13 March 2023

By Luca Bertalot, Secretary General ECBC, Colin YS Chen, DBS Bank & Chairman of the ECBC Global Issues Working Group, and Antonio Farina, S&P Global Ratings

Established in 2015, the European Covered Bond Council’s Global Issues Working Group (GIWG) aims at promoting a better global understanding of covered bonds and fostering convergence between countries towards similar market solutions, infrastructure, and regulatory treatment.

Following the implementation of the EU covered bond harmonization directive in July 2022, in February 2023 the GIWG published a Concept Note on third country equivalence that would align the regulatory treatment of covered bonds issued by credit institutions inside and outside the European Economic Area (EEA). The concept note is the result of a consultation with market participants such financial analysts, issuers’ representatives and investment bankers, and local authorities. This paper summarizes the GIWG’s findings.

The harmonization directive defines the pathway to achieve third country equivalence. The full legislative package consists of a directive that introduces a common definition of covered bonds and regulation that amends the EU’s Capital Requirements Regulation (CRR). European covered bonds receive preferential regulatory treatment that extends beyond risk weightings to include favorable treatment under the liquidity coverage ratio and the net stable funding ratio standards; the definition of exposure and investment limits; the eligibility rules as collateral in central bank liquidity schemes; and the exemption from bail-in. Since July 2022, EU regulatory treatment has been based on the directive, and new covered bonds must meet its mandatory requirements to be eligible for favorable treatment.

Such preferential treatment remains largely a European phenomenon; elsewhere, the treatment of covered bonds is mostly aligned with the Basel Committee’s stipulations, meaning that covered bonds are barely treated better than senior unsecured instruments. Importantly, covered bonds issued by credit institutions outside the EEA and purchased by European investors receive less favorable regulatory treatment than covered bonds issued by EEA-based credit institutions.

However, European authorities could, in future, decide to grant equivalent treatment to covered bonds issued by non-EEA credit institutions. Alignment of third country covered bond frameworks with the directive will be a key factor. Article 31 of the directive stipulates that the European Commission (EC) will submit a report on third country equivalence to the European Parliament and Council by July 2024. The report may be accompanied by a legislative proposal on whether or how an equivalence regime should be introduced.

EU financial services acts may contain “third-country provisions”, which empower the EC to decide on the equivalence of foreign rules and supervision for EU regulatory purposes. These legal acts set out the conditions, criteria, and extent to which the EU may consider the regulatory and supervisory framework of a third country. The EC’s assessments of equivalence are usually based on technical advice from European supervisory agencies such as the European Banking Authority.

Beyond the technical assessment of the equivalent legal framework, the EC will also consider other general financial policy criteria. These will include:

The EC will also consider the regulatory objectives that the framework pursues and the outcomes that it delivers, particularly regarding the impact of the third country regime on EU markets. Finally, the EC will factor in wider external policy priorities and concerns, in particular, the promotion of common values and shared regulatory objectives at an international level.

From the outset, the whole process typically involves an intensive technical dialogue with the competent authorities of the third country. These authorities are invited to contribute to fact-finding exercises relating to the way in which their regulatory and supervisory frameworks deliver the outcomes set out in the corresponding EU framework.

The directive does not empower the EC to take the equivalence decision. Article 31 only requires the EC to submit a report on whether and how an equivalence regime could be introduced. This report can be combined with a legislative proposal, but the EC might consider that such a proposal is not (yet) appropriate. While submission of the report is mandatory, the legislative proposal is not.

Three steps appear necessary to achieve third country equivalence. First, a report justifying the introduction of an equivalence regime and defining the technical requirements. Second, a legislative proposal (directive or regulation) transposing these requirements into a legal act and empowering the EC to take an implementing decision. Third, EC recognition of the equivalence, after a thorough assessment of the third country’s covered bond framework. Ideally, the EC would table both the report and a legislative proposal in July 2024. The latter must be adopted through the ordinary legislative procedure, the duration of which is difficult to predict due to the upcoming European Parliament elections in May 2024 and a new commission taking office in November 2024.

Missing from the directive are also the technical requirements or criteria applicable to the equivalence assessment itself, meaning that almost all technical requirements guiding the equivalence assessment are at the full discretion of the EC. An understanding of both the fundamental principles to be considered and the level of technical detail required will be important.

The EC’s legislative proposal could cover the following areas: 1) issuance by a credit institution; 2) existence of a legal basis; 3) dual recourse; 4) asset segregation (bankruptcy remoteness); 5) eligible cover assets (quality requirements in terms of asset types, derivatives, loan-to-value ratios, and valuation); 6) coverage requirements; 7) special public supervision; 8) liquidity rules; and 9) transparency (reporting and disclosures).

Regarding the extent of the technical specifications, there are good arguments for pursuing a principles-based approach, as it will be challenging to strike the right balance between the safety features of product components and the necessary flexibility for third countries and their market traditions.

Over the past few years, the GIWG has analyzed the alignment of global covered bond regimes with the covered bond harmonization directive. The GIWG updated its analysis in 2020, based on the text of the legislative package published in the Official Journal of the European Union in December 2019. While some time has passed since this analysis was conducted, and some third countries may have already adjusted their covered bond regulations, we believe that it still provides a fairly accurate picture of the current alignment.

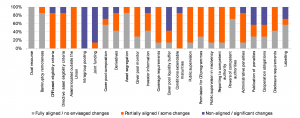

Chart 1: Directive Alignment per requirement – as of 2020 (Source: European Covered Bond Council’s Global Issues Working Group)

The analysis revealed full alignment with the dual-recourse requirements and an almost full alignment with the bankruptcy remoteness and asset segregation requirements. On the other hand, virtually none of the global regimes provide for intragroup or joint funding options. However, the lack of alignment with these requirements is not particularly relevant because, for example, the intragroup covered bond funding is only an option for national legislators–hence there is no obligation to implement it globally.

Regarding the eligibility of assets located outside the EU, the directive already allows for the inclusion of these assets in cover pools if they meet the directive’s eligibility criteria and the realization of the assets is legally enforceable in a similar way to assets located in the EU. Most global covered bond regimes have established asset eligibility criteria that already partially meet the directive’s requirements.

Another area that may require further clarification is asset coverage: non-EEA regimes do provide for nominal coverage, but are not always as detailed as the directive with regard to the type of cover assets that should contribute to the coverage requirement. The minimum required nominal overcollateralization level of 5% as specified in the amended Article 129 of the CRR is only included in a single legal framework.

But issuers often meet this requirement on a contractual level, and if voluntary overcollateralization is considered too, all jurisdictions would meet this requirement.

Most global covered bond jurisdictions do not explicitly provide for a 180-day liquidity rule, but their frameworks often include other types of liquidity provisioning. While commonly allowed, the use of extendable maturity structures is also not necessarily enshrined in law. And while non-EEA frameworks lack objective extension triggers, maturity extension triggers are, where applicable, mostly specified in detail in the contractual terms and conditions.

Global covered bond regimes are subject to covered bond public supervision, but the law does not explicitly require competent authorities to have the expertise, resources, operational capacity, powers, and independence necessary to carry out the function of public covered bond supervision.

Global covered bond regimes require permission from the competent authority to issue covered bonds, but some countries lack detailed requirements for permission. Provisions for supervision in insolvency or resolution are also often not as detailed as stipulated in the directive, while there are notable differences between the global frameworks on the reporting requirements to the competent authorities.

The equivalence analysis by the GIWG revealed that non-EEA frameworks were already fairly well aligned with the directive, and would, in most cases, probably not require significant amendments to achieve full alignment. However, the process remains fraught with uncertainty, for example, about how detailed the technical specifications will be, and how general financial policy criteria will be considered. As regards timing, the EC will probably not take an implementing decision on equivalence recognition until after 2024.