15 March 2018

By Franz Rudolf, UniCredit and Karsten Rühlmann, LBBW

This article is taken from the 2017 edition of the ECBC European Covered Bond Fact Book, which can be accessed here.

Just a few years ago, extendable maturity covered bond structures were the exception rather than the rule. However, analysts and rating agencies increasingly focused on the valuation of liquidity risks and thus refinancing risks in the wake of the financial crisis. By making structural adjustments to their programmes, issuers were able either to mitigate the related risks or transfer them in their entirety to investors. In addition to soft-bullet structures, where extension periods are typically 12 months, conditional pass-through structures with much longer maximum maturities have also gained ground in the last years.

Below, we take a closer look at current developments of covered bonds with extendable maturities also in light of the planned covered bond harmonisation and examine the motives of issuers on the one hand and the reactions of investors on the other.

The most fundamental idea of covered bonds is safeguarding a steady flow of payments to investors following an issuer event of default. Once the issuer ceases to exist, the cash-flow stemming from a separate portfolio of assets is used to cover all claims due to bondholders. The two most significant sources of risk threatening the ability to satisfy the claims are (i) credit default risk, which potentially leads to an over-indebted cover pool and (ii) market risk – first and foremost in the form of liquidity risk – which potentially leads to a sufficiently large cover pool, which, however, is no longer able to satisfy claims due to illiquidity.

In the past, the rating agencies and other market participants assumed that, following issuer default, the cover pool administrator could easily monetise the assets in the cover pool either by disposing parts of the cover assets or in an indirect way, i.e. by bundling them into an asset-backed security (ABS) or – if applicable – by using the refinance register. Some covered bond structures may also be able to raise new debt either in a technically “unsecured” way or even in the form of covered bonds. In particular against the backdrop of uncertainty regarding the functionality and the efficiency of these tools, it is particularly important that the cover pool administrator is equipped with a broad set of instruments so he is free to pick the most efficient one.

In cases involving hard-bullet structures, issuers try to enhance the effectiveness of the tools by regularly calculating pre-maturity tests or by maintaining a certain amount of liquid assets in the cover pool – a costly exercise for issuers since liquid assets usually come with a negative carry. Soft-bullet structures that have a limited extension period (usually one year) aim to manage the liquidity challenge at the expense of investors. However, since the soft-bullet timeframe might still turn out to be insufficiently long, the idea of pass-through aims to completely eliminate any refinancing risk by eliminating pressure to sell assets at the expense of a maximum timeframe for the payment deferral.

In a nutshell, the three major redemption regimes for covered bonds work as described below:

> Hard-bullet covered bonds: payments have to be made when due according to the original schedule. Failure to pay on the Standard Maturity Date (SMD) triggers default of the covered bonds, and the covered bonds accelerate.

> Soft-bullet covered bonds: payments have to be made when due according to the original schedule. Failure to pay on the SMD does not trigger covered bond default. The extension period grants more time (typically at least 12 months) to repay the covered bonds, setting a new Final Maturity Date (FMD). Failure to pay on the FMD triggers default and acceleration of the covered bond.

> Conditional pass-through covered bonds (CPTCB): payments have to be made when due according to the original schedule. Failure to pay by the SMD does not trigger default of that covered bond. The affected covered bond goes into pass-through mode. All other outstanding covered bonds are not affected and would only trigger the pass-through mode one after another if they are not redeemed on their respective SMDs.

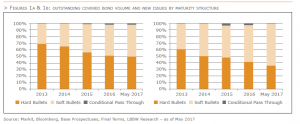

In the last 12 months, there has been no letup in the trend towards extendable maturity structures. A comparisonof the developments over the last five years on the basis of the iBoxx € Covered benchmark index reveals that soft bullet and conditional pass-through covered bonds now predominate with a share of 50.2% (as of May 2017). At the end of 2013, they did not even account for one third. In absolute terms, this means that hard bullets still make up EUR 386 bn of the outstanding benchmark volume of EUR 776 bn, while soft bullets and conditional pass-through covered bonds account for EUR 378 bn and EUR 12 bn respectively.

This development has been driven by two trends. First, numerous existing covered bonds have been converted from hard to soft bullet or conditional pass-through structures under consent solicitations. In cases in which the base prospectus did not permit such structures, appropriate changes were made ahead of such investor solicitations. Second, numerous institutions have started to issue new covered bonds with soft bullet formats. This is also reflected in the issuance trend. In the first five months of 2017, nearly two thirds of all benchmark covered bond issues had extendable maturity formats.

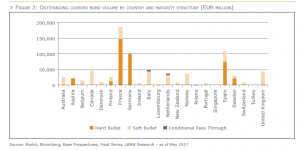

In terms of single covered bond jurisdictions, the figures clearly show that just three pure hard bullet jurisdictions how exist – namely Germany, Luxembourg and Spain (single cédulas). Until recently, Austria was also in that category. However, at the end of March 2017 Hypo NOE became the first Austrian issuer to make its soft bullet debut in the benchmark segment.

In addition to issuers from the aforementioned jurisdictions, the only other issuers to come to the market with hard bullet bonds in 2016 were from Sweden and France. The picture has been similar in 2017, and there is now a clear preponderance of extendable maturity structures. In addition, plans still exist in Germany to amend the German Pfandbrief Act to allow for a maturity extension as an additional tool for cover pool administrators.

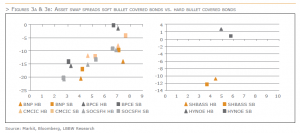

In jurisdictions in which single institutions have both hard and soft bullets outstanding under one programme, it is possible to analyse spread differentiation, if any, between the two structures. Bonds with similar maturities can be found mainly in France, but also in Sweden (Stadshypotek) and Austria (HYPO NOE). An analysis of these issuers still reveals no clear spread differentiation between soft and hard bullet covered bonds. One would expect investors to demand higher pickups to compensate for the risk associated with a maturity extension. However, the analysis shows that the spreads of soft bullet paper are even trading slightly below those of hard bullets in some cases.

The lack of spread differentiation by investors enables issuers to make full use of soft bullet benefits. Besides the preferential treatment by rating agencies with regard to lower overcollateralisation requirements, the simpler handling in the case of liquidity management plays an important role. For example, in jurisdictions such as the Netherlands pre-maturity tests are required for hard bullet issues, which involve certain rating requirements. In addition, in that connection a certain portion of liquidity must be maintained for maturities over the next 180 days, which causes additional costs.

As a result of the growing use of extendable maturity structures, regulators have increasingly turned their attention to them. Aside from the high level of complexity, criticism has been directed mainly at the different structures and changes to the structural features of the covered bond product. The main question that was raised was to what extend extendable maturity structures influence the dual recourse principle of covered bonds. For example, if the maturity extension were invoked too early, recourse to the issuer could be cut off too quickly, even though the issuer is still solvent. Moreover, if extension periods are too long, recourse to the issuer’s insolvency estate is considerably delayed.

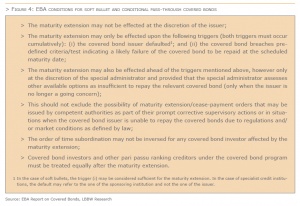

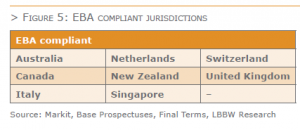

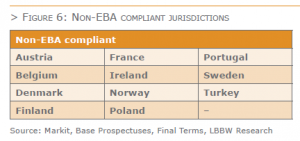

In response to such criticisms, the EBA’s report entitled “Recommendations on Harmonisation of Covered Bond Frameworks in the EU” dated 20 December 2016 put forward a wide range of requirements for soft bullet and conditional pass-through covered bonds. The recommendations aim to ensure, first, that such bonds meet the covered bond definition (step 1) and, second, that they are eligible for preferential risk treatment under the CRR (step 2). Specifically, the conditions are as follows:

In most cases, the conditions for a maturity extension are set out in the base prospectus and related final terms. So far, statutory requirements exist only in Poland and Denmark. In general, a distinction can be made between two types of structure:

1) Issuer and cover pool constitute legally independent entities

These are normally SPV structures. Several requirements have to be met before the maturity can be extended. First of all, a so-called issuer event of default must have occurred. The payment obligation then passes to the guarantor in connection with a notice to pay / guarantee enforcement notice. If the guarantor does not have sufficient liquidity to repay the covered bonds on the original date (final maturity date), payment is deferred to the extended maturity date.

This specific approach should comply with the EBA rules. On the one hand, the decision to extend the maturity is not made at the sole discretion of the issuer alone, but ultimately depends on the guarantor’s ability to pay. On the other hand, the issuer must first have defaulted. Accordingly, the maturity extension does not focus on the issuer’s ability to survive, but on securing the largest possible repayment for investors.

The plans for a shift in the maturity date in Germany should also comply with the conditions drawn up by the EBA. In the event that insolvency proceedings are opened in respect of the Pfandbriefbank, each cover pool is separated as a legally independent entity with its own banking license (Pfandbriefbank with limited business activity). The management of these Pfandbrief banks with limited business activity is the responsibility of the cover pool administrator who is appointed in accordance with §31 PfandBG. As a result, the extension falls outside the issuer’s scope of influence.

At present, 19 jurisdictions have covered bonds with extendable maturity structures outstanding in the iBoxx € Covered Index. Eight of the jurisdictions have structures similar to that outlined above. The total amount of soft bullet and conditional pass-through covered bonds outstanding in those countries is EUR 218.9 bn as of May 2017.

2) Issuer and cover pool constitute the same legal entity

These are generally on-balance-sheet structures. In addition to universal bank structures, specialist credit institutions and French SFHs and SCFs are included in this group.

Unlike in the jurisdictions under group 1, the conditions for a maturity extension for these structures are much more general. For example, the only requirement for an extension is that the issuer is unable to pay on maturity. The biggest difference, however, concerns the issuer event of default. In most cases, the documentation notes that a maturity extension does not lead to a default of the issuer. Conversely, this would mean that the maturity can be extended to avert or postpone an issuer default. Accordingly, an issuer event of default would not occur until non-payment of the due amount on the extended maturity date or non-payment of interest. This would contradict the EBA’s maturity extension proposals.

In this group, the total amount of extendable covered bonds outstanding is EUR 137.5 bn as of May 2017.

In the case of Polish covered bonds, a bankruptcy event triggers a maturity extension. However, the EBA report makes it clear that for specialist banks the sponsoring institution must have defaulted, and not the issuer itself.

In 2013, conditional pass-through structures were introduced in the covered bond benchmark universe. NIBC was the pioneer issuing a EUR 500 mn 5Y benchmark covered bond in October 2013, followed by further benchmark issues on a yearly basis. While for the first two years, conditional pass-through structures were widely discussed but remained a niche product, it was in 2015 that this redemption format started to gain momentum. Additional issuers took the conditional pass-through path with UniCredit SpA joining in February 2015 with a EUR 1 bn 10Y OBG, van Lanschot Bankiers bringing its inaugural EUR 500 mn 7Y benchmark in April 2015, followed by Aegon in November 2015 with a EUR 750 mn 5Y, Banca Monte dei Paschi di Siena converted its programme from soft bullet to conditional pass-through and Banca Carige followed in 2016 with a new CPT program. CPT programs can also be found in Portugal (Novo Banco and Caixa Economica Montepio Geral), in Austria (Anadi Bank) and in Australia with Bank of Queensland’s EUR 500 mn 5Y covered bond, issued in July 2017. Poland is so far the only country, which implemented a conditional pass-through extension into its updated legal framework for covered bonds. PKO Bank Hipoteczny made use of the new structure, issuing a EUR 500 mn Polish covered bond in October 2016.

In CPTCB programmes in general, following an issuer event of default, any repayments, including early repayments and excess spread, remain with the cover pool until a covered bond series reaches its SMD. Following an issuer default, a particular covered bond will only become pass-through once a covered bond reaches its SMD and the available cash is insufficient to fully redeem the bond. Other outstanding covered bonds will not turn into pass-through covered bonds as long as they are paid as scheduled. It goes without saying, that the switch to pass-through on the SMD does not prevent the cover pool administrator from trying to sell assets in order to improve the liquidity of the cover pool and, in doing so, making the switch to pass-through less likely. The maturity extension and switch to pass-through aims to reduce refinancing risk, i.e. the risk of fire-sales. In order to generate sufficient cash flows to repay the covered bonds due, the cover pool administrator is empowered to sell a randomly selected part of the asset portfolio as long as the conditions of the amortisation test are met.

Following issuer default, the amortisation test has to be passed. The amortisation test is designed to ensure that cover assets are sufficient to repay the outstanding covered bonds. Key aspects in that respect are the level of overcollateralisation in the programme as well as provisions to address transactions risks like servicing. If the test is failed, the commonly used structure is that all covered bonds becoming pass-through. In this case, the covered bond company will be required to use all funds available to redeem all covered bonds on a pro rata basis, while interest continues to accrue on the unpaid part of the covered bonds.

An important feature in the CPTCB is the minimum overcollateralisation (OC), which is needed to allow for the programme to switch to pass-through. Shortage of collateral, which could arise from paying administrative costs as well as covering potential credit losses, would otherwise instantly trigger a failure of the amortisation test and an acceleration of payments to bondholders. This is the reflection of the fact that cover pool credit risk is the key remaining source of loss in the cover pool asset-liability-management. In order to eliminate market risk completely, the legal final maturity is extended to beyond the maximum maturity date of the cover pool assets. The extension period usually ranges from 31 years to 38 years, depending on the respective program documentation.

The increased number of CPT programmes in the past few years has led to a relatively broad diversity of structures, for example showing different extension triggers and procedures following the failure of the amortisation test. While within countries like the Netherlands, CPT structures are relatively homogenous, they are less homogenous in Italy and Portugal and differ quite substantially between countries. In order to address the lack of standardised structures in the market, an initiative to achieve certain common minimum standards has been implemented.

The decisive difference between soft-bullet redemption formats and (conditional) pass-through formats raises the question of the length of the deferral term. The longer the deferral period of the soft-bullet payment regime, the closer the two redemption formats become. The remaining differences are not essential and could be replicated: the (implicit) SARA clause (Selected Asset Required Amount) that e.g. NIBC posts is also frequently found in soft-bullet structures. Thus, during the deferral period, the scope of actions taken by each cover pool administrator is quite similar: both will not hold on to an unnecessary amount of liquidity but will instead use it to redeem the deferred principal amount. Furthermore, both will try and find opportunities to liquidate assets (in line with the SARA clause) in order to allow redemption to occur as quickly as possible.

However, the one-year deferral period of most soft-bullet covered bonds provides the cover pool administrator with a relatively limited timeframe in which the required amount of cover pool assets can be liquidated. In contrast, the opportunities in a (conditional) pass-through case are technically unlimited. Hence, market risk is mitigated with soft-bullets covered bonds and eliminated with CPTCBs.

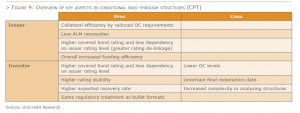

Issuers currently find themselves in complex situations: At the peak of the financial crisis, quite a few issuers were seeking funding by retaining transactions and were using them to collateralise European Central Bank (ECB) open market operations. The ECB applies two different haircut schedules for covered bonds: one for those rated A- or higher and another less-favorable one for those rated in the BBB-range. Non-investment grade covered bonds do not qualify. However, during the crisis, country ratings in the periphery dragged down the senior unsecured ratings of banks, which, in turn, resulted in lower covered bond ratings. In addition, quite a few assumptions of rating agencies, regarding the legal frameworks, market environment, refinancing cost, foreclosure periods of cover assets, etc., changed for the worse and, therefore, made it necessary for issuers to post ever-higher overcollateralisation. Taking a look at the agencies’ analyses of cover pool losses, it appears as if there was a unanimous view that the most significant source of losses was market-related rather than credit-related. Hence, eliminating market risk instantly reduces overcollateralisation requirements by a significant share. This means that issuers are either able to issue more covered bonds against the same amount of collateral and/or are able to achieve higher ratings for their covered bonds with the same amount of overcollateralisation – in any case, a massive increase of efficiency for the entire covered bond funding exercise.

Before going into the details of comparing various redemption formats, it is vital to depict the critical point in the life-cycle of a covered bond. Assuming they have the same issuer and identical collateral pools, the cash flows of a hard-bullet, soft-bullet and CPTCB are identical as long as the issuer does not default. In case of an issuer default, the cash flows of either redemption format are still identical if the available cash retained in the cover pool is sufficient. The only “interesting” case from an investor’s point-of-view is in the case of (i) insufficient liquidity – because this is the time when a bullet covered bond is prone to default – and a pass-through will start to defer payments or (ii) insufficient collateral – because this is the case when all series of a covered bond programme, irrespective of the repayment regime, accelerate and become due, including fire-sales with large hair cuts.

The following considerations are based on the investment decision between a bullet covered bond and a CPTCB of the same issuer out of two different, hypothetical programmes but based on cover pools that have exactly the same risk characteristics.

Several investors seem to have problems with the very long final maturity date of CPTCBs which can substantially exceed the scheduled maturity. Therefore, they prefer hard-bullets, which carry the obligation to be repaid on the SMD. However, while there are structural differences between the redemption regimes, arguably many of these differences fade upon a closer look.

The total damage of any adverse event can be split into a probability of the occurrence of the adverse event and the impact it has once it occurs – the critical question an investor has to answer is whether the adverse event is a deferral of payments or the technical default of an investment. In a hard-bullet case, both events happen simultaneously, while, in a soft-bullet case, and even more so in the case of a CPTCB, the events drift apart.

First, we take a look at investors that consider the technical default of a claim more adverse than a payment deferral. In case of a default, the result in terms of cash-flows are quite likely to be similar for both cases, bullet and conditional pass-through. The result in a bullet case would, quite likely, be a creditors’ meeting to decide how to treat the leftovers: fire sale or natural amortisation; result unknown ex ante. Thus is the case for a CPTCB; the roadmap is clearer in the CPTCB since there is an ex ante definition of what is about to be done. All bonds fall due and natural amortisation of the collateral will be split pari passu unless a bondholders’ meeting votes for something different. The difference comes in the form of the likelihood of the adverse “default” event. In both bullet and pass-through cases, a default could be triggered by asset-quality deterioration and, therefore, in both cases the issuer ex ante would have to post the same amount of overcollateralisation for the same result of assessed credit risk. However, precautionary measures to address liquidity risk in the cover pool have to be performed by the issuer of bullet covered bonds only. Whether or not the liquidity buffer turns out to be sufficient can only be assessed ex post. In other words, any liquidity buffer is nothing but a suboptimal hedge for liquidity risk. By way of aligning the cash flows from the cover pool to the covered bond investors, CPTCB issuers perform the only existing perfect hedge against liquidity risk. Therefore, the likelihood of a default of the covered bond is lower for the CPTCB. Consequently, an investor that is sensitive to a default of a claim as opposed to being sensitive to payment disruption should rather be focused on CPTCB.

An investor that is rather sensitive to payment disruptions apparently has the opposite rationale. In case of the occurrence of the payment disruption, the impact is probably quite similar irrespective of the payment regime (see rationale above). It might be the case that the net present value of the recovery payment is higher in a bullet regime due to a self-selection of the investor base; investors that fear a payment disruption might rather be inclined to vote for a shorter recovery period at the expense of a slightly lower nominal recovery rate. Investors that decided to invest in a CPTCB might be inclined to maximise nominal recovery at the expense of a longer recovery period. The true difference appears when considering the likelihood of the adverse event “payment disruption”. Credit driven occurrence would be similar in both repayment regimes, whereas the likelihood of a “payment deferral” occurrence is much higher for the CPTCB due to the fact that liquidity-driven default-precaution is passed on to investors. In the bullet case, the liquidity-driven default precaution comes in the form of additional overcollateralisation requirements/liquidity buffers. The liquidity buffers certainly are no perfect hedge against the occurrence of the adverse event “payment deferral” but are definitely better than taking no precautions.

However, given the important role covered bond ratings play within the regulation framework and in cooperation with central banks (e.g. spread-risk factors under Solvency II, CRR risk-weightings, liquid asset classification under LCR rules, ECB repo haircuts), risk aspects are not the only drivers of an investment decision. Rating-sensitive investors would benefit from the higher and more stable rating of the CPTCB. However, empirical evidence does not indicate significantly tighter spreads of CPTCB compared to slightly lower-rated covered bonds. In our view, this partly reflects the current overall compressed spread environment as well as the fact that some investors cannot buy conditional pass-through transactions due to internal restrictions. As we mentioned above, the likelihood of a payment deferral might be larger than that of a bullet case. Therefore, the uncertainly regarding duration might increase without compensation in form of higher yield. The benefit comes in the form of the investment being more suitable for the regulatory challenges constraining investors in many respects.

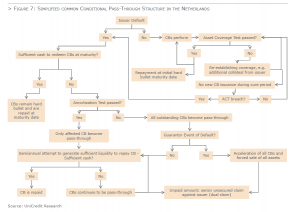

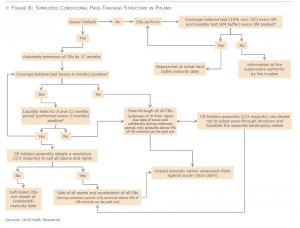

As the CPT landscape has become relatively diverse, we show the simplified mechanism of a CPT-structure for two cases, using the example of the Dutch CPT programs (Figure 7) and the Polish structure (Figure 8).

The above chart demonstrates the simplified procedure and triggers for Dutch CPT covered bonds. As long as there is no issuer event of default and all tests are met, the repayment of the covered bonds will be at the initial (hard bullet) maturity date. If the issuer defaults, however, the key question is, is there sufficient cash, to be derived from different sources, e.g. through selling or refinancing of assets, to redeem the covered bonds at the scheduled maturity. If the answer is yes, the covered bonds are repaid at the SMD. answer is no, the Amortisation Test becomes relevant. In case the test is passed, only the bond scheduled to be repaid becomes pass-through (conditional pass-through structure). If the amortisation test is not passed, all outstanding covered bonds become pass-through.

The above chart demonstrates the simplified procedure and triggers for Polish covered bonds. As long as there is no issuer event of default and all tests are met, the repayment of the covered bonds will be at the initial (hard bullet) maturity date.

If the issuer defaults, however, all covered bonds are generally subject to a 12-month maturity extension (soft bullet). The key question is whether the coverage test is positive or not. The coverage test, performed every six months after issuer default, determines whether the assets of the segregated cover pool are sufficient to satisfy all obligations towards the holders of covered bonds. If the result is negative, all covered bonds switch to pass-through, meaning that the extended due date of the covered bonds is three years after the last cover pool asset is due.

In case the coverage test fulfills its requirements, the question is whether the liquidity test, performed every three months, is positive or not. If the liquidity test fails, it will have the same effect as with a failed coverage test, meaning the switch to pass-through for all covered bonds. If the liquidity test is positive, the covered bonds are generally repaid at their extended maturity date (12 month soft bullet extension).

However, covered bondholders have the ability to intervene in the prescribed process at two stages: 1. When following issuer default covered bonds switch to pass-through (either in the case of a negative coverage test or in the case of a failed liquidity test), a covered bondholders’ assembly can decide with a two thirds majority not to opt for pass-through but to liquidate the segregated cover pool; 2. When following issuer default both tests are positive, covered bondholders can still decide in an assembly with a two thirds majority not to go for the soft bullet extension but rather to sell all claims and rights and thus accelerate the covered bonds.

In case of the sale of the cover pool assets and acceleration of covered bonds, and if not all covered bond claims were satisfied, there is still a senior unsecured claim against the issuer (dual claim).

There are theoretically also additional cases when covered bonds could become due before their scheduled maturity: 1. If the bank is subject to a non-bankruptcy liquidation, the bank shall redeem the covered bonds at par; 2. If the bank is subject to a merger, division or transformation and the acquiring entity is not permitted under the Polish Covered Bonds Act to issue covered bonds, then the covered bonds shall redeem at par.

Rating agencies’ methodologies have changed quite substantially in the past few years. Recalling Moody’s plain and simple rating methodologies for covered bonds back in 2003/04, when covered bonds were all rated 2/3 notches (for mortgage and public covered bonds respectively) above the senior rating, which later was expanded to 4/5 without big analysis supporting it, life has become more complicated. However, analysis is also more precise and detailed from an academic point of view. The step-by-step analysis of assessing issuer credit risk followed by the assessment of legal/regulatory/market related etc. aspects, and finalised by the assessment of the credit risk/liquidity risk etc. of the cover pool, was a milestone. Starting from the joint default basis, the degree of detail of rating agencies’ analyses increased exponentially. The high end of complexity is probably to be found in the analysis of the cost of raising liquidity against a static cover pool in a post insolvency situation. This necessitates an assessment of potential funding sources, assumptions on amounts that need to be raised, valuation adjustments and, last but not least, assessment of the role and the abilities of the cover pool administrator running the matter after issuer insolvency. Against this backdrop, rating agencies have unsurprisingly welcomed the development regarding CPTCBs. Default risk is essentially reduced to credit-risk-driven events.

S&P stated that conditional pass-through covered bonds structurally eliminate refinancing risk and that it delinks the rating on a covered bond from the rating on the issuing bank when the programme is not exposed to refinancing risk and the covered bond’s overcollateralisation is legally or contractually committed. Thus, more notches of uplift above the rating on the issuer can be applied than in the case of traditional covered bond programmes. While in a traditional programmes that is exposed to refinancing risk, S&P assigns up to four notches of collateral-based uplift, in a CPT programmes, the potential collateral-based uplift is unlimited.

Moody’s stated that CPTCB can remove refinancing risks sufficiently. Thus, the credit quality of CPTCB can be much less dependent on, or even independent of, the supporting bank’s credit strength. However, the type of structure that the issuer decides to use will determine the degree to which the programmes can effectively mitigate refinancing risk. Moody’s identified different mechanisms that lead to different levels of mitigation for refinancing and time subordination. The level of overcollateralisation is a key parameter in this respect. Even in CPTCBs, a fire-sale of the cover pool at high discount rates might occur, if OC levels are insufficient and as the breach of certain test, e.g. the amortisation test, may eventually lead to an event of default. Additional key elements are the evaluation of swap agreements, servicing and counterparty risks as well as legal risks (set-off risk, commingling risk, claw-back risk).

Fitch stated that in its covered bond methodology, that while covered bond ratings are typically not completely de-linked from the bank’s IDR (issuer default rating), CPT programmes can benefit from a higher de-linkage than hard- and soft-bullet progammes as long as refinancing risk and short-term payment interruption risk are mitigated. In this case, an uplift of up to eight notches from the IDR can be assigned. This is because the long extension periods and the pass-through mechanism effectively eliminate maturity mismatches and the need for asset liquidation at any cost, thereby removing the majority of payment interruption risk for covered bonds after an issuer default and leading to a discontinuity risk profile that is more in line with amortising structured finance transactions. The reason that Fitch has not entirely delinked the CPTCB rating from the issuer rating – in contrast to structured finance (SF) transactions – is because covered bonds allow for significantly more flexibility regarding cover pool composition and issuance capacity than typical SF transactions.

Covered bonds with extendable maturities are becoming more and more common on the covered bond market. In the meantime, you can find them in almost every covered bond jurisdiction. The largest share goes to soft-bullets where extension periods are typically 12 months. Another interesting addition to the existing soft- and hard-bullet structures are CPTCBs. In most scenarios, the cash flows of the various redemption profiles would be similar, all else equal. In a worst-case scenario, after issuer default and in a situation where the cover pool is not sufficiently liquid, CPTCB promise a lower nominal loss at the expense of investors accepting a potentially much longer deferral period compared to those of hard-bullet and typical soft-bullet structures. Hence, investors have to make up their minds, which adverse event they are more inclined to accept, i.e. payment deferral or technical default. From a regulatory perspective, CPTCB offer higher ratings, higher rating stability and less asset encumbrance. The higher complexity, the fact that CPTCB could switch into pass-through mode, together with the CPTCB very long theoretical final maturity dates represent a big hurdle for many investors. But despite of this, we have seen a gradually increasing acceptance for both – soft-bullets and CPTCB – in the market. This is likely to increase even further with the planned harmonisation addressing common minimum standards also for CPT-structures and clarifying trigger events for maturity extensions.