22 October 2024

INTRODUCTION

Despite slowing down from mid-Q2, covered bond supply has continued at a noticeable net positive trajectory for the third year running. Fortunately, investors have been there to meet the supply with order books especially at the start of the year heavily oversubscribed. While it was above all the surge in yields in 2023 that started to attract investors to the covered bond asset class, 2024 has rather been a story of spreads vs swaps topping out and covered bonds offering attractive spreads vs other asset classes. Hence, the broadening of the buyer base that we already saw in 2023 has continued into 2024 with the start of the year seeing additional credit investors looking at covered bonds just as bank treasuries have become more selective.

While analysing the evolution of primary market distribution statistics is crucial to get an idea about high levels shifts in demand, they only tell a part of the story. In fact, we would argue that the shifts we have seen from 2023 in these statistics (less banks, more asset managers) understate the true magnitude of the shift we have experienced in the demand for covered bonds this year. Hence, as last year, we have decided to run a broader investor survey that allows us to go into more detail and to give you as complete a picture of the covered bond buyer base and their preferences as possible.

OVERVIEW OF COVERED BOND INVESTOR BASE

The major migration movement of investors on the covered bond market has continued in recent months. The demand side was characterised by a variety of factors. In particular, the relative attractiveness of covered bonds compared to both rate products and corporate bonds took centre stage. One reason for this was not least the very pronounced repricing cycle that covered bonds went through.

In view of the focus of both issuers and investors on the longer end of the curve, monetary policy and expectations regarding the ECB’s future interest rate path must once again be seen as a key driver. On the other hand, specific risks – such as the uncertainties surrounding the commercial property market – have led to a shift in investor interest.

In this article, we again refer to the allocations of deals reported by investors for primary market transactions. We are focussing on the EUR benchmark segment as the largest submarket in the covered bond universe. In terms of allocation by region it is still obvious that the major share of the newly placed benchmarks goes to accounts in the DACH region (mainly Germany). However, the systematic analysis of the deal sheets also reveals that the share of the DACH region has recently declined somewhat. In the current year, this is 47.4% and thus below the previous year’s figures (2023: 53.3%; 2022: 53.5%). Growth was particularly evident in the Nordics, France, and Southern Europe regions. It should also be borne in mind that, due to the pronounced home bias in covered bonds, a higher issue volume in individual countries also “benefits” the allocation.

After the “Central Banks & Official Institutions” category in particular lost shares (in favour of the “Banks” category) in 2023 regarding the distribution of the allocation volume by investor type, it was the “Banks” investor type that recorded slight losses in the recent past. However, the “Banks” (45.3%) and “Central Banks & Official Institutions” (15.1%) categories will undoubtedly continue to account for significant shares in the current year. Bank Treasuries in particular remain the most important group of buyers of covered bonds in the EUR benchmark segment. What is noticeable when looking at the allocation data, however, is the increasing share of the categories “Asset Managers & Funds” and “Insurance & Pension Funds”, which can also be seen as representative of real money investors. For insurance investors in particular, we would speak of a countermovement to the crowding out that was triggered a few years ago by the ultra-expansive monetary policy.

While investors were more focused on the short end for a long period of time, this has also changed in the current year: Uncertainty about the future path of interest rates has diminished somewhat. In terms of demand behaviour, we see the long end supported by the fact that those with a longer investment horizon have (again) turned to the covered bond market in the “Asset managers & Funds” and “Insurance & Pension Funds” categories.

INVESTOR SURVEY

To get systematic feedback on a number of topics, we conducted an online investor survey in the first half of June. We received responses from 45 investors covering a broad range of investor types and regions. The questions focussed around (1) the investors’ general level of activity and motivation in covered bond markets, (2) their main concerns at this point, (3) what impact regulatory changes such as the Covered Bond Directive

have had for them as well (4) maturity structures and (5) what role ESG plays in their day to day operations.

Activity levels

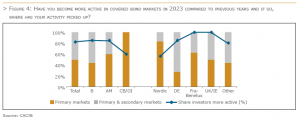

Investors have been increasing their exposure to covered bonds since 2022, first bank treasuries and just as they began to slow down into H2 2023, we saw asset management buying pick up. This is also reflected in our survey results. Around 80% of the investors we asked have become more active in covered bond markets. The only groups that have seen a lower share (around 60%) are central banks / official institutions (CB/OI) as well as Nordic investors. However, we believe that it was above all the longer tenors in primary markets that explain the slightly less enthusiastic response by CB/OI. In turn, Nordic investors were already very active in 2022 and 2023. While many of the investors, who have become more active, have focused on primary markets, around half have also focussed on buying in secondary markets as well (especially German accounts).

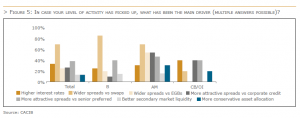

The rationale for investors to become more active have shifted this year compared to last year’s investor survey. While it was above all higher rates and wide spreads vs sovereign debt that drove up interest in the covered bond asset class last year, this year is all about relative spread valuations vs other asset classes and wider spreads vs swaps that have been mentioned by investors. After all, while covered bonds still widened in H2 2023 to start the year at multi-year highs vs swaps, credit had rallied during the same period leaving only limited spread pick-up to covered bonds. For some of the asset managers, de-risking portfolios was also mentioned during our survey. Despite a large number of investors also having become more active in secondary markets, better secondary market liquidity has in turn not been a big driver for investors to become more active in covered bond markets.

Concerns

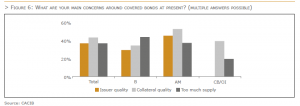

Despite the success issuers have had in covered bond markets these past couple of years with strong investor demand, there are concerns that have been there and that have actually become more acute this year. Last year, we were talking above all about collateral concerns and those concerns were focussed on commercial real estate assets inside cover pools. This year has seen these concerns around CRE assets also move up one level – from the cover pool to the issuer level (close to 40% of respondents said they have concerns around issuer quality). Developments around specialised CRE lenders from Germany this spring will have surely played a role there.

In turn, concerns around residential mortgages are nearly non-existent in our survey (7% of responses) and the same is largely true for public sector assets (22% of responses). On the latter point, we do have to stress that we ran the survey before the worst of the volatility around the French legislative elections and we would expect a stronger focus also on public sector assets if we were to re-run the survey today.

Last but not least, we still have around 40% of respondents who are concerned with too much supply. However, this is down from last year’s survey (55%) and when looking at the slower pace of supply this year (even when we focus on the time before June), we can only agree.

Covered Bond Directive (CBD)

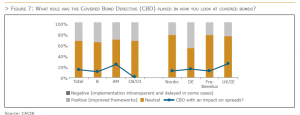

The CBD has been implemented for two years now with even the last major jurisdiction resuming issuing last summer (Italy). Currently, the EBA is drafting a report on a number of topics that it is to present to the European Commission in June next year. All investors took a neutral or even positive view on the Directive. The majority (67%) also said that the implementation of the Directive had been neutral for their view on covered bond

spreads, highlighting that spreads are not only driven by harmonisation of the legal framework but also by sovereign, credit and structural aspects Answers are not materially different across investor types or geographies on this point with German investors being an exception (they are more upbeat about the impact of the CBD).

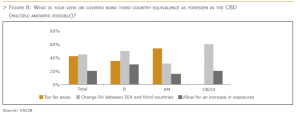

The area where CBD implementation could become a more relevant driver is on third country equivalence. Such a regime is seen as still too far away for around 40% of the respondents in our survey to care today. However, bank treasuries would be open to increase their exposure further beyond the already sizeable holdings of covered bonds from countries such as Canada. A third country equivalence regime would also change the relative value scheme between European and third country covered bond segments given the potentially reduced regulatory costs of holding them for banks.

Maturity structures

One of the points the EBA will investigate as part of its report is extendable maturity structures. To provide some more in depth feedback, we decided to add two questions on the subject to this year’s survey.

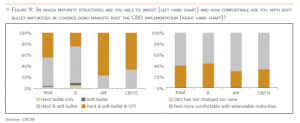

With the bulk of covered bond supply these days involving soft bullets, most investors are perfectly happy to buy hard as well as soft bullet covered bonds. In our survey, we had a single bank treasury investor who was only able to buy hard bullet covered bonds. The big change in the buyer base is rather between soft bullet and conditional pass through (CPT) covered bonds. While CPT structures are widely accepted by asset managers (77% can buy CPT), the situation is materially different for banks (only 25% can buy all maturity structures).

For roughly 60% of respondents in our survey, the additional clarity on extension features that the CBD has brought does not materially change their view as they were broadly happy with the previous market convention and level of transparency around maturity extensions. However, this also means that around 40% have indeed welcomed the tighter and above all clearer rules around extension triggers with this especially true for bank treasuries (45%) and German investors (54%).

ESG

ESG has been a huge theme across capital markets in recent years. However, while covered bond issuance in green, social or sustainable format has been growing, it still only represents a small share in overall volumes as the availability of data on the ESG credentials of balance sheet assets has been a constraining factor and banks have often chosen to use the loans that are in line with green or social bond frameworks for senior

preferred, non-preferred or even tier 2 issuance rather than for covered bonds.

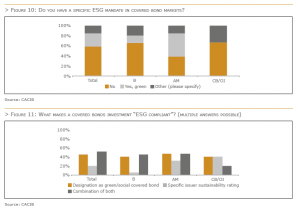

The fact that we are still talking about an evolving market has led to different approaches to ESG amongst investors and this can also be seen in our survey. Less than 50% of respondents stated that they have a specific ESG mandate that also covers covered bonds. Within this group, close to two thirds have a dedicated green mandate (above all asset managers) while for the other third, the responses ranged from investors using a combined framework for green and social bonds to a more holistic approach that assesses the ESG credentials of the issuer rather than the bond.

The diverse nature of our survey responses also continued with respect to our question what makes a covered bond investment “ESG compliant”. The designation as green / social covered bond by the issuer is good enough for just below half of the respondents while the other half looks at specific issuer sustainability ratings, a combination of both or they fully rely on internal models from the start.

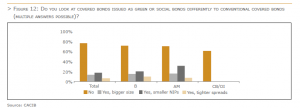

Last but not least, investors we surveyed do not make a big difference between ESG and conventional covered bonds when it comes to assessing relative value. Looking at data from primary markets, ESG covered bonds have tended to have stronger order books and slightly smaller new issue premiums. However, they have often failed to trade at materially tighter spreads vs conventional ones. The survey results reflect this as well as around 75% of respondents (unchanged from last year’s survey) do not look at ESG covered bonds differently when it comes to relative value and pricing. Around 20% accept smaller NIPs (especially amongst bank treasuries). However, only around 10% would buy in bigger size and / or accept tighter secondary market spreads.

The bottom line

Covered bond supply has been running at a noticeably net positive pace for the third year running. And while we have seen a number of bigger structural shifts in the covered bond investors base, overall demand has continued to be strong for the asset class. A slow-down in bank treasury net buying has been offset by more real-money involvement as well as some tentative pick-up in activity by insurance buyers. With covered bond spreads vs swaps peaking after nearly two years of widening, especially the start of the year saw the asset class look exceptionally good vs other asset classes and new credit investors joining in size clearly highlights this fact. The focus from investors has also broadened out in terms of tenors after 2022 and 2023 were still years with a big focus on short-end covered bonds.

Looking at the results of our investor survey, investors continue to be most concerned around the outlook for collateral quality, especially commercial real estate assets. Concerns around too much supply have fallen compared to last year’s survey, though. Turning to regulation, investors were broadly satisfied with the previous framework in covered bond markets. Still around one third see the implementation of the principles based Covered Bond Directive (CBD) as positive with the remainder taking a neutral view. The directive has, however, made around 40% of our survey participants feel more comfortable around extendable maturity structures in covered bond markets. The vast majority can buy soft bullets these days alongside hard bullets with only conditional pass through covered bonds experiencing a materially smaller investor base, especially amongst bank treasuries. Overall, only a small minority sees the CBD implementation as a strong enough factor to justify tighter spreads. However, a third country equivalence regime further down the line would have a positive spread impact with above all bank treasuries happy to buy at tighter levels and upsize their exposures to third countries compared to already sizeable holdings at present.

Last but not least, ESG covered bond issuance has been growing but it has still played a relatively small role in terms of volumes as issuers often chose to use eligible assets for issuance further down the capital structure. For the investors in our survey, approaches to ESG in covered bond markets also differ. Only around half have a specific mandate for ESG covered bonds and while some are happy to work with the issuer designations of a bond being green or social, others take a more holistic view and score the issuers with their own internal assessments rather than look at the bond in question. What most have in common, though, is that similar to last year’s survey, they do not materially differ between conventional and ESG covered bonds when it comes to spread valuations. Smaller new issue premiums are accepted by some but only few are happy to buy ESG covered bonds inside conventional ones.

By Florian Eichert, Crédit Agricole CIB, Frederik Kunze, Nord/LB and Niek Allon, Moderator of the ECBC Investor Task Force and Nationale-Nederlanden Bank