28 September 2017

Harmonisation of covered bond frameworks has been topping the agenda of authorities and the covered bond community in recent years, culminating in the EC proposal to go ahead with a legislative proposal for an EU framework for covered bonds. At the same time, European Secured Notes are likely be created as new funding instrument as well. In this article, we address both developments.

In recent years, an increasing number of reports have been published on harmonising EU covered bond frameworks. It started in July 2014 when the European Banking Authority (EBA) published its view on the preferential risk weight treatment of covered bonds. The EBA concluded that the preferential risk weight treatment of covered bonds was warranted, but it also noted that more convergence was needed. This in order to increase the safety and robustness of the covered bond instrument, which would enhance financial stability as well as safeguard the preferential risk weight treatment. Overall, the EBA identified some areas where convergence of legal frameworks was needed in the medium to longer term. The key areas were:

1. Dual recourse mechanism

2. Segregation of cover assets

3. Bankruptcy remoteness of covered bonds

4. Cover pool features

5. Valuation of cover assets and LTV limits as well as other requirements on cover assets

6. Coverage principle and legal over-collateralisation

7. Asset and liability risk management

8. Covered bond monitoring

9. Role of supervisor

10. Investor reporting

The European Commission (EC) took the discussion on covered bond harmonisation to another level in 2015, when it published a consultation paper on covered bonds in the European Union (EU), which was part of the EC’s action plan to build a Capital Markets Union. Overall, it was the EC’s aim to ‘evaluate signs of weaknesses and vulnerabilities in national covered bond markets as a result of the crisis, with a view to assessing the convenience of a possible future integrated European covered bond framework that could help improve funding conditions throughout the Union and facilitate cross-border investment and issuance in Member States currently facing practical or legal challenges in the development of their covered bond markets’. In the end, the EC proposed three options for convergence:

1. Voluntary convergence of Member States’ covered bond laws

2. An EU covered bond legislative framework seeking to harmonise existing national laws.

3. A new EU law framework for covered bonds (29th Regime)

The industry’s response by means of the ECBC, which represents covered bond issuers, analysts, bankers, investors, rating agencies and other stakeholders, was that a cautious approach to harmonisation would be welcome. The ECBC noted that the reason of national differences are a ‘consequence of historical national differences in terms of mortgage markets, housing policies, consumer behaviour, insolvency law, credit and valuation regulation etc., and that full harmonisation of EU covered bonds laws was an ‘utopia’.

However, the ECBC noted further that it saw room for convergence in specific areas. In general, the industry’s message to the EC was that a pan-EU framework should be flexible and principle-based, if any. In September 2016, the EC decided to request a study on the costs and benefits of introducing a legislative EU framework on covered bonds. This report ‘Covered Bonds in the European Union: Harmonisation of legal frameworks and market behaviours’ was published in May 2017. Please see the box at the end of the chapter for a summary of its main findings. Interesting to note is that this report examined the proposals of the EBA’s report that was published in July 2014.

In the meantime, however, the EBA published a follow-up report in December 2016, including recommendations on harmonising covered bond frameworks in the EU. Currently, it seems that these proposals will be the blueprint for a EU Directive on harmonisation. Indeed, the EU Parliament (with which the EC (and the EU Council) has to agree with on a final text of legislation in the end), published its own initiative on the harmonisation of covered bond frameworks (please see box). It supports the EBA proposals, while the EU Parliament also mentioned that it would support to also include European Secured Notes (ESN) in a new Directive, as a separate asset class next to covered bonds (see below more on ESN).

Following the publication of the different reports, the EC indeed decided in June 2017 to go ahead with a legislative proposal for an EU-framework for covered bonds. The attempt will be to ‘create a more integrated covered bond market in the EU, without undermining the quality of existing covered bonds’. This suggests that the legislation is likely to be of high-level and principle-based. Furthermore, the EC noted that it will also ‘explore the possibility of developing ESNs as an instrument for SME loans and infrastructure loans’. The EC expects to publish the detailed proposal of the EU framework on covered bonds during Q1 2018, while that 41 of ESNs is scheduled for Q2 2018. It is widely expected that the covered bond proposals will stay close to the recommendations set out by the EBA.

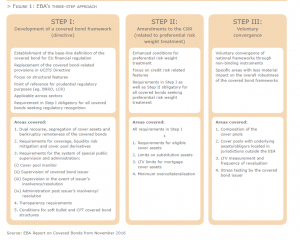

The EBA proposes a three-step approach towards harmonisation of covered bonds, taking into account that EU covered bond frameworks differ in particular in regard to legal, regulatory, and supervisory issues, while acknowledging that the final framework should build on the strengths of existing frameworks. This would still leave room for varying national implementation. This is in line with the industry’s preference that any convergence of national frameworks should be principle based.

Overall, the EBA proposes a three-step approach to harmonisation.

1. Step 1 focusses on the regulatory recognition of covered bonds (i.e. to rewrite UCITs and get to one

point of reference of covered bonds for regulatory purposes);

2. Step 2 addresses issues related to the preferential capital treatment of covered bonds;

3. Step 3 includes voluntary measures at a national level.

Step 1: regulatory recognition

Step 1: regulatory recognitionStep 1 deals with developing a covered bond framework, which implies a base-line definition of the covered bond for EU financial regulation and touches upon the standard structural requirements for covered bonds. In fact, the EBA notes that this would imply a rewriting of the UCITS Directive. The updated definition should focus on structural features of covered bonds (e.g. dual recourse, asset segregation, etc.), while also being a point of reference for prudential regulatory purposes (LCR, BRRD).

In the case of the segregation of cover assets, the EBA notes that ‘the cover assets within as well as above’ the legal minimal OC requirements should be separated. This seems to address the discussion whether investors have recourse to the entire cover pool (including voluntary OC) or on a reduced cover pool (with OC equal to the legal requirement). The EBA seems to solve this issue in favour of covered bond investors.

Furthermore, on coverage requirements, it recommends that payment claims on cover assets should at all times be equal or be higher than the sum of all payment obligations, which seems no different from current practice. Finally, to mitigate liquidity risk, a liquidly buffer is required covering principal and interest payments over the next 180 days. However, soft bullet structures as well as conditional pass-through (CPT) structures may take into account the final/extended maturity date of the bonds when calculating the size of the liquidity buffer.

The EBA also recommends enhancement of the system of supervision and administration. This relates to the cover pool as well as the covered bond issuer. On top of that, it takes into account the supervision in a going concern as well as in the event of an issuer’s insolvency or resolution. This should give investors more detailed information about what will happen in different scenarios, probably taking away some uncertainties.

On transparency of the cover pool, an often hot debate, the EBA also recommends to broaden the scope of what information needs to be disclosed. It mentions that issuers need to report on the following:

‘Disclosure of various risk characteristics of cover assets and cover bonds; contractual and voluntary OC; information on counterparties involved; methodology used for calculation of property values; structure of the covered bond and changes thereto; specific information based on type of cover pool’. This data needs to be reported on a quarterly basis on an aggregate level. Finally, the EBA wants all issuers to report whether the covered bond programme complies with the CRR and LCR rules, something that is currently not obligatory.

The EBA recommends to attach some additional conditions to soft bullet and CPT covered bonds in order to be eligible for the regulatory as well as preferential risk weight treatment. The main additional conditions are the following:

> The change of the payment mode may not be effected by the issuer

> The change of the payment mode may only be effected:

(1) At the discretion of the special administration; and

(2) Upon the following two triggers (both triggers must occur):

(i) the covered bond issuer has defaulted; and

(ii) the covered bond reached its scheduled maturity date and failed to be repaid.

> The maturity extension may also be effected ahead of the triggers mentioned above, however only at the discretion of the special administrator and provided that the special administrator assesses other

available options as insufficient to repay the relevant covered bond.

This should not exclude the possibility of maturity extension/cease-payment orders that may be issued by competent authorities as part of their prompt corrective supervisory actions or in situations when the covered bond issuer is unable to repay the covered bonds due to regulations and/or market conditions as defined by law. These proposals would, if implemented, take-away any discussion about the optionality of the extension of a payment. Please read more on maturity structures in Article 1.6 of the Fact Book.

The recommendations in step 2 relate to the preferential capital treatment of covered bonds, focussing on amending the Capital Requirements Regulation (CRR). This in turn, deals with requirements on cover assets, substitution assets, LTV limits, and minimum OC requirements. On eligible cover assets, the EBA sticks to its earlier recommendations to exclude SME loans, infrastructure loans, and non-public sector debtors (but the EC now seems to address this issue by introducing ESNs). Meanwhile, it keeps the cap on substitution assets at 15% of the nominal value of outstanding covered bonds. The EBA also considers the current LTV limits as appropriate (80% for residential mortgages and 60% for commercial mortgages), while it stresses that the limits should be soft of nature.

Finally, the EBA recommends a minimum effective OC of 5%, although it does not state the exact calibration, making this dependent on an impact assessment. Furthermore, the OC requirement should be applied to all types of covered bonds, not making any distinction between the assets that are backing the bonds.

The EBA refrains from setting hard conditions about a number of issues, which can be dealt with on a national basis. This is for instance about the composition of the pool, the location of cover assets, revaluation of assets, as well as stress tests that need to be conducted.

Overall, the three-step approach will imply that the biggest change will be that all structural features of the covered bond product will be covered in step 1, which stands in stark contrast with the broad definition in the current UCITs directive. This will have impact on legislation in different countries.

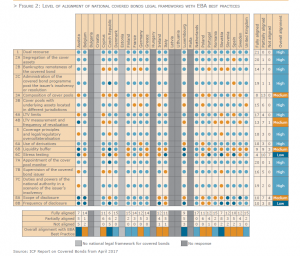

The EBA’s analysis showed that national covered bond frameworks adhere to most of the best practices that it had identified, with best adherence related to dual recourse, asset segregation, bankruptcy remoteness, and the coverage principle. In other areas, the EBA identified room for improvement. In particular, there is room for improvement with regard to reporting, liquidity buffers, and the composition of cover pools (please see the table below for more details).

The EC’s impact study concluded that possible changes needed to align covered bond programmes with new rules could probably be accommodated within existing covered bond programmes. Moreover, the study noted that these changes would be beneficial for investors. So, if investor consent is needed, this does not seem a major problem. Having said that, it is well possible that issuers will be faced with an increase in legal costs as well as IT expenses. Therefore, the report calls for a transition period during which issuers can adjust to new regulations.

The main actors in the covered bond community have not sat still in recent years neither, especially when it comes down to issues as disclosure and transparency. On the 16th of June 2015 the Covered Bond Label Foundation (CBLF) and the European Covered Bond Council (ECBC) announced the decision to implement the Harmonised Transparency Template (HTT) across jurisdictions for all covered bond issuers that hold the Covered Bond Label (which was introduced in 2012, please refer to the Covered Bond Label article in the Foreword chapter of the Fact Book).

The HTT has come into force since 1st January 2016 and is a binding requirement for the granting and renewal of the Covered Bond Label. It directly impacted more than 70% of eligible covered bonds1 and a separate label for non-CRR issuers is now also available. UOB in Singapore was the first to launch the HTT, an initiative seen as a positive and important step by market participants and regulators. The EBA as well as the EC specifically referred to the label and the HTT in recent publications and welcomed the initiative.

The HTT replaced the National Transparency Templates (NTT)2 established for the Covered Bond Label. The ECBC’s approach was pragmatic, keeping in mind the costs and benefits for the industry as a whole and managed to reach consensus to harmonise data disclosure and further enhance transparency in the covered bond market, especially for investors.

The HTT is notably addressing the following investors’ needs and wish list regarding disclosure:

> Harmonised data in a more user-friendly downloadable format (i.e., available in Excel).

> Harmonised definitions by issuers – ideally across jurisdictions and, if not possible, at least within a jurisdiction (definitions should be disclosed).

> Harmonised timing as issuers should disclose relatively recent data.

> Disclosure of key details – e.g. regulatory treatment, maturity structures, involved counterparties, levels of committed over-collateralisation and covered bond structures.

> No loan-by-loan data was required however, being used only by a small minority of investors. The availability of historical series was seen as more important.

Implementation of the HTT has been smooth and has entailed:

> An in-depth review of each new HTT to ensure consistency across countries.

> An active dialogue with the issuers e.g., on how to improve reporting or address any uncertainty.

> A new logo for the HTT to flag to investors when an issuer has switched to the HTT from the NTT.

The HTT will remain a dynamic process in order to meet investor and issuer requirements and ensure its appropriateness as the covered bond industry further develops. Various Labelled Issuers as well as investors requested minor modifications of the HTT, such as additional information on interest rate risks (i.e., before and after hedging, just like for currency risks), counterparty risk for swaps or conditional pass through triggers.

Any modification of the HTT will be presented to the Covered Bond Label Committee, which will consider and analyse their merits and any potential modifications agreed will be implemented during the next annual review. The ECBC has a Review Process in place which allows market participants to comment, while only introducing changes once per year. Such review process will guarantee that all feedback is taken into account and help preserve harmonisation efforts.

In March 2017, the Covered Bond Label Foundation (CBLF) announced that, following a thorough consultation process with market stakeholders, a new voluntary addendum will be added to the HTT, named “Optional ECB-ECAIs Data”.

Together with the specific display of extendable maturities on the CB Label website, this is intended to align the Label’s reporting process with the European Central Bank’s (ECB) new minimum disclosure requirements for CB ratings from Q3 2017 onwards. The new voluntary addendum to the HTT reports are:

1. Additional information on the covered bond programme;

2. Additional information on the swaps;

3. Additional information on the asset distribution.

The addendum was developed by the rating agency working group in coordination with issuers, and with the rating agencies as prime users of the newly disclosed data. The rating agencies and the Covered Bond Label have sought to cooperate in this exercise in order to minimise the additional reporting burden for issuers. The rating agencies’ active engagement since the beginning of this project has been critical for ensuring the rapid and successful development of the new addendum.

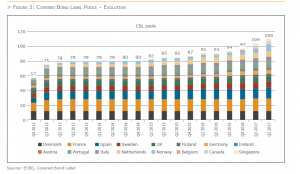

The label initiative has been a success from the start. End H1 2017, 93 issuers had 109 labelled cover pools across 16 jurisdictions and the number continues to grow (see the chart below). There are also over 20 (mainly Germanic) issuers using the HTT without having their programmes labelled.

The ECBC decided a while ago to assist and support the development of market initiatives that potentially play a crucial role in financing growth and the real economy while preserving the strength of the traditional covered bond market it represents.

It established a Task Force on Long-Term Financing (renamed into ESN-task force since) to investigate the possibility and viability of the creation of new capital instruments that make use of some key features that have made covered bonds one of the safest and most successful financial tools globally. The ECBC Task Force findings formed the basis of the ECBC response to the European Commission’s Green Paper on Building a Capital Markets. In the end, the ECBC proposed to create a new pan-European double recourse funding instrument, named ESN (European Secured Notes). As already mentioned, the EC has embraced the initiative, announcing that it will explore possibilities for ESN as additional funding instrument, details of which will be published in Q2 2018.

The ESN would require limited legislative intervention at national level and allow for the financing of asset classes beyond the traditional covered bond collateral types of mortgages and public sector assets, such as small and medium-sized enterprise (SME) or infrastructure assets. This initiative combines similar dual recourse funding techniques and market best practices for the establishment of a funding solution for SME and infrastructure loans by using a different name.

One of the key success factors is the common adoption of the same set of micro foundations and technology, in particular in terms of eligibility criteria, definitions, risk parameters, data disclosure and IT solutions across European countries. If correctly implemented, supported by a minimum level of regulatory recognition as a very high-quality product under a clear legislative and supervisory framework, it could facilitate issuers and investors in terms of due diligence, risk analysis, pricing and funding diversification.

Despite the similarities between the on balance sheet version of the ESN and covered bonds, it is important to highlight the features that distinguish covered bonds from ESNs. The main distinguishing feature is the different collateral used to secure ESN in comparison to the collateral of covered bonds. Covered bonds use highly standardised and low-risk assets, mainly mortgage loans and claims against public sector entities, as collateral. The high level of standardisation of cover assets is a key element that facilitates the analysis of covered bonds, limits research effort and increases comparability within the covered bond sector. Using highly standardised assets also makes it easier to define eligibility criteria for the cover assets that can be used on a relatively broad basis, i.e. in a larger number of jurisdictions.

The concept of dynamic collateralisation based on asset substitution through the issuer is more acceptable for investors if new assets which are added to the cover pool will meet certain minimum eligibility criteria. The use of other, potentially more risky asset classes for ESN makes a clear distinction between traditional covered bonds and ESN necessary, as the risk profile of the two instruments could vary significantly.

ESN would need time to establish a track record with investors and regulators, which can be built with robust structures supported by national legal frameworks. To ensure robust market access also in difficult times, transparent, detailed and frequent disclosure and transparency on the cover pool is another important factor for investors.

Drawing a clear line between covered bonds and ESN will help to protect the track record of covered bonds against potential dilution that could occur through the introduction of instruments that bear similarities to covered bonds but may have a different risk profile.

The ECBC Task Force on Long-Term Financing tried to design new bank funding tools aiming at improving banks’ ability to lend to the real economy, while at the same time stimulate the growth of SMEs by promoting the use of SME loans as collateral for ESNs. The outcome of the discussion was the proposal of two possible ESN structures, each with slightly different characteristics, aimed at providing different benefits to the lender as well as to the borrowers and investors. The first type of ESN would be closer in design to covered bonds in the sense that the originating bank would be the issuer of the ESNs and the investor would have dual recourse to both the pool and the issuer. The second type of ESN would resemble more closely to what is referred to as high-quality securitisation. This could involve risk transfer (and capital relief) for the issuing institution (as the collateral would be transferred onto an SPV3), but also still could retain a form of dual recourse.

The on-balance sheet ESN would be similar in structure to a covered bond. As such, it could have the obvious advantage of benefiting from regulatory recognition, thus providing the issuer with an additional tool to fulfil liquidity requirements such as the Liquidity Coverage Requirement (LCR). In fact, the transformation of SME loans into an ESN could improve the regulatory and prudential treatment of such assets, by making the bond UCITS and/or CRR compliant, and therefore exempt from bail-in, and eligible for a number of prudential and regulatory requirements, such as under Solvency II. In this context, two elements are necessary in order for

the ESN to be successful: (i) a robust specific legal framework around the creation of such an instrument; and (ii) a sufficiently high level of transparency regarding the asset pool and its performance.

The existence of a legal and supervisory framework is one of the major strengths of covered bonds. This should also be developed for on-balance sheet ESNs, whereby the asset pool would have to fulfil specific criteria. These include, but are not limited to: a harmonised definition of SME loans allowed as eligible collateral; clear rules on the segregation of the pool for the safety of the investor; appropriate levels of over-collateralisation (OC); and clear pari-passu priority claims of the investor to the issuer’s assets in the case of default and insufficiency of the pool to cover the value of the bond.

In addition, the eligibility criteria for SME loans need to be developed. A good starting point for this may be the European Central Bank’s (ECB) collateral framework which allows the use of credit claims as collateral for repo operations4. This alignment would ensure greater marketability and liquidity of the ESN. The second requirement, i.e. transparency, is very much linked to the first point, as it is a necessary condition for the accurate assessment of the true underlying risk of the SME assets used in the pool. High levels of transparency would facilitate due diligence and allow investors to effectively understand and monitor the underlying risk.

For more details on alternative structures like the Risk Sharing European Secured Notes (ESN) that use High Quality Securitisation Techniques, we refer to last year’s Fact Book.

The ECBC kicked off the ESN project in October 2015 with a high level Roundtable in Milan followed by several high level meetings with key stakeholders from both the private and the public sector. Italy was the first Member State to adopt a regulation on an ESN-like instrument in April 2016.

A second Roundtable was held in Milan in May 2016 where a broad range of stakeholders and authorities debated on the nature of the ESN, the state of play in the interested counties, funding needs of SMEs and infrastructures, and the possible eligibility criteria for the cover assets.

The ESN project has been gaining traction also in core EU countries such as Germany and Austria, where the initiative is considered a smart and effective way of funding a number of infrastructural projects, especially for green and sustainable financing projects.

To further support the development of the ESN initiative, the ECBC has worked on building a market platform where regulators, treasuries, central banks and supervisory authorities can meet with key market players to discuss a smooth implementation of the ESN. On several occasions, the European Central Bank, the European Commission, the European Investment Bank and a number of national regulators have praised the ECBC for the ESN project.

Looking ahead, the success of these ESN instruments would rely on both a robust legal framework and a high level of transparency regarding the underlying assets. The development of centralised credit registers5 with harmonised levels of information would provide the ideal tool for the achievement of full transparency (while complying with confidentiality laws), and the subsequent increased level of security of these ESNs. All parties involved would be able to accurately assess risks and thereby differentiate their portfolios accordingly, contributing to the quality of the instruments. This links closely to the other condition, i.e. a robust legal framework, which among other things would focus on determining which assets can be used as collateral. Having transparent information regarding these SME loans is a central aspect of this issue.

Moreover, the issuer, regulatory and investor community should work together to develop common eligibility criteria for assets (which could be inspired by the European Central Bank (ECB) collateral eligibility criteria for credit claims as well as EIB Group activity). Establishing a pan-European standard in terms of securities backed by SME or infrastructure loans would be a cornerstone of the strength of this product. Regulatory frameworks and existing laws should be amended to allow these new asset classes to be used as collateral within the regulatory and prudential framework. In this respect, the EC can lift the formal creation of ESN when it will come with a detailed proposal in Q2 2018.

In Q1 2018, we will get the details of the route towards a pan-EU framework for covered bonds, while we will know more on the ESN instrument in Q2 next year. As always, the devil will be in the details, but overall, further harmonising EU covered bond frameworks is likely to strengthen the covered bond brand, supporting the market. Having said that, it will be key for regulators not to harm an already well-functioning market. National covered bond frameworks will probably continue to show differences, largely reflecting national specifics. This also offers room for diversification for investors. As such, harmonisation is a good thing, but it is no panacea. Regarding ESN, regulators will have the momentum to support the creation of a new, solid, funding instrument by providing more clarity on a future legal framework and the possible regulatory treatment of ESN.