22 November 2017

By Steffen Dahmer, JP Morgan, Moderator of the ECBC Liquidity Task Force & Chairman of the ECBC Market Related Issues Working Group, Michael Weigerding, Commerzbank AG, Joost Beaumont, ABN AMRO BANK N.V., Jonny Sylvén, Association of Swedish Covered Bond Issuers and Kaare Christensen, Finance Denmark

This article is taken from the 2017 edition of the ECBC European Covered Bond Fact Book, which can be accessed here.

The international covered bond benchmark segment which started as interbanking market-making (head to head) market in the 1990’s, transformed during the crisis into a pure client (investor) market-making market. This makes the covered bond market very much comparable to the supranational, sub-sovereign and agency (SSA) and sovereign market. A functional Repo market increases constantly the liquidity of the covered bond market, as consequences the covered bond benchmark market can be named as one of the most liquid market segments. There are still two camps, one which views covered bonds thanks to the nature and the rating as part of the rates world, and the other which clearly see credit elements and would value it as strongest product of the credit world. As any other market in the rates or credit world, the covered bond market faces regulatory requirements which result in a more prudent approach by trading books in terms of balance sheet allocation, in sum bank inventories have gone down and often only axed trading books are able and willing to show competitive prices and sizes to investors.

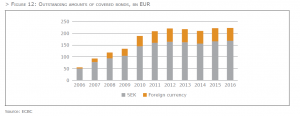

We continue to see the trend that EUR 500 m is becoming more and more the standard benchmark size for issuers, although issuers with larger annual funding appetite still favouring a EUR 1bn deal or larger. In the US $ market the 1bn and even larger is the standard; however, a few examples in the last 1-2 years did also proof the acceptance of a USD 500 m benchmark. The Swedish or Danish Kroner covered benchmarks are often significant by size and therefore far larger than the Euro or Dollar benchmarks. Obviously smaller benchmark volumes lead often to smaller secondary turnover given that the various covered bond markets are dominated by a majority of buy and hold investors. Furthermore, redemptions have also been at rather high levels in the past few years, resulting in negative net supply. This implied that the covered bond market shrank in 2014, 2015 as well as 2016. This year, gross issuance has also been lagging redemptions by some EUR 10bn so far. Overall, the markets has shrunk by around EUR 120bn in the past few years, newer jurisdiction such as Singapore, Turkey, Korea, Poland and others helping to lighten the net issuance reduction but were still not enough to stop the trend.

In sum, lower net supply, new deal size developments, a change of regulatory requirements and the nature of the investor base have a direct impact on secondary liquidity.

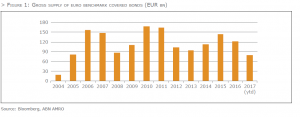

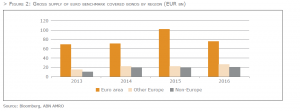

Gross supply of euro benchmark covered bonds has clearly increased in recent years, although it slowed down somewhat last year. After gross issuance declined in 2012 and 2013, it has started to rise again in the past few years. In 2014, the rise was mainly driven by an increase in both the number of new issuers as well as a rise in the amounts issued from jurisdictions outside the euro area. In 2015, the rise in gross supply of euro benchmark covered bonds was merely due to increased issuance from banks located within the euro area. This is related (at least partly) to the Eurosystem’s third covered bond purchase programme (CBPP3), which has made it increasingly attractive for banks to issue covered bonds. However, the rise in gross supply from euro area issuers was fully offset by primary allocation to the EUR central banks under CBPP3.

Last year, gross supply declined merely due to less issuance banks located in the euro area. This is likely related to the announcement of the attractive funding via TLTRO 2. As a result, market activities by the Eurosystem (CBPP3, TLTRO2) dampened turnover and reduced liquidity, the size of the traded volume drop is remarkable. Nonetheless higher placement shares with the CBPP3 are not directly linked to a lower liquidity on the secondary market since many other traditional investors have also become long term strategic investors for various reasons.

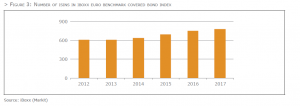

Meanwhile, the number of benchmarks outstanding in the Markit iBoxx euro covered bond index has steadily increased in recent years. In June 2017, the iBoxx included 774 benchmarks, which was 140 more than at the end of December 2014. However, the sum of the nominal value of the benchmarks has hardly changed, reflecting the decline in average deal size, thus, the number of flavours that investors can choose from has risen, which in the end should support liquidity.

Meanwhile, the number of benchmarks outstanding in the Markit iBoxx euro covered bond index has steadily increased in recent years. In June 2017, the iBoxx included 774 benchmarks, which was 140 more than at the end of December 2014. However, the sum of the nominal value of the benchmarks has hardly changed, reflecting the decline in average deal size, thus, the number of flavours that investors can choose from has risen, which in the end should support liquidity.

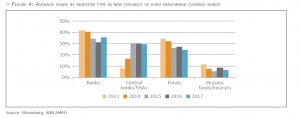

Let us again look at the evolution of investor base as an angle for liquidity. If the share of buy-and-hold investors has risen in the past few years, this should have reduced liquidity of covered bonds. Figure 4 below shows the average share per investor type in new euro benchmark deals. The graph clearly illustrates the crowding out impact of CBPP3. The share of central banks/SSAs has risen sharply, actually quadrupling from around 8% in 2013 to some 30% now. This has come at the expense of other investors, such as banks, asset managers and institutional investors. However, asset managers have seen the biggest drop in their share, followed by institutional investors. As these can be regarded as the most active portfolio managers, it seems fair to conclude that the change in the investor base in recent years has not supported liquidity of covered bonds.

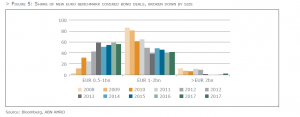

Finally, the larger the issue size, the better the liquidity. But also in this case, as indicated above, various recent developments point in the direction of a reduced liquidity. The graph below depicts the share of new deals broken down by issue size. The share of deals with an issue size below EUR 1bn increased strongly in recent years. Whilst only 3% of the deals had a size smaller than EUR 1bn in 2008, 59 % of deals had such a size in 2016. In contrast, only 1% new issues had a size above EUR 2bn in 2016 (none in the previous 2 years).

Meanwhile, the share of deals sized between EUR 1bn and EUR 2bn rose somewhat during the past few years, although the total remains still well below that seen in 2011 and before. So, also from an issue-size perspective, it seems that liquidity has deteriorated rather than improved in recent years.

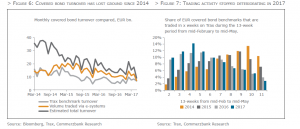

In April 2017, trading volume from Bloomberg, Tradeweb and Bondvision, the largest e-platforms for covered bonds, dropped to its lowest level for years: The aggregated covered bond turnover (including non-benchmarks) from January to April 2017 amounted to EUR 45bn, which compares to EUR 58bn over the same period last year. While we have seen an increase in e-trading turnover from 2014 to 2015, the turnover captured might have been supported by the fact that e platforms have gained importance, not least due to CBPP3’s order process. After adjusting for a shift from voice to e-trading[1] the total covered bond trading volume estimated from the largest e-platforms suggests that total turnover has almost steadily declined for years. The reports by the European Systemic Risk Board from October 2016 echo these numbers and trend.

Direction and scope of this change are confirmed by MarketAxess’s Trax turnover volume. Trax statistics compile turnover figures from banks using the company’s post-trade services. As the data capture  both voice and e-trading they are not biased by a shift in the latter’s importance. Additionally, the weekly Trax data show how trading activity has decreased for individual instruments: From mid-February to mid-May 2017, e.g., c. 5% of EUR benchmark covered bond have not been traded at all. Two years ago, that percentage was below 2%. The share of benchmarks traded less than every other week has more than doubled from 30% to 70% from 2014 to 2017. Usually, weekly turnover does not exceed EUR 5 m per bond. Although Trax data does not cover all trades in the market, these figures give an impression of the magnitude of the volume drain on the covered bond market.

both voice and e-trading they are not biased by a shift in the latter’s importance. Additionally, the weekly Trax data show how trading activity has decreased for individual instruments: From mid-February to mid-May 2017, e.g., c. 5% of EUR benchmark covered bond have not been traded at all. Two years ago, that percentage was below 2%. The share of benchmarks traded less than every other week has more than doubled from 30% to 70% from 2014 to 2017. Usually, weekly turnover does not exceed EUR 5 m per bond. Although Trax data does not cover all trades in the market, these figures give an impression of the magnitude of the volume drain on the covered bond market.

The density of turnover driven by private investors has, of course, fallen by a higher amount. After all, one has to adjust the total turnover for the CBPP3 secondary market purchases. This first requires some mathematical adjustments to the monthly figures reported by the ECB (as they are based on amortised costs rather than nominal levels etc.). In sum, in our model calculation CBPP3 purchases account for around a fifth of overall secondary market turnover.

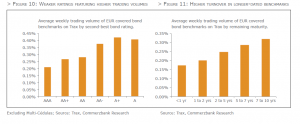

While the turnover reduction appears substantial, its causes are not that clear cut. As it is accompanied by the EUR central banks’ quantitative easing (QE) measures, the idea that CBPP3 has supported the activity drain seems plausible at first glance, as it has crowded out other investors (please see above). However, it is difficult to isolate the influence of this factor on the trading volume of EUR covered bonds and to estimate its magnitude. After all, volume has several other determinants and many of them apply to other covered bond or fixed-income segments as well, i.e., do not negatively affect the relative liquidity of EUR benchmarks. One of the most important turnover drivers is, of course, the volume outstanding: Around half of the turnover in EUR benchmarks is made up of covered bonds from Spain, Germany, France and Italy. This is predominantly due to the size of these segments as EUR benchmarks in jumbo size, e.g., have on average double the trading volume than benchmarks with less than EUR 1bn of nominal outstanding. When adjusted for size, the difference between both segments wanes. Therefore, the steadily decreasing size of new EUR benchmarks over recent years seems to have had a negative impact on volume.

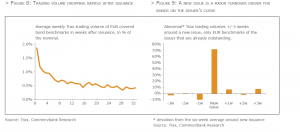

Another important turnover factor is the primary market. For one, a bond’s age determines its trading volume. A new benchmark loses three quarters of its initial trading volume in the first four weeks after issuance. Thereafter, weekly turnover captured by Trax only amounts to 0.5% of the nominal volume on average, with a declining tendency. A lively primary market that limits the average age of the outstanding bonds therefore is positive for a market’s trading volume. For another, switching interest induced by new issues is one of the most important turnover driver particularly for segments that lack a genuine trading activity. Roughly speaking, Trax trading volumes of an issuer’s covered bonds outstanding[2] increase by two thirds on average in the week where the bank launches a new benchmark. Trading volumes of other covered bonds in the issuer’s country climb by around one quarter. Individual examples show that the switching interest may even set in as soon as several weeks before the actual pricing of a new deal, in case there is a roadshow ahead. Hence, the lively issuance activity at the start of the year should have spurred the trading activity on the covered bond market.

Trading volume is also influenced by factors that are not directly liquidity-related. For instance, higher-beta covered bonds tend to feature higher trading activity. Trax turnover of benchmarks featuring a single A as second best rating, for instance, came in around twice as high as for AAA rated instruments, relative to their volume outstanding. Multi Cédulas also register higher relative trading volumes than Single-name Cédulas. Moreover, turnover is greater in bonds with a longer remaining maturity and thus higher duration. Among other things, this beta bias should be due to the fact that, since the sovereign debt crisis ebbed, active investors have relied to a greater degree on volatile names to generate outperformance while buy-and-hold clients prefer stable qualities.

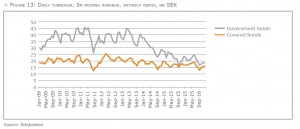

The Swedish domestic market for covered bonds is of great importance for the domestic capital market. Before Sweden implemented a law for covered bonds in 2004 there was a liquid market for mortgage bonds that had been around since the beginning of the 80’s. The outstanding volume of covered bonds in SEK was EUR 167.8bn at year end 2016. That was nearly twice as much as outstanding volume of government bonds.

The Swedish domestic market for covered bonds is of great importance for the domestic capital market. Before Sweden implemented a law for covered bonds in 2004 there was a liquid market for mortgage bonds that had been around since the beginning of the 80’s. The outstanding volume of covered bonds in SEK was EUR 167.8bn at year end 2016. That was nearly twice as much as outstanding volume of government bonds.

The Swedish bond market investors appreciate liquidity. The large banks issue their covered bonds as benchmarks which mean that large amounts (beginning at SEK 3 bn and more) are issued and that a number of dealers are contracted to show both bid and offer prices. Also, only benchmarks are deliverable in the future contracts. When a new benchmark-loan is issued, the issuers make sure that the amount issued meets the requirements for a benchmark sized deal. After the initial day of issuance the issuer can, without further notice, issue “on tap” the size that is required to match the lending. The benchmark bonds can be up to SEK 60bn in size. Sweden has a liquid and smoothly operating repo market with almost all banks and broker firms involved in the trading. The issuers offer their market makers a repo-facility in their own bonds. The repo transaction is viewed as a ‘sell-buy back’ or ‘buy-sell back’ deal and the ownership of the security has to be transferred.

60bn in size. Sweden has a liquid and smoothly operating repo market with almost all banks and broker firms involved in the trading. The issuers offer their market makers a repo-facility in their own bonds. The repo transaction is viewed as a ‘sell-buy back’ or ‘buy-sell back’ deal and the ownership of the security has to be transferred.

Overall this system has been working throughout a long period of time. The new regulations with higher capital requirements, larger information requirements (MIFID 2) and other potential obstacles like leverage ratio, structural reforms and so on will have a negative impact on liquidity in a small market as the Swedish. The Swedish central bank (Riksbanken) has been aggressive in its QE- policies which means that the central bank now owns a large part of outstanding government bonds. The Riksbank is not aiming to buy covered bonds. Activities in the market will also suffer. This far turnover is not significantly lower and the local FSA has performed studies of the liquidity in the covered bond market. The result of that study is that the liquidity is still good.

The type of bonds making up the Danish covered bond market fall into three major segments: callable bonds, bullet bonds and floater with or without a cap. All bonds are UCITS compliant and the vast majority are also CRD compliant. The market comprises a great number of series, but the vast majority of the nominal value is concentrated in a smaller number of large series.

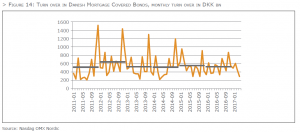

Reported trades in mortgage covered bonds (the Danish covered bond market – with an outstanding volume of EUR 391bn – is the largest market in Europe) to the Danish stock exchange, Nasdaq OMX Nordic, including over the counter trades and excluding repos, show no sign of diminished turnover in 2016 compared to recent years. The number of trades in covered bonds is less than in stocks for instance, however average trade sizes are much larger.

Average monthly turnover in the period 2011 – 2016 has come in at close to DKK 545bn (app. EUR 72.6bn). In 2016, average monthly turnover was DKK 519bn (app. EUR 69.2bn), cf. Figure 1, or approximately 18 percent of the outstanding volume, which is on par with previous years. For the first four months of 2017 turnover has been slightly above the equivalent period last year.

Although not as pronounced as in 2015 repayment activity in fixed rate callables in 2016 has remained relatively high. Hence, issuance in the primary market of callable bonds has been a driver for turnover in 2016. Meanwhile, as covered bonds issued outside the Euro area are not eligible for purchase under CBPP3, the Danish covered has not been directly affected by quantitative measures by the ECB, which have been a major factor dampening transaction activity in the Euro area. However, an indirect effect cannot be ruled out. Foreign investors have extended their ownership share of Danish covered bonds from an average of 21,3 percent over the year in 2015 to 22. percent in 2016. Currently, foreign investors are having a positive effect on market turn over and liquidity, but longer term effects remain to be seen.

Previously, the data was characterised by high turnover around the time of the November/December refinancing auctions of bullet bonds financing adjustable rate mortgages. Over the years, the spike has somewhat diminished as mortgage banks have spread the refinancing auctions from one to four annual settling periods – however not affecting average transaction volume over the year.

Danish specifics affecting turnover and challenges to liquidity in Danish covered bonds

Pass through, tap issuance, quarterly refinancing auctions and frequent early repayment activity are all characteristics of the Danish covered bond market, which among other more universal factors affect the level of market turnover. The strict balance principle, deployed to by Danish mortgage banks, incorporates pass through and means that mortgage covered bonds are tap issued on the go, in sync with demand for mortgage loans. Following the initial tap issuance, mainly bullet bonds and to an extend floaters are refinanced by the issuance of new bonds at refinancing auctions over the life of the loan.

Another specific influencing liquidity in the Danish covered bond market is borrowers’ early repayments. Any Danish covered bond can be bought back by the borrower at the current market price and delivered to the issuing mortgage bank (the buy back option) or in the case of fixed rate mortgages be bought back at par. This type of early redemption activity gives rise to an increase in transactions both when bonds are bought back , and when new bonds are issued. Again in 2016 market developments encouraged early repayment activity.

Meanwhile, while not all implemented, liquidity rules including LCR and NSFR, gearing ratio and capital requirements for market risk (see Fundamental Review of Trading Book (FRTB)) are already unintendedly increasing the cost of market making and repo transactions, through increased capital requirements and stricter liquidity management rules.

Due to tap issuance, the market maker function of universal banks is handed a central role providing liquidity in the covered bond market, as professional investors are mostly unwilling to buy in small batches. Onwards, market makers remain the main source of liquidity in the Danish covered bond market. However, higher capital charges, liquidity rules and the low interest rate climate have put pressure on the profitability of market making. In 2015, the Central Bank of Denmark, Danmarks Nationalbank, found evidence, that the five largest universal banks in Denmark have reduced their net positions available for market making by DKK 100bn since mid 20143. To a lesser extend market makers will be providers of market liquidity, but instead be matchmakers between buyers and sellers in the market. In 2016 Finance Denmark conducted a qualitative interview-based study among investors to explore how they perceive that the market making function has evolved. The results show that compared to ten years ago, the execution of trades above DKK 500m. takes longer time and move prices more. While market makers have reduced holdings, on the receiving end has been among others, institutional investors, which could also lead to lower turnover going forward.

Although approximately 80% of the outstanding volume of mortgage covered bonds are in series sizes above EUR 500m, giving rise to an LCR classification of Level 1B for the AAA rated Danish covered bonds, the new liquidity rules, do create a challenge managing smaller series sizes. If investors are unsure if a bond series will reach the critical mass – as bonds are tap issued – to qualify as Level 1B- or Level 2A-assets under the LCR, the pricing of the specific series may be negatively affected. This is an issue also affecting market makers.

Where turnover in the non-repo market has remained more or less on par with previous years, repo transactions have declined since 2012, and again in 2016 repo turnover was limited compared to earlier years. The decline in the covered bond repo market is a consequence of stricter capital and liquidity requirements mentioned above.