We are pleased to invite you to participate in the EMF-ECBC Institution & Industry Dialogue on “Getting Basel right for a sustainable European Housing Market”, which will take place online on Thursday, 27 May 2021 (14h15-15h45 CEST).

As the European Union prepares to implement the new Basel III framework which has the potential to bring about significant changes in the way banks finance businesses and households, the EMF-ECBC has decided to lead the public debate around this crucial topic. This Dialogue therefore aims to bring together industry and decision makers to address an issue that goes further than mere regulatory changes.

The European Commission’s NextGenerationEU and EU Green Deal initiatives are positioning credit institutions and capital markets in a new role in the context of the recovery from the COVID-19 pandemic and the Renovation Wave Strategy, and market stakeholders are acutely aware of the historic responsibility they have to support consumers and businesses at this unprecedented time. In this framework, the focus on financial stability, to which mortgages and covered bonds make a fundamental contribution, is key to preserve the ability of the market to deploy private capital and channel financial resources to address the challenges of climate change, particularly in the building sector, and at the same time secure social inclusion.

These challenges, combined with legal and socio-economic change, especially in labour markets, regulatory and technical innovation in the areas of digitalisation and sustainability, and an ongoing negative interest rate environment, are impacting the entire value chain transversally, from retail to funding markets. In an Industry worth more than €7 trillion, equal to almost 50% of EU GDP, this is significant. Covered bonds and mortgages on banks’ balance sheets are paramount to providing access to housing finance for EU citizens, promoting welfare and stability at the household level, and encouraging investment and fostering job creation in multiple sectors of the economy.

Against this background, a well calibrated implementation of the final Basel III rules in the Old Continent is of the utmost importance. The housing sector is called upon more than ever as a driver for a new economic and financial paradigm, given its essential role as a cog between monetary and fiscal policies and the homes of all European citizens.

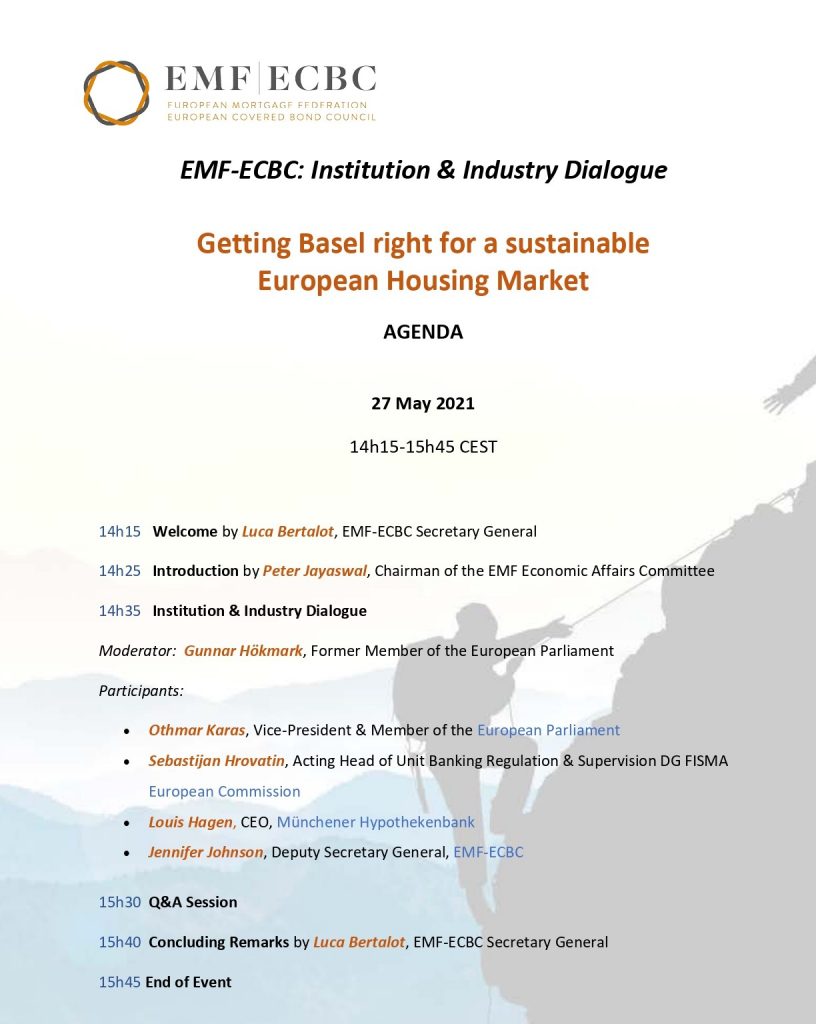

With these considerations in mind, the EMF-ECBC is pleased to present the accompanying programme of confirmed speakers who will exchange views on the key issues at stake and discuss appropriate legislative solutions.

We very much hope you will be able to join us for this event, which will be hosted as a Webex Meeting. In the meantime, we invite you to “Save the Date” and REGISTER HERE. There is no fee to participate in this event, which is open to all interested parties, so please feel free to share this invitation with other relevant colleagues.