28 May 2024

Introduction

The surge in covered bond issuance that started in 2022 has continued into 2023 with H1 recording an even more active primary market than the record setting 2022. Issuers have continued to refinance the various long-term central bank liquidity schemes while in some cases also offsetting deposit outflows. Fortunately, issuers have upsized issuance volumes just at a time when yields have surged and swap spreads shooting wider have led to covered bonds looking historically cheap against sovereign debt. This has brought a lot of traditional investors back into covered bond markets or led to more activity of those who have continued to be active in the market over the past few years. Even more so, it has, however, also led to new investors joining the market who sought the high quality and low volatility of covered bonds. We have seen even investors invest in especially shorter dated covered for high-yield or emerging markets portfolios as well as corporate treasuries deploying some of their cash holdings in the market at a significant pick-up over Bunds.

The inflection point for all of this was last year and at the time, we chose to conduct a series of more in-depth investor interviews for this article in the 2022 edition of the ECBC fact-book that allowed us to paint a more nuanced picture. With the trend firmly in place by now, we thought it more useful to branch out and go for a more standardised investor survey again this year, getting feedback from a broader range of accounts than last year. Hence, what we will do below is to run you through the classic distribution statistics of primary covered bond markets. We will, however, also outline the feedback from our investor survey to give you as complete a picture of the covered bond buyer base and their preferences as possible.

Overview of covered bond investor base

Probably the most significant structural break in recent years has finally taken place on the investor side of the covered bond market. And it is nothing less than the end of an era. After almost ten years the ECB finally concluded its purchases of covered bonds via the CBPP3. Within the PEPP – where reinvestments still take place – covered bonds play a minor role and, hence, the Eurosystem and its national central banks as price insensitive buyers of covered bonds all-over the EMU have turned their backs on the market – at least via the APP. In addition, the distorting effects of extremely cheap central bank liquidity ran out, exerting a noticeable influence on the supply side.

Together with this phasing out of the ECB’s unconventional monetary policy instruments, the interest rate turnaround also began (not only in Europe). The subsequent noticeable rise in capital market yields has made the asset class more attractive for investors, both in absolute and relative terms, although continuing uncertainties have led to a particular focus on the short end.

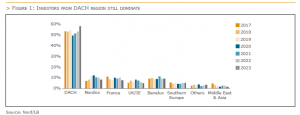

While the adjustments on the side of unconventional monetary policy instruments are not a new phenomenon, since they in parts took already place in 2022, this turnaround is now only becoming more noticeable, which is not least due to the new interest rate reality. As regards the investor distribution of primary market deals in the EUR benchmark segment investors from the DACH region remain to be the most dominant in terms of geographical distribution.

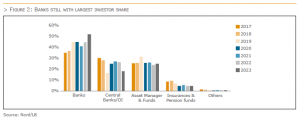

In terms of allocation by investor type it comes as no surprise at all, that the share of the category “Central Banks & Official Institutions” lost ground. Having said that, this should not be interpreted that central banks do not see covered bonds as a relevant asset class per se. However, in terms of magnitude the portfolio investments of central banks across the globe fall short the vast purchases of the ECB’s APP. Bank treasuries as the main representatives in the category “Banks” fill the gap and also “Asset Managers & Funds” gained some more ground.

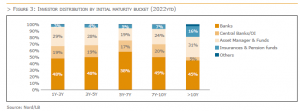

The high uncertainty with regards to the interest rate outlook yielded in a focus of the investors on the shorter-dated deals. But also with regard to the general supply of longer dated deals it is obvious that given the high term spread is not only a result of less demand but also of the inverted nature of the EUR swap curve. Based on the investor distributions we have been able to collect for 2023ytd we not surprisingly see higher demand of “Asset Managers & Funds” as well as “Insurances & Pension Funds” for the longer dated deals.

Last but not least, it is important to stress at this point how different demand depth has been across the term structure this year. Thanks to inverted swap curves and covered bond spreads being especially wide vs other asset classes, demand out to 5 years has been exceptionally strong. It has come from a wide range of investor types too including existing as well as new buyers either seeking the large pick-up over EGBs and SSAs or simply looking for a low-risk and low-volatility asset at the peak of the swap curve. The moment one steps beyond the 5Y point, though, the share of more traditional buyers, above all bank treasuries at this point, becomes more important and with it increased sector and issuer differentiation. The moment one steps beyond the 10Y point, many banks drop away and with insurance buyers the investor group that has been slowest to return (lack of liquidity in many cases), demand at that part of the curve has been fairly volatile as it relied on asset managers’ appetite for duration.

Investor survey

To get systematic feedback on a number of topics, we conducted an online investor survey in the second half of June. We received responses from 43 investors covering a broad range of investor types and regions. The questions focussed around (1) the investors’ general level of activity and motivation in covered bond markets, (2) their main concerns at this point, (3) what impact regulatory changes such as the Covered Bond Directive have had for them as well (4) what role ESG plays in their day to day operations.

Activity levels

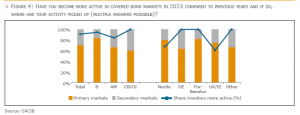

As we discussed above, investors have become materially more active in covered bond markets this year and last. If anything, asset management accounts as well as Nordic and UK investors have been slightly less open to increasing their exposure to covered bond markets but even there we are talking about the majority having in fact upsized their buying. The expected impact of supply as well as still at times challenging secondary market conditions were two responses given by investors in our survey for why they have not increased their activity in the space.

In turn, the rationale for investors to have become more active has differed somewhat across investor types (as one would expect). For asset managers it has above all been higher yields as well as wider spreads vs EGBs while for bank treasuries (who typically swap their investments), wider levels vs swaps have been the main driver. In turn, less ECB involvement, better secondary market liquidity and even increased primary supply did not feature very prominently. Secondary market liquidity has improved. However, we are talking about above all the most recent vintages with the older stock of Eurozone covered bonds still tightly held by the Eurosystem and hence featuring very limited free-float. The “other” category featured responses such as the attractive RV vs corporate bonds, reducing risk weighted assets or the availability of shorter-dated issuances.

In other words, it was above all rates and relative spread moves that have made covered bond markets more attractive with intrinsic market drivers such as the higher supply or the expectation for improved liquidity with the ECB stepping back not in themselves leading to a major spike in interest from investors.

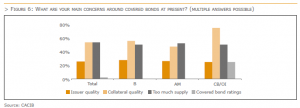

Concerns

Despite investors absorbing the surge in issuance, especially in shorter tenors, there are concerns that have built up in recent months. The two main concerns are collateral quality as well as too much supply with just over 50% of responses each. While the latter already led to a 10Y Pfandbrief transaction having to be pulled in June, we have yet to see any deterioration of collateral quality in cover pools and even on bank balance sheets we are only starting to see loan loss provisioning going up. These concerns are fairly similarly spread across investor types too. If anything central banks / official institution investors are especially concerned around collateral quality.

Concerns around issuer quality in turn are not very prominent. Only around one fourth of respondents ticked this box. In other words, while collateral quality is a concern, most respondents seem confident the main reason for the deterioration (higher rates) is also supporting bank profitability to the point where higher loan losses will be absorbed by banks without too much trouble.

The main concern around collateral amongst investors has been on commercial real estate assets (close to 90% of responses), followed with a huge gap by residential assets (a mere 20%). In turn, less than 10% of investors ticked the public sector asset box. Hence, concerns around higher Eurozone sovereign risk seems to not be on the cards at present despite the ECB’s QT extending to the PEPP at some point.

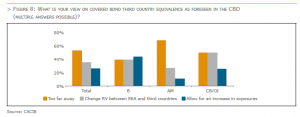

Covered Bond Directive (CBD)

Last year July was the official implementation deadline for the CBD and with Italian issuers finally also able to access markets again, we thought it only fitting to get an idea as to what the CBD implementation has done to how investors look at covered bond markets. For just above 50% of respondents the implementation has been neutral. Around one third of respondents do, however, view the improved frameworks as a positive, a view held above all amongst bank treasuries with hardly anyone taking a negative view. However, even for most of those who take a positive view of the CBD in general, it is not a sufficiently material factor to drive spreads. Overall, the CBD is neutral for spreads for more than 90% of respondents.

The one area where CBD implementation could become a more relevant driver is when it comes to third country equivalence further down the line. Especially bank treasuries would look at third country covered bonds differently accepting lower spreads vs EEA based covered bonds as well as potentially upsizing the amounts they can invest in these regions. For the majority of investors (53%), we are still talking about events that are too far away to already be relevant, though.

ESG

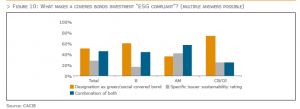

ESG has been a huge theme across capital markets in recent years. However, in covered bond markets, issuance in green, social or sustainable format has been relatively limited in absolute terms as availability of data on the ESG credentials of balance sheet assets has been a constraining factor and banks have often chosen to use the loans that are in line with green or social bond frameworks for senior preferred, non-preferred or even tier 2 issuance rather than for covered bonds.

The fact that we are still talking about an evolving market as well as regulatory regime has led to a wide range of different approaches to ESG amongst investors and this can also be seen in our survey. Just above 50% of respondents stated that they have a specific ESG mandate that also covers covered bonds. However, only half of those have a dedicated green mandate (above all asset managers) while for the other half, the responses ranged from investors using a combined framework for green and social bond issuances to using a more holistic approach that assesses the ESG credentials of the issuer rather than the bond.

The diverse nature of our survey responses also continued with respect to our question what makes a covered bond investment “ESG compliant”. The designation as green / social covered bond by the issuer is good enough for around half of the respondents while the other half looks at specific issuer sustainability ratings, a combination of both or they fully rely on internal models from the start.

Last but not least, investors we surveyed do not make a big difference between ESG and conventional covered bonds when it comes to assessing relative value. Looking at data from primary markets, ESG covered bonds have tended to have stronger order books and slightly smaller new issue premiums. However, they have often failed to trade at materially tighter spreads vs conventional ones. The survey results reflect this as well as around 75% of respondents do not look at ESG covered bonds differently. Around 20% accept smaller NIPs (especially amongst bank treasuries). However, less than 10% would buy in bigger size and / or accept tighter secondary market spreads.

The bottom line

Covered bond issuance has surged further in 2023 as issuers have continued to replace central bank funding with covered bonds and the first ones have also issued to offset potential deposit outflows. Thankfully, this has happened against a backdrop of higher rates and wide swap spreads. As covered bonds have also widened against swaps with more sector and issuer differentiation returning, investors have found a market that was able to offer exceptionally wide spreads vs other alternatives and they have embraced it with existing accounts upsizing their buying and entirely new investors joining as well. The drop in Eurosystem buying has been offset by bank treasuries becoming more active and some classic central bank official institutions investors coming back at the higher yields too. Inverted swap curves have, however, concentrated a lot of the interest in shorter tenors and we have seen longer-dated trades struggle at times.

Looking at the results of our investor survey, at this point, investors are most concerned around the outlook for covered bond supply as well as collateral quality. While the former has already led to a 10Y Pfandbrief having to be pulled in June, on the latter point, we are above all talking about commercial real estate assets. Concerns around issuer quality have not been prominent in our survey indicating that investors are comfortable issuers can cope with a loan quality deterioration. Turning to regulation, the Covered Bond Directive is broadly seen as neutral to marginally positive. However, even those who take a positive view hardly see it as a strong enough factor to justify tighter spreads. If anything, a third country regime further down the line would have a positive spread impact with above all bank treasuries happy to buy at tighter levels and even upsize exposures compared to now. Last but not least, ESG has so far played only a small role in terms of covered bond issuance. For the investors in our survey, approaches to ESG in covered bond markets also differ quite materially. Only around half have a specific mandate for ESG covered bonds and while some are happy to work with the issuer designations of a bond being green or social, others take a more holistic view and score the issuers with their own internal assessments rather than look at the bond in question. What most have in common, though, is that they do not materially differ between conventional and ESG covered bonds when it comes to spreads. Smaller new issue premiums are accepted by some but hardly anyone in our survey is happy to buy ESG covered bonds inside conventional ones.