29 April 2024

Introduction

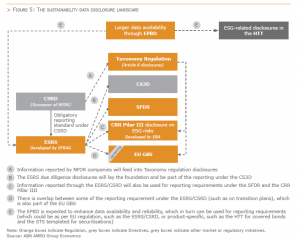

Since the European Commission launched its Sustainable Finance Action Plan in 2018, a string of initiatives has been launched. Several important legislative initiatives have been introduced or are in the process of being rolled out. Key building blocks include the Taxonomy Regulation, the Sustainable Finance Disclosure Regulation (SFDR), the Corporate Sustainability Due Diligence Directive (CS3D), the Energy Performance of Buildings Directive (EPBD), the Corporate Sustainability Reporting Directive (CSRD), and the European Sustainability Reporting Standard (ESRS). In all, a wholesale reform of sustainability risk analysis and reporting, that ensure a consistent (and to some extent, comparable) flow of ESG information through the financial system and the economy.

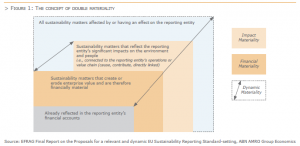

European sustainability reporting is based on the concept of double materiality. This means that a company should account both for material financial effects that sustainability matters result in (“outside in”) as well as the material impact on the individual, society and the environment that result from its operations (“inside out”). In the ESRS the “outside in” perspective is represented by Risk, the “inside out” perspective by Impacts and any positive potential effects from the transition to a sustainable economy by Opportunities. Together they are referred to as IRO.

The financing of real estate assets is in scope for several of these regulatory initiatives. Hence, as financial institutions start to report and better assess IROs of their mortgage portfolios, reporting on sustainability for covered bonds will also have to evolve. Given the role and position of the ECBC’s harmonized transparency template (HTT), it is well suited to play a key role also in future sustainability reporting.

The harmonized transparency template (HTT) is the worldwide standardised, Excel-based form that issuers who have been granted the Covered Bond Label use to disclose information on their covered bond programs in a standardized way (For further details – see section Covered Bond Label). It is aligned with the transparency requirements of Article 14 of the Covered Bond Directive[1] asking issuers to regularly publish a set of information to enable investors to analyse the cover pool. In that context it undergoes constant review to be always up to date with regulatory and market requirements.

In the course of the past HTT revisions, various datapoints on the sustainability dimension of green mortgage assets have entered into the template taking into account the growing issuance of green and social covered bonds. They are queried in worksheet F1 and include:

Further planned revisions will consider additions regarding the general sustainability strategy of the issuer, information on the provider of the Second Party Opinion as well as sustainability data for other cover pool assets. While the completion of the sustainability data section in the HTT is voluntary, it is currently filled out in whole or in part for already almost 40% of the cover pools with at least one sustainable covered bond (i.e. covered bonds marked with a green leaf).

Although the HTT is not yet requesting information on the alignment of cover pool assets with the EU Taxonomy criteria, nor is it asking for data helping to assess acute and chronic physical risks of cover pool assets, it is not unlikely that with the approaching regulatory requirements for financial institutions and unfolding market practices, not only the sustainability section of the HTT will evolve but the ratio of issuers providing sustainable data will rise as well.

The EU Sustainability Reporting Landscape

The CSRD

The CSRD was introduced in 2022 in response to a revision of the Non-financial Reporting Directive (NFRD) and marks a further expansion of both the scope of reporting as well as the number of companies required to report. Most importantly it paves the way for establishing a European sustainability reporting standard and integrates sustainability reporting in the annual report. Companies subject to the CSRD will have to report according to the ESRS.

The CSRD also details the mandate for the EU commission to issue reporting standards (that is, the ESRS) in the form of EU regulations (delegated acts). This is particularly important for the implementation of the ESRS, as even though the CSRD will have to be implemented into national law, the ESRS will become binding upon issuance.

The timetable for reporting under the CSRD is staged and the number of companies required to report will grow until 2029 when full implementation is reached (see Figure 2).

The ESRS

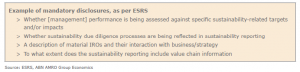

The ESRS widens the scope of sustainability disclosures to not only the scope of operations, but also to the whole value chain (upstream and downstream). However, the Commission recognizes that data on the value chain may not be available from the start, which means companies may defer disclosing on this until 2027. The ESRS as a starting point is based on a materiality assessment, where only material IROs need to be disclosed. However, it also contains certain mandatory disclosures which companies need to provide regardless of whether these are deemed material or not. These mandatory disclosures belong to the fields of due diligence processes, principal adverse impacts, incentive schemes linked to sustainability matters and provisions for value chain information.

The information gathered and reported under ESRS is also relevant for other regulatory initiatives. For example, financial institutions can use the reported information to, in turn, disclose the Principle Adverse Indicators (PAI) under the SFDR, and report on environmental impacts under the Pillar III of the Capital Requirements Regulation.

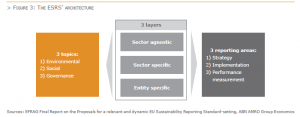

The ESRS is built on three layers of standards:

Each layer also covers all three sustainability matters (E, S and G) and reflects reporting areas under three key management dimensions: strategy, implementation, and performance measurement.

A first set of drafts covering the first layer and the principles for the third layer have been developed by the European Financial Reporting Advisory Group (EFRAG) and sent to the EU Commission in November last year. These should be issued in the form of Delegated Acts no later than July 31, 2023. While finalizing this article the EU Commission has unveiled a draft delegated act in early June and is seeking feedback until early July. Sector specific standards still need to be developed.

The CSRD/ESRS puts the responsibility of the identification of all material sustainability IROs on the board of directors, which is required to measure them, act upon them and report on them in the annual report. ESRS is, in short, a comprehensive remodelling of sustainability reporting aiming at high quality data, greater standardisation, and accountability. Critical is that the responsibility for the identification of material IROs lays with the reporting entity and not the standards.

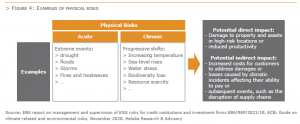

In the light of these changes, there are important parts of the disclosures that apply to covered bonds. For instance, acute and chronic physical risks are highly relevant topics for the value and insurability of the collateral assets that back the bonds (see Figure 4). However, disclosures do not only cover risks but also impacts. In ESRS S4, focus is on Consumer and End-users and this leads to a requirement to disclose not only negative impacts but also positive impacts of housing finance. Access to housing is a key function of a modern society and plays an important role for social cohesion, well fare and financial security These are just a few examples that illustrate the comprehensive nature of ESRS reporting and the need for reporting companies to have in-depth insight into is operations Impacts, Risks and Opportunities.

Other regulatory initiatives

Companies in scope of the CSRD need to also to provide disclosures under the Taxonomy regulation. These refer to mainly the proportion of activities that align with the EU Taxonomy. For financial institutions, this is reflected in the form of the so-called Green Asset Ratio (GAR).

The GAR, as well as other sustainability KPIs such as the Banking Book Taxonomy Alignment Ratio (BTAR), also forms part of the Pillar III disclosure requirements on ESG risks. These are developed by the European Banking Association (EBA) as part of their mandate under the Capital Requirements Regulation (CRR). The Pillar III ESG disclosures (which are only applicable to banks) are statistical and not risk based, which require the collection of data also from customers that are not in scope for ESRS reporting, such as households, and micro companies.

Also the SFDR is an important regulatory initiative in the EU landscape. The regulation which came into effect in early 2021, is applicable to financial institutions that operate in the EU and that either (i) provide investment or insurance advise, (ii) produce and sell financial goods, or (iii) provide portfolio management services. The foundation of SFDR are the PAI, which consist of a list of sustainability metrics that need to be reported on and incorporated into the financial institution’s investment policies and decisions. While covered bonds do not fall under the definition of a “financial product” as per the SFDR, investments in those instruments are considered “direct investment in investee companies” and are therefore part of entity level PAI disclosures. In other words: investors will not be required to disclose, for example, how the covered bond considers PAI on sustainability factors (product level disclosures), but they will have to disclose how their investment strategy in general consider PAIs on sustainability factors (and this shall include investments in covered bonds). Furthermore, as per the SFDR, sustainable investments must ensure that the investee company (i.e. the covered bond issuer) follows good governance practices and does no significant harm to environmental or social objectives, as defined by the investor.

Ongoing developments

The EU Green Bond Standard (EuGBS) is a standard with the goal to improve the transparency and integrity of the green bond market by drawing on best practices and as such to prevent “greenwashing”. Although the EuGBS is a voluntary standard, issuers must fully comply with all requirements in order to use the label on their bonds.

A key element in the standard is the alignment of the use of proceeds with the EU Taxonomy. Furthermore, it introduces a new layer of additional requirements, that are currently either not included or not mandatory under the ICMA Green Bond Principles, such as the completion of a standard European Green Bond factsheet and allocation report.

Companies using the European Green Bond label are required to fill in certain templates. These are intended to provide a detailed structure and format for (i) how issuers and external reviewers should demonstrate and check the alignment with the EuGBS requirements and (ii) how the investments feed into the transition plans of the issuer.

Moreover, the standard requires companies to engage in the green transition. Disclosures will include:

the minimum proportion of bond proceeds to be used on activities that are Taxonomy aligned, where there will be a flexibility pocket of 15% for sectors not yet covered by the EU Taxonomy and for other certain very specific activities.

To increase transparency beyond European Green Bonds, the EU will also publish non-binding guidelines with a view to establishing templates for pre- and post-issuance disclosures for issuers that don’t want to use the EuGB designation but do want to show their transparency and integrity.

The current status is that the negotiators of the Council and the European Parliament reached a provisional agreement with the European Commission on the creation of European green bonds. However, it still needs to be confirmed by the Council and the European Parliament, and formally adopted by both institutions before it is final. It will start applying 12 months after its entry into force (for more details, see article 1.3 of this Fact Book).

To boost energy efficiency the Commission proposed a revision of the Energy Performance of Building Directive (EPBD) – last amended in 2018 – in December 2021. The aim is to reflect higher ambitions and more pressing needs for climate and social action but also to mobilize (public/private) funding for renovation and create renovation incentives. The EPBD is the key legislative instrument to deliver on the 2030 and 2050 decarbonisation objectives. Its´s main targets are reducing buildings’ greenhouse gas (GHG) emissions and final energy consumption by 2030 and setting buildings towards EU-wide climate neutrality in 2050.

The Commission’s proposal follows its Renovation wave strategy published in 2020, which contains an action plan with concrete regulatory, financing and enabling measures to boost building renovation. Its objective is to at least double the annual energy renovation rate of buildings by 2030 and to foster renovation.

According to the amendments adopted by Parliament in March 2023, new buildings are to be zero-emissions from 2028. For new buildings used, operated or owned by public authorities, this is to apply as early as 2026. Zero-emissions buildings would need to factor in their life-cycle global warming potential.

Measures in the new proposals include:

These will enhance the data availability and reliability of important data points when it comes to sustainability reporting and analysis and will also support issuers on their path to greater taxonomy compliance.

The proposed revision of the directive has been considered by the European Parliament and the Council and is expected to be approved by the end of 2023 whereupon EU countries have to adopt it into national law before certain deadline (for more details, see article 1.3 of this Fact Book).

The Corporate Sustainability Due Diligence Directive (CS3D) codifies the requirements for companies (including those in the financial service) to respect human rights and to identify, end, prevent or mitigate human rights violations and environmental effects in the company’s own operations. This also introduces a requirement for the directors of EU companies to set up and oversee due diligence processes integrating them into corporate strategy. However, negotiations are still ongoing, and the final text therefore remains unknown. What is clear though is that the ambition in the proposed directive is a complement to the requirements outlined in the CSRD/ESRS.

The European Supervisory Authorities (ESA) and the ECB are working towards enhancing sustainability-related disclosures for securitized assets. These include, for example: the development of templates for “simple, transparent and standardized” (STS) securitisations, as well as guidance on how ESG standards could be implemented in the context of securitisation. The European Securities and Markets Authority (ESMA) is also undertaking a review of the loan-level securitisation disclosure templates. As the value of underlying assets linked to securitized products (such as mortgages) could be affected by climate-related events, ESA and ECB share the view that the reporting on existing climate-related metrics needs to improve, and that additional metrics are necessary. The aim is therefore to not only simplify reporting templates, but also include new, proportionate and targeted climate-change related metrics. The introduction of sustainability-related disclosures for securitized products may become also relevant for similar instruments backed by the same type of underlying assets, such as covered bonds. However, in the draft sent by the ESAs to the EU Commission end of May 2023 the ESAs considered that expanding the disclosure to other asset classes is not appropriate at this stage. Nevertheless,

sustainability-related disclosures in a consistent and harmonized form will help to assess and address climate-related risks, while facilitating comparability for investors and equal treatment by EU supervisors. This should also foster the classification of these products as sustainable under the SFDR, and consequently, enhance the flow of funds.

While mandatory disclosure requirements are not yet in place, the ECB and the ESA have published a joint statement in March 2023 calling on originators to collect, at the time of loan origination, the data that investors need to assess the climate-related risks of the underlying assets. In the case of securitisation, originators and sponsors should fill in the voluntary climate-related fields in the existing securitisation disclosure templates.

Enhanced-climate related disclosure requirements for not only securitised assets, but also covered bonds, is also essential for the ECB, who has become one of the largest investors in such assets under its securities purchase programmes. In July 2022, the ECB has taken important measures to include climate-related considerations in its purchase programmes and collateral frameworks. While first targeted towards corporate securities, it has already noted the need to implement a similar approach for its covered bond and ABS portfolios. This, however, still requires the development of a framework. Nevertheless, in this context, the ECB is committed to acting as a catalyst, engaging closely with the relevant EU authorities to support better and harmonised disclosure of climate-related data. Furthermore, these climate-related measures of the ECB might have an impact on covered bond spreads, How big this impact could be will depend on whether it decides to actively reshuffle the portfolio after stopping with reinvestments, as already pointed out by the member of the Executive Board Isabel Schnabel. That should also incentivise more voluntary disclosures by issuers.

Conclusion

The ECBC harmonized transparency template HTT play an important role in providing investors with important insights into cover pools. The additional sustainability disclosure requirements introduced by the CSRD/ESRS will require further amendments in covered bond disclosures. The introduction of reporting in sustainability in both financial reporting and regulatory reporting underlines this. Furthermore, there are also several additional initiatives at EU level aiming to increase the flow of sustainability-related data. Issuers should therefore be prepared to meet upcoming demands from different parties also given that investors need to comply themselves with a wide range of ESG-related regulatory requirements.

In the medium to the long-term, the ECB might also include sustainability-related disclosure requirements regarding eligibility of covered bonds for monetary purposes. Following the ECB’s decision to decarbonise its corporate bond portfolio, issuers should expect similar measure to be replicated to the covered bond portfolio. The importance of disclosing sustainability-related information (and in particular, covered bonds) lies therefore not only on meeting upcoming regulatory requirements, but also on potentially reducing funding costs. Better assessment and therefore, better pricing of climate-related risks will be a contributor to stronger investment demand by both the ECB and investors. This will, in turn, provide additional incentives for covered bond issuers to not only improve the quality of the data provided under mandatory disclosures, but also to disclose voluntary sustainability information.