31 August 2022

The publication of this year’s edition of the European Covered Bond Council (ECBC) Covered Bond Fact Book, the 17th edition, comes at a critical geopolitical moment, when financial markets are entering uncharted waters and, at the same time, 30 countries in the European Economic Area are starting to apply the national legislation transposing the Covered Bond Directive. This historic event crowns years of efforts to achieve market convergence and harmonise Industry best practices, efforts which have paved the way for the Capital Markets Union and have positioned the covered bond asset class at the centre of long-term funding strategies. Indeed, for centuries, covered bonds have secured macroprudential features in the banking sector, ranging from tradition and financial stability to market innovation and ESG dynamics, more recently.

Against the backdrop of the implementation of the Covered Bond Directive, inflationary trends, evolving monetary policies and the COVID-19 pandemic, which has influenced every aspect of life, housing markets and market strategies over the past 3 years, now more than ever the Fact Book represents the backbone of the ECBC’s activities. As the Industry’s think-tank, the ECBC looks to highlight not only the latest developments but also the core fundamentals that have made covered bonds the most traditional yet innovative asset class in the European financial landscape.

This anti-cyclical, long-term financing instrument has become a pillar of financial stability and is the nexus between harmonised European financial innovation and the traditions that sit within national legal frameworks. The Covered Bond Fact Book therefore seeks to identify and assess the key drivers of developments in the covered bond space over the past 12 months, providing the market perspectives and analysis of more than 100 contributors in over 40 countries. These experts share with us their views on the key market and legislative developments that have occurred, the best practices that have emerged, and address issues which have come to the fore such as digitalisation and sustainability, including both the social and green dimensions.

This compendium of market developments encompasses the essence and collaborative spirit of the ECBC members’ work, which amalgamates different cultures, perspectives but more importantly legal and financial features in a common qualitative and quantitative perimeter. Over the years, this collaborative and constructive approach has become the true fil rouge of our Industry’s modus operandi i.e., always ready to adapt to challenges whilst preserving asset quality and ensuring investor protection. The Fact Book represents the collective effort of our community to produce a prime academic and statistical benchmark publication, whilst coordinating a discussion forum involving over 2,000 covered bond experts and aficionados around the globe.

Over the years, this community has been able to foster a covered bond philosophy with clear macroprudential characteristics for investors, thereby ensuring capital market accessibility and financial stability for mortgage and housing markets.

More importantly, beyond the financial aspect, for most jurisdictions the introduction of covered bonds has also resulted in the provision of more affordable mortgages, more funding choices for lenders and more long-term borrowing options for consumers when they make the biggest investment of their life.

On a daily basis, capital markets participants need complete and accurate information to support regulatory compliance with the Covered Bond Directive, LCR eligibility and ESG-related due diligences, to name but a few priorities, and this need is growing all the time. This is where the ECBC comes into its own. The ECBC-led Covered Bond Label[1], has become a qualitative benchmark as informative gateway in the covered bond space, celebrating its 10th Anniversary this year.

Most recently, the ECBC has completely refreshed its Comparative Database[2] on global covered bond legislative frameworks, which is embedded in the Covered Bond Label website.

During the last years of market turmoil, pandemic and technological innovation, the EMF-ECBC has played a prominent role as a market catalyst, through its efforts to monitor and align best practices. Furthermore, through its working groups, technical committees and task forces, the EMF-ECBC has developed technical knowledge and centres of competence in relation to both the mortgage and covered bond businesses, with a focus on retail considerations, property valuation, prudential regulation, funding strategies, to name but a few areas. By way of a think tank approach and a clear global market governance structure, the EMF-ECBC’s has put this expertise to use in preventing market disruption, whilst delivering active coordination and implementation of initiatives aimed at harmonising procedures, standards, definitions and solutions, whether this be through the Covered Bond Label[3] and its Harmonised Transparency Template (HTT), the Energy Efficient Mortgages Initiative (EEMI)[4] or the Energy Efficient Mortgage Label (EEM Label)[5] and its Harmonised Disclosure Template (HDT), for example.

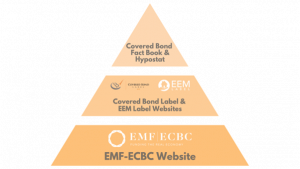

Significantly, all of this know-how and expertise can be accessed by way of a unique information ‘pyramid’ which offers direct and rapid access to market participants to a wide variety of information and data on specific national markets or on European/global market and policy trends. The content and structure of this pyramid is fine-tuned on a regular basis with market participants in the covered bond and mortgage spaces.

The operational entry level of the pyramid is the EMF-ECBC website[1] through which the EMF-ECBC provides access to all position papers, studies and analysis produced by its technical committees and working groups, offering a valuable window into the potential of current and future legislative and market evolutions. The EMF-ECBC website furthermore provides links to its member organisations, giving an insight into the experts behind the knowledge.

Stepping up a level of detail, the next layer of the pyramid consists of the Covered Bond Label website, where around EUR 2 trillion of covered bonds outstanding are officially registered. The Covered Bond Label website offers unique transparency directly managed by issuers, ISIN by ISIN, bond by bond, on: (1) liabilities’ characteristics, (2) cover asset data via the Harmonised Transparency Template (HTT) and (3) the features of national legislation, which are summarised and comparable at global level. In a similar way, on the ESG lending side the EEM Label website offers transparency in the energy efficient mortgages space for consumers, lenders and investors.

At the top of the information pyramid are the EMF-ECBC’s flagship publications offering a deeper dive into market dynamics and legislative developments: the ECBC Fact Book and the EMF’s Hypostat. The ECBC Fact Book crowns the Covered Bond Label Website and Comparative Database with its deeper dive into key themes and trends impacting the covered bond space in the previous year, national legislation, overviews of the overarching macroprudential value and regulatory treatment of this asset class, as well as summaries of rating agencies’ methodologies. Through Hypostat, the EMF-ECBC delivers unique analysis of trends in Europe’s mortgage and housing, offering a comprehensive asset side perspective of mortgage market dynamics and national characteristics for investors and other market participants.

Significantly at the current time, this information pyramid acts as an operational magnifying glass which will guide market participants through the labyrinth of compliance with the Covered Bond Directive, providing legal details, hard data and intelligence, all of which is crucial for investor due diligence. The pyramid’s cornerstone lies in the compliance disclosures requirements with the HTT fully aligned to Article 14 of the Directive. Indeed, at the time of writing, EU Member States are finalising the revision of their national legislation aimed at implementing the European Covered Bond Directive. 27 countries have passed an official act, with some of them in the process of finalising their secondary legislative process after having met the Directive’s transposition deadline of 8 July 2022.

At the global level, the prospect of a third-party equivalence regime (due to be finalised by 2024) is boosting the interest in adopting covered bond legal frameworks and helping to make compliance with the qualitative standards foreseen in the Directive a clear point of reference for regulators and legislators.

Access to information, market guidance and harmonisation efforts are the secret ingredients which make the covered bond space a unique corner of the market rooted in stakeholder confidence that in turn represents the real essence of the crisis management capabilities of this asset class.

The EMF-ECBC has always sought to be ‘part of the solution’ and, through recent market turmoil, has activated the Industry’s best resources to monitor, analyse, discuss and guard against potentially negative impacts for mortgage, housing and funding markets worldwide. As a community, the EMF-ECBC remains committed to supporting the transition to a more sustainable economy and society, encouraging countries to move from a pandemic mind-set towards a more sustainable capital markets infrastructure, and supporting consumers and borrowers in turning the current challenges into opportunities.

After so many years, there is no doubt that we are stronger together and we would like to thank all ECBC members for their input, engagement and continued support during what have been challenging times. We would particularly like to express our gratitude to the contributors to this year’s publication for their work in ensuring that, despite the exceptional circumstances of the past year, this 17th edition of the ECBC European Covered Bond Fact Book remains:

by Morten Bækmand Nielsen, ECBC Chairman and Luca Bertalot, EMF-ECBC Secretary General

[1] https://hypo.org

[1] www.coveredbondlabel.com

[2] https://compare.coveredbondlabel.com

[3] www.coveredbondlabel.com

[4] www.energyefficientmortgages.eu

[5] www.energy-efficient-mortgage-label.org