11 October 2024

Ongoing current geopolitical challenges, resulting energy security concerns and climate change are making it increasingly necessary to radically rethink the regulatory framework and market best practices of the European housing finance sector. The pressure to accelerate the pace and scale of coordination of national and European policies is real and ever-increasing, and has had – and continues to have – a profound impact on political and legislative debates around key files, including the EU Taxonomy, the Energy Performance of Buildings Directive (EPBD), the implementation of the final Basel III reforms and, more generally, all issues related to digitalisation and sustainability.

The housing and housing finance sectors are key to the development of a clear market roadmap that will enable the European Union (EU) to achieve its goal of reducing greenhouse gas emissions. Indeed, housing is a strategic sector not only because homes are the main place where people spend their lives and, increasingly, work, but also because buildings account for 40% of CO2 emissions in continental Europe.

The scale of the investment needed to improve the energy performance of more than 220 million homes to meet the EU’s energy saving targets is immense and cannot be achieved by the public sector alone. The private finance sector in the EU has a central role to play in the transition to a more sustainable economy, reducing energy poverty for households, especially those that struggle to meet the transition challenges, safeguarding consumers’ wealth in terms of disposable income and asset value, and supporting economic growth and job creation. In this context, it is of strategic importance to align the interests of lenders, investors, SMEs, utilities and, above all, consumers in multi-service platforms at European level. If we are to reach our 2030 targets, almost 500,000 homes in Europe must be renovated each week.

The real breakthrough of a net-zero Europe will come from the large-scale use of green mortgages. Today, the mortgage market is equivalent to around 46% of the EU’s GDP. Stimulating the development and offering of green mortgages is crucial to achieving a climate neutral economy, as highlighted by the Energy Efficient Mortgages Initiative (EEMI), which seeks to introduce an integrated greener, sustainability-focused approach to purchasing, renovating and living in homes.

At the heart of the EEMI are efforts to boost and support consumer demand for building energy renovation by way of an energy efficient mortgage “ecosystem”. Bringing together a wide range of relevant market players, including lenders, investors, SMEs and utilities, the EEMI is aligning strategies and actions through a new, innovative market mechanism focused on a green “fulcrum” of products, services and data.

Based on consumer research, market research and value chain analysis conducted over a number of years, the EEMI has boiled the findings down into core elements which are being brought together in an EEMI “ecosystem”. The EEMI Ecosystem is intended to guide consumers towards financial and technical solutions which support them in the energy renovation of their homes. In essence, by combining market innovation, digitalisation and green financing instruments across the whole value chain and seamlessly integrating all market participants into a new value chain, the EEMI Ecosystem will optimise the end-to-end customer journey and experience, deploy market interventions and partnerships that support delivery and maximise benefits for consumers.

Concretely, the EEMI Ecosystem platform is focused on the delivery of a seamless customer renovation journey by way of a three-pillar structure, comprising:

1. A simulator to support consumers in understanding their energy efficiency renovation needs and guide them through the most cost-efficient renovation solutions. The simulator also provides an indication of the potential value increase of the property, energy savings and CO2 footprint reduction after the renovation project, as well potentially eligible public support mechanisms.

2. Access to financing options by way of the Energy Efficient Mortgage Label (EEML), which is also intended as a quality and transparency benchmark targeted at market participants, including consumers, lending institutions, investors and public authorities. On the Label platform, labelled lending institutions have the possibility to be directly contacted by potential customers who can request an indicative financing offer for their renovation project by submitting the output of the simulation delivered under pillar 1 or other project quotes. Moreover, on a product feature grid consumers have the possibility to succinctly assess the key characteristics of each labelled product and guide themselves towards the most efficient and cost-effective financial products. All these efforts seek to scale-up the EEMI’s work, demonstrating the end-to-end customer journey and the EEM life-cycle.

3. A directory of accredited suppliers, including both a popular and an ESG rating system, currently under construction via a partner EU-funded Project, and a “marketplace” where not only consumers and SMEs can interact, but also all other relevant market participants providing and requiring a service or product in support of the improvement and financing of the EU’s building stock. In order to access the marketplace, the SME needs to be able to satisfy three conditions: (1) provide an ex-ante and ex-post EPC free of charge; (2) present an ESG score – if a score is not available, our Partner Crif (Synesgy) is able to provide one to SMEs on their website free of charge; and (3) guarantee that the works undertaken deliver the projected energy savings.

With a view to delivering this “ecosystem”, from October 2024, the EEMI will embark on a new EU-funded Project alongside a consortium of expert partners with a view to accelerating the operationalisation of the

“ecosystem” with a focus on the following:

1. De-risking EE investments for financial institutions;

2. Enhancing the articulation of ESG factors in property valuation;

3. Optimising financial operating models with a focus on ESG;

4. Coordinating an integrated renovation supply chain; and

5. Putting consumers at the heart of the transition.

As indicated above, at the heart of the EEMI Ecosystem lies the Energy Efficient Mortgage Label (EEML), launched in 2021 as a quality benchmark for consumers, lenders and investors to support recognition of and confidence in energy efficient mortgages. This is achieved through access to relevant, quality and transparent information for potential borrowers, regulators and other market participants. In addition, the Label aims to facilitate a process of standardisation to secure and enhance overall regulatory recognition of the asset class.

The Label is built around the EEML Convention and a process of self-certification, both of which are overseen by the label governance structure consisting of: the Label Committee, the Label Secretariat and the Label Advisory Council.

The EEML has been developed using the Covered Bond Label as a blue-print, which is managed by the EMFECBC and can look back on a 10-year success story, a period during which it has established itself as the global reference point and data collection benchmark for the over EUR 3 tn outstanding covered bond asset class. The intention is that the EEML emulates this goal in relation to energy efficient mortgages and in the wider field of financing of energy efficient renovation, scaling-up volumes and best practices in respect of both ESG-related retail activities and funding policies.

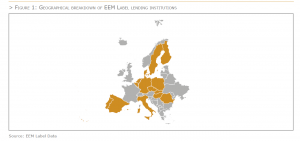

The initiative comes at a pivotal point in time, where efforts are underway at EU level to redesign the regulatory and monetary policy framework to address climate change and transition risks. As of August 2024, 27 pioneering lending institutions from 11 countries have adopted the EEML, covering the four corners of the Old Continent, large and small lending institutions, traditional banks and FinTech platforms.

To be part of the EEML, interested parties need to self-certify that they are a lending institution with products aligned with the EEML Convention, for which they need to disclose relevant information using the Harmonised Disclosure Template (HDT), at least on a quarterly basis. A dedicated Harmonised Reporting Template has been developed for Retrofitting Loans with which to provide the relevant disclosure on leases, targeted and non-targeted loans.

The EEM definition was launched in December 2018 and consists of high-level, principles-based guidelines for the technical assessment and valuation of eligible properties. The definition provides clear eligibility criteria for assets and projects that can be financed by energy efficient loans, and for the tagging of existing assets in banks’ portfolios. The EEM definition provides the protocols to ensure appropriate lending secured against properties that are likely to have both lower credit risk and support climate change mitigation and adaptation.

In the context of the EEM Label, this definition currently forms the basis of the Convention and serves as the technical benchmark of the Label:

> Energy Efficient Mortgages (EEMs) are intended to finance the purchase/construction and/or renovation of both residential (single family & multi-family) and commercial buildings where there is evidence of:

(1) energy performance which meets or exceeds relevant market best practice standards in line with current EU legislative requirements and/or (2) an improvement in energy performance of at least 30%.

> This evidence should be provided by way of a recent EPC rating or score, complemented by an estimation of the value of the property according to the standards required under existing EU legislation. It should specifically detail the existing energy efficiency measures in line with the EEM Valuation & Energy Efficiency Checklist.

> Lending institutions are committed to providing regular information enabling investors to analyse the Energy Efficient Mortgage products, following the Harmonised Disclosure Template or the Harmonised Reporting Template, depending on the type of labelled loan.

Importantly, the EEM Label Committee is working on the revision of the Definition/Convention to ensure alignment, as appropriate, with the EU Taxonomy.

Finally, it is worth noting here that in recognition of the availability of different types of energy efficient/green financing products, the EEM Label website also provides the possibility to label unsecured consumer loans for energy efficient renovation purposes.

Closing the data gap by providing the housing sector with global ESG data disclosures best practices: The Harmonised Disclosure Template and Harmonised Reporting Template

The Harmonised Disclosure Template

With a growing focus on sustainable finance – from regulators, market participants and investors alike – transparency and disclosure are becoming crucial drivers in harmonising best practices and in mitigating the “greenwashing” risk in the financial sector, securing investors’ confidence and financial stability. Considering this, the Harmonised Disclosure Template (HDT) allows for improved comparability of energy efficiency mortgages. The key is to establish centralised and up-to-date qualitative and quantitative information, which will be available for investors, regulators and other market participants.

The objective is to stimulate the creation of a positive incentive sequence across the mortgage value chain for more consistent and standardised data collection and management, as well as to better link loan information, property and energy efficiency characteristics in a single common template. Standardisation will support investor due diligence, facilitate regulatory reporting requirements in this area and enhance overall transparency in the EEM and (covered) bond markets. To strike the balance between the standardised structure valid for all labelled EEM products and the national peculiarities in reporting specific data points such as the breakdown of loan size, the HDT provides for the introduction of nation-specific breakdowns managed by national coordinators.

The HDT is based on the Master Template delivered under the Energy efficient Data Protocol & Portal (EeDaPP) Project, which organises EEM “input” data and is also inspired by the successful Harmonised Transparency Template (HTT) of the Covered Bond Label. Indeed, efforts have also been undertaken to align the HTT and the HDT as much as possible to facilitate completion and due diligence by banks which have both an EEM Label and the Covered Bond Label. The HDT is furthermore fully compliant with existing regulatory and market disclosure requirements.

The HDT must be completed for each labelled EEM product at least every quarter and has the following structure:

> A1. EEM General Mortgage Assets: Tab where information on the general mortgage portfolio is requested (e.g. location, size, ESG, repayment type, LTV, NPL, type of building). The information is also subdivided for type of real estate (residential or commercial).

> B1. EEM Sustainable Mortgage Assets: Tab which requests the same set of information as tab A1, but focused only on the subset of mortgages which are EEM compliant.

> EEM Harmonised Glossary: Tab where definitions and further comments on the sections of the HDT can be introduced.

> Optional Taxonomy Tab: Tab where lending institutions can provide some high-level indication on the EU Taxonomy of their mortgages.

In order to be aligned with market best practices and regulatory requirements, the HDT undergoes an annual revision process which culminates with the approval of the updated HDT in September/October. This effort is supported by both the lending institution community and by the Disclosure Working Group comprising national coordinators, EEML Committee members and interested representatives of the lending institutions, to support the Secretariat in gathering potential amendments to the HDT based on suggestions related to overarching and national-specific reporting and disclosure issues.

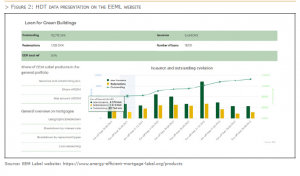

Currently, 27 lending institutions have disclosed HDTs on 27 products that are available on the EEM Label website. As with the Covered Bond Label, for the EEML the HDTs are exclusively publicly available via the lending institutions’ own websites. A reporting tool using direct links to these HDTs creates a graphical representation of the data contained therein on the EEML website, as shown in Figure 2.

In the same fashion as the HDT reports data on EEM Labelled mortgage products, the Harmonised Reporting Template (HRT) focuses on retrofitting loans intended to support consumers in improving the energy performance and/or reducing environmental risk vulnerability of their dwelling.

The HRT is inspired by the work already done in the HTT and HDT, as well as by reporting templates from the ECB and reporting templates used for private finance loans by various market participants. The HRT must be completed by all lending institutions which present a labelled retrofitting loan starting from cut-off date Q2 2023. It is structured as follows:

> A1. EEM Loans: Tab where information on retrofitting loans is reported. Contrary to the HDT there is only one loan-specific tab including all EEM labelled loans as collecting information on the general loan portfolio to be used as a reference with respect to the EEM labelled loans would not provide a useful datapoint. Against this background the information is reported by dividing the retrofitting loans into three categories: leases, targeted loans and non-targeted loans. The information to be provided, besides the size and location, repayment type and interest rates, focuses on the division of the dedicated use of the loans, namely whether it is used for financing housing energy efficiency or renewable energy.

> EEM Harmonised Glossary: Tab where definitions and further comments on the sections of the HRT can be introduced.

> Optional Taxonomy Tab: Tab where lending institutions can provide some high-level indication on the EU Taxonomy of their mortgages.

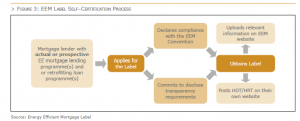

As indicated above and once again drawing on the experience of the Covered Bond Label, the EEML is based on a process of self-certification, according to which lending institutions signal their compliance with the Convention. The process of self-certification is detailed in Figure 3.

The self-certification process highlights and is testament to a real ESG engagement and strategy for EEM labelled lenders. This process of self-certification has proven to work very efficiently in relation to covered bonds, as a result of subsequent scrutiny by other market participants, including investors and rating agencies, of the publicly disclosed HTT, representing a form of “third-party verification”. This has given rise to a marketled mechanism which effectively polices itself with the result being that the cost of not accurately disclosing data or falsely declaring compliance with the Convention is high in terms of reputation and potential impact on the underlying product or ratings. This helps to mitigate any risk of “greenwashing”.

CONCLUSION

The Energy Efficient Mortgages Initiative (EEMI) continues to lead the market towards a fundamental, cultural change in the housing sector by proposing coordinated and integrated solutions at global level for retail, funding, marketing and risk analysis strategies in the banking sector. The EEMI is accompanying lenders in building common best practices and delivering new green products and solutions for consumers, whilst supporting the appetite for ESG assets in capital markets and mitigating “greenwashing”, thereby facilitating investors’ due diligence and reinforcing the overall financial stability perspective in the ESG space.

The Initiative is actively seeking to scale-up volumes, solutions and opportunities for the entire value chain with the end goal of delivering into the hands of consumers a real and affordable microeconomic advantage when renovating their homes.

Against this backdrop, we must remember that the real decision-makers in the housing transition economy are the owners of properties who need to be encouraged to make informed decisions for the future benefit of their family and society, looking at the world from a new perspective. This revolutionary change in behaviour should be supported by the appropriate toolbox of incentives, regulation and subsidies. The banking sector is ready to provide the necessary support along the customer journey by supplying new green financing products and renovation opportunities.

Such an exercise should not be seen as “just” a philanthropic decision taken by already environmentally conscious people who also tend to be more affluent. This needs to be a win-win solution, especially for those families for whom it is more difficult to make ends meet and who are more likely to live in less energy-efficient homes and for whom running and living costs represent a larger share of their budget. Indeed, our homes, the place where we raise our children, are at the heart of our lives and interests: exactly like the word “Home”, οϊκος (oikos) at the heart of the ancient Greek word “oikonomia”. A sustainable economy must be built around the concept of “home”, the cornerstone of citizens’ interest, centred on an ESG “ecosystem” that promotes green values and raises environmental awareness.

Through the EEMI and its Ecosystem, the mortgage and covered bond industries are proactively laying the foundations for a market paradigm that secures both economic growth and financial stability. This, it is hoped, will support a green “Renaissance” rooted in a new perspective of sustainability, digitalisation and social inclusion, to fund the hope for a better, greener future.

by EMF-ECBC Secretariat