19 July 2016

By Daniele Westig, Economic Adviser, EMF-ECBC

By Daniele Westig, Economic Adviser, EMF-ECBC

For the EU’s housing and mortgage markets, 2016 started where 2015 ended: increasing outstanding mortgage lending and decreasing interest rates. These two dynamics, however, show a decelerating pace with respect to the previous quarter. For house prices, the overall trend was one of increases, albeit to differing degrees according to the different countries. The recent vote by the UK to leave the EU will almost certainly have a significant impact on markets in the second half of 2016 and beyond, both in the UK and on the continent, which will be reflected in forthcoming quarterly reviews.

At the beginning of 2016, in aggregate terms, in the EU the outstanding mortgage lending decreased by 0.6% y-o-y for the first time since the end of 2013. Likewise, aggregate gross lending figures show a 5.6% decrease, the worst figure since Q1 2013. While for various countries the outstanding mortgage figures show a slight decrease, in terms of gross lending there are more extreme positive and negative dynamics. Equally, in this quarter the dynamics across the continent are very heterogeneous and are influenced by both the economic conditions and legislative developments. Some of these developments are outlined below:

In Central and Eastern Europe, gross residential lending developed positively on a year-on-year (y-o-y) basis. In Romania, there was over a 13% increase, which was driven by an increase in local currency loans, while foreign currency lending registered a slight fall of 4.4% q-o-q. Also, non-performing loans (NPLs) decreased further to 5% in Q1 2016. The beginning of the year was also characterised by a significant increase of credit demand for mortgage loans coupled with a tightening of credit standards, principally through lowering loan to value (LTV) limits. The latter can be explained by the fact that in April 2016, the Datio in Solutum Law was enforced, giving mortgage debtors the right to close their loans by renouncing the dwellings given as collateral.

Similarly, Poland increased its gross lending by nearly 4% y-o-y and at the end of Q1 2016, for the first time, the total number of residential mortgage loans exceeded 2 million contracts. Here, in Q1 2016, standards and conditions of mortgage lending were tightened due to regulatory factors, such as new provisions on the client’s own contribution, which shall now amount to at least 15%, and new guidelines from the Polish Financial Supervision Authority regarding the calculation of the borrower’s creditworthiness. Mortgage demand increased mainly due to borrowers’ concerns regarding the near-depletion of funds earmarked for loan subsidies under the government-subsidised housing scheme “Flat for Youth”, which by March 2016 had already disbursed 95% of the overall amount budgeted for the entirety of 2016; applications for this subsidy can now only be made for funding in 2017-18.

Notwithstanding the surprisingly weak economic growth, in Hungary, the gross lending in this quarter – though less than the second half of 2015 – increased by 50% with respect to the same period in the previous year. In 2016 the government has announced important changes which will affect mortgage lending activity and housing market activity more generally for at least the rest of this year. For example, the VAT for new dwellings was reduced from 27% to 5% from January 2016 and housing subsidies, especially for large families, will be more generous when buying a newly-built dwelling.

In the UK, positive economic fundamentals and higher earnings growth helped to underpin a recovery in the housing and mortgage market, where gross residential lending for Q1 2016 depicted a healthy 28.9% increase y-o-y. Lending in March was boosted as buy-to-let activity was brought forward to avoid the additional stamp duty land tax (transaction tax), which would have meant those buying a second property would be subject to an extra 3% tax on top of the standard stamp duty that is payable when purchasing a property. The second quarter of the year is set to be quieter as the distortion from the stamp duty change affects levels of activity, coupled with increased uncertainty in the lead-up to the UK’s EU referendum vote in June. Other factors restricting activity are the already elevated levels of house prices relative to earnings, regulation in the home-owner space as well as the tight supply in the secondary housing market, which continues to cause supply/demand imbalances.

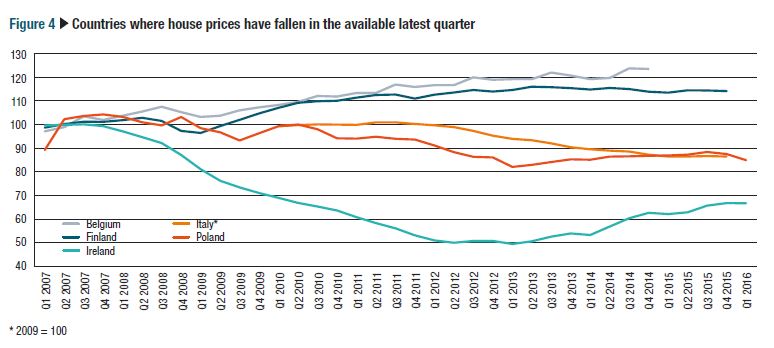

Nearly all countries of our Q1 2016 survey depict an increasing house price index, which shows an active market based on improving economic fundamentals throughout the EU coupled to tight supply and high demand.

For example in Ireland, in the framework of positive economic fundamentals, with decreasing unemployment and upward trends in retail, construction and tourism, house prices experienced a 7.4% y-o-y increase in Q1 2016. Contrary to other countries, Dublin’s house price increase was relatively low with growth of 3.9%, while the rest of the country rose by 10.5%. Similarly, rents grew faster outside the capital, particularly for apartments. One of the major issues in the Irish economy lies in the lack of available housing, especially suitable family accommodation. Building activity has increased in recent years with completions up 20% y-o-y in Q1 2016 according to the Department of the Environment, Community and Local Government, and building starts are up 57%. However, building levels are well below the annual estimated demand of 25,000 homes.

In Sweden, house prices and increasing household debts are heavily debated. House prices for one-family homes increased by an impressive 13.1% y-o-y in Q1 2016, which accelerated from 9% of previous year. With 14% y-o-y growth, the price increases of apartments have slowed down and are almost in line with that of one-family homes. In the fourth quarter of 2015, the prices on tenant-owned apartments increased by around 18% y-o-y. Although construction figures show an increasing trend during 2015, the strict building standards and building permits prevent a construction boom in Sweden, and house prices are expected to grow. It is also important to mention that in spring 2016, the latest statistics showed that this trend is flattening and the increases are expected to be smaller.

In aggregate terms, the interest rates for a mortgage in our sample decreased in Q1 2016 by 17bp y-o-y to 2.6%. The vast majority of countries continued to see their interest rates dropping, although here too the picture is heterogeneous.

For Q1 2016, though it slightly increased from the last quarters, the lowest interest rate was found in Denmark where households were able to find a mortgage loan at a variable rate of 1.17%. The more long-term interest rates (over 10 years) which households were able to secure stood at 3.67%, an 11 basis-point decrease with respect to the previous quarter.

In Spain, interest rates for new residential loans continued to decrease in parallel to the trend observed on the main benchmark index of the Spanish mortgage market (Euribor), supported by the expansive monetary policies of the ECB. The weighted average interest rate on new residential loans was 2.02% in Q1 2016, a decrease of 48 bp with respect to the previous quarter. Also, the variable, short and long fixed term interest rates all decreased q-o-q setting the rates at 1.72%, 2.06% and 2.65% respectively, with the first two reaching their lowest values since 2007. The medium fixed term, on the other hand, increased by 21 bp to 5.23%. New loans are increasingly issued with a fixed interest rate thanks to its benefits for households and financial institutions. This explains why residential loans with an initial rate fixation period of over 10 years account for 10.7% of new loans, a 56.2% increase q-o-q and a nearly fourfold increase y-o-y.

The full Quarterly Review Q1 2016 and the archive of previous editions (back to Q3 1998) are available on the EMF website.