18 May 2016

By Martin Kjeldsen-Kragh, Manager – Regulatory and Economic Affairs, Danish Mortgage Banks Federation

By Martin Kjeldsen-Kragh, Manager – Regulatory and Economic Affairs, Danish Mortgage Banks Federation

A currency peg like Denmark’s used to be standard in Europe. Nowadays it’s a special case. So is the match funded mortgage system. Both meant that Denmark had some issues to deal with when interest rates became negative.

Negative interest rates are a challenge across Europe. Financial institutions are struggling with profitability and investors are struggling to obtain satisfactory returns.

In an effort to boost sluggish economies, policy rates have been set below zero and have remained there, in the absence of a self-sustaining recovery.

Denmark shares this fate with much of the euro zone. But it does not share the currency and the mortgage model. This means we have at least two unique challenges.

The policies of the European Central Bank (ECB) have sent rates below zero, especially at the short end of the curve. Also, many EUR-denominated covered bonds now have negative yields, despite the credit risk.

Other central banks, e.g. in Sweden, also have negative policy rates. Either they agree with the ECB that such a policy is needed or they feel they have little choice but to follow suit. Maintaining higher rates would lead to capital inflows and, possibly, currency appreciation.

In Denmark the answer to this policy dilemma has been the same since 1982, in the form of a currency peg, first in the Exchange Rate Mechanism (ERM) and then to the euro under the ERM-II, in both cases with a variation margin of 2.25%. In practice, the (Danish) Central Bank keeps variations well below 0.5%.

In the 1980’s this was a much needed stabilisation device, following a period of instability in the 1970’s. Today, it still has the role of making monetary policy predictable, but it also works as a political signal of commitment to the European currency union.

Traditionally, the important policy challenge has been to make sure that there was always enough foreign currency to maintain the peg when faced with speculation. Raising interest rates was the tool at hand.

In February 2015, the challenge turned out to be the opposite. In the aftermath of the Swiss currency shock, markets were speculating that Denmark would make a similar policy move.

The Central Bank was adamant that the parity would not be changed. If the markets want more of our currency, they can have it. We have got plenty of it, they declared. An obvious point, but it did not immediately convince everyone. After all, the Swiss abandoned their peg voluntarily.

There may have been speculation that if rates went too far into negative territory, the situation would become too awkward or perhaps damaging to the financial system or the economy in general.

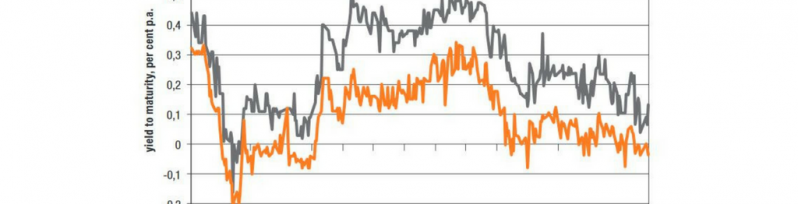

Despite a policy rate of -0.75% to discourage speculators, the effect was a very large capital inflow, depressing money market rates further than in the euro area.

Mortgage bonds traded at yields of -0.2% to -0.3% for 2-3 year maturities.

Gradually the speculative onslaught lost force and market conditions became comparable to those of the euro area, although the lowest policy rate – the deposit rate – remains at -0.65%.

Over the years the notion of negative interest rates, if considered at all, was not regarded as a real possibility. Negative interest rates would be of interest only to academically inclined economists who also dismissed them as impossible, arguing that cash is always a zero yield alternative.

Both financial contracts and legislation lacked provisions pertaining to that situation. The tax code, for example, defined “interest” as a payment made by a borrower to a lender and no explicit provisions existed for taxation or deductibility if the direction of the payment were reversed. This situation was swiftly remedied by making amendments and insertions in the appropriate legislation. That did not include any legislation on the mortgage industry or the bond market.

The prospectuses for floating rate mortgage bonds lacked provisions on what to do if the reference rate, and thus the coupon, became negative. Would it be legal to deduct the negative payments from future positive payments?

Furthermore, the Danish match funded mortgage system added an extra challenge. For each bond with a negative coupon, there would be a loan with terms matching those of the issued bond. A claim for negative interest payments from bond holders would – if applied consistently – translate into an obligation to pay negative interest rates to borrowers. And if the issuer decided that the negative rate should not apply to bond holders, would they be entitled to withhold the corresponding payments to borrowers?

The challenge was not the negative rate as such, but a negative coupon. Three-quarters of all mortgage bonds have fixed positive or zero coupons. Yields become negative when the bonds are purchased at prices above par, and this situation is handled quite easily. Negative coupons on floating rate mortgage bonds – the last quarter of the market – were a separate challenge.

Most issuers concluded that the entitlements of borrowers would not be violated if their interest payment were simply set at zero. In the absence of any reference to a negative rate, borrowers would not be legally entitled to such payments.

However, for new floating rate loans granted after the situation had arisen and for the corresponding bonds, the problem had to be addressed explicitly.

Most issuers opted for a model in which interest could become negative and in which the necessary deductions in simultaneous or subsequent positive payments would be made. This applies to both investors and borrowers, maintaining consistent match funding.

One issuer decided to keep a floor at zero based on indications of investor preferences. This makes for a less complicated and investor friendly instrument, and reduced requirements for new technical solutions. A disadvantage to some investors and borrowers may be that the payment profile no longer dovetails with a standard swap contract, which has no similar floor on the variable rate.

Although policy rates remain low, it seems that markets are no longer expecting a “Swiss exit.” The DKK money market was only seriously affected by such speculation in February 2015. What remains is the challenge of negative rates, as seen in most other European countries. The system has coped well, even with the awkward negative coupons. Mortgages based on floating rate bonds are becoming increasingly popular and the negative coupon issue has not deterred investors.

This article was originally published in the EMF-ECBC Newsletter Market Insights & Updates in April 2016. Please note that any views or opinions expressed in this article are those of the authors and not necessarily those of the EMF-ECBC. This article does not constitute investment advice.