28 May 2020

By Jacek Kubas, Polyxeni Pentidou, EBRD and Richard Kemmish, Consultant

The European Bank for Reconstruction and Development (the EBRD or the Bank) is an International Financial Institution (IFI) founded in 1991. Since then, the EBRD has invested over EUR 125 bn in more than 5,100 projects. The Bank is now doing more than ever before, being present in 38 economies from Mongolia to Morocco across three continents, in order to further progress towards “market-oriented economies and the promotion of private and entrepreneurial initiative.” The Bank’s overall work is based on the concept of transition, which is the process of moving towards a well functioning market economy. In practice, the EBRD is always asking itself how each transaction can be additional for the transition of the country, and thus why the Bank should be involved.

The EBRD emphasizes investments in the private sector – a unique characteristic among IFIs. However, this focus does not preclude it from engaging in policy dialogue. Rather, the EBRD provides technical advice, support, and reform work, fostering innovation and building modern economies in its countries of operations. This holistic approach maximizes the EBRD’s impact and showcases in practice the Bank’s transition concept. Within this frame, the EBRD is engaged in the field of covered bonds. This article aims to illustrate the EBRD’s role in developing covered bond markets in its regions. First, we provide an overview of the importance of developing local capital markets and how covered bonds fit within this broader goal. Then, we discuss how the Bank’s legal and regulatory work and investments are structured in order to build covered bond markets. Finally, we offer case studies of covered bond reforms in the EBRD’s countries of operation and consider next steps in this exciting field.

One of the EBRD’s functions is “to stimulate and encourage the development of capital markets.” Acknowledging that capital markets are the engine rooms of modern economies, the EBRD supports the creation of an efficient ecosystem for local currency and local capital markets through a combination of transactions, investments, own bonds issuance, legal reforms and policy engagement.

The EBRD works to develop capital markets in its regions for a number of reasons. It is often the case that financial intermediation is largely bank-based; banks are predominantly foreign owned, leading to an over reliance on parent funding; there is a persistent credit demand-supply gap; and financial stability is often fragile and vulnerable to external shocks. There is significant room for improvement; while the Central Eastern European (CEE) countries account for 20% of the EU’s population and 8% of its GDP, their capital markets represent only 3% of all listed shares and debt. Acknowledging this, the EBRD is deploying all available means in its “development toolbox” to promote local capital market development. Investment is indeed central to growth and sustainable development, but it is not an end in and of itself. Equally important is policy dialogue and technical advice. This is the unique advantage of the EBRD, which, as an IFI, is actively engaged in both investment and policy work, establishing modern legal and regulatory frameworks that support the transition towards a well-functioning market economy. Further to the latter, in the roadmap to the development of local capital markets, there are various policy priority areas to focus on, including upgrading capital markets policy frameworks, enhancing the legal and regulatory environment, improving capital market infrastructure, and expanding the product range and investor base.

To this end, covered bonds are an important building block for developing local capital markets. The Bank has been championing this product for a number of years through legal and regulatory reforms and investments in CEE and Southern Eastern Europe (SEE). The Bank’s work in the field of covered bonds encompasses all parts of the “development toolbox” and illustrates how the EBRD supports the development of local capital markets.

Establishing covered bonds as a long-term funding tool brings numerous benefits to issuers, investors, market participants and the public. Covered bonds are an important and efficient source of long-term funding for credit institutions. In the case of the CEE countries, in which the banking sector has been dominated by foreign ownership, covered bonds can serve as an alternative funding tool. The year 2019 marks the tenth anniversary of the Vienna Initiative, which aims among other goals to provide proper wholesale funding tools for banks; covered bonds fit well within that goal. In the aftermath of the financial crisis in 2008, it became especially evident that the subsidiaries had to be more independent and the deposit base was not sufficient.

In addition, the dual nature of the protection offered by covered bonds sets them apart from both senior unsecured debt and asset-backed securities (ABSs). Although securitizations have also served as a method of financing mortgages, we consider this more as a “technique”, while covered bonds as a “brand”. A well-functioning covered bond market can contribute to more affordable housing, as it provides a stable, fixed-term funding source for credit institutions that would, on that basis, be better placed to provide affordable mortgages for consumers and businesses. It further supports lending more broadly by channelling funds to the property market. Such a market is definitely a long way from signing a mortgage to issue covered bonds and effectively ensure affordable housing for the public, but capital markets do have the potential of making a real difference to the public.

a. Background

While covered bonds are frequently used in mature markets, their proliferation in the EBRD regions is still relatively new, including both in the EU Member States and non-EU Member states. In December 2015, the outstanding volume of covered bonds reached EUR 2.5 trillion globally, of which EUR 2.1 trillion was issued by EU-based institutions. This constitutes 84% of the global total. The largest markets in the EU are Germany (18% of the EU outstanding volume), Denmark (18%), France (15%), Spain (13%), Sweden (11%), Italy (6%), and the UK (6%). The four largest markets accounted for almost two-thirds of the EU market in 20151. The size of the covered bond markets in CEE and SEE is significantly smaller. In CEE only three countries (Hungary, Poland and Slovak Republic) have any meaningful number of bonds outstanding and the CEE in total represents substantially less than 1% of the total covered bond market. This number had been significantly lower prior to the EBRD’s engagement.

The comparatively large market for covered bonds in certain EU-Member States may be attributed to the fact that many of these countries have long-standing domestic legal regimes for covered bonds in place. In other countries, including in CEE and SEE, often there is no legal framework surrounding covered bonds, or the existing legal framework might be inconsistent or for other reasons not applicable.

Taking into account this discrepancy and acknowledging the importance of having long-term funding available in local capital markets, the EBRD remains engaged in a series of covered bond legal and regulatory reforms in its regions. The aim of these reforms is to align the applicable frameworks with widely accepted standards; render them more transparent, efficient, and understandable to investors, including foreign investors, and to rating agencies; and remove barriers hindering the use of covered bonds for finance.

b. What do the legal and regulatory reforms entail?

The reforms are implemented through the EBRD’s Local Currency and Capital Markets (LC2) team working closely with a number of departments across the Bank, including Financial Institutions (FI). Throughout the process of the reforms, the EBRD team is usually supported by a local legal counsel and an international expert, which provides a combination of local market knowledge with much-needed international expertise. This is one of the reasons why national authorities, usually the Ministry of Finance or the Central Bank, trust the EBRD as a partner for the reforms. The national authorities are also involved throughout the process and actively participate in all stages of the reform.

The process is not an easy task. Behind every reform there is detailed legal research and analysis, long negotiations and active discussion with market participants, including through public consultation, outreach events, and other informal channels. Most importantly, in order for each reform to succeed, there is a need for the involvement and buy-in from all relevant parties. There must be a strong belief that, technical as it may be, covered bond reform can bring real and tangible benefits to local capital market development and to the country’s economy. This is why, based on past experience, the Bank seeks the engagement and support of the national authorities – coupled with the “push” from the market, including the banking association – as the defining point for success.

Equipped with this support, the starting point is to analyse the existing legal, regulatory, and commercial conditions in the country. The next step is identifying any issues hindering the growth of the covered bond market. Based on this analysis, a Concept Paper is prepared. This serves essentially as the roadmap for the reform and includes the proposed legal and regulatory amendments. It should be noted that all proposals are benchmarked against international best practice, the European Banking Authority’s (EBA) guidelines and the recently adopted EU Directive. The Concept Paper constitutes the basis for further discussions with authorities and other market participants in order to identify the optimal solution for the local capital market and set the necessary safeguards. Following this consultation and once consensus is reached on the provisions needed, the covered bond law and other relevant regulations or by-laws are drafted, consulted with the market and submitted to the appropriate legislative body for approval.

With regards to the contents of the amendments, the primary legislation should address the definition of covered bonds and securitisations, including their broad parameters. Other more technical aspects are usually

discussed in secondary legislation. Each reform is different. There is no one-size-fits-all approach, and the weight of each step of the process differs significantly among countries. In addition to the technical legal and regulatory work, the EBRD is also engaged in many outreach events, which allow us to showcase the progress made in EBRD regions to investors and the international covered bond community. In the same vein, the EBRD is an active participant in the European Covered Bond Council (ECBC) events and Euromoney conferences.

c. In which countries has the EBRD been engaged in legal and regulatory reforms?

As of June 2019, the following reforms have been completed:

Poland: In early 2016, the EBRD completed a TC project with the Ministry of Finance (MoF) in Poland. The project focused on the development of a new covered bond legal framework based on best practices. The LC2 team facilitated the reform by reviewing and providing comments and recommendations for updating the Act on Covered Bonds and Mortgage Banks from 1997. This work, initiated by the Polish Mortgage Credit Foundation and mortgage banks, resulted in the amendment of the Act on Covered Bonds and Mortgage Banks combined with associated changes in the bankruptcy law. This led to the creation of the market, including domestic and international benchmark issuance by such banks like PKO Bank Hipoteczny. Recently, a Polish issuer issued its first green covered bond in Central and Eastern Europe.

Romania: The EBRD played a significant advisory role to the new covered bond law adopted by the Romanian Parliament in September 2015. In Romania, there had not been a covered bond issuance since the covered bond law of 2006 was adopted. The new law conforms to: (i) the definition of covered bonds as per EU legislation, including the Capital Requirements Directive and the UCITS Directive; and (ii) the “Best Practice” supervisory guidelines as published by the European Banking Authority (EBA). According to a comparative analysis, published by the ECBC in 2018, Romania’s legal framework aligns with the EBA’s best principles, thus enhancing investor confidence in the market. The first bond was finally issued in 2019.

Slovak Republic: The EBRD completed a TC project in the Slovak Republic in 2017, updating the regulatory regime surrounding covered bonds. The previous covered bond law had supported the development

of the covered bond market to a certain extent, but it presented many issues that hindered further market growth. The market was confined to sub-benchmark bonds purchased by domestic investors, typically other banks; and it was difficult for banks to structure internationally acceptable benchmark-sized transactions. Out of the 17 best practices identified by the EBA, the Slovakian covered bond framework was only fully compliant with 6. The reform created the legal foundations for covered bonds with amendments to the existing law and incentivised a vibrant local covered bond capital market.

The following reforms are ongoing:

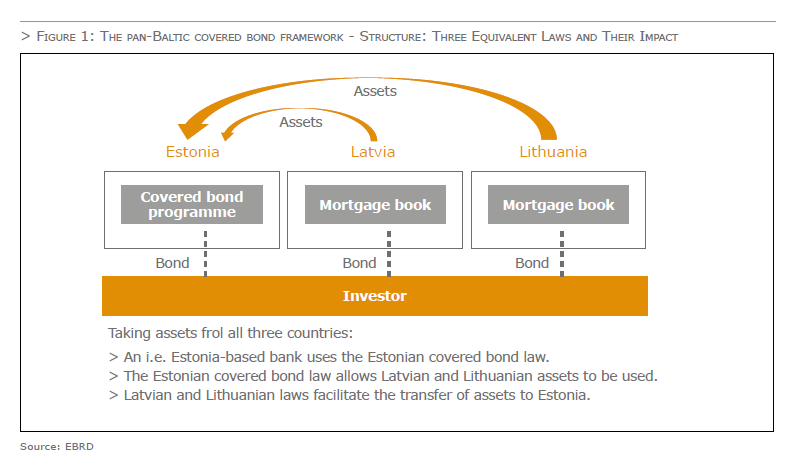

Baltic States (Estonia, Latvia, Lithuania): In the spirit of pan-Baltic cooperation mandated by the 2017 Memorandum of Understanding (MoU) signed by the three Ministries of Finance, the covered bond reforms in the three Baltic countries will endeavour to be part of a coordinated Baltic covered bond framework. With this project, the European Commission’s Structural Reform Support Service (SRSS), together with the EBRD, supports the Baltic States with the introduction of a pan-Baltic covered bond framework, contributing towards well-functioning and larger capital markets in the region, opening up long-term funding options for banks, and increasing the level of lending to economies. It is envisaged that each Baltic State will have its own covered bond law and secondary regulations, and so the pan-Baltic covered bonds issuance will be achieved on the basis of the overall framework. The interim report on the pan-Baltic covered bond framework was published in March 2019 for public consultation; currently, the comments received are in the process of being analysed. In Estonia, the law on covered bonds was adopted by the Parliament in February 2019 and the respective laws in Latvia and Lithuania are expected to be submitted to their Parliaments soon.

The following diagram illustrates how the covered bond framework will operate:

Croatia: The EBRD is working with the Ministry of Finance (MoF), the Croatian National Bank (CNB) and the market’s supervisor, HANFA. On November 20th, 2018, the EBRD and the CNB organised a one-day event, “New EU Covered Bonds Framework – what is in it for Croatia?” in Zagreb. The event featured panellists and speakers representing a broad range of international and national market participants. It showcased the market’s interest in the development of a regulatory regime for covered bonds in the country. Due to other pressing legislative priorities, the reform is currently on hold, but there are positive signs that the adoption of the EU covered bond framework will bring progress soon.

In the field of covered bonds, the EBRD has in recent years invested a total of EUR 650 mn in covered bonds across its regions, including in Greece, Hungary, Poland, Turkey, and the Slovak Republic. The investments are being led by the EBRD’s Financial Institutions (FI) team. Given that there is a robust covered bond legal and regulatory framework in place, issuers are encouraged to venture into the covered bond market. Supporting the first issues is very important and the EBRD, as an IFI, has usually a pioneering role, taking up to 20% of a public issue to incentivize the market. The issuance must be listed to ensure liquidity and be rated by at least one rating agency, in line with international practice and what other investors require. The EBRD’s role is primarily at the beginning of a market’s development, when investors are learning about and getting comfortable with the new jurisdictions. To develop a covered bond market, it is important to have a certain volume and frequency of issuance, and also to have issuance done according to international standards.

As of June 2019, here are some of the EBRD covered bonds’ investments:

Greece: In 2017, the EBRD invested EUR 30 mn in the EUR 750 mn covered bond inaugural issuance by the National Bank of Greece (NBG), marking the return of the Greek banks to the international capital markets. Established in 1841, NBG, one of the four Greek systemic banks, is the country’s oldest lender. The transaction was the second publicly placed Greek covered bond since NBG’s 2009 issuance and the first capital market transaction for a Greek bank since 2014. Raising new funds allowed NBG to provide mortgage lending and support the real estate market, a fundamental pillar for the recovery of the economy.

Poland: The EBRD has invested more than EUR 115 mn in Polish covered bonds issued by PKO Bank Hipoteczny (PKO BH), denominated in Polish Zloty (PLN) and EUR, to increase trading volumes and to ensure investors stability. PKO BH is one of three mortgage banks operating in Poland, specialising in PLN-denominated residential mortgages. The bank, which started its operations on the 1st of April 2015, is a 100% subsidiary of PKO Bank Polski, the largest commercial bank in Poland. In June 2019, the EBRD invested PLN 50 mn (EUR 11.7 mn equivalent) in PKO Bank Hipoteczny’s first green covered bond issuance under the mortgage bank’s Green Covered Bond Framework, which was certified by the Climate Bonds Initiative (CBI) to be aligned with its low carbon buildings criteria. The investment marks the first signed project under the EBRD’s Green and Sustainability Bond investment framework targeted at financial institutions.

Romania: In May 2019, Alpha Bank, a local lender in Romania, issued the country’s first ever covered bond. The EBRD has invested EUR 40 mn in the EUR 200 mn offering. Building on the EBRD’s extensive policy work in Romania to help revise the legal framework for covered bonds and align it with EU best practices, this investment opened a new chapter in the Romanian banking market. It should also be noted that, earlier this year, the EBRD approved a framework to invest in senior unsecured and secured bonds, including covered bonds, issued by Romanian lenders, making EUR 350 mn available for such transactions. This transaction is the first under the new framework.

Turkey: In July 2017, the EBRD invested the Turkish lira equivalent of EUR 75 mn in a covered bond issued by Turkish lender Garanti Bank. The Baa1-rated bond is backed by a portfolio of residential mortgages. Prior to this, in April 2016, the EBRD invested EUR 50 mn in a EUR 500 mn covered bond benchmark issuance by Turkish lender VakifBank. This pioneering issuance met strong investor demand and signalled the beginning of a covered bond market in the country.

Slovak Republic: In March 2019, the Board of the EBRD approved a new framework, which will involve investments of up to a total of EUR 385 mn in a series of newly issued covered bonds by Slovak banks that have rated programs over the next three years. EBRD’s investment in up to 20% of each issuance will be made alongside local and international investors. The EBRD’s presence as a significant covered bond investor serves as an endorsement of this asset class and contributes to a diversification of Slovak capital market products. It should be noted that the framework also includes green commitments, as to support projects financing energy efficiency, renewables or environmental improvements. Building on the success of the first covered bonds framework launched by the EBRD in 2017 with a volume of up to EUR 200 mn, under which the EBRD invested into 5 issuances by Slovak banks, the new framework aims to help mobilise some EUR 1.6 bn of private sector investments into covered bonds issued by Slovak banks. This was the first triple-A-rated covered bond issued by the local lender Slovenská sporiteľňa and the first ever triple-A-rated issuance in an EBRD country of operation.

There is an increasing interest in the EBRD’s regions for the development of well-functioning covered bond markets. The success of the markets in Poland, the Slovak Republic and Romania, in combination with the new EU Covered Bond Framework, demonstrates both what can be done and how to do it. In the past, many countries have attempted to develop covered bond markets, but many have failed through a combination of inappropriate laws based on structures in countries with very different financial systems, a lack of commercial need as western banks provide their eastern subsidiaries with cheap liquidity, and a lack of credible support for reform initiatives.

In the medium term we see several areas of development:

> Existing covered bond markets must continue to evolve to reflect both the new EU rulebook, changes in market standards (such as the introduction of maturity extension structures or covered bond labels), and new opportunities to better fund the real economy;

> New jurisdictions will continue to develop covered bond technology. As countries with less developed markets increasingly look at the product, the benefits available from covered bonds, and the challenges to develop them, will increase; and

> Other asset classes will increasingly be financed using covered bond technology. Turkey has already used the tool to finance its vibrant small and medium-sized enterprises (SME) sector; other countries in the region with limited stocks of mortgages can be expected to similarly diversify the eligible asset classes. The imperative to finance renewable energy sources and to improve existing energy efficiency is likely to drive further developments in the application of the financing tool.

The question for EBRD, the Covered Bond community and our countries of operations is… where shall we go next? We have some ideas on the additional countries to be added to the Global Covered Bond Map.

A. Pinedo et al (2017), “Frequently Asked Questions about Covered Bonds”, Morrison & Foerster LLP

F. Packer et al (2007), “The covered bond market”, Bank for International Settlements

S. Schwarcz (2013), “Securitization, Structured Finance, and Covered Bonds”, The Journal of Corporation Law

EBRD (March 2017), “EBRD invests in PKO Bank Hipoteczny covered bonds”

EBRD (July 2017), “EBRD invests in Garanti Bank’s covered bond”

EBRD (October 2017), “EBRD invests in covered bond issued by National Bank of Greece”

European Commission (March 2018), “Capital Markets Union: covered bonds, cross-border distribution of investment funds and cross-border transactions in claims and securities”

Vienna Initiative (March 2018), “Report by the Working Group on Capital Markets Union”

EBRD (March 2019), “EBRD launches €385 million Slovak Covered Bond Framework”

EBRD (May 2019), “EBRD backs Romania’s first covered bond”

EBRD (June 2019), “EBRD invests in debut issue of Polish green covered bonds”