9 October 2018

This article is taken from the 2018 edition of the ECBC European Covered Bond Fact Book, which can be accessed here.

EXECUTIVE SUMMARY

Initiated in September 2014 by the ECB and later embedded in a broader asset purchase programme, the Covered Bond Purchase Programme (CBPP) is scheduled to end in December 2018. It has been a major driver for the covered bond market since its implementation. The article addresses the criteria and mechanism of the purchase programme as well as the development of ECB’s covered bond portfolio following termination. The article concludes with a scenario analysis following the tapering/ending of the programme including the potential impact on spreads.

On 4 September 2014, the European Central Bank (ECB) announced its plan to buy covered bonds. This Covered Bond Purchase Programme (CBPP) came as a surprise to markets at that time and was the third covered bond purchase programme besides the CBPP1 (from July 2009 to June 2010) and the CBPP2 (from November 2011 to October 2012). Purchases of the CBPP3 started at the end of October 2014. The CBPP3 programme was originally scheduled until October 2016. In January 2015, however, it was embedded in a broader asset purchase programme (APP), including sovereign debt, international and supranational institutions and agencies as well as asset-backed securities with a monthly target volume of EUR 60 bn. In December 2015, the ECB asset purchase programme was extended to March 2017 and the monthly volume was increased to EUR 80 bn in March 2016, including also corporate bonds from June 2016 onwards. After two years in operation, the ECB announced in December 2016, that from April 2017 onwards, monthly purchases under the APP are reduced to EUR 60 bn from previously EUR 80 bn, while at the same time extending the term of the programme until year-end 2017. In October 2017, the ECB announced to extend the programme until September 2018 with monthly purchases lowered to EUR 30 bn from EUR 60 bn previously. Finally, in June 2018, the ECB decided to extend the programme by another three months and to reduce monthly purchases further to EUR 15 bn. Purchases are intended to end in December 2018.

The ECB’s rational is that alongside the public sector purchase programme (PSPP), the asset-backed securities (ABS) purchase programme (ABSPP), the corporate sector purchase programme (CSPP) and the Targeted Longer-Term Refinancing Operations (TLTROs), the CBPP3 will further enhance the transmission of monetary policy, facilitate credit provision to the euro area economy, generate positive spill-overs to other markets and, as a result, ease the ECB’s monetary policy stance, and contribute to a return of inflation rates to levels closer to 2%.

The purchases are conducted in both primary and secondary markets in a uniform and decentralised manner, meaning that the Eurosystem central banks purchase eligible covered bonds from eligible counterparties.

In order to qualify for purchase under the programme, covered bonds must fulfil the following eligibility criteria:

> Be eligible for monetary policy operations in line with section 6.2.1 of Annex I to Guideline ECB/2011/14 (eligibility criteria for marketable assets) and, in addition, fulfil the conditions for their acceptance as own-used collateral as laid out in section 6.2.3.2. (fifth paragraph) of Annex I to Guideline ECB/2011/14.

> Be issued by euro area credit institutions; or, in the case of multi-cédulas, by special purpose vehicles incorporated in the euro area.

> Be denominated in euro and held and settled in the euro area.

> Have underlying assets that include exposure to private and/or public entities.

> Have a minimum first-best credit assessment of credit quality step 3 (CQS3; BBB- or equivalent) by at least one rating agency.

> For covered bond programmes which currently do not achieve the CQS3 rating in Cyprus and Greece, a minimum asset rating at the level of the maximum achievable covered bond rating defined for the jurisdiction will be required for as long as the Eurosystem’s minimum credit quality threshold is not applied in the collateral eligibility requirements for marketable debt instruments issued or guaranteed by the Greek or Cypriot governments, with the following additional risk mitigants: (i) monthly reporting of the pool and asset characteristics; (ii) minimum committed overcollateralisation of 25%; (iii) currency hedges with at least BBB- rated counterparties for non-euro-denominated claims included in the cover pool of the programme or, alternatively, that at least 95% of the assets are denominated in euro; and (iv) claims must be against debtors domiciled in the euro area.

> Covered bonds issued by entities suspended from Eurosystem credit operations are excluded for the duration of the suspension.

> Counterparties eligible to participate in CBPP3 are those counterparties that are eligible for the Eurosystem’s monetary policy operations, together with any of the counterparties that are used by the Eurosystem for the investment of its euro-denominated portfolios.

> The Eurosystem will apply an issue share limit of 70% per ISIN (joint holdings under CBPP1, CBPP2 and CBPP3), except in the case of covered bonds issued by issuers in Greece and Cyprus and not fulfilling the CQS3 rating requirement; for such covered bonds, an issue share limit of 30% per ISIN will be applied.

> Covered bonds retained by their issuer shall be eligible for purchases under the CBPP3, provided that they fulfil the eligibility criteria as specified.

> Since February 2018: In case of conditional pass-through covered bonds, the issuing entity must have a first-best issuer rating of at least credit quality Step 3.

Furthermore, the Governing Council has decided to make its CBPP3 portfolio available for lending. Lending will be voluntary and conducted through security lending facilities offered by central securities depositories, or via matched repo transactions with the same set of eligible counterparties as for CBPP3 purchases.

Compared to the CBPP1 and CBPP2, the current purchase programme (CBPP3) did not apply any minimum size or any specific maturity of the covered bonds purchased.

In June 2009, the ECB had announced its first Covered Bond Purchase Programme (CBPP1) with a volume of EUR 60 bn – with purchases between July 2009 and June 2010. The programme was fully used with a nominal value of EUR 60 bn, and, in total, 422 different bonds were purchased, 27% in the primary market and 73% in the secondary market. The Eurosystem mainly purchased covered bonds with maturities of three to seven years, which resulted in an average modified duration of 4.12 for the portfolio as of June 2010. In November 2011, the ECB launched its second Covered Bond Purchase Programme (CBPP2) with a programme size of EUR 40 bn and eligible covered bonds to be purchased up until October 2012. However, cumulative purchases reached only a volume of EUR 16.4 bn, of which 36.7% related to the primary market and 63.3% to secondary markets.

As of 15 June 2018, the ECB reported covered bond holdings of EUR 254.4 bn under the CBPP3 at amortised costs, deriving from primary market (37%) and secondary market sources (63%). In addition, the remaining holdings from terminated covered bond purchase programmes were reported as EUR 4.4 bn under the CBPP1 and EUR 4.1 bn under the CBPP2.

The introduction of quantitative easing by the European Central Bank (ECB) in 2014 aimed to anchor inflation close to a level of 2% again. To achieve this, a purchasing programme for covered bonds (CBPP3) has been set up alongside the purchasing programme for ABS (ABSPP). Later on, programmes for public sector assets (PSPP) and corporate bonds (CSPP) have been added to the toolkit. Unlike the PSPP, under the covered bond purchasing programme the Eurosystem can also make purchases in the primary market. It thus participates actively in the primary market, with the result that a large number of transactions are affected. It means, for instance, that deals can also be issued in the market, which could not have been carried out at all without the participation of the ECB, or would have been issued at different terms and conditions.

As at 31 May 2018, the Eurosystem had purchased covered bonds totalling EUR 254.3 bn, of which EUR 94.1 bn is attributable to the primary market. This equates to a share of 37% of the CBPP3. In the first three months of this year, the ECB continued its purchase activity in the market. By the end of May, net holdings climbed up by EUR 13.6 bn, with the volume acquired thus only slightly down on the figure for the first quarter of the previous year of EUR 16.4 bn. The fact that the monthly purchasing volume for the entire QE programme in the same period of the previous year was EUR 80 bn, while the volume in the current year stands at EUR 30 bn, makes this all the more surprising. The reduction in the total volume purchased is therefore also reflected in covered bonds, but to a disproportionately lesser degree than would have been assumed. It should be noted here that the growth is almost completely in the form of purchases in the primary market, whereas 27% was still attributable to the secondary market in the first quarter of the previous year. This means that primary market purchases have become increasingly important for the ECB in the context of the purchasing programme over time and in the first five months of 2018 accounted for nearly all of the growth in portfolio volume.

As at 31 May 2018, the Eurosystem had purchased covered bonds totalling EUR 254.3 bn, of which EUR 94.1 bn is attributable to the primary market. This equates to a share of 37% of the CBPP3. In the first three months of this year, the ECB continued its purchase activity in the market. By the end of May, net holdings climbed up by EUR 13.6 bn, with the volume acquired thus only slightly down on the figure for the first quarter of the previous year of EUR 16.4 bn. The fact that the monthly purchasing volume for the entire QE programme in the same period of the previous year was EUR 80 bn, while the volume in the current year stands at EUR 30 bn, makes this all the more surprising. The reduction in the total volume purchased is therefore also reflected in covered bonds, but to a disproportionately lesser degree than would have been assumed. It should be noted here that the growth is almost completely in the form of purchases in the primary market, whereas 27% was still attributable to the secondary market in the first quarter of the previous year. This means that primary market purchases have become increasingly important for the ECB in the context of the purchasing programme over time and in the first five months of 2018 accounted for nearly all of the growth in portfolio volume.

However, we understand that the course of action adopted by the Eurosystem is not based on a freely accessible set of rules, but is the result of practice over time (which we suspect, however, is not based on regulations that have been made public). For example, there is no information available in the public domain regarding the ECB’s course of action regarding individual primary market transactions. Based on discussions with issuers and press reports, we assume that until mid-March, the Eurosystem issued orders for 50% of the anticipated issuance volume and the respective order was then increased if the issuance volume communicated was higher than expected. Since 15 March, the Eurosystem has changed its previous practice and ordered only 40% of the expected issuance volume, although we believe the order could have been increased if the issuance volume had been adjusted. However, just one month later, issuers were seemingly informed that another change had been made to the procedure for primary market transactions from mid-April onwards. The order size has been reduced once again to 30% of the expected issuance volume. Moreover, in the future the Eurosystem will no longer raise the size of the original order if the deal size is increased during the bookbuilding process.

This means that for an issuance volume of EUR 500 mn, an order for the CBPP3 of EUR 250 mn was made until mid-March. Up until mid-April, the order size for a comparable deal was EUR 200 mn, and since mid-April the order size has been just EUR 150 mn. Consequently, issuers now face the challenge of finding other investors for new deals in order to fill the gap in demand caused by the change in order behaviour. This is typically achieved by adjusting prices, prompting investors to change their pattern of demand.

> Figure 6: Monthly bid-to-Cover ratio

Following almost euphoric demand from investors in October and November last year resulting in a bid-to-cover ratio of almost 2.5, demand had already dropped off by the start of the year. This was reflected by substantially lower order books than in Q4 2017. The average bid-to-cover ratio from 2 January to 14 March this year was 1.59, down 27 basis points on the long-term average of 1.86 (2011 – ytd) and 26 basis points lower than the average bid-to-cover ratio of 1.85 (November 2014 – ytd) in the CBPP3. Since 15 March, the date at which we believe the ECB reduced its order level, the bid-to-cover ratio has dropped further to 1.50. We interpret this data as showing that investors are no longer prepared to accept the previous low spreads in the primary market.

Since November 2017 the ECB provides an overview of the maturities of the next 12 month on a rolling basis, so that market participants have at least more detailed information of the potential reinvestment of the ECB although their criteria allows them to spread the reinvestment across the asset classes that are eligible under the programme. In the reporting period from May 2018 to April 2019 the maturities amount to EUR

172.2 bn. Maturities of CBPP3 covered bonds in the current reporting period amount to EUR 19.7 bn. ABSPP above all seems to have a short duration in relation to the other programmes, while the durations of the other programmes seem to be much higher. The proportion of maturities over the next 12 months under the ABSPP is 27%, against 7% under the entire EAPP. In the ECBC Covered Bond Fact Book 2017 Edition, we tried to calculate the maturity profile of the ECB CBPP3 portfolio and argued that, based on these figures, the influence of the reinvestments on the covered bond market is not as high as often was discussed before the first publication of the data in November 2017. Meanwhile we could compare the published data with our forecast and the difference is only marginal up to the data up to 2019. So, we still conclude that the maturities for the single years have a bulk of max up to EUR 30 bn per annum in the period from 2020 to 2023. Therefore, we conclude that the level of 30% the ECB has set meanwhile in primary market will last as long as the ECB will stick to their reinvestment strategy and undertakes the full reinvestment of the maturities.

Since mid-March, the ECB has been tapering its activities in the CBPP3 in order to fully reduce its net purchasing by the end of the year. To this end, we understand that it has changed its purchasing policy in the primary market and triggered a price adjustment in the wake of the gap in demand. A state of equilibrium has still not been achieved, and in our opinion further price adjustments could follow as the year progresses. We estimate that the ECB’s current order behaviour is now at a stable level. Based on our forecast, the funding requirements for the following years could be mainly achieved in the primary market in line with current practice.

On 14 June 2018, the ECB confirmed to phase out the net purchases under its asset purchases programme by the end of this year after an anticipated three-month extension post September at a lower pace of €15 bn. It was the first major QE tapering statement since 26 October 2017 when the ECB announced to reduce its purchases from EUR 60 bn to EUR 30 bn as of January 2018 while at the same time extending the duration of the programme until the end of September 2018.

The ECB had always left the option open to lengthen the duration of the programme beyond September 2018 if necessary, or until it sees a sustained adjustment in the path of inflation consistent with its inflation target. However, as of March this year, the Central Bank already no longer hinted at a potential increase in the size and/or duration of the programme if the outlook becomes less favourable or if financial conditions become inconsistent with the advocated inflation path.

Although the ECB assured market participants in June to stand ready to adjust all of its instruments as appropriate to ensure inflation continues to move towards its inflation target in sustained manner, it is clear the asset purchase programme is nearing its end date.

The demonstrated tapering pattern for the APP is somewhere in the middle of our second and third tapering scenarios discussed in the previous edition of this Factbook (see box 1). However, in contrast with our expec- tation of a pro-rata tapering across the four different APP programmes, the ECB has remained a more active buyer of covered bonds than anticipated given the reduction of the monthly purchase pace from EUR 60 bn to EUR 30 bn since the start of this year. With the net purchases running at least until the end of September 2018 and given the 33% ISIN limitations (50% for supranational bonds) under the public sector purchase programme, the halving of the net monthly purchases has had a proportionally stronger impact on the PSPP than on any of the other purchase programmes, including the CBPP3.

In the first five months of this year, the share of the CBPP3 in the APP aggregate rose to over 9%, almost double the programme’s share in the EUR 60 bn monthly purchases from April to December 2017 (figure 9).

As a consequence, net purchases have remained relatively stable in a EUR 2.4 bn to EUR 4 bn range since April 2017. The same holds for the gross purchases in a EUR 3.8 bn to EUR 5 bn range (figure 10).

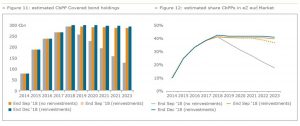

Total CBPP covered bond holdings aggregated to EUR 263 bn at the end of May 2018, roughly 40% of the Eurozone EUR benchmark covered bond debt outstanding. The covered bond holdings are on track to exceed EUR 270 bn by the end of this year (figure 11). They may even surpass the EUR 280 bn mark if the net asset purchases are extended by an additional three months to the end of this year at a EUR 15 bn monthly asset purchase pace.

The ECB intends to reinvest redemption payments under the APP for an extended period of time after the end of its net purchases for as long as deemed necessary. In the past five years, Eurozone banks have issued on average EUR 80 bn per year in EUR benchmark covered bonds. Reinvestments of covered bond redemptions, if done via primary, would coincide with an average CBPP3 take-up in new deals of 33% per annum at similar supply volumes. This is just above the 30% average take-up of Eurozone primary deals since the start of the CBPP3 and the central bank’s understood 30% current order presence in new deals.

Figure 11 gives an update of the total prospective covered bond holdings over the coming five years in the event that 1) the asset purchases end in September, and as of the end of this year a) redemptions are no longer reinvested, or b) the ECB continues to reinvest redemptions in full during the coming five years, and

2) the asset purchases are extended by three months to the end of 2018 at a monthly pace of EUR 15 bn. If redemptions continue to be fully reinvested, the ECB will still hold roughly EUR 270 bn to 275 bn by the end of 2023. If the ECB ends the net buying of assets in September this year and no longer reinvests redemptions as of next year, the central bank’s covered bond portfolio would shrink to around EUR 115 bn in 2023.

As such CBPP holdings of Eurozone EUR benchmark covered bonds would still be around 40% of the total amount in covered bond debt outstanding in five years’ time if the ECB continues to reinvest redemptions in full, unless supply picks up notably compared to the past five years. Even in the event that the ECB decides to gradually reduce its reinvestments of redemptions two years after ending its net purchases, the central bank is still likely to hold over 35% of the outstanding Eurozone covered bonds by the end of 2023. Without reinvestments of redemptions this percentage would decline to 17% by 2023, which is still well above the 10% share of the CBPP holdings at the start of the CBPP3 (figure 12).

This underscores that the ECB will remain an important player within the covered bond market for quite some time, unless the Central Bank would at some point see the economic rationale to actively reduce its covered bond holdings by selling down its portfolio.

With one year of additional empirical evidence on spread behaviour in response to ECB asset purchase programme communications, this section updates our analysis of covered bond spreads during the course of the CBPP3. The main purpose is to assess the potential performance impact on covered bonds of the end of the asset purchases. We look at the interaction of covered bond spread developments with the following:

> The CBPP3’s secondary purchase support;

> Primary market activity;

> Bund trading levels versus swaps; and

> Yield levels (swap rate).

The performance charts give insight in the covered bond market’s response to five distinct ECB policy announcements in the past four years (see figure 13):

All these policy announcements have had a far more significant impact on spreads than their actual execution. On the latest date, i.e. 26 October 2017, the ECB decided to lower the size of its asset purchases to EUR 30 bn, while extending the term of the programme until September 2018. The spread tightening seen thereafter up until March, the month that the ECB removed among others the reference to a potential increase in the programme’s size/duration from its communication, shows that (confirmation of) the final end date for the net asset purchases may indeed have a more definitive impact on spreads than the actual decline in total net purchases.

Covered bond spreads have been particularly well supported by the CBPP3’s demonstrable presence in the secondary market until the summer of 2015. The lower secondary buying pace since September 2015, on the other hand, coincided with a notable widening in covered bond spreads through until the ECB’s March 2016 meeting (figure 13). The slower secondary purchase pace concurred at that time with a strong pickup in Eurozone covered bond supply (figure 14). The abundance in fresh paper saw CBPP3 purchases shift away from secondary to the primary market, at a time that increasing supply already pressured covered bond spreads. The weaker covered bond performance since March this year also corresponded with a pickup of primary market activity at the expense of secondary purchases by the CBPP3.

While figure 15 confirms the relationship between higher CBPP3 primary buying volumes and wider covered bond spreads, figure 16 illustrates that higher primary purchase volumes also tend to coincide with higher take-up percentages of the CBPP3 in covered bond primary deals. The higher primary allocations to the CBPP3 during episodes of spread widening reflect the weaker market conditions and related moderated interest from other investors for new supply. Nevertheless, they do amplify the negative impact of high covered bond supply on secondary CBPP3 demand during periods that market conditions already feel softer.

On top of that, the substantial covered bond holdings by the ECB and the impact thereof on liquidity, has the unfortunate side effect that spreads may respond more severely to changes in secondary CBPP3 demand. Against this backdrop, the reduction of ECB’s primary orders to 30% discussed earlier in this article, should assure at least a certain secondary presence by the CBPP3 even after the net purchases end. At roughly EUR 80 bn in annual Eurozone EUR benchmark covered bond supply, almost 85% of the reinvested redemptions would be made in primary in the event of full allocation at order sizes of 30%. This percentage would decline to 70% if the Central Bank were to lower its order size to 25% or is on average allocated only 83% of its 30% order size. The percentage would fall to 55% if the CBPP3’s order sizes would be reduced to 20% or if allocations are only 66% of the central bank’s initial order. This year’s average share of primary buying in the gross monthly purchases is around 65%, up from 35% last year.

Figure 17 gives an overview of the relationship between covered bonds and Bund asset swap spreads. More expensive Bund trading levels versus swaps are constructive to tighter covered bond spreads. Bunds have only modestly underperformed swaps thus far this year, despite the proportionally stronger impact of the lowering of the monthly asset purchases to EUR 30 bn on public sector purchases. This partly reflects a flight to quality support for Bunds on the back of the Italian government concerns. That said if Bunds start to underperform swaps further once the net purchases end and PSPP support becomes fully reliant on the reinvestments of redemptions, we are likely to witness a concomitant widening in covered bond spreads.

In addition to less supportive sovereign asset swap spreads, we probably have to witness a rise in underlying yield levels to support a widening in covered bond spreads to the levels seen prior to the ECB announcing its intentions to buy covered bonds in September 2014 (figure 18). At the same time, the past two years’ performance of covered bonds has illustrated that modestly rising yield levels may even be constructive to covered bond spreads for as long as they don’t trigger market concerns regarding their impact on economic growth. In that case, the higher underlying yield levels may even free up space for spreads to tighten.

Figure 19 gives an updated overview of the spread implications of QE tapering, monetary tightening and balance sheet normalisation in the US for US sovereign bonds and US$ denominated covered bonds. The Federal Reserve’s first hint in 2013 and subsequent market anticipation of tapering had a stronger impact on spreads than the actual start of the tapering process in December 2013 when the Fed made the first reduction to its monthly purchases from US$85 bn to US$75 bn. The subsequent US$10 bn reduction per each Fed meeting had little negative impact on spreads. If anything, spreads even tightened.

The strongest widening in spreads occurred after completion of the tapering process, when the market started to anticipate the first Fed rate hike. Part of these asset swap spread developments is a reflection however of swap market technicalities caused by regulatory developments in the US in this period. That said, after the first 25bp hike at the end of 2015, Treasury spreads remained relatively stable. This suggests that an anticipated tightening of monetary policy is likely to have a stronger impact on spreads than the tapering of asset purchases or the actual monetary tightening itself.

Figure 19 also includes the first experience in the US with the gradual reduction of reinvestments of redemp- tions (balance sheet normalisation). On 20 September 2017, the Fed announced its policy normalisation principles and plans. As of October 2017, reinvestments are made only to the extent that redemptions exceed the applicable gradually rising caps (see figure 20). The steady balance sheet normalisation in combination with further rate hikes still have limited negative performance implications. Spreads continue to tighten against the backdrop of rising underlying yield levels. This confirms our belief that even in the event of a tightening or normalisation of monetary policy conditions, the spread implications should remain contained for as long as markets remain relatively comfortable with the economic prospects of the region affected.

The first experience with ECB tapering strengthens our confidence that the end of the net purchases is likely to have more pronounced spread implications for covered bonds than the tapering itself. Once the tapering of asset purchases is completed, the market is likely to anticipate the Central Bank’s next course of action in the form of tightening in financial accommodation. The ECB assured market participants in June that interest rates are expected to remain at their current levels at least through the summer of 2019. However, experience with QE tapering, monetary tightening and balance sheet normalisation in the US illustrates that ultimately the severity of the market’s response to all these events will largely depend upon the comfort with their potential economic spill-over consequences.