26 February 2018

By Alexandra Schadow, LBBW and Maureen Schuller, ING Bank

This article is taken from the 2017 edition of the ECBC European Covered Bond Fact Book, which can be accessed here.

If a financial institution finds itself in difficulties and the supervisory authority determines that it is “failing” or “likely to fail”, the bank may be put into resolution if certain conditions are met. Under a resolution, four tools are in principle available: sale, bridge institutions, asset separation, and bail-in. Under a bail-in, the resolution authority is given powers to write down liabilities or convert them into equity in order to absorb losses and carry out recapitalisation measures. This approach presupposes that all institutions have sufficient “bail-inable” capital. To this end, Art. 45 of the BRRD (Bank Recovery and Resolution Directive) sets out a separate minimum requirement for own funds and eligible liabilities (MREL). The same idea underlies the total loss absorbing capacity (TLAC) requirement, which, through the FSB (Financial Stability Board), applies only to global systemically important institutions (G-SII). The subordination of permitted liabilities explicitly demanded by TLAC and compliance with the “no-creditor-worse-off” (NCWO) principle led to amendments to the corresponding laws in certain countries. However, the results varied, which is reflected in some cases in very different creditor hierarchies. This in turn led to the call at EU level for a joint approach. The EU is now attempting to combine the TLAC and MREL rules in such a way that these requirements fit together and pave the way for a harmonised solution in the future. On 23 November 2016, the EU Commission presented a reform package with proposals for numerous amendments to the CRD (Capital Requirements Directive), CRR (Capital Requirements Regulation), BRRD and SRMR (Single Resolution Mechanism Regulation). A key issue in this connection is the integration of the TLAC requirements into the European legislative framework. A central demand in this context is the introduction of a new asset class known as “senior non-preferred” through Art 108 of the BRRD, which is currently being handled separately in a fast track procedure.

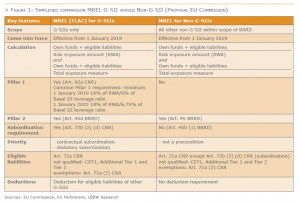

A significant idea regarding the EU Commission’s proposal to combine TLAC and MREL initially is that G-SIIs and non-G-SIIs will be treated differently. A harmonised minimum level applies to G-SIIs as in the case of TLAC. This is to become a Pillar 1 requirement and is found in the CRR. From January 2019 onwards, G-SIIs will have to maintain TLAC corresponding to 16% of RWA and 6% of the Basel III Leverage Ratio. These ratios will rise to 18% and 6.75% respectively from 2022. Moreover, institution-specific add-ons are possible. These are, however, included in the BRRD and SRMR as Pillar 2 requirements. By contrast, non-G-SIIs are not subject to an exact ratio for MREL. This is only a Pillar 2 requirement, which is determined on a case-by-case basis for each bank and which is set out in detail in the BRRD and SRMR. While the methods used to calculate the two requirements were harmonised – namely the two points of reference, RWA and the Basel III Leverage Ratio exposure measure, apply – they still differ considerably in terms of subordination. In contrast to TLAC, liabilities still do not generally have to be subordinated to count towards MREL A subordination requirement will be explicitly introduced for the G-SIIs. For all other banks, the authority may demand this on a case-by-case basis. So far, however, nothing has been decided. In addition to the EU Council, the EU Parliament must also decide on the planned amendments before the overall package is handled under the trilogue procedure.

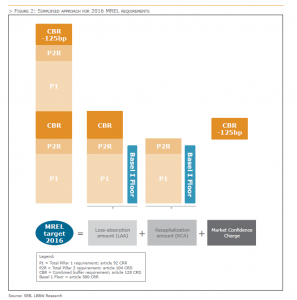

One important component for the specific determination of MREL has been in force since 23 May 2016. The Delegated Act 2016/1450 of the EU commission considers the methodology to determine MREL. Based hereon, the responsible authority SRB (Single Resolution Board) published the MREL approach on 17 February 2017. The two components loss absorption and recapitalisation play the main role in measuring the amount of the MREL requirements. The measures are the capital requirements, the Total Pillar 2 requirement (P2R) and the combined buffer requirement, which are based on the individual SREP process of a single institution. While the loss absorption component must be met by each bank, the recapitalisation component could be set at zero. However, this applies only to banks that are subject to liquidation under regular insolvency proceedings. There may also be a component to maintain market confidence. All the components are added up and result in the following potential overall requirement. If all three components were taken into account and if the averages from the 2016 SREP process were applied, the MREL requirement would be more than 22%.

Covered bonds are explicitly excluded from bail-in by the rules of Art. 44 (2) BRRD. This includes covered bonds that are UCITS-compliant (Directive 2009/65/EC Art. 52 (4)). There is just one restriction that allows covered bonds to be bailed-in, namely if the liabilities from the covered bond exceed the corresponding collateral in the cover pool and the resolution authority believes a bail-in for this “uncovered” part is appropriate. This would, however, correspond to a cover shortfall, which is not allowed by law. The covered bond exception in Art. 44 (2) BRRD is unaffected by the EU Commission’s proposed amendments to the BRRD.

The EU Commission’s proposal regarding TLAC and MREL introduces a new category of “eligible liabilities” in Chapter 5a of the CRR. Under Article 72a (2) (e) CRR of this chapter, covered bonds are classified as being not eligible. This means that covered bonds, being exempted from bail-in, are not eligible for MREL. However, the EU legislation (Article 3 Delegated Regulation 2016/1450) requires that the resolution authority must identify all liabilities that are excluded from bail-in. The MREL must also be met having regard to all exclusions. The main purpose of this is to build up a correspondingly sufficient MREL buffer so that the bail-in exceptions do not have to be written down or converted.

In general, a standardised approach applies to the measurement of MREL. Nevertheless, the resolution authority may adjust the standardised approach to take account of the institution’s business model, funding profile and overall risk profile. This decision is based on the results of the SREP process. An upward or downward adjustment may be made. It must, however, reasonably reflect the institution’s resolvability. With regard to the business models, the MREL already provides for mortgage credit institutions to be treated differently. However, there is one exception in the BRRD for mortgage credit institutions financed by covered bonds. If they are not allowed to receive deposits, the resolution authority can exclude them from the MREL requirement. This, in turn, is only possible in case of a realisable winding-up according to a national insolvency procedure or other types of measures in accordance with the resolution tools in BRRD and in line with the resolution objectives. This exception was also confirmed in the revised version of Art. 45a BRRD.

Overall, covered bonds retain their privileged status as a funding instrument even in light of the planned reform package for CRR, CRD, BRRD and SRMR. While the rules of TLAC and MREL are being harmonised, implementation into law is very complex and very difficult for investors to understand. As soon as the rules are adopted and transposed into national law, the new asset class of senior non-preferred should receive a clear boost. Nevertheless, covered bonds will remain part of the liability side of banks. The costs of refinancing covered bonds are very attractive for issuers and, in our opinion, create a counterweight to the relatively expensive senior non-preferred bonds. In our view, the risk that covered bonds will be “crowded out” by extremely high MREL requirements, which will also be covered by the issuance of senior non-preferred bonds, is manageable. On the one hand, the planned rule for all non-G-SIIs creates sufficient flexibility with regard to the measurement of MREL requirements – business models and risk profiles can be adequately taken into account. On the other hand, the capacity to issue covered bonds depends primarily on the availability of cover pool assets, which in turn is attributable mainly to the performance of the real economy. Below, we examine the different liability structures of issuers and their impact on covered bonds.

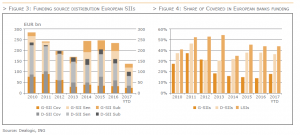

Developments in the field of bank solvency capital and resolution requirements have demonstrable ramifications for covered bonds, that extend well beyond their specific exclusion from bail-in protocols. In some instances, the relegation of covered bonds from core funding to a more opportunistic funding instrument has been one of the unintended consequences. The relevance of covered bonds in the funding mix of global systemically important institutions (G-SIIs), is nowadays a fraction of what it used to be. Last year, European G-SIIs issued a little over €30bn in covered bonds, representing 14% of their total  print. In the period 2010-2012 covered bonds were responsible for 32% of the funding of G-SIIs, implying an average annual issuance of over €75bn (Figure 3 and Figure 4). Higher capital requirements have had a stronger impact on the covered bond issuance of G-SIIs than for any other banking segment. In the past two years, domestic systemically important institutions (D-SII’s) still attracted 37% of funding via covered bonds, just modestly less than the 44% share of covered bonds in the debt issuance of systemically less important institutions (LSIs).

print. In the period 2010-2012 covered bonds were responsible for 32% of the funding of G-SIIs, implying an average annual issuance of over €75bn (Figure 3 and Figure 4). Higher capital requirements have had a stronger impact on the covered bond issuance of G-SIIs than for any other banking segment. In the past two years, domestic systemically important institutions (D-SII’s) still attracted 37% of funding via covered bonds, just modestly less than the 44% share of covered bonds in the debt issuance of systemically less important institutions (LSIs).

As G-SIIs must meet the first TLAC hurdle of 16% of their RWAs by 2019, they also already see a stronger focus on the issuance of bail-in eligible HoldCo and “non-preferred” senior unsecured instruments (NPS) than other banks. Since 2016, senior unsecured issuance represents 70% of the total funding G-SIIs, compared to 63% in prior years. This compares with a share of 47% in the D-SIIs funding mix since 2016, down from 55% previously. D-SIIs focus more on the issuance of subordinated debt instruments for regulatory capital. That said, in coming years, banks with systemic importance are likely to accelerate their issuance of debt instruments which meet the loss absorption requirements, probably at the expense of covered bonds. We do recognise however, that there are numerous factors driving covered bond supply, with bail-in buffer requirements being just one of them.

As described in greater detail in the first section of this article, the MREL/TLAC will in principle be expressed as a percentage of the total risk exposure measure (i.e. risk-weighted assets). Loss absorption requirements may alternatively be dictated by the 6% (per 2019) or 6.75% (per 2022) minimum versus the leverage exposure measure. We do note that bank-specific MREL requirements may be set higher to ensure that the bank maintains a loss absorption buffer at least equal to 8% of the institution’s total liabilities and own funds (TLOF) that has to be bailed in before recourse to resolution funds can be permitted.

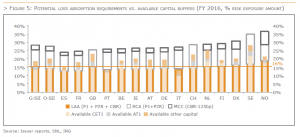

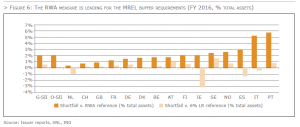

Figure 5 gives an indication of the average MREL requirements for 55 European covered bond issuers that have been identified as systemically important institutions. The loss absorption amount (LAA) matches the expected fully phased in capital requirements of the banks and the recapitalisation amount (RCA) is set equal to the Pillar 1 and Pillar 2 capital requirements. The market confidence charge (MCC) is equal to the bank’s bespoke fully loaded combined buffer requirements less 125bp. Calculations for the UK, Swedish and Swiss banks are based upon the announced national guidance for the determination of bail-in buffer requirements. Figure 5 confirms the somewhat higher prospective loss absorption requirements for G-SIIs compared to O‑SIIs. Nordic banks are expected to face the strictest hurdles in terms of building loss absorption buffers within the European banking set. The calculated loss absorption buffer requirements, adopting the “mechanical calculation” protocols of the SRB, are compared with the average capital ratios of the selected banking jurisdictions at the end of FY 2016. The O-SIIs seem better positioned to meet a larger proportion of their loss absorption buffers with regulatory capital than G-SIIs. The chart also illustrates that most banking sectors are already sufficiently capitalised to meet the (bare minimum) loss absorption amount (LAA), without recourse to specific bail-in instruments.

Figure 6 plots the capital shortfall versus the LAA plus RCA requirements calibrated using the risk exposure measure. This shortfall is compared with the estimated capital deficit versus the 6% leverage exposure measure applicable as of January 2019. Both deficits are expressed as a percentage of the banks’ total assets. The chart indicates that the shortfall versus the estimated LAA plus RCA percentage of the bank’s risk weighted assets will be leading in terms of buffer requirements. Southern European banks have relatively the highest shortfalls as a percentage of their total assets. The Nordic issuers may also be among the more active issuers of eligible loss absorption instruments going forward, based upon the estimated capital shortfalls versus their indicative bail-in buffer requirements.

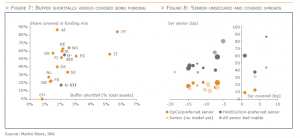

Building loss absorption buffers with subordinated debt or eligible senior unsecured debt instruments will remain an important driver for bank funding decisions over the next couple of years. Figure 7 plots the share of covered bonds in the supply aggregate of European banks in 2015, 2016 and 2017 YTD (y-axis). The average loss absorption buffer shortfalls (based on capital instruments only) as a percentage of total assets are depicted on the x-axis. This graphic suggests that banking sectors with more moderate buffer shortfalls as percentage of their total assets, such as the UK, France and the Netherlands, have seen a more modulated focus on covered bonds in their funding due to an emphasis on the issuance of regulatory capital in the past few years. Therefore, banking sectors that have more work to do in terms of meeting their MREL requirements, may consequently also see a more moderate use of covered bonds for funding purposes in the coming years.

Although the impact of loss absorption requirements on senior unsecured spreads seems more obvious, the pricing impact of establishing sufficient loss absorption buffers on covered bonds is less straightforward. Figure 8 provides an overview of 5yr senior unsecured trading levels versus 5yr covered bond spread levels for a selection of European banking names. The magnitude of the bullets reflects the buffer shortfalls of these particular issuers as a percentage of their total assets. This graphic provides the following insights:

> Bail-in buffer eligible HoldCo and non-preferred senior unsecured debt instruments trade at an average pickup of 30bp over OpCo/preferred senior unsecured instruments. The spread differential between bail-in buffer eligible bonds versus OpCo/preferred senior equivalents bears no significant relationship with the size of the buffer shortfalls based upon the availability of capital instruments.

> The German statutory resolution model, where all existing senior unsecured bonds statutorily absorb losses ahead of other unsecured claims in a bail-in, results in comparable senior unsecured spread levels to those of HoldCo or non-preferred senior unsecured debt instruments.

> In jurisdictions where we have not yet seen any issuance of bail-in eligible senior unsecured paper, the existing senior unsecured bonds are quoted roughly in line with the OpCo and preferred senior unsecured bonds of issuers that have already issued bail-in buffer eligible HoldCo or non-preferred senior debt.

> There is at this stage no strong indication that either lower buffer shortfalls or tighter OpCo or preferred senior unsecured spreads coincide with tighter covered bond trading levels.

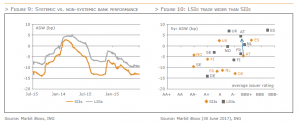

That said, loss absorption buffer requirements do cross support bank capitalisation levels and bank credit ratings, and are likely to coincide with less covered bond supply pressure. Hence a bank’s systemic significance would seem to correspond with observable funding cost advantages. Figure 9 illustrates the persistent spread premium of systemically less important institutions versus systemically important institutions for a selection of core Eurozone countries. These wider spreads indeed partly reflect weaker issuer credit ratings. We refer to figure 10 for an overview of average 5yr equivalent covered bond spreads for systemically important and less systemically institutions by average issuer credit ratings. However, also in a jurisdiction such as Austria, where the average issuer credit ratings of institutions with less systemic significance hardly differ from the ratings of the systemic banks, spreads are wider.

Systemically important banks have better going concern prospects in our view. Smaller less significant institutions on the other hand are more likely to end up in insolvency procedures and consequently have less need for loss absorption buffers facilitating full recapitalisation in the case of failure. Insolvency proceedings and the segregation and a standalone administration of the cover pool is likely to result in more timely payment uncertainty for covered bondholders compared to a going-concern resolution strategy, which involves a bail-in of unsecured creditors. However, the prospects of selling assets or transferring a covered bond programme to another bank entity are, in our view, better for smaller institutions than for larger programmes. The perceived systemic importance of covered bonds in a jurisdiction remains an important consideration in this regard. That said, differences in systemic significance are not necessarily the only driver of these observed spread discrepancies. Smaller size, less frequent issuers also typically have a smaller base of investors willing to invest in their covered bonds.

For obvious reasons, loss absorption buffer requirements and the treatment of senior unsecured instruments in the resolution hierarchy have more impact on senior unsecured paper than on covered bonds. However, whether the preferred treatment of certain senior unsecured bonds within a bail-in scenario will support a reallocation into these relatively “safe” instruments away from covered bonds, is not that obvious.

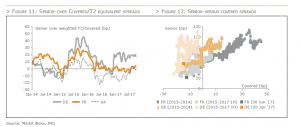

Figure 11 plots the spread difference between senior unsecured bonds and an “implied” senior unsecured alternative based upon a combination of covered bond and T2 exposure. The implied senior unsecured alternative is derived as the spread neutral equivalent of weighted covered bond and T2 exposure versus senior unsecured comparables with reference to the applicable spread levels at the beginning of 2013. For all three reference jurisdictions the implied senior unsecured alternative is based upon 74% exposure in covered bonds and 26% exposure in T2 debt.

This analysis presumes that at the beginning of 2013, i.e. well ahead of the publication of the FSB’s TLAC recommendations, senior unsecured spreads were not yet affected by bail-in buffer eligibility considerations. Subsequently, in 2015 Germany decided to statutorily subordinate all senior unsecured bond claims to other unsecured claims (effective as of this year), while the larger global systemically important UK banks progressed with building TLAC buffers via the issuance of HoldCo senior paper. Since the end of last year, the global systemically important French banks have started to issue non-preferred senior unsecured bonds. For the purpose of Figure 11 only OpCo and preferred senior unsecured bonds are taken as reference for the UK and France.

In our view, if the impact of the preferred status of these senior unsecured bonds has indeed been supportive to their trading levels, the bonds should be expected to trade notably tighter than the “implied” senior equivalent of covered bonds and T2 exposure. In the UK this has indeed been the case for a period of time for OpCo senior paper, supported by among others elements several buy-backs of OpCo senior unsecured bonds. However, even UK OpCo bonds are currently trading essentially neutral again to the covered bond/T2 equivalent spread. In France we have not observed notably tighter preferred senior spread levels versus the implied senior equivalent. This can partly be explained by the fact that French banks started issuing non-preferred senior unsecured bonds only recently and have also indicated that going forward they will partly continue to fund themselves via preferred senior unsecured instruments.

On the other hand, in the case of Germany we have seen a demonstrable spread impact of the statutory subordination of all senior unsecured bonds versus other unsecured claims. For most of the time since 2015, German senior unsecured bonds have traded wider than the implied senior unsecured equivalent derived from covered bond and T2 exposure.

In Figure 12 we drill down to the German and French loss absorption solutions. The figure plots the average covered bond spreads and the average senior unsecured spreads of a selection of French and German banks during the period 2013-2014 and 2015-2017 YTD. The chart shows that German senior unsecured spreads were already wider than French senior unsecured spreads before Germany’s decision to statutorily subordinate all existing senior unsecured bonds to other unsecured claims in the insolvency hierarchy.

However, senior unsecured and covered bond spread dynamics were more or less similar in the two jurisdictions. However, that changed in the period 2015-1H 2017. The volatility in German senior unsecured spread levels versus covered bond trading levels has increased significantly after Germany’s decision to change the status of its existing senior unsecured bonds in the insolvency hierarchy. This is confirmed by the steeper spread relationship between covered bonds and senior unsecured bonds since 2015. The spread dynamics between French (preferred) senior unsecured bonds and covered bonds, on the other hand, have remained approximately stable

However, senior unsecured and covered bond spread dynamics were more or less similar in the two jurisdictions. However, that changed in the period 2015-1H 2017. The volatility in German senior unsecured spread levels versus covered bond trading levels has increased significantly after Germany’s decision to change the status of its existing senior unsecured bonds in the insolvency hierarchy. This is confirmed by the steeper spread relationship between covered bonds and senior unsecured bonds since 2015. The spread dynamics between French (preferred) senior unsecured bonds and covered bonds, on the other hand, have remained approximately stable

In our view this illustrates that considering today’s tight spread environment, senior unsecured instruments with a preferred status do not necessarily trade at more compressed spread levels versus covered bonds than previously noted. On the other hand, bonds now prioritised for meeting the loss absorption buffer requirements, such as German senior unsecured bonds, do experience stronger spread volatility than before. Consequently we do not necessarily expect a significant further spread tightening of preferred senior unsecured bonds over covered bonds. That said, the spread relationship between the two may flatten. The preferred status of certain senior unsecured bonds and the growing scarcity of these bonds against a backdrop of a broader investor base for preferred over non-preferred senior unsecured instruments, is likely to mitigate the underperformance of the bonds within a general widening trend. Within such a widening move, senior unsecured over covered bond spreads are nevertheless expected to widen, albeit at a more moderate pace.

Perhaps counterintuitively, resolution strategies and loss absorption frameworks are an important analytical dimension for covered bonds, and not simply as reinforcing the product as a protected asset class. The focus of financial institutions towards issuing bail-in eligible paper will affect covered bond supply and spread dynamics. However, we don’t see evident spread impact in covered bonds from potential reallocations into relatively safe preferred senior unsecured alternatives. The additional security offered to covered bond investors and the fact that the bonds are explicitly shielded from bail-in risk, where preferred senior unsecured instruments are ultimately not, will remain an important advantage for covered bonds.