10 November 2017

Marc Dillen, General Director, Flemish Construction Confederation, Jeroen Van der Veken, Project Manager Division Indoor Climate, Systems and Energy, Belgian Building Research Institute (BBRI), Ruben Decuypere, Project Manager Lab Sustainable Development, Belgian Building Research Institute (BBRI)

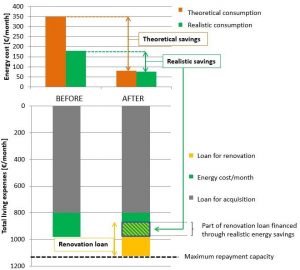

The major advantage of an energy efficient renovation is that the renovation will probably result in a financial return. In an ideal world, this financial return could help to finance at least a part of an energy efficiency mortgage. So far banks are unable to take into account the expected energy bill savings when offering loans. One of the major challenges is the high uncertainty about the actual savings on the energy bill. The estimation of energy savings should be regarded as a stochastic problem not only due to the spread on the actual building properties (insulation, heating system) but also due to the large impact of user behaviour on the energy consumption.

The VCB (Flemish Confederation of Building Contractors) and BBRI (Belgian Building Research Institute) have developed a procedure to correctly estimate energy bill savings and to convey this information to banks.

The ReCalculator webtool estimates actual savings using a dataset of about 10 000 Belgian (single-family) homes. This dataset contains information about the calculated energy efficiency of the building (in the framework of EPBD) and the actual measured energy consumption. A statistical model allows us to create the link between building properties and the actual energy consumption. The ReCalculator webtool only requires information about the building’s energy efficiency before and after renovation as calculated by an EPBD software and uses this input to provide a realistic estimation of the energy savings caused by the renovation. In order to reflect the large spread in the actual energy consumption for a specific building type, caused by varying user behaviour, the ReCalculator does not only give insight into the average expected energy savings, but provides a minimum and maximum savings as well.

The ReCalculator uses the calculated results of two Energy Performance Certificates (EPC), one for the initial situation and one for the situation after renovation, allowing the use of existing data and calculation methods as much as possible.

Figure 1: The ReCalculator rescales Theoretical savings to Realistic savings, providing a reliable base for the use of these savings to finance an energy efficiency mortgage.

Figure 1: The ReCalculator rescales Theoretical savings to Realistic savings, providing a reliable base for the use of these savings to finance an energy efficiency mortgage.The ReCalculator webtool is free to use and open to everyone. However, in order for banks to be able to make decisions about loans based on the information provided by the ReCalculator, we provide additional security and reliability. The very moment a bank wants to take into account the ReCalculator results when granting a renovation loan, the calculations need to be carried out by an expert who has received additional training. This expert calculates what effect the renovation will have on the house’s energy efficiency and uses the ReCalculator to create an official certificate. This certificate states in the simplest terms the information that the bank needs to know: monthly expected energy savings (both average, minimum and maximum savings) and a description of the planned energy conservation measures.

The importance of the ReCalculator experts’ role in the whole process necessitates additional guarantees about their expertise and reliability. A framework for certification is to be developed so that ReCalculator experts’ input and processes can be monitored by an independent quality assurance institute.

If banks can take into account realistic savings on the energy bill when offering energy efficiency loans, then this will provide a large stimulus for home renovation. Additional advantages for the banks are the improved repayment capacity for the energy efficiency mortgage due to the lower energy costs, and the expected increase of the underlying property value after the renovation works.

On top of that, the banks will have a better view on the real value of the property they are financing. The value of the renovated house will be more future-proof, since housing prices that better reflect the real (energetic) quality of the houses are to be expected in the future housing market.