30 October 2024

By the end of 2024, globally, more voters than ever in history will have headed to the polls, as elections will have been held in at least 97 countries, including the 27 countries of the European Union, representing nearly half of the global population.

In this context, and following on from months of financial turmoil and geopolitical crisis, housing and housing finance are issues which are taking central stage in a completely new way in global political debates, alongside financial stability, competitiveness and long-term access to capital markets.

In such a dynamic landscape and in particular in the context of supporting the transition to a more sustainable economy, the financial sector can play a critical role in strengthening the capability of societies and political decisionmakers to respond efficiently and effectively to the real needs of citizens and businesses. Indeed, worldwide, an ‘efficient, sustainable and sound housing ecosystem’ and access to capital markets resources are seen as drivers of long term sustainable economic growth and social integration.

‘Building the hope for a better future’ has been the leitmotiv for many political initiatives, where themes such as housing affordability and sustainability are knocking at the doors of all parliaments around the world. The complexity and depth of those challenges are requiring a systemic response addressing fundamental economic, financial, environmental and social issues. This systemic response should focus on rapidly mobilising both public and private sector resources in coordinated and complementary ways.

For the first time in history, political action plans are being drawn up in which housing and housing finance are being given a new perspective. As very recently stated in Strasbourg by the European Commission’s President, Ursula von der Leyen: ”But, Honourable Members, for us to choose the Europe of tomorrow, we must acknowledge how people feel today. We are in a period of deep anxiety and uncertainty for Europeans. Families are feeling the pain from the cost of living and housing.”….

“Europe faces a housing crisis, with people of all ages and families of all sizes affected. Prices and rents are soaring. People are struggling to find affordable homes. This is why, for the first time, I will appoint a Commissioner with direct responsibility for housing. We will develop a European Affordable Housing Plan, to look at all the drivers of the crisis and to help unlock the private and public investment needed. Typically, housing is not seen as a European issue”[1].

Not only Europe but the entire world faces a severe housing shortage, with the root of this crisis lying in a simple economic principle: demand is exceeding supply. This imbalance has led to skyrocketing housing prices, making it increasingly difficult for many people to afford a place to live. As urban populations swell and economic pressures mount, the urgency to find viable solutions grows more pressing especially in the light of the transition to a greener economy where more than 40% of the pollution comes from the building sector.

The housing crisis manifests in various ways across the globe. In major cities, the cost of living has outpaced wage growth, resulting in a significant portion of the population being unable to afford adequate housing. Addressing the global housing crisis requires innovative solutions and a collaborative global approach, and increasingly housing finance is being seen as a global private sector solution to address local, regional and national challenges.

Today’s market environment is shaped by new digital technologies, dynamic consumer preferences, increasing competition and changing regulations. Supervisors therefore regularly assess and adjust supervisory practices to ensure effective stimulus and monitoring of the banking sector. In doing so, they have to strike the difficult balance of strengthening the institutions’ resilience without undermining their business sustainability. Maintaining an efficient and reliable banking system is fundamental to achieving sustainable economic growth, securing competition for the broader economy.

The financial sector has been under considerable pressure in the past decade. Businesses, citizens and national authorities have been affected by the financial crisis. Challenges relating to the development of new technologies, the fragmentation of the EU markets and climate change persist. More recently, new emerging risks and transitions risks for the financial sector will need to be addressed as part of the EU’s economic recovery efforts.

To address the current challenges and to seize new opportunities, the EU has adopted various initiatives. These initiatives have resulted in new and complex legal frameworks requiring implementation at national level. In recent years and further to extensive research, analysis and outreach, the EMF-ECBC has designed a new, integrated, European and global housing finance ecosystem. This ecosystem is designed to act as a catalyst for families’ renovation decisions and financial market opportunities. A housing finance ecosystem is the smart solution to implement new sustainable best practices which respond to social and sustainable policy targets and allow the entire financial value chain, including lenders, issuers and investors, to adapt quickly to a changing market, and deliver a broad range of financing options for consumers and the real economy.

Against this backdrop, the EMF-ECBC has taken a proactive role in leading more than 2000 global market participants towards a new market mentality via a series of market initiatives offering enhanced transparency in disclosure, access to data, market governance and market transformation capacity.

The EMF-ECBC is fully engaged in the creation and consolidation of such a global housing finance ecosystem focused on affordability and sustainability with the support of the International Secondary Mortgage Market Association (ISMMA) which gathers mortgage refinancing companies from around the globe. The International Secondary Mortgage Market Association (ISMMA) joined the EMF-ECBC community in 2022 having been established in 2018 under the sponsorship of the World Bank. The association provides a platform for member countries to exchange ideas on how to improve access to housing finance for their citizens and ultimately reach the goal of adequate, safe and affordable housing for all. As an extension of these global activities, the EMF-ECBC and the Housing Finance Information Network (HOFINET) have joined forces to consolidate the collection and dissemination of standardised housing finance data at global level. HOFINET is the quality-assured portal that consolidates regularly updated international housing finance knowledge in one central, easily accessible place. The provision of financial support to the real economy, particularly in areas such as housing, is essential for achieving Sustainable Development Goals and objectives related to climate. Investors engaged in the housing sector seek access to internationally comparable market data, insights into regulatory frameworks, and information regarding successful products and practices within both primary and capital markets for housing finance. This need is especially pronounced in emerging markets and developing economies, where the expansion of housing finance systems is imperative, but data is often insufficient.

With the creation and consolidation of a global housing ecosystem in mind, for several years the EMF-ECBC has furthermore been leading on a series of market initiatives, focused on retail and funding activities, intended to strengthen market governance, enhance data availability, promote common definitions, increase transparency, stimulate digitalisation and drive affordability and sustainability in the housing sector. These initiatives recognised at global level are significantly reshaping market practices, enlarging and diversifying the institutional investor base and facilitating issuer and investor due diligence and full compliance with the regulatory landscape.

The Covered Bond Label provides for enhanced quality in data disclosure and comparability of legal information on cover assets , reinforcing significantly the strategic relevance of the covered bond asset class for investors at global level. On a daily basis, capital market participants need complete and accurate information to support regulatory compliance with the Covered Bond Directive, LCR eligibility and ESG-related diligence matters, to name but a few priorities, and this need is growing all the time. This is where the ECBC comes into its own. The ECBC-led Covered Bond Label has become a qualitative benchmark as an informative gateway into the covered bond space. Most recently, the ECBC has completely refreshed its Comparative Database on global covered bond legislative frameworks, which is embedded in the Covered Bond Label website. Covered bonds are anti-cyclical, long-term financing instruments that help fund around two-thirds of all mortgage lending in Europe. Thus, the changes taking place on the mortgage retail side will surely have an impact on the covered bond side, and vice-versa.

The real estate sector plays a key role in decarbonising the economy and achieving the Paris Agreement goals established in 2015. In the EU, activities related to buildings (heating, cooling, lighting, and so on) are responsible for 40 per cent of energy consumption and 36 per cent of CO2 emissions. Between 75 and 90 per cent of the EU building stock is expected to still be standing in 2050, making energy efficiency refurbishment and financing a priority. Meeting the EU’s energy efficiency targets, indeed, requires very high investments. Consequently, the role of private finance has become paramount in the shift towards a more sustainable economy and future. According to the European Commission, the EU’s financial sector can significantly foster sustainable finance, positioning itself as a global leader in this domain. Such a transformation is expected to yield positive repercussions for economic growth and employment opportunities[2].

The Energy Efficient Mortgages Initiative (EEMI) and the Energy Efficient Mortgage Label (EEML) (see below) are at the heart of the EMF-ECBC’s efforts to promote sustainable housing and lay the foundations from which to fund a socially desirable housing future. Through these initiatives, mortgage lending institutions are at the forefront of efforts to finance the transition towards a zero-carbon economy. Actions to curtail energy consumption and CO2 emissions are becoming increasingly urgent, more so if we consider the dramatic increases in energy prices. Mortgage lenders can help drive the green transformation of the European housing stock by supporting the implementation of energy efficient financial products and stimulating new renovation initiatives, whether national or regional.

The Energy Efficient Mortgage Label, launched in February 2021 with the support of the European Commission, is a quality instrument that allows for the transparent identification of energy efficient mortgages in banks’ mortgage portfolios by market stakeholders and its delivery is a key component of the broader Energy Efficient Mortgages Initiative (EEMI). Moreover, the Label is a catalyst for consumer demand and a driver of the qualitative upgrade of the energy profile of lending institutions’ portfolios, which translates into enhanced asset quality. Through the Harmonised Disclosure Template (HDT), the Label provides information on the portfolios of energy efficient loans as assets to be included in green (covered) bonds, allows for enhanced evaluation and tracking of their financial performance relative to alternatives, and provides greater transparency regarding climate risks and resilience.

Against this backdrop, the EMF-ECBC is delighted to announce the successful application for a new round of EU funding for a European Project entitled “Delivering the Energy Efficient Mortgage Ecosystem” (DeliverEEM) which will take forward the extensive work already delivered under the umbrella of the EEMI. All in all, the EMF-ECBC’s expertise and think-tank approach to market questions helps to deliver solid insights into the housing and housing finance markets, while setting standards and developing solutions that improve the market. The EMF-ECBC looks forward to presenting the results of this EU funded Project in the near future.

Covered Bonds: Industry roadmap for principles-based harmonisation and transparency to secure solid long term funding lines

Covered bonds are a cornerstone of long-term finance for many EU Member States as a key instrument to channel funds to the property market and public sector entities. The implementation of the Covered Bond Directive in the European Union has crowned a long journey and firm commitment undertaken by the covered bond community, under the leadership and governance of the European Covered Bond Council (ECBC), to align market and supervisory best practices so as to facilitate the optimisation of funding strategies. In parallel, this has helped ensure wider access to capital markets and fostered the opening up of global opportunities for both lenders and investors, whilst benefitting consumers. Against the backdrop of the recent implementation of the Directive, it is of paramount importance to secure legal stability in order to ensure the continued smooth alignment of market best practices, due processes and due diligences.

According to the European Mortgage Federation (EMF) statistics, covered bonds finance around 25% of European mortgage loans. Several factors explain their popularity with issuers and investors. Issuers like the ability to diversify their funding sources away from short-term deposits and toward longer-term instruments, which better match the maturity of their mortgage book. Covered bonds are cheaper and often have longer maturities than other funding sources, such as unsecured bank debt. Investors like the additional security that dual-recourse offers to both the issuing credit institution and a cover pool of segregated financial assets, usually prime mortgage loans. Generally, covered bonds show higher and more stable ratings than the issuing banks, and have never defaulted over their long history.

The principles-based approach adopted in the Directive was designed to capture and strike the right balance between both long-standing macroprudential features in national supervisory landscapes and overarching market innovations and mechanisms, thereby representing a form of osmosis to securing harmonisation at the European and global levels. It should be kept in mind that national covered bond markets have been well functioning for many decades and that, in general, investors are satisfied with the current framework, which is characterised by principle-based harmonisation combined with product diversity; therefore, any further harmonisation in the legal framework for covered bonds should take into account the existing differences in terms of insolvency law regimes across Member States.

The focus and strength of finding the right balance has been the critical diversification and reinforcement of the investor base through enhanced transparency and availability of standardised information on collateral assets, legislative frameworks and liability issuances.

Over recent years the covered bond market has crucially evolved towards financial structures with extendible maturities, an instrument conceived to address potential liquidity shortfalls and ensure a last resort to avoid the insolvency of the cover pool. Such structures are well appreciated by all market participants, such as investors and rating agencies, and feature different triggers defined at national levels according to the existing specificities of banking crisis management and supervisory roles. In this context, the ECBC has played an important role in the dialogue with authorities and is proud of its success in helping to ensure a well-functioning principle based extension mechanism. At the end of 2023, around two-thirds of outstanding covered bonds had an extendable maturity. In relation to the above and to avoid any unnecessary and unwarranted markets’ fragmentation (in contrast with the principle of the CBD), it’s crucial that the extendable maturity structures and the attached discretions exercised by the Member States will be confirmed in the terms of the EU framework currently in force.

The current political debate regarding the revamp of the Capital Markets Union (CMU) initiative comes at a critical geopolitical moment. With financial markets entering uncharted waters and with inflation and a new monetary policy landscape once again highlighting the anti-crises nature of the covered bond asset class, the appetite for a product that can at the same time offer stable and robust long-term financing and efficient asset liability management is evident. Throughout recent years of market turmoil and deposit volatility, lenders have been able to secure access to capital market funding by relying on the more than 250 years old DNA structure of covered bonds’ unique characteristics: low volatility, exceptionally low transaction execution risk, superb credit ratings, lower refinancing costs and a reduced need for banks to rely on more expensive funding means and interbank markets, especially during turbulent times. And of course an impeccable credit history throughout the various EU jurisdictions.

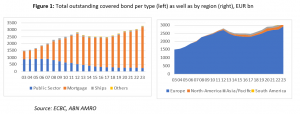

In the context of the rethinking of the Capital Markets Union, it is important to underline the macroprudential value and contribution to financial stability of the covered bond asset class. From an investor perspective, covered bonds are already supporting the development of deeper capital markets having achieved a significant degree of granularity, with the value of outstanding covered bonds reaching the peak at the end of 2023 of over EUR 3.3 trn: this is represented by 433 different programmes from 329 active covered bond issuers, of which 77 also issue sustainable covered bonds.

The aim of the ECBC statistics is to provide the most reliable data on the size and issuance of covered bonds globally. As such, it paints a realistic a picture of developments and trends in the covered bond market. In 2016, a breakdown by maturity structures was added to the statistics, while in 2019, we started to collect statistics on sustainable covered bonds. Sustainable covered bonds include a formal commitment by the issuer to use the bonds’ proceeds to (re)finance loans in clearly defined environmental, social, governance (ESG) or a combination of these. The data is based on self-certification by issuers. In the coming years, we will try to further enhance the quality of this data, as we expect that the importance of sustainable covered bonds will continue to grow over time.

Covered Bonds as a Crisis Management Tool: Outstanding Amount of Covered Bonds Increased at Strongest Pace Since 2008

The new record in outstanding of 2023, reflects the large volume of new supply more than compensating for covered bonds that matured during the course of the year. The amount of outstanding covered bonds rose by EUR 230 bn between 2022 and 2023 to EUR 3.3 trn. This was the sixth consecutive year of growth, and the pace of growth (+7.6%) was the strongest since 2008. Moreover, it was more than double the growth rate in 2022 (+3%), taking the volume of outstanding covered bonds further above the EUR 3 trn mark. A breakdown by covered bond type showed that the increase in 2023 was largely due to a rise in outstanding amounts of mortgage covered bonds, as the outstanding amounts of public sector continued to decline in 2023.

Indeed, the nominal amount of mortgage covered bonds rose by EUR 246 bn to EUR 2.9 trn (+9%), while the volume of outstanding public sector covered bonds dropped by EUR 19 bn to EUR 258 bn (-6.8%). The amount of ship covered bonds rose by EUR 0.3 bn and the “other” category, which largely includes export finance covered bonds in Spain, increased by EUR 2.7 bn. Both categories recovered somewhat following a decline in outstanding amounts in 2022. At the end of 2023, the share of mortgage covered bonds in the total amount of outstanding covered bonds was 90%, up from 88.7% in 2022. Meanwhile, the share of public sector covered bonds dropped to 8%, while the share of covered bonds backed by ships/other assets remained stable at around 2.1%. Finally, the share of sustainable covered bonds reached 3% last year, up from 2.6% in 2022 and 1.8% in 2021.

The EMF-ECBC remains fully committed to deploying and scaling up market solutions which touch upon banks’ retail and funding activities and are focused on building a solid and sustainable housing ecosystem which secures data transparency, financial stability and affordability at global level.

Luca Bertalot, EMF-ECBC Secretary General

[1] Statement by the President following the vote (europa.eu)

[2] https://www.bancaditalia.it/pubblicazioni/qef/2024-0868/QEF_868_24.pdf