30 May 2018

By Natalia Rogaczewska, BL – Danmarks Almene Boliger

This article is taken from the 2017 edition of the ECBC European Covered Bond Fact Book, which can be accessed here.

What do the Danish mortgage institutes have in common with the Danish non-profit social housing? And could they have a common message? The answer to the first question is ‘yes’, indeed. Both the mortgage sector and the Danish non-profit social housing sector are very old, very safe and stable seen from an economic point of view – and on top of that, both contribute greatly to the Danish welfare system.

As for the second question, the answer is an even bigger ‘yes’ – future financial European regulation should focus on the costs for real people and should be based on a sound judgment.

The Danish mortgage institutes were born out of a very large fire in Copenhagen in 1795. One in four houses was burnt to the ground. Funding was needed to rebuild the city, but provision of credit was scarce. Lenders formed a mortgage association to provide loans secured by mortgages on real property on the basis of joint and several liabilities to enhance credit quality.

To fund the loans, the first Danish mortgage bonds were issued and thus more than a 200-year tradition of mortgage bond issuance in Denmark commenced.

Over the past 200-plus years, the Danish mortgage credit system has gone through a number of stages and survived several occasions of economic and political turmoil, including the bankruptcy of the Kingdom of Denmark in the early-19th century and the depression of the 1930s with no record of a default [1]. Not even during the latest financial crisis.

In fact, the Danish mortgage credit bonds were as liquid as the triple A-rated Danish government bonds during the recent crisis. Danish covered bonds are treated as level 1assets in the Liquidity Coverage Ratio (LCR), i.e. assets of extremely high liquidity and credit quality.

While commercial and mortgage institutes around the world where in serious difficulties, and governments had to issue guarantees, no government guarantees where therefore needed in respect of Danish mortgage bonds. Danish mortgage institutes where able to continue to grant loans and sell mortgage bonds, and mortgage lending actually increased in the second half of 2008, when the crisis peaked [2].

The non-profit housing sector was born out of an epidemic of cholera in Copenhagen in 1853, which made it clear that something had to be done about the housing for the upcoming new industry-working class; the unskilled worker with no employer-guaranteed housing.

Housing, not being part of the public issue, was brought up by a doctor who together with well-known architects created the earliest Danish social housing projects – and in the 1890’s the first national legislation was passed providing cheap building loans to associations of workers. Later the workers organised themselves aiming to provide dwellings on rental basis. The ownership was collective and non-profit and the system with privately organised non-profit housing organisations providing housing for mainly the working class, was founded[3] – and still is how the Danish ‘social housing’ is organised today.

During the latest economic crisis, non-profit social housing in Denmark worked as a stabiliser of the economy. While most of the construction sector experienced a serious fallback, construction of social housing kept the economy going. The sector brought much needed jobs, affordable housing as well as a greening of the economy through energy refurbishments of the existing stock.

With almost 1 million people living in non-profit social housing, the sector represents around 20% of the total housing stock in Denmark. It thus has a decisive impact on both the housing market and the overall economy. Furthermore, the mortgage sector and the non-profit social housing sector have a more direct link since social housing in Denmark, like other forms of construction, is mainly financed on normal market terms with mortgage loans.

A well-functioning housing market is crucial. One of the reasons why Denmark managed to get through the crisis fairly unscathed was exactly because our housing market did not collapse like in many other European countries and in the rest of the world.

The explanation is that Denmark has a wide offer of different types of housing; ownership, cooperative, private rentals and non-profit social housing. This diversity ensured that even though the crisis hit the housing sector hard, there was still enough housing for all. The ‘Danish housing model’ makes Denmark a very economically stable country, which is of general interest to all. This is also why parties across the Danish parliament broadly support non-profit social housing.

The traditional Danish mortgage model reflects the way Danish mortgage institutes operate. The model has a number of attractive properties, not only to borrowers and bond investors, but also to the Danish economy at large. The model ensures low and transparent loan rates and unique prepayment terms, investors who buy the issued bonds do not incur any default risk in practice and the mortgage model has a stabilising effect on the Danish economy and helps sustain financial stability.

The Danish mortgage system is unique as it is based on an important general principle called the match funding principle. Under this principle, there is a direct match between the loan which a homeowner raises with the mortgage institute and the bonds which a mortgage institute issues to fund the loan. This principle under which a loan and specific bonds are matched has always been the mainstay of the Danish mortgage system [4].

Match funding provides transparency to the mortgage-credit system and enables borrowers to prepay their loans at any time until maturity, either at parity price or at current market prices of the bonds behind the loan depending on the terms of the loan. A core requirement to the specialised Danish mortgage-credit institutions is the balancing principle, which effectively limits both liquidity and market risk.

The balancing principle requires that differences between payments from the debtor side to the creditor side and vice versa of a mortgage-credit institution and the risks following therefrom must be kept within strict limits. Match funding with a high degree of matching between loan terms and terms on the corresponding bonds issued is an effective and simple way to observe the strict requirements of the balancing principle. Due to the balancing principle a mortgage-credit institution is primarily exposed to credit risks.

Danish mortgage-credit institutions are regulated in detail by Danish law and EU law regarding credit institutions. This defines a very narrow scope of business for mortgage-credit institutions. The most important parts of the legal framework are.

> Mortgage institutes grant loans secured by mortgages on real property. A limit has been determined for every loan relative to the assessed value of the property financed (LTV limit). Further, the loans are subject to a number of provisions on terms and interest-only periods.

> Mortgage institutes must observe the rules of the Danish Financial Supervisory Authority when assessing the value of a property.

Mortgage institutes have only one source of funding: bond sales. A mortgage institute does not operate in the same way as a commercial bank, which may take deposits of raise funding with other banks for lending purposes.

> Mortgage institutes must observe a so-called balance principle when issuing bonds. The balance principle limits the risk that mortgage institutes may incur.

> The bonds are bankruptcy-remote. Hence, it is very unlikely that investors should suffer any losses. Throughout the past two centuries, all investors have been paid in full [5].

This unblemished record is attributable mainly to the strong legislative framework, which from an early stage in the development of the market, has put great emphasis on the protection of the mortgage bond investor by imposing strict limits on the risk taking of the mortgage institutes. In 1850, a long tradition of strict regulation of the activities of mortgage institutes commenced with the passing of the first Mortgage Bond Act. The legal framework has been amended several times. However, guiding principles such as the balance and investor protection principles have remained unchallenged[6].

Non-profit social housing is sort of a public-private partnership, which delivers welfare to Danish society. As stated in the Law on Danish Social Housing [7] its purpose is to offer people of all kind good quality and decent housing at an affordable rent, while giving tenants a right to influence their own housing conditions. Apart from being non-profit, the sector is both environmentally and socially sustainable as well as economically sound, as the model generates an overall socio-economic surplus for Denmark.

Maybe this is why an increasing number of delegations from most of the EU Member States as well as Australia, China, Japan, Korea, USA and Canada have been visiting Denmark in the last years to learn about the non-profit social housing system, wanting to copy parts of or the entire model.

The non-profit social housing sector in Denmark houses all groups of people, i.e. the elderly, handicapped (mentally and physically), students, families, single individuals, rich and poor, representing 180 different nationalities.

Also, the Danish non-profit social housing is strictly regulated. Every aspect, from the financing of new construction and renovation of the existing stock, to the size of apartments and the activities the housing organisations may engage in, is regulated. Social housing organisations fall under municipal supervision and thus work in close cooperation with the local authorities.

For example, the municipalities have the right to dispose over at least one in every fourth vacant apartment, but most often dispose over more. Moreover, new construction depends on an actual housing need estimated by the municipalities. In brief, the non-profit social housing sector in Denmark stands on the following three pillars that are all rooted in the Danish welfare society:

> Non-profit: The rent covers operating and maintenance costs, capital expenditure, as well as taxes and duties. This is also known as the rental balance principle and means that income and expenditure must balance out.

> Tenant Democracy: All housing organisations are run on the principle of tenant democracy which derives from the legal right of self-determination over one´s own housing. The residents have the majority in the housing organization’s board and at other levels of the tenant democracy system.

> Financial Model: 88 percent of the costs of new builds (construction costs) are financed with mortgage loans on normal market terms. The State, the relevant municipalities and the tenants (only 2 percent) fund the rest, but do not contribute towards the running costs and thus renovations and refurbishment. Instead, the National Building Fund[8] supports both physical improvements and residential projects. The

physical improvements may range from the amalgamation of housing units to environmental improvements and renovations and demolition of units which cannot be rented out, although this is very rare. The point is that the Fund makes sure that the stock is maintained and keeps its value.

The National Building Fund is a self-governing institution, which was established by law in 1967, with the purpose to increase self-financing in social housing. It is completely regulated by law and the funds are accumulated through payments from the tenants rent. Thus, the money in the National Building Fund are not public, but paid by the tenants living in social housing.

The non-profit social housing organisations are big and important clients within the mortgage institutes. And they are good clients. Not many other loan borrowers can show bigger stability and security than the Danish social housing organisations. This is mainly due to the fact that the National Building Fund works as a guarantee for the loans and in practice there is no risk connected to the loans – neither for the mortgage institutes nor the municipalities.

This makes non-profit social housing a very safe and attractive loan borrower, which is reflected in the price for their loans. This is again reflected in the rents, which – since Danish social housing is non-profit – can be kept at a reasonable level. In the end, the final beneficiaries are the social housing residents as well as the overall Danish economy due to socio-economic benefits.

The mortgage institutes finance new build of non-profit social housing in Denmark and ‘in return’ the non-profit social housing sector provides over half a million dwellings available for all in need. It is a common good that is delivered to the Danish society. It maintains a certain level of social mix in the cities, which are accessible to all – not only the richest, and thus the ‘social’ in social housing is a positive label in Denmark. Being social is something that contributes to societal equality and this is rooted strongly in Danish history, tradition and welfare system.

On other words, non-profit social housing is a very good investment for Denmark.

Over the last 10 years renovations of dwellings have contributed to approximately 10.000 dwellings that have been made accessible for people in wheel-chair or with other physical impairments. It is quite an investment of just under EUR1bn, which has been paid by the National Building Fund. Thus, it has not been an expense for the state nor the municipalities. It has been paid by the tenants of the non-profit housing sector.

These investments mean that elderly people can live in their own homes for longer. It is good for the public budget. It saves the municipalities many costs. And it contributes to developing the Danish society as a whole. Furthermore, more than 50.000 dwellings have been lifted to an actual energy standard providing on average a minimum of 30% energy savings – also over the past 10 years and also paid by the National Building Fund. This contributes greatly to lowering emissions and energy bills.

Finally, there is a heavy investment in breaking negative social heritage as this is the single biggest cost for the individual person and society. In the most challenged non-profit social housing areas in Denmark, which include more than 200.000 people, most residents are under 34 years and either without education or unemployed. In these areas, the National Building Fund co-funds special comprehensive social plans that are set up in cooperation with local authorities, schools, police and other relevant actors – and it is working.

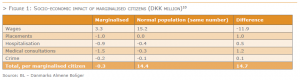

From 2008-2015 the amount of young people under 20 years of age finishing or engaged in education has risen with 25%, while youth crime has fallen with almost a half. In this relation, the SKANDIA-model[9] calculates all relevant income and expenditure in a two case scenario: Where a young person is part of the labour market and society and where a young person lives in the periphery of society (long-term unemployment, abuse or mental disorder). It shows enormous potential savings for the public budget, as shown in the table below:

All over Europe, people living in the periphery of society are placed in social, public and co-operative housing. What the housing providers have in common is that they hold the key to unlocking huge welfare savings, creating better public budgets and better lives for the individual European citizens.

Housing Europe [11], the European Federation of Public, Cooperative & Social Housing, represents 44 national and regional federations alone, which together gather about 43.000 public, social and cooperative housing providers in 23 countries. Altogether they manage over 26 million homes, about 11% of existing dwellings in the EU.

Before even taking into consideration the SKANDIA-calculated socio-economic effect of their services and social investments, the impact of the sectors mere existence is already a heavy contribution to job creation and growth:

> 43 000 local housing organisations

> 26 090 000 dwellings

> 267 000 new dwellings completed in the year 2012

> 155 000 dwellings refurbished in the year 2012

> 38 529 430 000 Euros investment in 2012

> 88 480 107 000 Euros turnover in 2012

> 7 170 staff employed by the federations

> 369 024 staff employed by local housing providers [12]

In Denmark, the general picture is that a larger part of single persons, with and without children, as well as a larger part of immigrants and descendants live in the non-profit social housing sector. In fact, more than half of all descendants from non-western countries live in the sector, amounting to 58%. Also the average income is lower while there is a larger part living off social welfare benefits, compared to the rest of the population. More specifically, 42.6% of the people living in non-profit social housing are currently outside the labour market, compared to 20.4% in the rest of Denmark [13].

In 2013, the European Commission published its Social Investments Package. The aim was to invest in people through policies that strengthen peoples’ skills and capacities and support them to participate fully in employment and social life. Key policy areas include education, quality childcare, healthcare, training, job-search assistance and rehabilitation. Two main challenges where defined, which were to be tackled.

First, unemployment and poverty and social exclusion levels, which then, and unfortunately still in some European countries, reached record highs. This was and is a huge drain on Europe’s human resources at a time when public budgets are under pressure.

Second, the working-age population in Europe was and still is shrinking, while the proportion of older people is growing. Solutions must be found to ensure sustainable and adequate social protection systems.

The beneficiaries were also defined:

> Children and young people – early support to break the inter-generational transmission of disadvantage and address the severe youth unemployment problem;

> Jobseekers – integrated and more accessible support for finding work, such as skills development;

> Women – more equal opportunities, better access to the labour market and thus better social protection, notably in retirement;

> Older people – more opportunities for active participation in society and the economy;

> Disabled people – support for independent living and adapted workplaces;

> Homeless people – help with reintegration into society and word;

> Employers – a larger, healthier and more skilled workforce;

> Our societies – higher productivity, higher employment, better health and social inclusion, more prosperity and a better life for all.

To sum it up, the beneficiaries pointed out by the European Commission are the people living in non-profit social housing in Denmark, and other form of social housing all over Europe – and many of the solutions to the defined challenges are already out there, developed and working within the European social housing sector, offering real solutions to the challenges ahead in Europe.

However, it is clear that investments are needed. It starts with viewing the social housing sector as a sound long-term investment – not a cost. Exactly like the Danish mortgage institutes are doing. And in fact, what the European Commission stated in the Annual Growth Survey 2016 [14]: “[…] it is essential that Member States promote social investment more broadly, including in […] housing […]”.

This article started by asking two questions: What do the mortgage institutes have in common with the Danish non-profit social housing? And could they have a common message? The answer to the first question was ‘yes, indeed’. Both the mortgage sector and the Danish non-profit social housing are very old, very safe and stable seen from an economic point of view – and on top of that, both contribute greatly to the Danish welfare system. As for the second question, the answer is an even bigger ‘yes’: future financial European regulation should focus on the costs for real people and should be based on a sound judgment.

And this is where the long-awaited Basel IV comes into the picture. Denmark is quite concerned about the risk of a significant negative impact on the Danish mortgage credit institutions due to their low risk business model, where the average loan impairment charge has been 0.2% over the past 30 years while the corresponding average for commercial and savings institutes has been 1.0%. Basel IV could increase capital requirement substantially and generally decrease risk sensitivity with direct consequences for risk management. Furthermore, decreasing

the risk sensitivity gives the credit institutions incentives to shift their portfolios towards higher risk assets.

In Denmark, there is a saying of ‘wearing your belt and braces too’ when someone is over-exaggerating precautions in relation to the actual risk. Since Danish mortgage bonds are already secure, higher capital floors would be like paying a high price for a set of expensive braces when you already have a robust belt. In times where Member States are still just recovering from – and some still battling with the consequences of – the economic crises, money should be out working in the real economy providing jobs and growth. Not stashed away in mortgage institutes where they do not deliver any added value, on the contrary.

The main logic should be the risk. Denmark is therefore opposing a move away from risk-based capital requirements and believes that capital requirements should primarily be risk-based. After all, this model has worked in Denmark for the last 200 years – and the mortgage bond market in Denmark is one of the largest in the world, both relative to the size of the Danish economy and in absolute terms.

The market value of all Danish outstanding mortgage bonds currently corresponds to around 140 % of Denmark’s GDP and EUR 370 bn. Due inter alia to a long tradition using covered bonds for e.g. liquidity and market risk management, the mortgage bond market is four times larger than the Danish government bond market.

Basel IV, when implemented in Europe, will most likely mean higher loan-costs for the Danish non-profit social housing organisations as the price on their loans will rise. This is due to the expected higher capital floors being imposed, but also due to a possibility that Basel IV will mean that Danish non-profit social housing could fall under a category of risk-assessment that does not reflect reality.

This means that not only the capital floors could be a challenge. The main challenge could actually be the risk assessment of the Danish non-profit social housing sector itself. What category should it fall under and how should risks be calculated?

Even though the non-profit social housing system has proved to be a very safe and stable investment, financed mainly on market terms with mortgage loans and backed by the National Building Fund, the fact is that this is a purely Danish system that cannot be compared internationally to any other.

Both the Danish mortgage sector and Danish non-profit social housing sector are extremely safe and stable, but both sectors are also very specialised. In relation to Basel IV the two sectors stand a common risk of falling into a wrong category of risk assessment due to the level of specialisation. Such a result would impose costs that do not match the actual risk.

The mortgage institutes and the non-profit social housing in Denmark could be punished for being too specialised in spite of 200-years of extraordinary creditworthiness. As a result, it is clear that future European financial regulation can have a negative impact on the mortgage institutes in Denmark.

What is even clearer is that it is the 1 million tenants living in non-profit social housing in Denmark, who will pay the main bill if non-profit social housing changes status from a good, stable and safe loan borrower to a specialised, high-risk borrower. Costs will be transferred to the non-profit social housing organisations – which again will be reflected in the rent to be paid by some of the socially and economically most vulnerable people in Denmark.

European financial regulation should not destroy well-functioning and stable economic structures that support sound long-term socio-economic investments that promote strong welfare systems. It should strengthen them. Denmark might be a small fish in the European sea. But the risk that future European financial regulation imposes on Denmark, both human and economic, can be echoed all over Europe and should be taken seriously.