ECBC for the ESN project. This initiative, designed outside of the traditional covered bond space, combines existing techniques and market best practices for the establishment of a funding solution for lenders that is also accessible in a stress scenario. Traditional covered bonds have ensured financial stability and access to capital markets during the crisis thanks to very precise macro-prudential characteristics. It is important to clearly distinguish any funding solutions for SME and infrastructure loans using similar dual recourse techniques from the traditional covered bond space, because of their different characteristics (see below). One of the key success factors is the common adoption of the same set of micro foundations and technology, in particular in terms of eligibility criteria, definitions, risk parameters, data disclosure and IT solutions across European countries. If correctly implemented, supported by a minimum level of regulatory recognition as a very high-quality product under a clear legislative and supervisory framework, it could facilitate issuers and investors in terms of due diligence, risk analysis, pricing and funding diversification.

Despite the similarities of the ESN as on balance sheet funding tool and traditional covered bonds, it is important to highlight the features that distinguish covered bonds from ESNs. The main distinguishing feature is the different collateral used to secure ESN in comparison to the collateral of covered bonds. Covered bonds use highly standardised and low-risk assets, mainly mortgage loans and claims against public sector entities, as collateral. The high level of standardisation of cover assets is a key element that facilitates the analysis of covered bonds, limits research effort and increases transparency and comparability within the covered bond sector. Using highly standardised assets also makes it easier to define eligibility criteria for the cover assets that can be used on a relatively broad basis, i.e. in a larger number of jurisdictions (also outside the EU) and have facilitated the success of the various harmonisation efforts, described in chapter 1.1 of Fact Book 2018. The use of low-risk assets as collateral is one cornerstone of the high level of investor confidence that covered bonds enjoy. The concept of dynamic collateralisation based on asset substitution through the issuer is more acceptable for investors if new assets which are added to the cover pool will meet certain minimum criteria. For issuers, the use of high quality collateral means a more stable credit quality of the cover pool and ultimately less frequent asset substitution. The use of other, potentially more risky and less comparable asset classes for ESN makes a clear distinction between traditional covered bonds and ESN necessary, as the risk profile of the two instruments could vary significantly. A further distinguishing factor between covered bonds and ESN, at least at an initial stage, would be the established track record that covered bonds enjoy. Together with robust national legal frameworks, the longstanding track record of covered bonds has helped to make them more reliable and stable. The long track record, which is the basis for a deep and diversified investor base, helps to support market access of covered bond issuers also in time of stress. The robust market access itself is an important stabilising factor for covered bonds. Drawing a clear line between covered bonds and ESN will help to protect the track record of covered bonds against potential dilution that could occur through the introduction of instruments that bear similarities to covered bonds but may have a different risk profile.

With the spirit of the Capital Markets Union in mind, the ESN Task Force tried to design new bank funding tools aiming at improving banks’ ability to lend to the real economy, while at the same time stimulate the growth of SMEs by promoting the use of SME loans as collateral for new ESNs. ESN Task Force has proposed two possible ESN structures, each with slightly different characteristics, aimed at providing different benefits to the lender as well as to the borrowers and investors. The first type of ESN (focused on funding only) would be similar in design and structure to covered bonds in the sense that the originating bank would be the issuer of the ESNs and the investor would have dual recourse to both the pool and the issuer. The second type of ESN resembles more closely to what is referred to as highquality securitisation that also involves an element of risk-sharing with investors. The first type of ESN is the structure that was selected for further market studies by EC and EBA. ESNs would benefit from a kick-start via regulatory recognition which could be most quickly and easily done via an amendment of the Covered Bond directive to clearly identify ESN as a separate funding instrument besides traditional covered bonds with its own separate status and treatment. The ESN can afterwards be implemented through a bottom-up approach, which would aim at amending the current legislative frameworks by adopting common definitions, risk parameters and market best practices (even if this may be implemented de facto through different legal options/solutions at national level). This combination of common European guidelines, flexibility and adaptability in the implementation at national level should ensure a smooth adoption of this structure in what remains a heterogeneous market, as well as supervisory and legislative landscape. As such, it could have the obvious advantage of benefiting from regulatory recognition. In fact, the transformation of SME loans into an ESN could improve the regulatory and prudential treatment of such assets, by making them UCITS1 compliant, and therefore exempt from bail-in, and eligible for a number of prudential and regulatory requirements, such as under Solvency II. In this context, two elements are necessary in order for the ESN to successfully play this role: (i) a robust specific legal framework around the creation of such an instrument; and (ii) a sufficiently high level of transparency regarding the asset pool and its performance.

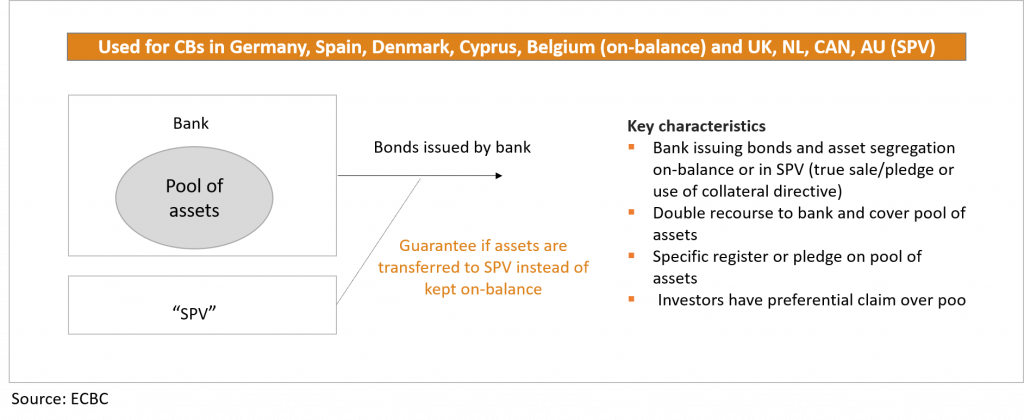

On-balance sheet European Secured Note

|

|---|

The existence of a legal and supervisory framework is one of the major strengths of covered bonds (see figure 1). This should also be developed for on-balance sheet ESNs, whereby the asset pool would have to fulfil specific criteria. These include, but are not limited to: a harmonised definition of SME loans allowed as eligible collateral; clear rules on the segregation of the pool for the safety of the investor; appropriate levels of overcollateralisation (OC); and clear pari-passu priority claims of the investor to the issuer’s assets in the case of default and insufficiency of the pool to cover the value of the bond. In addition, the eligibility criteria for SME loans needs to be developed. A good starting point for this may be the European Central Bank’s (ECB) collateral framework which allows the use of credit claims as collateral for repo operations2 . This alignment would ensure greater marketability and liquidity of the ESN. The second requirement, i.e. transparency, is very much linked to the first point, as it is a necessary condition for the accurate assessment of the true underlying risk of the SME assets used in the pool. High levels of transparency would facilitate due diligence and allow investors to effectively understand the underlying risk. More importantly, it would allow issuers to effectively manage their portfolio. Therefore, it is of paramount importance to develop an effective transparency framework. Also, the framework of the Italian (Obbligazioni Bancarie Collateralizzate) and/or French (Banque de France’s ESNI facility) versions of the ESN could serve as a blueprint for some of its characteristics. The latter is developed in the next section.

1 http://ec.europa.eu/finance/investment/ucits-directive/index_en.htm.

2 https://www.ecb.europa.eu/pub/pdf/scpops/ecbocp148.pdf.

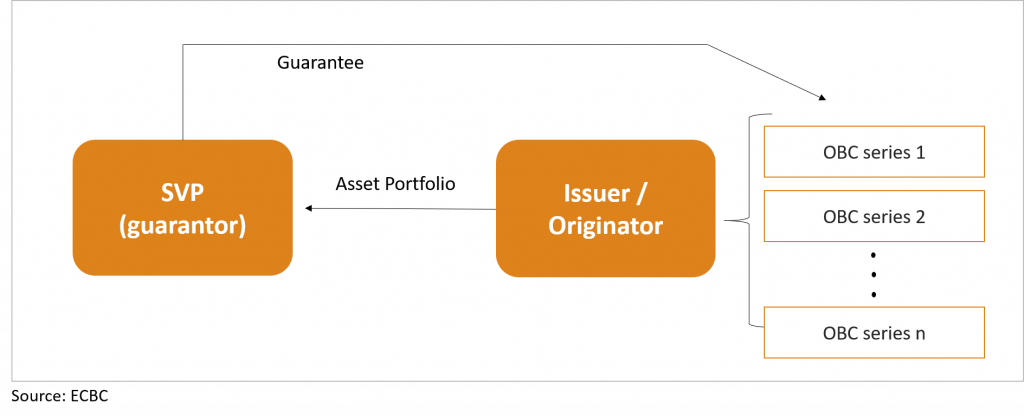

The Italian government proposal to amend the securitisation law in order to introduce the ESN framework was approved by the parliament on 6th of April 2016 and subsequently converted into law. The primary legislation allows the issue of bonds (called Obbligazioni Bancarie Collateralizzate – OBC), collateralised by SME loans, leasing, factoring, ship loans and other types of commercial assets. The structure is similar to the existing covered bonds (Obbligazioni Bancarie Garantite – OBG), though the law clearly differentiates between the two products (see figure 2). Secondary regulation will specify some features of the new instrument such as the exact definition of eligible assets and identification definition of licensable issuers.

The Italian ESN structure

|

tesr |

OBCs will be under public supervision. This is a key element as public supervision is a pre-requisite for the ESN to be UCITS compliant, and therefore exempt from bail-in, and eligible for a number of prudential and regulatory requirements such as under Solvency II. Other characteristic features will be the bankruptcy remoteness of the segregated assets, which will be assigned to an SPV. This is the so-called true sale mechanism. Two major rating agencies have already expressed their support to the Italian ESN underscoring the success of the implementation in the “Bel Paese”. To further support the development of the ESN initiative, the ECBC has worked on building a market platform where regulators, treasuries, Central banks and Supervisory authorities can meet with key market players to discuss a smooth implementation of the ESN.

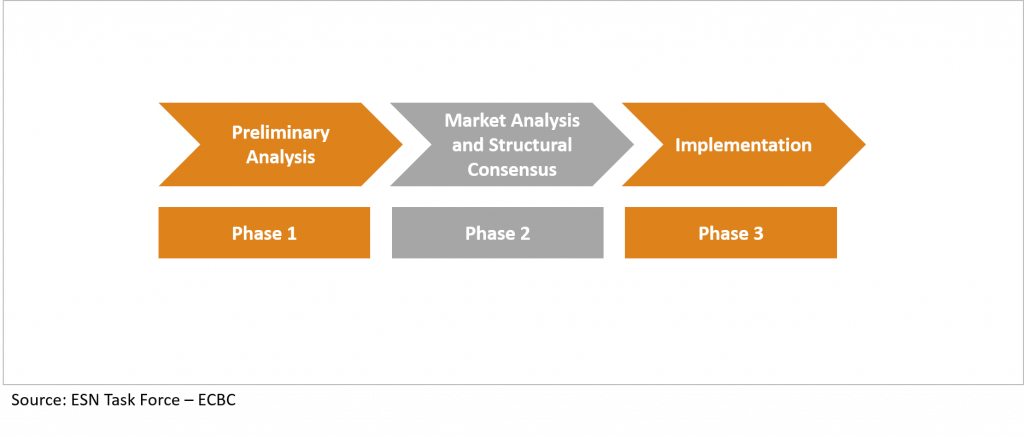

Looking ahead, the success of these ESN instruments would rely on both a robust legal framework and a high level of transparency regarding the underlying assets. The development of centralised credit registers3 with harmonised levels of information would provide the ideal tool for the achievement of full transparency (while complying with confidentiality laws), and the subsequent increased level of protection of these ESNs. All parties involved would be able to accurately assess risks and thereby differentiate their portfolios accordingly, contributing to the quality of the instruments. This links closely to the other condition, i.e. a robust legal framework, which among other things would focus on determining which assets can be used as collateral. Having transparent information regarding these SME loans is a central aspect of this issue. Moreover, issuers, regulatory and investor communities should work together to develop common eligibility criteria for assets (which could be inspired by the ECB collateral eligibility criteria for credit claims as well as European Investment Bank-EIB Group activity). Establishing a pan-European standard in terms of securities backed by SME or infrastructure loans would be a cornerstone of the strength of this product. Regulatory frameworks and existing laws should be amended to allow these new asset classes to be used as collateral within the regulatory and prudential framework. In order to drive the effort forward, contributions from the institutional side as well as from the market side should include the following process (see figure 3) designed by the ESN Task Force of the ECBC:

Three phases of the ESN Project

|

tesr |

3. [ One example of this could be the Analytical Credit Dataset (AnaCredit) “The development of a steady state approach for an analytical credit dataset will continue in 2015 in close collaboration with the FSC. This entails drafting a new ECB regulation and guideline for the collection of granular credit data and the development of an IT tool for data collection, maintenance and dissemination.”, source: ECBC Statistics ]↩

Following on from the results of the ECBC Long-Term Financing Task Force meetings, the ECBC kicked off the ESN project in October 2015 with a high-level Roundtable in Milan, attended by a wide range of representatives from the European banking industry, investors’ community and regulators. Following the Roundtable in Milan, the ECBC has been holding several high level meetings with key stakeholders from both the private and the public sector in order to push forward this new instrument initiative aimed at fostering investment in SMEs and infrastructural projects. Italy was the first Member State to adopt a regulation on an ESN-like instrument in April 2016. The ESN project has also been gaining traction in core EU countries such as Germany and Austria, where the initiative is considered a smart and effective way of funding a number of infrastructural projects. It is important to highlight the value of such a product in Germany, where the “Energiewende”, i.e. the transition to a low carbon, environmentally sound, reliable, and affordable energy supply, and other infrastructure programmes will need additional funding in the coming years. Among other things, funding such projects via ESNs would be advantageous with respect to the much used syndicated loan methodology. Following the introduction of the Italian legislative ESN framework on the 6th of April 2016, the ECBC Secretariat organised a second Roundtable in Milan in May 2016. During the meeting, a broad range of stakeholders and authorities, both national and European, debated on the nature of the ESN, the state of play in the interested countries, funding needs of SMEs and infrastructures, and the possible eligibility criteria for the cover assets. The European Commission and EBA both see a business case for the creation of European secured notes (ESNs) as a dual-recourse instrument to fund SME loans as stated in the EBA latest recommendations in June 2018 (see the following section). There is still ongoing discussion regarding infrastructure ESNs. Some raised concerns on the quality of such assets is, in our view, based on some potential misunderstanding about the definition of infrastructure assets. Smaller sized, more granular operational infrastructure assets could be included within the ESN framework while large one-off long-term projects with long construction phase will be more challenging due to their lumpy character. More individual analysis would be required if those would be eligible. The EC is confident that the legislative package around CB directive will be adopted by first quarter of 2019, but some technical details need to be ironed out especially on the definition of eligible assets. It is to be seen if ESN will be included in the total package via an amendment of the CB directive to recognise ESNs as separate asset class.

The EBA presented its recommendations for the future regulation of European Secured Notes (ESNs) during a public hearing in London end June 2018. Its final report to the European Commission should be published by end July. The EBA advocates a clear separation of covered bonds and ESNs, which should have covered-bondlike structure and receive preferential regulatory treatment but less pronounced than for covered bonds. This is in line with the ECBC’s view and would support the future success of ESN as double recourse, liquid funding instrument for assets that are not eligible for traditional covered bonds. The EBA also proposed some minimum standards regarding required transparency and supervision besides other recommendations which overall make sense and were well received, while some (minimum OC level, definition of eligible assets) will probably be subject to further discussion at EC level in the coming months.

The success of covered bonds and in particular their resilience during the financial crisis, have made them an obvious choice as a model for the creation of a new pan-European funding instrument. The creation of such instruments is an important step towards establishing deeper and more integrated capital markets, which is a key objective of the Capital Markets Union initiative. Drawing from the experience of a long standing but also dynamically expanding covered bond market will help to save time and increase efficiency when creating a new funding instrument. At the same time, it is important to draw a clear line of distinction between covered bonds and ESNs. Nonetheless, ESNs are steadily taking shape with structures and certain key features that will allow broad market acceptance. Contributions from the institutional side as well as the market side are helping to further increase the chances of a successful introduction of ESNs in the European markets.