28 February 2022

According to the European Commission, 40% of Europe’s CO2 emissions are generated by buildings. In turn, European banks are the main source of funding for the construction and acquisition of buildings.

The question then arises as to which role can banks play to decarbonise the building stock, considering that they do not own the underlying assets which produce emissions.

Regulatory initiatives have -for now- been focused on disclosures. However, the looming physical and transition risks posed by climate change mean that banks will be required to adopt a proactive approach.

Following existing academic literature and practical experiences, banks’ involvement in tackling carbon emissions reductions needs to be based on designing participative ways to interact with other stakeholders (homeowners, the construction sector, regional and national authorities…) to develop strategies which can incentivise the construction and renovation of energy efficient buildings and lead to a relevant reduction in carbon emissions aligned with the European Union targets.

But any such scheme should build upon definitions that can serve in the future as guiding targets.

The EU Taxonomy has allowed stakeholders to understand those definitions of what will be considered as “green”. Underpinned by existing regulations (the Energy Performance of Buildings Directive 2010/31/EU and the Energy Efficient Directive 2012/27/EU), the EU Taxonomy defined as ‘sustainable activities’ the Construction of New Buildings (7.1.), Renovation of existing buildings (7.2.) and the Acquisition and ownership of buildings (7.7.).

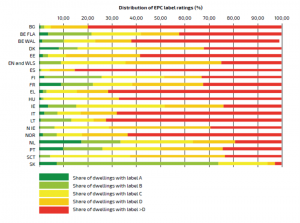

Moreover, the upcoming EU Green Bond Standard will be based on the EU Taxonomy, adding up a new incentive to drive the economic activity towards those definitions, which consider as compliant those buildings within the best performing 15% of the national building stock as well as those renovations leading to a reduction of 30% or more in primary energy demand, both measured in kWh/m2 and year. Although this means different EPCs in different countries, we believe that the final version of the Taxonomy reached a good balance by requiring the same relative performance in every EU country, while designing a moving target that will naturally become more demanding as time passes by and the building stock’s performance improves.

Share of registered EPC ratings across the EU

At Caja Rural de Navarra (CRN) we are putting in place a strategy that not just complies with disclosures but that is also aligned with decarbonisation targets and aims at facilitating the necessary adaptation from our client base. Being a regional, retail, and cooperative bank, this means supporting homeowners and SMEs to improve new buildings performance and -considering Europe’s aging building stock- embark in the Renovation wave fostered by the EU and underpinned by the Next Generation EU initiative.

Under this strategy, CRN intends to:

In our view, the issuance of use of proceeds bonds is not, by itself, a sufficient condition to change the activities of a particular bank or those of its borrowers, not least because banks are not the final owners of the assets involved in such economic activities.

However, and as shown by our own experience, capital markets stakeholders’ expectations (investors, ESG rating agencies and Second Party opinion providers) can be very helpful. Green bond issuing banks send a strong external and internal message that helps to shape a business strategy going beyond pure compliance and embracing change. Green Bonds are a powerful tool to guide economic activity towards environmental targets.

Therefore, as part of our overall environmental strategy (and not as a ‘nice to have’, opportunistic feature for a bond), we successfully issued on 9th of February our inaugural Green Covered Bond, which is also Spain’s first.

Despite difficult market conditions, CRN decided to go ahead, being able to keep our pricing objective (15 bp over swaps), having previously carried out an investor roadshow through which positive feedback was gathered. Investors’ expectations were clearly focused on the green features of the bond and its full alignment with the EU Taxonomy. In fact, according to Joint Lead Managers’ estimations, almost two-thirds of the final investors were considered as “green”.

The book was above €700m with over 50 accounts involved. By Geography, Spain got the biggest portion with 45% of allocations, followed by Germany and Austria with 41%, France with 5%, Benelux and Switzerland with 3% each, with the remaining 3% allocated to other jurisdictions.

We fully aligned our use of proceeds green framework to the EU Taxonomy, so that investors could be certain they were buying something that was fully compliant. This essentially means that proceeds will be used to invest in the top 15% of Spain’s most energy-efficient building stock or in renovated buildings where there has been a 30% improvement in the building’s energy efficiency.

Many of the conversations we had with investors were about the green aspects of the deal, as opposed to our credit history or the economic outlook for Spain, a testimony to the fact that the EU Disclosures Regulation is helping real money investors to develop their own investment vehicles which in turn require eligible bonds to comply with the regulation.

The Green Covered Bond market is still in its first steps (at around €30bn outstanding), but we believe that it is the natural asset class to finance energy efficient buildings and that its growth prospects will be accelerated by the EU Taxonomy and the Disclosures Regulation, as our recent trade showed.

Caja Rural de Navarra has been inspired throughout this journey by other pioneers in the fields of financing buildings energy efficiency, many of which also take part in the Energy Efficient Mortgages Initiative (EEMI) and the Energy Efficient Mortgage Label (EEML), under the leadership of the EMF-ECBC.

This journey is not over. In fact, it has only begun. CRN is just a regional bank in one country of the EU. Many others have also embarked, and we firmly believe that the European financial sector will play a key role in greening our economy and securing a better and safer world for next generations to come.

By Miguel Garcia de Eulate, Head of Capital Markets at Caja Rural de Navarra