9 July 2016

By Frank Will, Head of Covered Bond Research, HSBC and Chairman of the ECBC EU legislation Working Group

The upcoming second anniversary of the European Central Bank’s (ECB) Covered Bond Purchase Programme (CBPP3) is a good opportunity to analyse the impact of the CBPP3 in terms of supply volumes, spread performance as well as market liquidity and to discuss if the purchase programme can be regarded as a success.

The upcoming second anniversary of the European Central Bank’s (ECB) Covered Bond Purchase Programme (CBPP3) is a good opportunity to analyse the impact of the CBPP3 in terms of supply volumes, spread performance as well as market liquidity and to discuss if the purchase programme can be regarded as a success.

The CBPP3 was announced on the 4th of September 2014 and the actual covered bond purchases started a few weeks later, on the 20th of October 2014. Since then, the ECB has bought a staggering amount of almost €200bn of covered bonds, representing about a third of the eligible benchmark market.

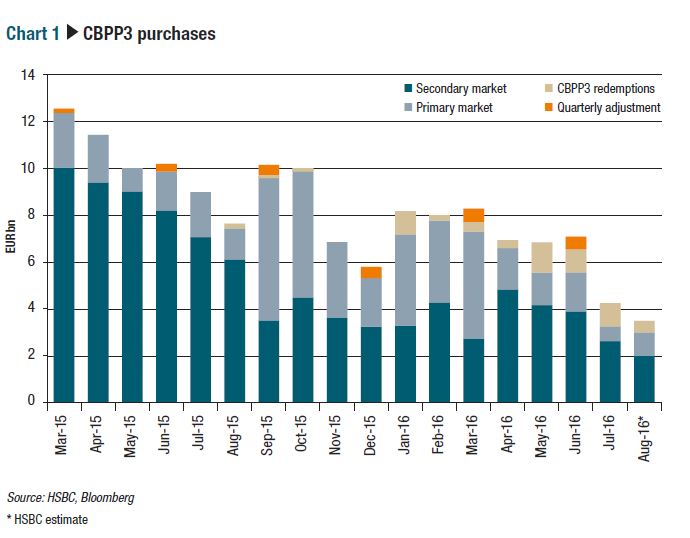

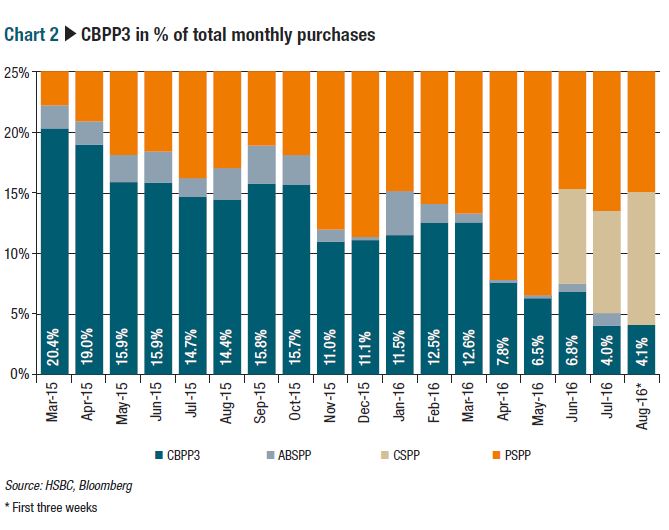

At the beginning of the programme, the ECB bought between €10-13bn of covered bonds each month. This year, the monthly CBPP3 volumes have been much lower, even if redemptions and quarterly adjustments are included. In April the purchases were less than €7bn despite the rise of the overall monthly purchase target from €60bn to €80bn. The ECB achieved the monthly volumes by higher PSPP purchases and the start of the CSPP purchases in June. In June and July, the corporate purchases significantly exceeded the covered bond volumes, which hit a new all-time low of just €3.3bn in July and accounted for just 4% of the ECB’s total purchases. The figures of the first three weeks indicate that the CBPP3 purchases will remain low in August and will again be a fraction of the CSPP purchases. Year-to-date, the covered bond purchases have been roughly €35bn lower than in the corresponding period last year. Taking into account CBPP3 redemptions and quarterly adjustments does not alter the overall trend.

The ECB lowered its monthly gross covered bond purchases from €8bn in Q1 to €7bn in Q2. In July, the gross volume fell further to €4.3bn reflecting the lack of new issue activity and secondary market liquidity. The gross figure for August should stay low given the subdued levels of new issuance in the first three weeks of the month and the relatively low redemption volumes. However, once the primary market activity increases in September and October, the CBPP3 purchases will probably rise again, but the average monthly volumes until year-end should remain below the volumes seen in the first half of the year.

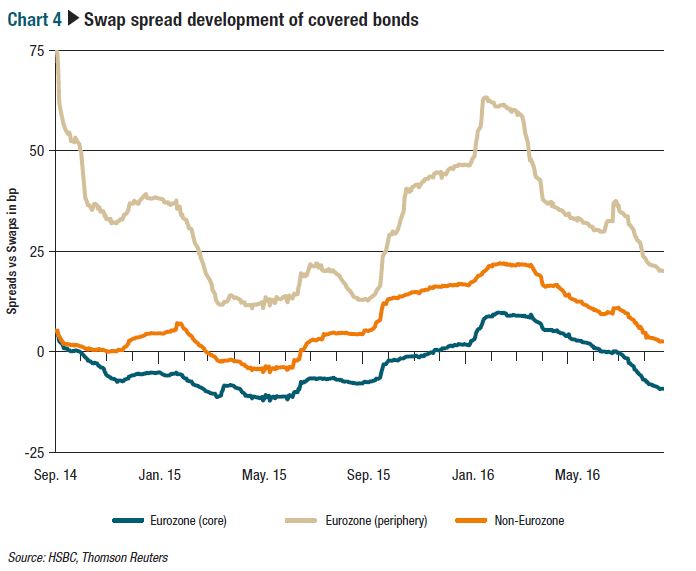

The spread impact of the CBPP3 on the covered bond market has been immense, but not all market segments have benefitted to the same extent. The comparison of the spread levels of eligible and non-eligible covered bonds before the announcement of the CBPP3 on the 4th of September 2014 with the levels of mid-August 2016 shows that Italian, Spanish, Portuguese and Irish covered bonds benefitted the most from the programme (see chart 3). Core and semi-core covered bonds also performed strongly but not as much as their peers in the periphery. The swap spread levels of non-eligible covered bonds, however, are almost unchanged compared to September 2014.

In terms of maturity, eligible covered bonds at the longer end of the curve outperformed swaps more than those with shorter maturities. However, as chart 4 shows, the spread tightening of the Eurozone covered bonds was by no means a linear development, bearing instead a striking resemblance to a rollercoaster ride. Over the last couple of months, covered bond spreads tightened strongly reflecting both the lack of primary market activity as well as the fact that the central banks of the Eurosystem vacuumed up the last breadcrumbs of liquidity in the secondary market. These artificially low spread levels increase the setback risks as investors will painfully remember when thinking about September and October 2015.

So can the CBPP3 be viewed as a success story?

It depends on the aims of the programme. The inflation in the Eurozone remains stubbornly low (June 2016: 0.1%) and inflation expectations (based on the 5y5y inflation swap rate) have even fallen from 2.0% in September 2014 to 1.3%, which probably count as a miss. The lending volumes in the Eurozone have started to slowly increase again – though the respective figures for the periphery countries remain lacklustre.

Lowering the funding costs of banks has surely had a positive impact on their lending activity. The ECB was actually so successful in lowering the yield levels of covered bonds (and many other asset classes) that many traditional covered bond investors have been crowded out by the central banks and have been driven into other more risky, higher yielding asset classes. Currently more than four-fifths of the EUR covered bond market have negative yields with some bonds at the short end of the curve trading even below the -0.4% deposit rate threshold of the ECB. Since the introduction of the CBPP3, the supply volumes have increased significantly, but again it is difficult to tell where they would have been without the programme.

Nonetheless, there is the trend of lower covered bond purchases by the ECB despite the significant increase of the overall purchase target in April. The big question is, however, if the observed fall in the CBPP3 volumes signals a change in the ECB purchase behaviour or if it is rather driven by the lack of available bonds.

Given the stubbornly low inflation rates in Eurozone and the gloomy inflation expectations, the ECB will probably continue to throw everything but the kitchen sink at the problem. Having said that, the CBPP3 purchases have continuously fallen this year despite the increase in the overall purchase volumes. The full-year CBPP3 purchase figure will therefore probably turn out significantly below last year’s figure of €114bn. It remains to be seen whether this reduction is enough to revive the secondary market or if the ECB purchase programme will continue to distort the market by withdrawing liquidity and increasing volatility in a product which has proved in the past to be very resilient.

This article was originally published in the July-August 2016 edition of the EMF-ECBC Market Insights & Updates Newsletter. Please note that any views or opinions expressed in this article are those of the authors and not necessarily those of the EMF-ECBC. This article does not constitute investment advice.