22 December 2017

In our EU sample the outstanding market continued to increase both with respect to the previous quarter (quarter-on-quarter, q-o-q) and with respect to the same quarter last year (y-o-y), by respectively 0.8% and 2.3%. Regarding new lending, the figures remained virtually unchanged at around EUR 278 mn. with respect to the previous quarter and to the same quarter of the previous year. In general, this positive evolution can be explained by the above-mentioned factors which encourage borrowers to climb up or to take the first step onto the housing ladder. The national particularities are described in more detail in this section following the geographic macro-areas of the continent.

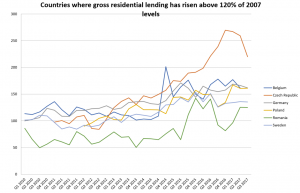

In Central and Eastern Europe, the picture shows a generally positive economic evolution, however this is not translated everywhere into an increasing mortgage market. In the Czech Republic, the outstanding mortgage market reached a new all-time high increasing by over 14% y-o-y. On the contrary, in Q3 gross lending showed a decrease of 8% with the lowest level since the beginning of 2016. In Hungary, the summer and autumn of 2017 marked a turning-point with increasing outstanding mortgage figures for the first time since 2011. Gross mortgages also continued to grow by 30% y-o-y and by 5% q-o-q. Among the new mortgage loans disbursed there has been a doubling of the share of loans for construction and for purchase of new dwellings from 2015 to Q3 2017, now standing at 17% of the overall market. Parallel to the increase in mortgages the housing market also showed a positive development, with 32% more housing permits issued in Q3 2017 than in the same period last year. Similarly in the first nine months of 2017 the construction sector completed around 8,000 new dwellings, marking a 50% increase with respect to the same period in 2016 and this trend is expected to continue. In Poland, mortgage activity slightly decreased in terms of numbers of mortgages by around 8% q-o-q, but the amount of an average loan slightly increased over the same period, with the most popular loan ranging from around PLN 300,000-400,000 (EUR 70,000 – 93,000). It should be noted that especially in the largest Polish cities over 60% of homebuyers rely only marginally or not at all on mortgages. In Romania, outstanding and gross mortgage figures continue to grow and the share of NPLs decreased by 27 bps to 3.5%. Almost all mortgages have been granted in Romanian Leu. In Germany, the mortgage market continued a positive trend with increasing gross and outstanding figures.

In the north, the general trend shows a positive evolution in the housing and mortgage market, but the steep increases of the previous quarters continue to decelerate and to cool off. In Sweden, net mortgage lending seemed to have floored at around 7% in Q3 2017, from double-digit figures seen in the last year. Construction figures also continue their growth and are about to reach the record levels of 1990.

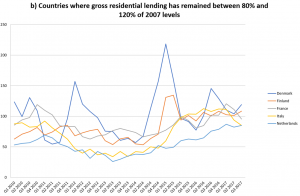

There is still a lack of housing, especially in the larger cities, however this trend is clearly shifting as newly constructed houses are too expensive for a significant share of the population. This is clear from the increasing time-horizon these newly built dwellings remain unsold on the market. In Ireland too the mortgage and housing market is growing. Housing completions increased by nearly 30% and housing starts increased by 35% in the first nine months of 2017 with respect to the same period in 2016. It is expected that around 18,000 dwellings will be started in 2017, but this is still less than half of the 40,000 new dwellings needed to meet the current demand. Non-household buyers are growing more important, accounting for the purchase of 25% of new and 13% of existing dwellings in the twelve months up to September 2017. Mortgage figures follow a similar path with a 30% increase of drawdowns and a 18.9% increase in value terms in the first nine months of the year. In Finland, mortgages are in high demand with a nearly 8% increase of gross lending y-o-y and outstanding loan increase of 2.2% y-o-y. The generally low interest rate environment also leads to an increased amortisation of outstanding loans. In the UK, the mixed economic performance nationally is reflected in the housing and mortgage market with some components holding up better than others. Total property transactions have averaged just over 100,000 per month over the course of 2017, helped by a recovery in house purchase approval numbers. The mix of activity has shifted though, away from cash and buy-to-let, towards first-time buyers. Re-mortgaging continues to recover taking advantage of the low interest rates, which are expected to continue as mortgage holders are willing to lock-in to the still favourable mortgage deals. Similarly, in Denmark outstanding and gross residential mortgage increased over the last quarter, however the gross figure slightly decreased over the year while the outstanding figure increased by 1.7%.

In Western Europe, the mortgage market also increased, especially after some more cautious quarters earlier in 2017. In France, after the uncertain electoral period, the mortgage and housing market resumed its growing path. In the twelve months before September 2017, 950,000 existing dwellings have been sold, which is a greater than 3.1% increase with respect to the rolling 12 months aggregate at the end of June 2017. The average maturity of home loans tends to stabilise at around 18 years. In Belgium, the mortgage market figures of Q3 2017 significantly consolidated with respect to Q3 2016, but still grew with respect to Q3 2015. This can be explained by the record-levels in mortgage credit reached in autumn 2016. Overdue contracts continued their downward path in Q3 2017 standing at around 1.03%. In the Netherlands, gross lending continued to increase reaching its all-time high since the crisis. Likewise, in Italy in the first nine months of 2017 the residential market has shown a positive performance with a 2.1% y-o-y increase in the outstanding figures. According to Bank of Italy demand seems to have stabilised and short-term perspectives have also been improved.

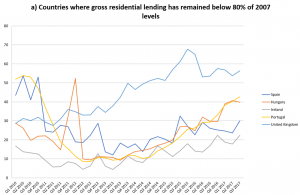

On the Iberic peninsula mortgage markets continue their positive trend in gross lending while outstanding figures contracted. In Portugal, transactions increased in line with the previous quarters. Outstanding mortgage loans continue to decrease following the downwards path which started at the end of 2011, while gross lending increased to its highest level since 2011, although still far below before the crisis. In Spain as well the deleveraging process is still ongoing despite the increase in new loans, which grew by nearly 20% y-o-y.

As a new section in the Quarterly Review, here the reader will find more detailed information regarding the actions of the relevant public authorities to cool-down markets or to support some specific market categories. Recognising the wealth of ongoing measures, this section focuses exclusively on actions which have either been announced or introduced in Q3 2017 to provide a sense of the current action in this regard.

The public authorities in Central and Eastern Europe have been relatively active in the reference quarter. In the Czech Republic, considering the first signals of heating in the economy, the Czech National Bank (CNB) became the first European central bank to increase its reference interest rates since the crisis, raising them by 25 bps in August 2017 and by another 25 bps in November 2017. Moreover, regarding the LTV, since 2016 the CNB has issued several recommendations and has currently set the LTV limit at 90% in order to counteract rising house prices and potential signs of a bubble in the real estate market. At the beginning of 2017, the CNB introduced a legislative proposal which should make this recommendation legally binding, but the political elections have postponed the parliamentary passage of the law. For the time being, the second reading is scheduled for January 2018. In July 2017, the CNB has increased the rate of the countercyclical capital buffers from 0.5% to 1.0% and in December it announced that the rate will be increased further in the future. In Hungary, during the summer banks started to offer so-called “Certified Customer Friendly Mortgage Loans” with which consumers could borrow with shorter administrative deadlines and lower costs. The National Bank of Hungary (NBH) was also discussing two new instruments which will be introduced starting from 2018, namely a mortgage bond purchase programme and the conclusion of long-term interest rate swap transactions with partner commercial banks for five and 10 year maturities at regular tenders. With these new monetary instruments, the NBH expects to curb the mortgage market and to incentivise the proportion of fixed-rate loans. Moreover, it hopes that the risk of changes in the yield curve might be better managed with these new instruments. In Poland, on the 22 July 2017, the Mortgage Credit Directive was implemented and, in August, the President singed the Act on the National Property Resource, which will collect and manage State Treasury real estate, allocating it for the construction of cheap apartments for rent.

In the north of the continent, some countries have introduced new measures. In Sweden, Finansinspektionen (the Swedish FSA) published in June 2017 a regulation which suggests stricter amortisation requirements on housing loans for households with a high Loan-to-Income (LTI) ratios. These requirements state that new borrowers who have a loan that exceeds 4.5 times their gross income must amortise an extra 1% to prior amortisation requirements. These requirements have been approved and will enter into force on 1 March 2018. The current amortisation requirements state that new loans issued from 2016 with more than 50% LTV should amortise and for mortgages with an LTV exceeding 70%, the amortisation has to amount to at least 2% of the original amount every year, while for mortgages with an LTV between 50% and 70% the amount is 1%. In the UK, the Bank of England’s Financial Policy Committee (FPC) said in its Financial Stability Report that its macro-prudential recommendations are likely to remain in place for the foreseeable future and clarified its affordability tests. It now expects lenders to stress affordability at three percentage points higher than the reversion rate specified in the mortgage contract at origination. Moreover, in August 2017 the FPC voted unanimously to close the drawdown period for the Term Funding Scheme on 28 February 2018 as originally planned. This scheme aimed to support new lending and offset some of the financial pressures that lenders were facing because of low interest rates. In addition, starting from 30 September 2017 landlords with four or more buy-to-let properties, so-called “portfolio landlords”, will be subject to a more specialist underwriting approach when applying for a new buy-to-let mortgages, which includes scrutiny of the landlord’s experience in the buy-to-let market, the cashflow associated with all their existing properties and inspection of their business plan.

In Western Europe, France announced a new “housing strategy” for 2018, including stimulus measures to release lands and to encourage home construction, but also significant cuts to some incentives such as zero rate loans and housing grants. In Spain, the central bank has approved new accounting rules for the financial entities (IFRS 9) whose implementation requires credit institutions to make provisions based on Expected Credit Losses, instead of the former Incurred Credit Losses, thus raising the credit coverage level.

In the other countries of our sample not specifically mentioned in this section, no new measures have been introduced or announced in Q3 2017. This was either because the legislator did not deem it necessary or because, as in the Netherlands, the parties were still negotiating a coalition agreement, which in the case of the Netherlands was reached in October.

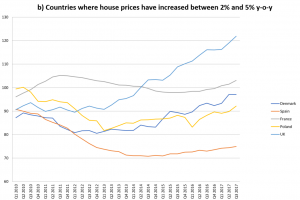

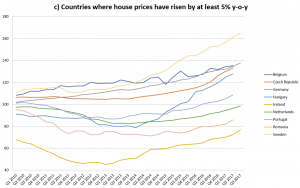

In various countries, the latest data available on house prices show a generally ongoing increasing trend due to the well-known supply and demand imbalances, but in some cases the dynamics shifts to a slower or stagnating pace. This is also reflected in our sample in which the unweighted average of the house price indices slowed to a 0.6% q-o-q increase in Q3 2017 from an over 2% q-o-q increase in Q2 2017.

In Central and Eastern Europe, house prices show an overall increase. In the Czech Republic, the strong increase at a double-digit pace with respect to Q3 2016 for all kinds of houses/flats was actually one of the reasons for the CNB to consider a further rise in the Countercyclical Capital Buffer rate (see above). Prices in cities like Prague reached such levels that even above average income households struggle to find affordable places to live. Newly built houses are decreasing and legislative requirements create bottlenecks to an already tight real estate market. The fact that nearly a third of purchased flats are actually for investment and not for living in further pushed prices up and there are considerations taking place nationally as to the potential existence of a bubble. Similarly, in Hungary house prices continue their upward trend with 2.9% growth q-o-q and, especially in Budapest, houses cost 80% more than in mid-2017 (the latest available data) than three years ago when the lowest level was reached. In the rest of the country, the dynamics showed less stark developments. In Poland, transaction prices for both new and existing dwellings increased in Q3 2017 with on average more marked increases in the former. New dwellings saw the steepest q-o-q cost increase in Gdynia (6.5%) and in Szczecin (3.8%), while existing dwellings’ prices increased most in Szczecin (4.5%) and in Krakow (3%). In Warsaw, prices increased at a slower pace at less than 2% q-o-q for both markets. In Romania, house prices showed a steep increase of 7.2% y-o-y in Q2 2017, the last available data-point. In Germany, owner-occupied dwellings increased by 6.1% y-o-y, which exceeds by far the growth in consumer prices. Although purchase prices are in some cases very high, many market participants still consider home ownership to be a sound investment. Broken down by property type, prices for condominiums are 7.4% higher than in the third quarter a year ago, while those for owner-occupied houses are 5.6% more expensive.

In Central and Eastern Europe, house prices show an overall increase. In the Czech Republic, the strong increase at a double-digit pace with respect to Q3 2016 for all kinds of houses/flats was actually one of the reasons for the CNB to consider a further rise in the Countercyclical Capital Buffer rate (see above). Prices in cities like Prague reached such levels that even above average income households struggle to find affordable places to live. Newly built houses are decreasing and legislative requirements create bottlenecks to an already tight real estate market. The fact that nearly a third of purchased flats are actually for investment and not for living in further pushed prices up and there are considerations taking place nationally as to the potential existence of a bubble. Similarly, in Hungary house prices continue their upward trend with 2.9% growth q-o-q and, especially in Budapest, houses cost 80% more than in mid-2017 (the latest available data) than three years ago when the lowest level was reached. In the rest of the country, the dynamics showed less stark developments. In Poland, transaction prices for both new and existing dwellings increased in Q3 2017 with on average more marked increases in the former. New dwellings saw the steepest q-o-q cost increase in Gdynia (6.5%) and in Szczecin (3.8%), while existing dwellings’ prices increased most in Szczecin (4.5%) and in Krakow (3%). In Warsaw, prices increased at a slower pace at less than 2% q-o-q for both markets. In Romania, house prices showed a steep increase of 7.2% y-o-y in Q2 2017, the last available data-point. In Germany, owner-occupied dwellings increased by 6.1% y-o-y, which exceeds by far the growth in consumer prices. Although purchase prices are in some cases very high, many market participants still consider home ownership to be a sound investment. Broken down by property type, prices for condominiums are 7.4% higher than in the third quarter a year ago, while those for owner-occupied houses are 5.6% more expensive.

Moving north it seems that the major push for house price increase has lost most of its steam. In countries like Sweden, prices in the analysed quarter increased y-o-y by 8.1% for one-family homes and by 7.2% for apartments, showing an ongoing decelerating trend with respect to the previous quarters. In the subsequent quarter, major shifts are expected as the data for October already shows that overall house price growth halved and, in Stockholm, prices actually fell by 2.5% y-o-y. In Finland, house prices remain stable on average with increases in Helsinki due to urbanisation and immigration trends. In Denmark, over Q3 2017 the price dynamics of both single homes and owner-occupied apartments were respectively stable or slightly increasing. Figures over the year show a nearly 10% increase of owner-occupied apartments while single family houses appreciated by 3.4% over the same period. The principal factor driving prices is the movement of long-term interest rates, which considering also tax deductions, have reached a historic low. In the UK, undersupply of new and existing dwellings and high transaction costs and weak house price inflation are set to continue. As a result, though house prices slowed down during 2017, it is unlikely to fall into negative territory as demand remains strong. In Ireland, house prices continue to increase in double-digits in the rolling year to September 2017 with a 12.2% increase year-on-year. However, according to the Central Statistics Office, the national property price index is still 23.7% lower than its highest level in 2007, notwithstanding the almost 70% increase since the trough in early 2013. Over the same period Dublin’s house prices rebounded with 86% more than the rest of the country, which stopped at 6.%.

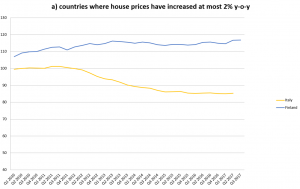

In Western Europe, house prices reflect the recovery of the general economic factors. In the Netherlands, in Q3 2017 house price dynamics marked a new record with 7.5% y-o-y increase and in the analysed quarter an all-time high of 61,000 houses have been sold. In Belgium, house prices increased at a national level by around 1% in the first nine months of 2017, with regional differences. In Wallonia and Flanders, the increase was of 2.9% and 1.4% respectively, while in Brussels house prices decreased by 6.3%. Concerning apartments, at a national level, prices increased by around 1.5% and the regional breakdown was 1.4% for Flanders, 4.6% for Wallonia and 1.3% for Brussels. It also has to be highlighted that the price levels differ substantially across regions. For example, if on average an apartment in Brussels costs around EUR 235,000, in Wallonia it is a little over EUR 171,000. Likewise, in France, house prices are increasing. Existing dwellings had a 5.1% increase y-o-y nationally and a 7.8% y-o-y increase in Paris. The new housing market showed a more contained growth rate of around 1% y-o-y. Moving south, in Italy, house prices in Q2 2017, the last available data, remain virtually at a standstill both q-o-q and y-o-y. New dwellings slightly increased in price while existing dwellings increased by 0.1% q-o-q and decreased by 0.3% y-o-y. In Spain, house prices marked the steepest increase since the bursting of the housing bubble in 2008 with 2.7% y-o-y. Q3 2017 is thus the 10th consecutive quarter of rising prices, though there are large differences across the countries. House prices grew the most in Madrid, Catalonia, the Canary and the Balearic Islands. Large unused housing stock and demographic evolution are two elements to be taken into account for future evolution of house prices in Spain.

In our sample, in aggregate terms, the average interest rate virtually did not change with respect to the previous quarter. In Q3 2017 it remained around 2.25%, the lowest average of our sample so far. Interest rates across the continent remained low following the overall low reference rate of the central banks and fixed interest rate types are increasing their overall market share as borrowers seek to be locked-in to the more favourable low interest rate environment.

In Central and Eastern Europe, the Central Bank of the Czech Republic was the first on the continent to raise reference rates. Nevertheless, the average interest rate on new loans for house purchase went slightly down by 5 bps to 2.17% in Q3 2017. Following the tightening of monetary policy, it is expected that in the upcoming quarters this will eventually rise. In Hungary, the reference rate of the Central Bank remained unchanged but the average mortgage interest rate continues its downwards trend to 3.55%. For the time being, the most typical mortgage interest rate is variable and is linked to the Budapest Interbank Rate. The new policy instruments explained above, which will kick-in at the beginning of 2018, will further increase the appeal of more fixed-rate loans. In Poland, interest rates remained virtually unchanged as did the reference rate of the Central Bank, although inflationary pressures are becoming more evident. The average mortgage loan’s interest rate has slightly declined by 1 bps to 2.17%, while the interest rate on new mortgage loans slightly increased to 4.5%, the highest level in the analysed sample. In Romania, the average interest rate increased by 26 bps to 3.6% with respect to Q2 2017. In the breakdown of interest rates, those with a fixed period of more than a year have now reached a market share of nearly 12% of all new loans, a remarkable increase from less than 3% in Q2 2017. In Germany, after an all-time low reached at the end of 2016, the average mortgage interest rate slowly climbed to 1.85%.

In the north, interest rates remained mostly stable or decreased even further reaching all-time lows. In Finland, the mortgage interest rate reached 1.02% and in Denmark it went under the 1% mark reaching 94 bps for a variable interest rate. All other interest rate types also saw a general reduction. In Sweden, longer initial fixed interest rates (five years and above) were around 2.5%, but over the last two quarters they reached a record low of 1.9%. More variable mortgage rates reached 1.5% in Q3 2017 after remaining stable for a couple of years at around 1.6%. In the UK, interest rates remained very attractive due to fierce competition among lenders and, especially in the lower LTV range, the fixed-term mortgages remain at or close to historic lows at the two, three, five and even 10-year lengths. In Ireland, the average interest rate has reached the lowest level since Q3 2012 and, for the first time, variable mortgage rates, including those with a fixed period of up to one year, accounted for less than half (47%) of the newly issued mortgages, proving the growing appeal of more fixed mortgage arrangements.

Similarly, in the west, interest rates continued to stay at very low levels. In Belgium, the average interest rate was around 2.11% and long-term fixed interest rates continue to represent the vast majority of newly issued loans. In France, interest rates remained very low at around 1.5%, as they have over the last six quarters. A similar picture can be seen in the Netherlands where over the last four quarters the interest rates remained stable at around 2.3%. Here too the breakdown of interest rate types remained virtually unchanged, with the majority of new mortgages presenting an initial fixation rate of 5-10 years. In Italy, interest rates continued to decrease with the average figure reaching 2.02% and the variable rate decreasing to 1.63%, while the more fixed interest rate types remained at around 2.2%. A different trend is spotted in Spain, where all interest rate types showed a marginal increase compared to the previous quarter. Nevertheless, the levels stay low following the monetary policy of the ECB. After the peak of long-term fixed interest rates reached at the end of 2016 with nearly 35% of new loans having an initial fixed interest rate period of at least five years, in Q3 their share shrank to 28.9%. In Portugal, around 60% are borrowing with a variable interest rate while the rest is split among the various fixed-term lengths. The variable interest rate is based on an exogenous component, the Euribor, and an endogenous component based on the creditworthiness of the borrower and on the LTV of the mortgage contract. The very low Euribor has helped reduce household indebtedness and increased gross lending. The average interest rate continues to decrease and is currently 1.48%.