Covered Bonds

What is a Covered Bond?

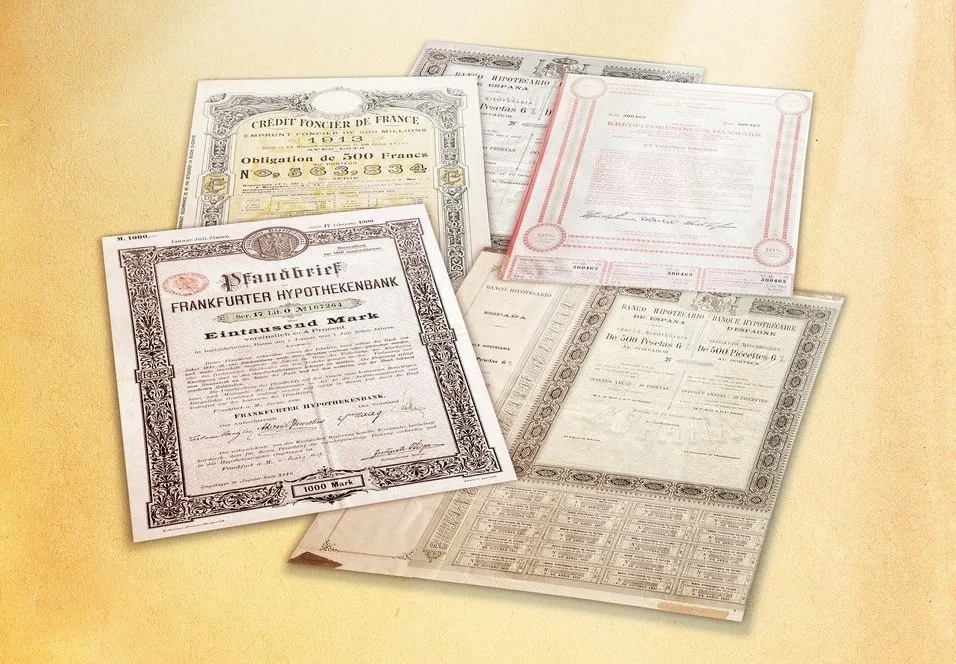

Covered bonds are debt instruments secured by a cover pool of mortgage loans (property as collateral) or public-sector debt to which investors have a preferential claim in the event of default. While the nature of this preferential claim, as well as other safety features (asset eligibility and coverage, bankruptcy-remoteness and regulation) depends on the specific framework under which a covered bond is issued, it is the safety aspect that is common to all covered bonds.

Introducing Covered Bonds

Covered bonds are increasingly used in the marketplace as a funding instrument, in addition to savings deposits, senior issuances, mortgage-backed- securities, etc. The issuance of covered bonds enables credit institutions to obtain lower cost of funding in order to grant mortgage loans for housing and non-residential properties as well as, in certain countries, to finance public debt. The covered bond investor has the advantage of investing in safe bonds with a relatively high return. Thus, covered bonds play an important role in the financial system.

The internationalisation of formerly domestic covered bond markets began more than 25 years ago with the introduction of a new benchmark product attracting international institutional investors and providing the necessary market liquidity.

As a consequence, many European countries have introduced new covered bond legislation or have updated existing rules to be a part of this development and to also respond to the considerable growth of mortgage lending activities in the European Union.

This evolution led to the issuance of the Covered Bond Directive which enshrines the key characteristics of the instrument and which acts also as international standard-setter.

With over EUR 3.3 trillion outstanding at the end of 2024, covered bonds play an important role in European capital markets, contributing to the efficient allocation of capital and, ultimately, economic development and recovery.

Essential features of Covered Bonds

Introduction

The ECBC sets out below what it considers to be the essential features of covered bonds, together

with explanatory notes.

It is intended that they be read independently from any other definition or interpretation of covered

bonds, such as those set out in the Covered Bond Directive and Article 129(1) of the Capital Requirements Regulation (CRR).

These common essential features should be understood as the ECBC’s minimum standards for covered

bonds.

Essential features

Covered bonds are characterised by the following common essential features that are achieved under

special-law based frameworks or general-law based frameworks:

- The bond is issued by—or bondholders otherwise have full recourse to—a credit institution which

is subject to public supervision and regulation. - Bondholders have a claim against a cover pool of financial assets in priority to the unsecured

creditors of the credit institution. - The credit institution has the ongoing obligation to maintain sufficient assets in the cover

pool to satisfy the claims of covered bondholders at all times. - The obligations of the credit institution in respect of the cover pool are supervised by public

or other independent bodies.

The CBD regulates the requirements for covered bonds, which, up to now, were only laid down in a rudimentary fashion in Article 52(4) of the UCITS Directive; this provision has been accordingly amended and now refers to the CBD, as has the Bank Recovery and Resolution Directive (BRRD). Given that the CBD has become the new single reference point for regulation related to covered bonds, various other provisions on covered bonds in other directives that refer to Article 52(4) of the UCITS Directive are thus also indirectly amended.

The regulatory discussion on the creation of the CB harmonisation package was characterised by the “principle based harmonisation” aimed at by the EU regulatory framework. This means that the EU provisions lay down the minimum requirements for secured bonds issued by credit institutions and, in a number of ways, leave room for particularities and detailed regulations at the national level; this has also been the (almost) unanimous petition of CB issuers and other market participants. This is of fundamental importance both for understanding the regulatory package and for interpreting the individual provisions.

While the CBD builds on the essential traditional quality features of covered bonds, it leaves national legislators a wide margin of leeway in shaping their national CB laws. This is also illustrated by the fact that the CBD contains both mandatory and optional provisions. Some mandatory provisions also contain optional elements, and vice-versa

The CBD consists of the following Titles:

I. Subject matter, scope and definitions (Articles 1-3)

II. Structural features of covered bonds (Articles 4-17)

III. Covered bond public supervision (Articles 18-26)

IV. Labelling (Article 27)

V. Amendments to other Directives (Articles 28-29)

VI. Final provisions (Articles 30-34)

Further information can be found in the Article 2.1 Overview of Covered Bonds of the ECBC Fact Book 2021

The delegated act of Solvency II secures a favourable treatment under Solvency II for covered bonds. A low-spread risk factors is in fact assigned to covered bond—i.e. preferential treatment under the spread risk module and concentration risk module.

EU Bank Recovery and Resolution Directive (BRRD)

The BRRD has important direct and indirect implications for covered bonds, particularly as it exempts CBD-compliant (or grandfathers UCITS-compliant) covered bonds from the scope of the bail-in tool, under specific conditions (Article 44(2)).

Liquidity Coverage Ratio (LCR) Delegated Act

Central to the covered bond regulations at EU Level is the Liquidity Coverage Requirement (LCR) treatment, which was specified by the European Commission through a Delegated Act under the Capital Requirements Regulation. The LCR Delegated Act—which entered into force on 1 October 2015 and was fully implemented at the beginning of 2018 and which represents EU-wide implementation of the Basel’s LCR rules—introduces a favourable treatment for covered bonds. The treatment is specific to EU and aims to reflect credit quality, liquidity performance and the role of covered bonds in the funding markets of the EU. It allows covered bonds to be included in Level 1, 2A and 2B liquid assets for the purposes of calculating their LCR under specific criteria. Furthermore, covered bonds can be included up to 70% in the liquidity buffer (leaving 30% for the highest liquid Level 1 assets such as Level 1 government bonds).

RTS on risk mitigation techniques for OTC derivative contracts under EMIR

The RTS on risk mitigation techniques for OTC derivative contracts not cleared by a CCP, developed under the European Market Infrastructure Regulation, provide for a specific treatment of cover pool derivatives (derivatives entered into by covered bond issuers for the hedging of the cover pool’s market risks and included within the scope of the protective measures established by the respective covered bond regime). The RTS set out a specific set of conditions under which such cover pool derivatives, which are concluded with regard to covered bonds compliant with Article 129 of the CRR, are exempted from margin requirements in the context of bilateral clearing (i.e. clearing not executed through a CCP).

Capital Requirements Regulation (CRR)

Another cornerstone is the Capital Requirements Regulation (CRR). It is based on a proposal

from the Basel Committee on Banking Supervision to revise the supervisory regulations

governing the capital adequacy of internationally active banks. The package entered into

force on 17 July 2013 and replaced the Directives 2010/76/EU, 2006/48/EC and 2006/49/EC.

Covered bonds are defined in Article 129 of the CRR.

Read the Covered Bond Directive

ESG and Covered Bonds

What is a Sustainable Covered Bond?

A Sustainable Covered Bond includes a formal commitment by the issuer to use an amount equivalent to the proceeds of that same covered bond to (re)finance loans in clearly defined environmental (green), social or a combination of environmental and social (sustainable) criteria. Covered Bond Labelled sustainable covered bond programs are based on their issuer’s sustainable bond framework which has been verified by an independent external assessment.

The issuer strives, on a best efforts basis, to replace sustainable assets that have matured or are redeemed before the maturity of the bond through the (re)financing of new eligible sustainable assets.

On the Covered Bond Label website sustainable covered bonds are flagged with a green leaf which you find here.

Against this background, please note that the EMF-ECBC is currently working on market initiatives which will ultimately define European criteria for energy efficiency covered bonds and sustainability standards.

ESG Policy Library with impact on Covered Bonds

| Specific legal/website references: | Simplified information Fact: |

|---|---|

| Taxonomy (overview) (legislation) | EU Taxonomy (PDF) |

| Sustainable Finance Disclosure Regulation (SFDR) (overview) (legislation) | SFDR Disclosure (PDF) |

| Corporate Sustainability Reporting Directive (CSRD)(overview) (legislation) | Green Asset Ratios (PDF) |

| EU Green Bond Standard (link) | EU GBS (PDF) |

| ECB monetary policies (link) | ECB monetary policies (PDF) |

| EBA report on green securitisation framework (link) ESA joint consultation paper on STS-securitisation related sustainability disclosures (link) Joint statement ECB and ESAs (link) |

EBA report on green securitisation framework (PDF) |

| ICMA’s Green Bond Principles (GBP) (link) ICMA’s Social Bond Principles (SBP) (link) ICMA’s Sustainability Bond Guidelines (SBG) (link) |

ICMA’s Green and Social Bond Principles overview (PDF) |

ESG and Covered Bonds Research Papers

- Fact Book articles:

- Other articles/websites: