30 October 2017

European Secured Notes (ESN) are a new type of collateralised bonds being developed in the European Union (EU). ESN will resemble the dual-recourse framework of covered bonds, but will be backed mainly by loans to small and medium-sized enterprises (SME) and infrastructure loans, instead of the mortgage and public-sector loans that typically back covered bonds.

The establishment of ESN was originally proposed by the European Covered Bond Council (ECBC) and the idea has been embraced by the European Parliament and the European Commission. The European Commission is exploring the feasibility of ESN, including the regulatory treatment of the instruments under existing EU legislation, and this process is scheduled to be completed by the second quarter of 2018.

In this article, Moody’s analyses the incentives for EU banks to issue ESN, the interaction between ESN and other debt instruments, the complexity of the credit risks posed by the underlying assets and the approach Moody’s would take to analyse ESN.

ESN will allow EU banks to mobilise the infrastructure and SME loans on their balance sheets by issuing secured debt backed by these assets under a specific legal framework. ESN will likely be on-balance sheet secured bonds, so will not free up capital for banks in the way that securitisations may do.

Regulators could grant ESN more favourable treatment than unsecured debt. Given the secured nature of the instruments, if such preferential regulatory treatment were to be provided, the yield of ESN would likely be somewhere between those of covered bonds and preferred unsecured debt and much lower than the non-preferred unsecured debt issued by some European banks.

As a result, in Moody’s opinion, ESN issuance will likely help banks reduce their wholesale funding costs. ESN may cannibalise the market for preferred unsecured debt, because of their lower cost.

In addition to lowering wholesale funding costs and diversifying the financing mix of banks, ESN issuance is expected to help banks reduce maturity mismatches between their assets and liabilities, especially for those banks highly reliant on short-term wholesale funding.

Moody’s anticipates that EU banks may also use ESN instead of or in addition to retained SME securitisations as a way to build eligible collateral with central banks. ESN could be more flexible and cheaper to implement than one-off SME securitisations, which may encourage banks to use them in place of or in addition to SME securitisations. Thus, ESN could replace a significant part of about €80 billion of outstanding retained SME securitisations in Europe.

In Moody’s view, the liquidity position of most European banks is currently strong and given the ultra-low interest rate environment, there is little incentive to issue a new type of debt instrument. In addition, banks are building up loss-absorbing capital layers to meet their TLAC[1] and MREL[2] requirements, which may moderate the issuance of ESN and covered bonds in the near future.

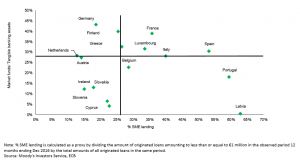

However, the issuance of ESN may be attractive to some banks when conditions change in the future. Moody’s believes that Italian and Spanish banks, and other smaller European banks, will have the highest incentives to issue ESN, based on their reliance on market funding and relatively high share of SME lending as a proportion of total lending (Exhibit 2). Retained ESN could also replace retained covered bonds, which can be sold more easily in the market.

Exhibit 2

Reliance on market funds and lending to SMEs varies in Europe

Market funds over tangible assets and share of new lending to SMEs over total lending (Dec 2016)

Due to the potentially lower funding costs of ESN, some issuers may replace some of their senior unsecured debt issuance with ESN. In Moody’s opinion, such a switch in liability structure is not neutral and may have negative consequences for unsecured creditors.

Firstly, in an insolvency scenario, the ESN holders would likely have a preferential claim over other creditors to the cover pool proceeds. The asset encumbrance of the cover pool therefore reduces the recovery value of other creditors in the event of a fire sale, especially those that are unsecured.

Secondly and more important, in a resolution scenario prior to insolvency, one option under the Bank Recovery and Resolution Directive (BRRD) is the write-down of bail-inable debt to absorb losses. If no other bail-inable debt has been issued and all other things being equal, the reduction of senior unsecured debt may increase the losses shared across this debt class because the same amount of losses has to be allocated to a lower volume of debt.

In addition, the reduction in bail-inable debt may increase the probability that other liabilities – including deposits and other senior operating obligations – will have to bear a loss.

ESN will also need to maintain a certain level of collateral of a certain credit quality in the cover pools, which may require issuers to replace assets that become ineligible, particularly during an economic downturn. Excessive issuance of ESN may limit the ability of issuers to replace the assets, when such replacement is important to protect the quality of the cover pool.

In Moody’s view, the credit risks posed by ESN will be more complex than the risks posed by traditional covered bonds, because of the nature of the underlying SME and infrastructure loans backing ESN. Loans granted to SMEs tend to be riskier and perform worse than loans to households. SME loans are also more exposed to cyclical downturns than household loans, as evidenced by their underperformance during the financial crisis.

Exhibit 3 shows that non-performing loan (NPL) ratios for SMEs are considerably higher than those for household loans in Germany, Spain, France and Italy.

Exhibit 3

SME loans have higher NPLs than household loans

NPL ratio (% of gross loans) by country (June 2016)

In addition, Moody’s believes that establishing a framework that defines a homogeneous, high-quality SME portfolio that would be eligible as an ESN cover pool will be a complex task, given than certain limits will need to be placed on the types of assets that can be included, while allowing enough flexibility so that the eligible cover pool can be of an appropriate size.

Some of the key limitations or exclusions that could be placed on an eligible pool of SME loans could include: 1) excluding borrowers with a probability of default above a certain level; 2) excluding or limiting the percentage of start-up companies; 3) limiting the concentration of particular borrowers, regions or industries; 4) excluding delinquent loans; 5) excluding or limiting forborne loans; 6) including only fully-drawn loans; and 7) including only loans from one single originator, granted to borrowers located in one single European country, to ensure homogeneity in the underwriting process.

It will also be important to define exactly what is meant by SMEs in the context of an eligible pool of loans, given that over 99% of businesses in the EU are considered SMEs.

Within the infrastructure universe, there is a wide range of diverse assets that present different risk factors, revenue drivers and exposures to the economic environment. Due to their specific characteristics, infrastructure entities are exposed to a set of risks that are different from those typical for non-financial corporates.

Given the bespoke nature of some infrastructure and project finance transactions, including debt structural features that provide creditor protection, entities operating in the same sub-sector may have different risk characteristics. Hence, the specific risk exposures of individual infrastructure assets vary on a case by case basis.

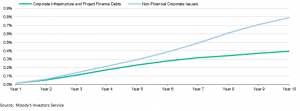

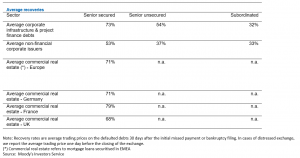

On average, corporate infrastructure and project finance entities have a stronger credit profile than non-financial corporates and the credit quality of infrastructure debt is more stable over the long term than that of non-financial corporates (Exhibit 4).[3] Infrastructure recovery rates are on average comparable or slightly better for some classes to those of commercial real-estate mortgage loans included in European securitisations (Exhibit 5).

Exhibit 4

Infrastructure debt loss rate is lower than non-financial corporate loss rate

10-year credit loss rates for single-A rated infrastructure debts and like-rated non-financial corporates

Exhibit 5

European infrastructure and project finance debts have higher recovery rates than non-financial corporates debts

ESN will resemble the dual-recourse structure of covered bonds. The difference between ESN and covered bonds will be the different type of collateral backing the notes. As such, Moody’s will analyse ESN as covered bonds and apply our existing covered bond methodology to this process. [4]

We rate four SME loan backed covered bonds using our existing methodology; three programmes in Turkey that are governed by a specific covered bond law and the contractual based covered bonds backed by SME loans issued by Commerzbank AG in Germany, which were issued outside the Pfandbrief framework.

Although SME loans tend to be riskier assets than traditional cover assets in the same country, this does not necessarily mean that the credit risk of ESN backed by SME loans is higher than the risk for covered bonds. Factors that would mitigate risk in ESN would need to be taken into consideration, including the level of overcollateralisation and features such as conditional pass-through repayment mechanisms that mitigate refinancing risk. The same consideration would apply for ESN backed by infrastructure loans. Thus, if sufficient risk mitigants are in place, ESN may achieve ratings similar to those assigned by Moody’s to traditional covered bonds in the same country.