3 December 2020

On Nov. 19, 2020, S&P Global Ratings hosted an industry roundtable to delve into the rapidly evolving world of sustainable covered bonds and assess the impact of COVID-19 on the product.

Speakers included

The roundtable was moderated by Andrew South, Head of EMEA Structured Finance Research at S&P Global Ratings.

Watch the webinar replay here, or view the latest S&P Global Ratings’ report here.

Here are the highlights.

Why haven’t we seen more sustainable covered bond issuance?

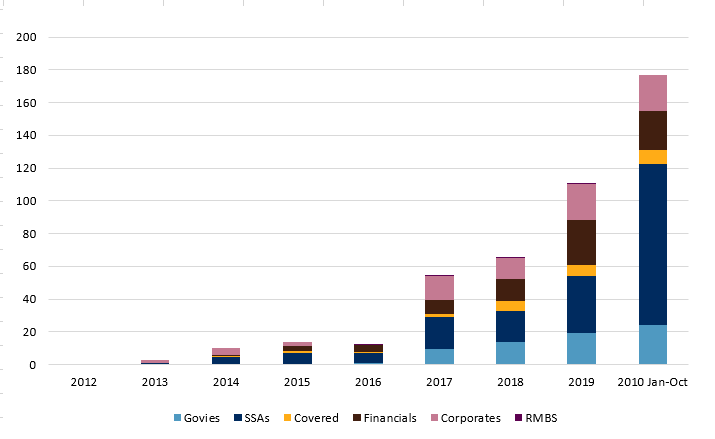

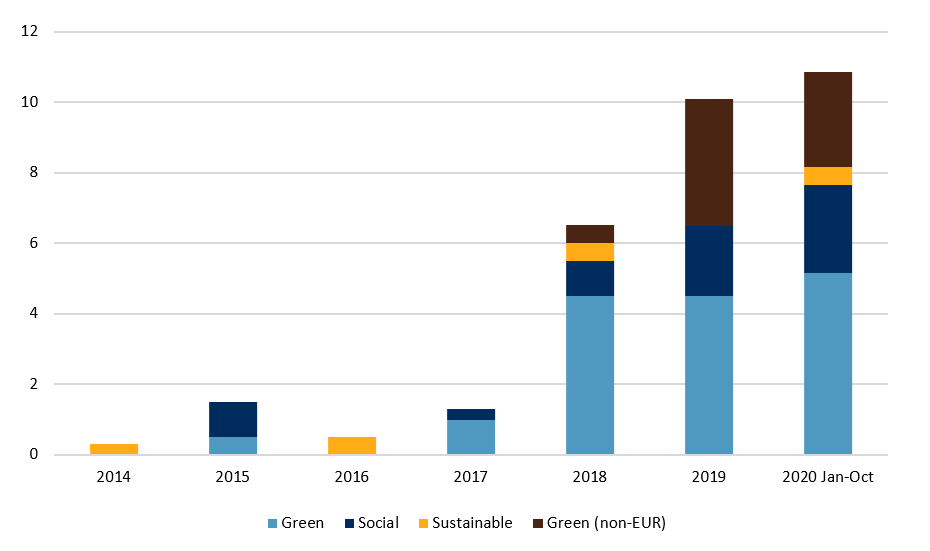

In terms of issuance volumes, sustainable covered bonds are lagging behind other types of sustainable issuance from financial institutions: having passed the €20 billion mark, covered bonds still represent only about 5% of total sustainable bond issuance (euro-denominated, minimum size of €250 million). The positive news is that the covered bond segment has been the only part of the wider sustainable financials debt landscape that has witnessed a modest rise in supply this year to €8 billion. This is despite the decline in overall euro benchmark covered bond supply, which will end the year approximately €40 billion lower than in 2019.

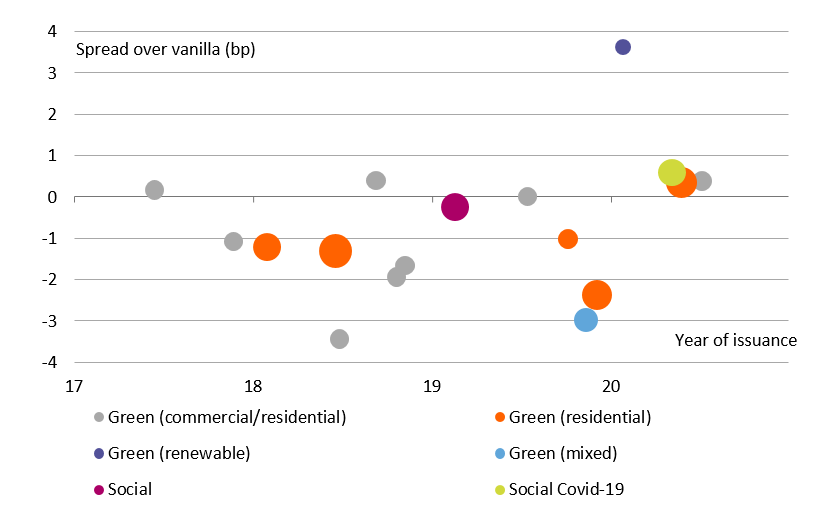

According to Ms Schuller, there are several reasons behind the delayed pick-up in sustainable covered bond issuance. First, the underlying assets have to meet the criteria of issuers’ green or sustainable frameworks, as well as existing eligibility requirements for covered bond collateral pools. Moreover, cover pools primarily consist of residential mortgage loans, which tend to be smaller in size than for example renewable energy loans or commercial mortgage loans. These assets have as such often been used to build green portfolios for sustainable senior unsecured bonds. Due to the mostly residential nature of covered bond collateral pools, it has been more difficult for covered bond issuers to gather a substantial pool of eligible green assets sufficient to issue green covered bonds. Against this backdrop it also makes no surprise that the first green covered bond issuance was seen from Germany, where commercial real estate assets often make up a substantial part of the cover pools. Additionally, the pricing differential between green and vanilla issuance is greater in the senior unsecured space than for covered bonds, which may mean issuers favor the former. Finally, the first green-dedicated investors were primarily asset managers, who are more oriented toward higher spread products than covered bonds, which traditionally have bank treasuries as the dominant investors.

Chart 1 – The Euro Sustainable Bond Market Is Growing Rapidly

Chart 2 – Not All Sustainable Covered Trade Through Vanilla

Mr Berninger suggested that issuers’ priorities may also explain somewhat lagging sustainable covered bond issuance. Many financial institutions, when setting up a green issuance program, focus first on unsecured issuance because their priority is to diversify the investor base in this segment of the market, with covered bond issuance often considered a second step. Another key reason is the technical aspect of the process: setting up a green or social covered bond issuance program is more complicated. There are also different challenges in setting up a separate mortgage covered bonds program and public sector covered bond program, because they have different frameworks. On the mortgage side, issuers must adapt their IT systems, check energy certificates, and adapt loan contracts in order to receive the required information. However, it is even more complicated for public sector assets, where issuers can finance both green and social investments, such as green buildings, local public transports, waste management and water management, and have to set up different reporting systems, different measures to assess the impact, etc.

Which initiatives has the ECBC taken in order to support sustainable covered bond issuance?

Ms Johnson summarized three initiatives intended to boost sustainable covered bond issuance in the short to medium term:

What are the key ESG-related risks and opportunities that investors take into consideration?

Mr Abdi cited a lack of liquidity as a key risk. Investors holding social and sustainable covered bonds will generally find it easy to sell them because of the high demand, but if they are looking to buy, liquidity becomes an issue. So-called “green washing” is another challenge but the EU has helped to mitigate this issue with its taxonomy, better defining defines what makes an investment green. Finally, the segregation of assets can present a potential problem, because upon issuer insolvency green or social assets may be mixed with other brown assets in the cover pool.

Looking at opportunities, the Mr Abdi said his firm depended on ESG data and had its own scoring system, assigning an ESG score to all issuers and investments, whether they are marketed as green or not. Green and social covered bonds’ scores are significantly higher than nongreen scores and generally between 75 and 85 on a scale from 0 and 100. This makes sustainable covered bonds an attractive investment for a portfolio manager and he saw high demand for this product. The scoring methodology helps portfolio managers to not only look at financial return, but also “social return”. Finally, sustainable covered bonds offer the opportunity to have a more diversified client base.

How can rating agencies help?

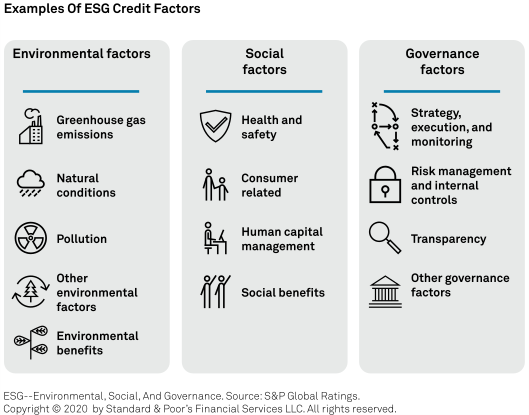

Mr Farina said that S&P Global Ratings has always included environmental, social, and governance considerations in its credit analysis. In terms of transparency, S&P Global Ratings have recently published their ESG report card for covered bonds, which reviews around 100 programs and describes how ESG credit factors affect the results of their analysis.

ESG credit factors can affect the final covered bond ratings, the outlook on the ratings, the required credit enhancement, and number of unused notches for the covered bond programs that we rate. S&P Global Ratings’ methodology has therefore not changed to incorporate ESG factors, but they have increased transparency for market participants on how ESG factors affect their credit view.

Environmental and social credit factors may affect the quality of the assets in the cover pool and the results of the collateral analysis. Currently cover pools are primarily exposed to positive environmental credit factors via mortgage loans granted to increase the underlying property’s energy efficiency. However, S&P Global Ratings generally would only consider the inclusion of these loans in the cover pool as a positive ESG credit factor if higher updated property valuations lead to a decrease in the estimated loss severity and, ultimately, in the credit enhancement required for the rating. On the other hand, they would consider the exposure of the mortgaged properties to climate change and natural disaster risk as a negative credit factor if it leads to a greater credit enhancement to maintain the current rating. It’s important to note that S&P Global Ratings would not necessarily see the issuance of so-called “green” covered bonds as a positive environmental credit factor. They would consider it as such only if the collateral characteristics were less risky, for example because of higher property valuations, than in other comparable pools. Covered bonds’ exposure to social risk largely stems from measures that regulators may impose in order to treat customers fairly, which may include provisions to decrease interest payments or delay property foreclosures. Social benefits include guarantees provided by government-related entities to support underbanked borrowers,

Governance factors tend to affect the final rating or the number of unused notches. Several considerations are related to governance, including the quality of data they receive and the rule of law in a certain country. However, the most important tend to be the commitment to maintain a certain level of overcollateralization or liquidity, as these factors tend to have a more direct impact either on the ratings or the number of unused notches.

Overall, governance is currently the most important ESG credit factor in their analysis of covered bonds, but they believe that environmental and social credit factors will play a larger role in the future.

What were the results of the recent study conducted by EeDaPP on the correlation between energy efficiency and credit risk?

The EeDaPP is a market-led initiative, led by the EMF-ECBC, focusing on the design and delivery of a market-led protocol, which will enable the large-scale recording of data relating to energy efficient mortgage assets, via a standardized reporting template.

Ms Johnson said the results of the study showed a significant negative correlation between building energy performance and credit risk. Notably, this was across all energy classes from the best-performing to the least well-performing buildings. The analysis was conducted on a sample of 70,000 Italian mortgage loans. From their point of view, this was a very significant and timely result particularly in the context of the implementation of Basel III into EU legislation at a time where the EC is also focused on implementing green legislation and developing the sustainable finance agenda. The European Banking Authority (EBA) also has a mandate to consider the prudential treatment of exposures associated with ESG objectives and has requested that the ECBC supports them in their data collection and analysis through the energy-efficient mortgage initiative pilot scheme, which consists of 66 pilot banks across Europe. Hence, the ECBC is in a pivotal position to influence this work and has disseminated the results widely to the EC, the EBA, and others. It is also currently working on a third project, taking forward the correlation analysis and trying to draw some policy conclusions from it, particularly with the Basel framework in mind.

What are the most important regulatory developments that could affect sustainable covered bonds?

(At the time of the roundtable, the EC technical screening proposals were not published.)

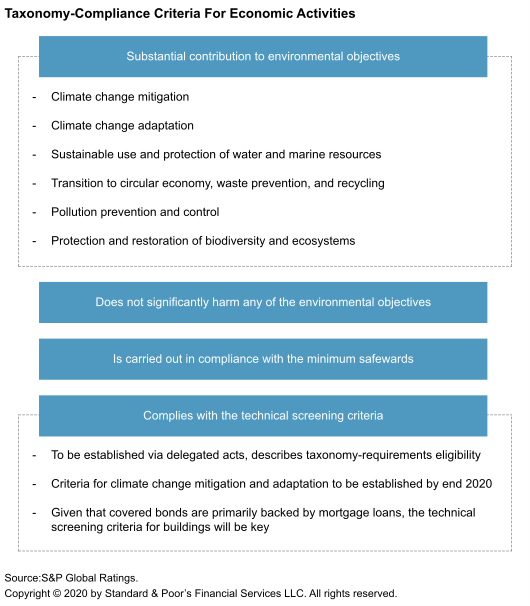

Ms Schuller stressed that investors have to integrate sustainability aspects into their investment considerations, which is important for future ongoing demand for sustainable bond products. The European Taxonomy Regulation is likely to be one of the most influential regulatory developments. The EC still has to establish the technical screening criteria, building on proposals by the Technical Expert Group (TEG) which already integrate the EU climate ambitions of 50% to 55% greenhouse gas reduction. The TEG’s final proposals were somewhat changed versus the initial proposals. According to the TEG’s proposal, for loans that were originated before 2021, the 15% best-in-class approach could still be applied. However for new buildings built as of 2021, it will be important to look at the net primary energy demand that has to be 20% lower than the primary energy demand (PED) resulting from the ‘nearly zero-energy building’ requirements, binding for all new buildings in the EU per 2021.

Another important question to consider is where the EU may be heading with its climate ambitions in light of European Parliament proposals for even a 60% emission reduction target, which could lead to stricter requirements under the technical screening criteria. It is also crucial whether the 15% best-in-class approach will continue to be applied. We have seen that the TEG already removed the reference to EPC levels because it was felt that more work needed to be done in this field. In the initial proposals, there was a reference to an Energy Performance Certificates (EPC) label of at least ‘B’. So while for the acquisition and renovation of buildings EPC labels may still be used, the explicit reference to a minimum level of ‘B’ was removed in the March proposal. It is unclear whether and under what criteria, in the final EC proposals, the use of EPC labels will be allowed.

It’s also important to consider further developments in the renewed sustainable finance strategy, particularly the Green Bond Standards, in light of the EC’s publication of a consultation on the topic. As the technical screening criteria should be periodically reviewed it is therefore an important question whether–once a bond is assigned a green label–it should apply throughout its life, as the technical screening criteria will continue to evolve. Finally, it would be interesting to see whether the CRD6/CRR3 capital requirement proposals, which are expected to be published next year, will already introduce a more favourable risk weight treatment for certain sustainable assets and/or bonds.

Ms Johnson highlighted that for an existing building to be taxonomy-compliant, it would have to be compliant with an A grade Energy Performance Certificate (EPCA) now, according to the draft of the Delegated Act for the taxonomy. In the technical expert group recommendations, the reference was to 15% best-in-class. This has caused significant levels of concern from many EMF-ECBC members and from banks that are close to the energy efficient mortgage initiative because they consider that this reference to EPCA rather than 15% best-in-class could significantly reduce the eligibility of assets for the taxonomy. Hence, the EMF-ECBC is currently discussing the draft Delegated Act and preparing its response to the consultation launched on 20 November.

Will issuers still have the right incentives to issue sustainable covered bonds?

Mr Berninger stressed that incentives will remain extremely strong, thanks to investor appetite.

A good illustration is their own green bond issuance. They completed their first transaction a year ago, and had roughly 40% of investors with an ESG focus. They recently completed their second green bond transaction, in which 80% of the investors had an ESG focus. This clearly shows that the investor landscape is changing rapidly, which is a strong reason for issuers to remain committed to the green covered bond product.

The second incentive is transparency requirements. Clearly, issuers face certain obstacles when setting up a green covered bond program, for example, identifying the green mortgage loans and checking whether they comply with the taxonomy. However, against the backdrop of upcoming transparency requirements, these are all tasks that financial institutions will need to complete regardless. A lot of financial institutions already ask, how much of their activity complies with the taxonomy? How much of the balance sheet complies with the taxonomy? The work required in setting up a green covered bond program is also important in terms of overall communication to investors. This should strengthen green bond issuance given that all issuers need to get up to speed on these issues, which will allow them to come to the market with green bond products more easily.

Chart 3 – Supply Of Sustainable Covered Bonds

And do these regulatory initiatives create the right incentives for investors?

Mr Abdi stressed that demand for ESG products also arises from asset managers’ end-clients. However, from an investor perspective, ESG considerations do not replace credit or pricing considerations. The key factor is the issuer and its credit quality. Here, the ratings are very important.

In addition to credit analysis of the issuer and pricing considerations, investors now take into account the new ESG dimension and use ESG scores. Hence, ESG criteria for many investors are becoming increasingly important and transparency is key. EU regulatory developments, which provide additional transparency, are positive and will sustain an already growing demand. It is also positive that the various market participants, be it central banks, policymakers, investors, or issuers, are all in this together.

From an investor perspective, it is also important to consider that they invest in green and social or sustainable companies because ultimately, those companies with a high ESG score are the future, and they believe that they have lower risk profiles than companies with lower ESG scores.

What’s next for rating agencies in the ESG space?

Mr Farina stressed that there are a lot of moving parts is the ESG space. European authorities are very active in updating or introducing new regulation. Market participants are using new collateral in their cover pools. Even our climate and the climate science are evolving.

Rating agencies’ role will be to continue providing transparency on market developments and to be timely in updating their opinions, and to the extent that is necessary, their methodology to reflect all of these changes.