29 September 2017

Introduction

IntroductionIn Q2 2017 the economic momentum in the European Union continued with positive GDP growth, falling unemployment rates and expanding private consumption. In an environment of improving economic fundamentals, coupled with generally very low interest rates, the overall mortgage market in the EU is expanding. Almost across the board house prices are stable/increasing year-on-year (y-o-y) and, in some jurisdictions, they are increasing by double-digits. In this generally positive market outlook a growing number of countries are considering the introduction of or have already introduced macroprudential recommendations to cool-off the more heated market segments. The widespread imbalance between demand and supply, especially in the high-growth areas of the continent, is likely to persist over the coming quarters, although construction figures are picking up. Of course, national heterogeneities are still present and these have to be analysed more in depth.

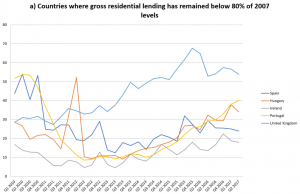

In Q2 2017 at an aggregate level the mortgage market in our EU sample[1] continued to increase both with respect to the previous quarter and with respect to the same quarter last year. In particular, gross lending in this quarter increased by 3.1% quarter-on-quarter (q-o-q) and by 5.5% y-o-y, reaching over EUR 278 bn. Principal factors for the ongoing increase in loans for housing purposes can be explained by overall favourable market conditions, such as a widespread improvement of the economic fundamentals which have a positive impact on consumer confidence, coupled with an expansive monetary policy and increasing house prices.

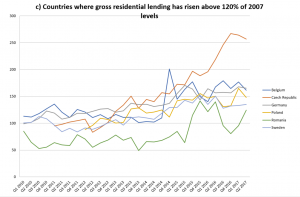

In order to curb the mortgage market, several countries introduced or were planning to introduce new macroprudential measures. In the Czech Republic, due to the rapid increase in mortgage lending, the Czech National Bank (CNB) started to implement several recommendations for lending. These include a loan-to-value (LTV) limit of 90%, which will be decreased to 85% later in 2017. Although the banks are not legally obliged to follow this rule, the CNB can request a higher level of the Mandatory Minimum Reserve, which means higher costs for lending. Another recommendation relates to the proportion of loans with a LTV of 80% – 90%, which should be not more than 15% of the total volume of loans provided by a bank. Notwithstanding these measures, the volume of new mortgages increased by 11.1% in the first half of 2017 with respect to the same period in 2016 and the average mortgage amount increased by nearly 7.5% in the same period.

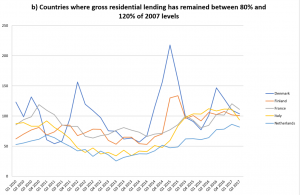

Moving north, in Finland and in Sweden the topic of increasing household debt is heatedly debated. In Finland, drawdowns decreased by 7% and gross lending decreased by 4.5% y-o-y. A decision was taken on the average risk weight floor of 15% for IRB mortgage banks’ portfolios. This decision will take effect on 1 January 2018. In Sweden the Finansinpektionen, the national FSA, has published a draft of sharpened amortisation rules for mortgage borrowers with a loan-to-income (LTI) ratio of over 4.5, which should also enter into force in the beginning of 2018. Gross mortgage lending is still comparably high but continues to drop slowly, growing by 6.9% in Q2 2017 compared to 8.2% in Q2 2016. Besides the improving economic conditions, rapid urbanisation and insufficient supply, difficulties of the renting market also contribute to increasing lending due to a general rent control, which have led to a limited supply of available rental apartments. In Denmark, notwithstanding the increased demand for homeownership, gross mortgage lending decreased by more than 6% q-o-q in Q2 2017, reaching roughly the levels of the same period previous year. The lower level of gross lending was mostly due to a fall in loans with floating interest rates.

In the Netherlands, a record of more than 58,000 sales was registered by the Dutch Land Registry, a 19% increase with respect to the previous quarter. However, this trend seems to have cooled off in Amsterdam in Q2 2017. Also, first-time-buyers (FTBs) plan their first step on the housing ladder later in time as they need to accumulate more equity, which, in turn, is reflected in the transaction trends by house type. While transactions for cheaper apartments grew by 36% since 2015, transactions for more expensive types of houses, particularly detached ones, grew by 50%. In accordance to this housing development also gross mortgage lending grew by more than 27% y-o-y to EUR 23.7 bn in Q2 2017. The absolute peak is still far ahead as mortgage conditions have become stricter. A more mixed picture is provided by Belgium where, on the one hand, the amount and volume of new mortgage loans contracted by 15% and 3.5% y-o-y respectively, while on the other hand, taking into account also remortgaging transactions, the amount contracted by 8.2% and the respective volume increased by 5.5%. Credits for renovation and for “other purposes” such as garage, notary costs etc., decreased the most, while loans for construction, renovation and purchase increased in Q2 2017. Moving south to France, mortgage activity lost momentum after the beginning of the year, which may be explained by the presidential and legislative elections. In Italy gross lending in Q2 2017 was roughly around the same value of the same period previous year, while the outstanding figures reached EUR 372 bn, a 2.2% increase y-o-y. Â

On the Iberic peninsula outstanding mortgage loans continue their decreasing path, although at a decelerated rate in the light of new mortgage loans picking up. Moreover, in Spain this decrease is due to the deleveraging process which started in 2009. Gross lending increased by 15.8% q-o-q but decreased by 16.5% y-o-y. The contraction with respect to the previous year is mainly explained by the decrease of remortgaging loans, which accounted for more than 28% in Q2 2016, while accounting for less than 5% one year later. In Portugal outstanding residential loans decreased by 2.9% y-o-y, an ongoing trend since Q4 2011. Nevertheless, new loans continued to increase, reaching more than EUR 2 bn in Q2 2017. In any case, the pre-crisis levels are still far from being reached. The greater competition among banks and the general increased demand for housing loans may in the future lead to looser credit standards.

In Poland the mortgage market kept on growing in Q2 2017 as in the previous quarter. Nearly 50,000 new loans were granted and more than 2 million loans were active in this period. On the other hand, an increasing share of homebuyers funded their property purchases without recurring to a mortgage, reaching peaks of 65%-70% in the largest Polish cities. These dynamics prove that in a low-yield, low-interest rate environment many Poles see real-estate purchases as a good investment alternative. Besides looking for investment alternatives, people who bought their homes in the property boom of 2005-2008 are now looking for new dwellings to improve their housing conditions, thus increasing the demand in the market. Concerning legal changes, the implementation of the Mortgage Credit Directive of the European Commission has been finalised on the 22 July with “The Act on Mortgage Loan and Supervision over Mortgage Brokers and Agents”. Also in Romania the mortgage market grew steadily in Q2 2017 with more than 60% of new loans y-o-y, which were almost entirely granted in local currency. NPLs decreased in this period by nearly 1 pp reaching 3.8%. The bank-lending survey of the Romanian Central Bank showed a marginal tightening of credit standards and a small increase in credit demand.

In Ireland and the UK, the number of first-time buyers continues to grow. In Ireland the government’s Help-to-Buy scheme, which provides income and deposit interest tax rebates for FTBs of new residential property, was one of the reasons of a boosted mortgage activity, which depicted a more than 28% y-o-y increase in value and more than 17% increase in volumes. Out of the 8,000 mortgage drawdowns, 3,000 were due to FTBs. In the UK over the last 12-months FTBs nearly equalled the number of movers (353,000 vs 358,000). The subdued number of home movers continues to impact the wider housing market, as fewer properties are on the market for sale. The principal reason is the recent weakness in income growth, coupled with uncertainty around future income levels, which will inevitably delay the moving timing. Also buy-to-let purchases remain significantly weaker than a year ago, as a tax change on second properties introduced in March 2016 continues to dampen activity. Nevertheless, gross mortgage lending increased q-o-q thanks to remortgaging activity, as attractive mortgage rates continue to encourage borrowers to refinance.

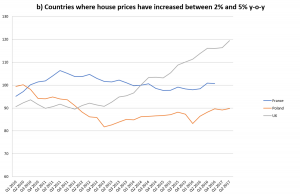

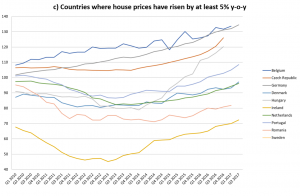

Throughout the analysed sample house prices continued their upwards path in Q2 2017, increasing on average by 1.5% q-o-q and by 5.0% y-o-y. However, significant differences remain both among and within countries, which have to be analysed more in depth. At first glance, house prices continue to increase throughout the EU principally due to improved economic fundamentals but also due to the lack of available housing and due to an insufficient construction rate, which, however, is showing signs of picking up.

The most impressive growth in our sample has been registered in Ireland, where house prices grew by more than 11% y-o-y. In Dublin the acceleration was around 11.1%, while in the rest of the country prices rose slightly faster, around 11.7%. According to the Banking & Payments Federation Ireland the principal reasons for this development are to be found in the lack of available housing, especially when it comes to suitable family accommodation. Building activity increased in recent years with 27% more housing completions in April and May 2017 y-o-y and 61% more building starts. However, building levels are still well below the annual estimated demand of 25,000 homes. In the UK house prices are rising but at a markedly slower pace, which is a result, amongst other factors, of the elevate price of housing compared to income.

Moving north, the second highest house price increase in Q2 2017 was in Sweden, where one-family homes increased by 9.4% and apartments by 8.9% y-o-y. Construction tries to keep up with this price evolution and is expected to reach the former record level of 1990, but there is still lack of housing in many regions in Sweden, especially in the larger cities. According to the National Board of Housing, this imbalance will be present for several years to come. However, the high prices, coupled with the new amortisation rules, which exclude some groups from entering the housing market, are going to have a dampening effect in the coming years. In Finland, construction activity continues its expansion and house prices are relatively stable, increasing by 1.2% y-o-y. Higher price increases are seen in the greater area around Helsinki. House prices increased also in Denmark, where single-family houses and owner-occupied apartments appreciated by respectively 4.1% and 3.7% q-o-q and by 5.2% and 7.5% y-o-y. The appreciation of house prices last year has been driven by movements in the long-term interest rates, which decreased well under 3%, thus leading to a greater demand of owner-occupied homes.

Also in Central Europe house prices are increasing remarkably due to the demand outstripping supply particularly in large cities and high growth regions. In Germany prices for owner-occupied housing recorded an increase of 5.2% y-o-y. Condominiums are in high demand, especially in large cities. For this type of dwelling a 6.4% y-o-y increase was registered in Q2 2017. Owner-occupied houses increased at a slightly slower pace of 4.8% y-o-y. Moving east, in the Czech Republic housing prices increased at double-digit levels in 2016 and are following the same path also in 2017. The most expensive areas are besides Prague and Brno also smaller cities such as Hradec Kralove. Prices also increased the most in these areas, around 20% y-o-y, while in other towns the increase was of around 10%. The supply of newly developed flats is decreasing mainly due to legislative bottlenecks and high requirements, which led to a drop of 60% of new flats in Prague in the last two years. The principal reason is the long timespan, which has to be taken into account in the preparation and implementation of new residential projects. This will cause a lack of supply and an ongoing increase of house prices also in the future. Also in Poland House Prices increased by nearly 4% y-o-y. The construction sector tries to keep up with the demand by expanding both housing starts and building permits. The former increased q-o-q by 40%, reaching nearly 62,000 units, while the latter increased by 20% to nearly 70,500 units, thus easing price tensions on the market.

In Western Europe house price increases follow similar patterns. In the Netherlands house prices increased by 7.7% y-o-y, closing up to the pre-crisis level of 2008. In the large cities, the current prices are already well above this level due to housing shortages. This picture is expected to remain unchanged also for the next quarters, meaning that the pre-crisis level should be reached by the second half of 2018. In Belgium, the prices increased by nearly 5% y-o-y in Q1 2017, the last available figure. Newly-built homes increased by 2.5% q-o-q while existing flats increased by 1.6% q-o-q. All house categories increased, but detached houses and villas increased substantially more than apartments. In France in the existing housing market prices increased especially in the tightest markets. Countrywide in Q2 2017 there was a 4.2% y-o-y increase for collective housing and a 2.9% for individual housing, while in the new housing market the price increased by 0.7% for collective housing and slightly decreased by 1% for individual housing. On the supply side, the construction industry is expanding. On a rolling 12-month time span 12.5% more existing homes have been sold, 13.8% more permits have been granted and 15.6% more housing starts have been observed.

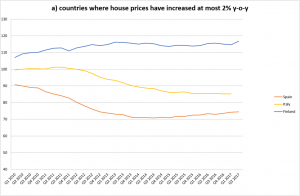

On the Iberic peninsula the housing market saw a clear increase, though still far from pre-crisis levels. In Spain Q2 2017 marked a 1.6% y-o-y increase and a 5.1% increase with respect to the lowest price level reached in Q3 2014. Madrid and Barcelona experienced the steepest increases. Similarly, in Portugal house prices marked a healthy increase in Q2 2017 registering a +3.2% q-o-q and a +8.0% y-o-y rise, thus totalling nine consecutive positive quarters – a first since the beginning of this series. This development has improved the confidence of banks to provide more new loans at lower spreads. Here too positive house price developments will continue in the future due to lack of available houses, both to sell and to rent.

In Italy house prices remained stable compared to the previous quarter, while they decreased by 0.1% y-o-y. New dwellings decreased by 0.4% y-o-y while they remained stable for existing dwellings over the same period. In Romania house prices increased by 2.2% y-o-y.

In aggregate terms interest rates are practically unchanged in the analysed sample. The unweighted average of the sample is 2.42%, 1.9 bps less than in Q1 2017. In six countries, the weighted average of the applied interest rates increased while in the remaining ten it either decreased or remained unchanged.

In the countries of Western Europe interest rates slightly increased. In the Netherlands rates went up from 2.39% to 2.42%, though the rates in contracts with longer fixed rates went up more slowly than those of shorter fixed rates. In Q2 2017 a countertendency with respect to the previous quarter towards shorter initial fixed rates is perceptible for the first time since Q3 2013 and this evolution is expected to hold steady in the next quarters. In Belgium, the weighted average increased by 4 bps to 2.13 and in Q2 2017 the market share of new fixed-interest rate loans and loans with an initial fixed rate for more than 10 years was equal to c. 90% of all new loans provided. Overdue contracts continued to decrease in this period. In France the weighted average of interest rates increased by 10 bps to 1.56% in Q2 2017. Nevertheless, this figure, taking into account inflation, amounted to an actual rate of 0.87% in June.

In Central Europe the picture shows increasing or stable figures. In countries like Germany and the Czech Republic the weighted averages of the interest rates increased by respectively 3 bps to 1.83% and 5 bps to 2.22%. In the latter, this trend is expected to increase mainly due to legislative changes and recommendations with regards to maximum LTVs for new loans and consumer loans. In Poland, on the other hand, interest rates remained stable at around 4.4%, the highest value in our sample.

In the north of the continent interest rates decreased overall. In Denmark, the representative interest rate on new loans with a fixed period of one year fell by 0.02 bps to 1.09%. Short and medium-term fixed interest rates fell and maintained low levels in Q2 2017. In Finland, the interest rates reached a new record low of 1.07% due to harsh competition among lenders and the low Euribor values. This interest rate level is also the lowest throughout the analysed sample. In Sweden as well the representative interest rate decreased, by 0.01 pps to 1.74%. Longer initial fixed rates of more than five years have been relatively stable at around 2.5% in the last two years and fell to a record low of 1.9% in Q2 2017. Variable mortgage rates decreased slightly to 1.5%.

In Southern Europe interest rates showed an overall decrease. In Portugal, the representative interest rate decreased to 1.61% in Q2 2017 from 1.70% in the previous quarter. The decrease is mainly due to the low Euribor values. These low interest rates induced more households to switch to more fixed interest rate contracts to avoid interest rate rises. In Spain, the representative interest rate also decreased, by 5 bps, to 1.92%. However, there are different dynamics according to the length of the initial fixed period. The variable and the shorter fixed-term interest rate agreements saw a q-o-q decrease while the longer initial fixed interest rate periods saw a slight increase. In Italy, the representative interest rate slightly decreased by 1bps to 2.10%. Here too the rates of the variable interest rate agreements decreased, while the more fixed rate ones slightly increased. In Romania the representative rate decreased by 37 bps to 3.34%.

In the UK and in Ireland interest rates showed a mixed picture. In the UK, the representative interest rate decreased by 4 bps to 2.05% in Q2 2017 and average mortgage rates on lower LTVs remain close to historic lows at two, three and five-year lengths. On the other hand, in Ireland the representative interest rate slightly increased by 3 bps to 2.42%. In Q2 2017, almost 47% of the value of new mortgage loan agreements, including renegotiations, was at fixed rates, namely with a fixed period of more than one year, the highest share of loan agreements since the beginning of the series in 2013. Mortgage rates on outstanding loans are also heavily influenced by the ECB base rate because about 48% of mortgages outstanding were on tracker rates, which averaged 1.04% for private dwelling home mortgages and 1.09% for buy-to-let mortgages.